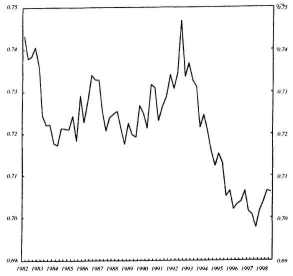

Graph 1: United States: Labour’s Share

in the Corporate Sector [21]

From International Socialism 2:90, Spring 2001.

Copyright © International Socialism.

Copied with thanks from the International Socialism Archive at http://www.lpi.org.uk.

Marked up by Einde O’Callaghan for the Marxists’ Internet Archive.

2001 will be a year of living interestingly. It may prove to be a year of living dangerously.

So wrote the Financial Times in its first issue of the new year. It did so after a fortnight of increasingly pessimistic media comment about what was happening to the US economy. Whereas 12 months before the overwhelming view among mainstream capitalist commentators was that the US had stumbled upon a ‘new paradigm’ which permitted continued expansion into the indefinite future, perhaps punctuated by a brief ‘soft landing’, now the tone was suddenly one of expectation of a ‘hard landing’ or even a full slump.

The Sunday Times, for instance, reported on Christmas Eve:

Fears of a hard landing for the American economy, with serious consequences for Britain and the rest of the world have heightened ... John Makin of the Washington-based American Enterprise Institute says that ‘the recession’ has already started. ‘Over $2.5 trillion has already disappeared in the US since March. The US economy is on a dynamically unstable downward path.’

The day before the Financial Times had said:

US consumer confidence has fallen to its lowest level since the financial crisis of 1998, according to one of the most-watched surveys of confidence, adding to fears that the world’s largest economy may be heading for a hard landing ...

The University of Michigan’s latest consumer confidence survey suggests that the steady stream of profits warnings and job loss announcements is beginning to have an effect on the US public ... If the losses mount, the economy could be pushed towards a downward spiral of falling confidence and lower demand.

General Motors (GM), still the biggest manufacturing firm in the US, had already ‘announced plans to cut 15,000 jobs, shut 15 percent of its factory capacity in Europe and kill off its 103 year old Oldsmobile name’.

As the global automobile industry braces for its first significant slowdown in six years, GM is under pressure to move faster to boost the company’s mediocre profit margins. By 2004 GM plans to slash its current line-up of 80 models by as much as 20 percent. Entire engine programs and so-called architectures, the basic building blocks of vehicles, have been cut from future product plans, averting hundreds of millions of dollars in factory, engineering and materials costs. In North America GM plans to cut 10 percent of its 49,000 salaried jobs. [1]

The sense of panic was real enough as the new year started. Whether it will translate immediately into a ‘hard landing’ or full blown recession is too early to see at the time of writing. The last time there was a panic on such a scale was in the autumn of 1998 when the crisis that started in Asia and spread to Latin America and Russia hit the Wall Street ‘hedge fund’ Long Term Capital Management. For a couple of weeks papers like the Financial Times had headlines discussing whether a ‘meltdown’ of the whole system was at hand, and George Soros published a book called The Crisis of Global Capitalism.

Yet within weeks the panic had disappeared in the face of emergency action by the US Federal Reserve to keep Long Term Capital Management afloat, and continue the expansion of the US economy. Unable to see beyond the end of noses perpetually looking for new troughs to swill in, the supporters of the system swung from believing the end was nigh one day to believing in eternal life the next. They are quite capable of doing the same again if, for a few months, the figures for the US economy do not turn out as badly as forecast in December 2000. They will then accuse radical critics of the system of ‘underestimating’ its capacity to adapt and grow.

Yet there was good reason for them to worry in the autumn of 1997. Some 30 to 40 percent of the world was hit by recession, sometimes on a scale comparable only to that of Europe and North America in the inter-war years. Hundreds of millions of people were thrust into sudden dire poverty. And quite a few capitalists lost money.

There is even more reason for them to worry now because the most dynamic sector of world capitalism, the US economy, does face very serious underlying problems. Even if it manages to shrug off the worries that were all too obvious at the turn of the year, it cannot prevent those problems returning to plague it with a vengeance in the not too distant future. For they are built into the very processes that have underlain the US boom of the last eight years.

Very few people expected the US economy to boom through the 1990s. When Bill Clinton won the presidential election in 1992, one slogan hammered into the head of every member of the campaign team was ‘It’s the economy, stupid.’ In other words, the key to the Democrat campaign was the dire condition the economy had got into under the Republicans. And conditions did seem dire. Not only was the US in the third recession in 16 years, but its performance in the boom of the late 1980s had been poorer than its main international competitor.

Japan’s economy had an average growth rate of 4.2 percent for 1980-1989, as against 2.7 percent for the US. [2] The picture for US productivity was even worse. Whereas in the years 1950-1973 labour productivity had grown at 2.5 percent a year, in the years 1973-1987 it grew at only 1 percent. This was less than a third of Japan’s rate and two fifths of Germany’s (although absolute productivity remained higher in the US). [3] Most worryingly for the US ruling class, Japan seemed to be leaping ahead of the US in important industries. Nissan, Toyota and Honda were pushing General Motors and Ford hard, and Japan had the cutting edge in the range of new technologies associated with the microchip. In 1988 the world’s top three semiconductor companies in terms of sales were Japanese, and so were another three of the top ten, as against only two American. [4] So great was the US lag in this key industry that the Pentagon began to be worried about a Japanese monopoly position that would threaten US ‘defence’ capability. [5]

The sense that the US was losing out was reinforced by the enormous stock market valuation of Japanese companies. The world’s biggest company in 1990 was reckoned to be Nippon Telegraph and Telephone – 70 percent bigger than IBM and twice the size of Exxon in terms of market capitalisation. [6] Two years before, Japanese firms accounted for 41.5 percent of world stock market valuation, the US 31 percent, and the continental EU countries 13.3 percent. Such statistics created a moral panic in the US itself about the supposed threat from Japan – films portrayed the ‘Rising Sun’ as the new threat replacing the near-defunct ‘red menace’, and union leaders became hysterical about Japanese imports.

Robert Heilbroner could write in the prestigious New York Review of Books

At the apparent zenith of its triumph, its enemies confounded, America seems headed for disaster. What might seem a hyperbole is only to repeat what I hear on every side. The country is visibly decaying. I do not know of anyone who sees a bright future for it. [7]

At this time a proliferation of ‘experts’ extolled Japanese methods as the way forward for world capitalism. Ford launched an ‘After Japan’ programme in its factories, books proclaimed the ‘Japanese century’, centre-left critics of Reaganism and Thatcherism contrasted the ‘success’ of the ‘Japanese model’ of capitalism with the failure of the ‘Anglo-Saxon’ variant. [8]

When recession hit the US and Britain in 1990 such prophecies seemed vindicated, for the Japanese economy continued to expand for a couple of years more. In 1989-1990 its growth rate soared, touching an annual rate of 7 percent in the spring of 1990, and the deputy governor of the Bank of Japan was saying as late as February 1992 that there was ‘no risk of a sudden decline in economic activity’. [9]

Against such a background Ed Balls (then of the Financial Times, now economic adviser to Gordon Brown) was not at all out on his own when he wrote that the ‘days’ of the US as ‘the world’s number one economic superpower ... could be numbered ... Japan looks set to push the US into second place as a share of world output early in the next century ... over the next decade ... Japan will be catching up with the US at a faster rate than ever’. [10]

Kenneth Coutis, vice-president of Deutsche Bank, told the US Congress’s joint economic committee that ‘the Japanese financial crisis is part of an official policy to restructure Japan in the 1990s to become the world’s dominant economy’. [11]

Even when the US began to show signs of economic recovery in 1993 (coincidentally, soon after the inauguration of the Clinton presidency), most commentators expected it to be a feeble, ‘jobless recovery’. And virtually no one expected there to be a reversal of the long term relative decline of the US compared with Japan. [12]

Some bourgeois commentators came to the conclusion that recovery of any sort was unlikely. As I said at the time:

Bourgeois economic commentators are necessarily short sighted. It is therefore not surprising that some of those who were ecstatic about the superficial signs of recovery in the mid-1980s are suicidal in their belief that there can be no recovery of any kind today, with former Times editor William Rees Mogg talking of endless slump and the end of civilisation within the next 30 years. [13]

In opposition to this view I pointed out:

It would be wrong to rule out any recovery from crisis. There was some recovery from the crises of the mid-1970s and the early 1980s. There was even a temporary recovery of the US economy from the great slump of the 1930s in 1934-1936 – with a substantial though short-lived fall in unemployment in key industries – before renewed recession set in through 1937-1940 ... Fundamental features of the system make it very difficult for capitalism to achieve any substantial improvement in long term profit rates, and rule out any return to the conditions of the long post World War Two boom. But they do not stop some sectors of the world economy growing while others contract. [14]

But I have to admit I did not expect the US economy to enter eight years of expansion, resulting in an increase in the gross domestic product (GDP) of some 50 percent and a resurgence of US economic power compared with that of Japan and Europe.

Shortly before he lost office in January 1993 George Bush Sr gave a speech in which he boasted of three achievements from a dozen years of Republican presidencies. The US, he claimed, had re-established its global military power, it was on its way to establishing global free trade and it had recovered its industrial supremacy. [15] Amidst the impact of the recession, few people took the last claim seriously at the time. But he was saying something important. The US ruling class had not just been prepared to sit back and watch while Japanese capitalism challenged its global economic hegemony, any more than it had been prepared to permit the challenge to its military hegemony from the rulers of the Soviet Union. It had set out to undertake decisive action to reassert itself on both fronts. These efforts continued right through the Clinton years.

First, major US firms responded to the increased competitive challenge from Europe and especially Japan by a sustained programme of rationalisation and re-equipment. This began in the early 1980s. It was then, for instance, that the US auto giants began to undertake programmes designed to re-establish their dominance of both the US and global market in face of competition from Toyota and Nissan. They shut some plants, slimmed down others, secured the support of union leaders for ‘give-backs’ or ‘concessions’ (wage cuts and speed up) in older plants, and opened up new, more technologically advanced plants in regions (notably the ‘sunbelt’ states of the south and west) with weak traditions of unionisation and, often, anti-union laws to go with them.

Along with this went a strategy of accelerated investment. ‘Having grown at a steady rate of about 6 percent from 1960 to 1980, investment in producers’ durable equipment accelerated to an annual growth rate of more than 12 percent in the 1990s’. [16]

The close interaction between the big corporations and the military, to which they provided so much hardware, played an important role here. The response of the Pentagon to the technological lag with Japan in electronics was not merely to bemoan what was happening. It was to set out to resuscitate the microchip industry by putting pressure on firms to merge, to invest and to innovate. [17] It found a ready response among figures in the industry, as the Financial Times reported at the time:

Many new chip entrepreneurs acknowledge the need for a fundamental change in the relationship between industry and government. ‘The laissez faire free market, survival of the fittest approach worked well in the 19th and early 20th century because we lived in an island economy. But in today’s global economy some central vision is required,’ says Mr Hackworth of Cirus Logic. ‘Somebody has to have an industrial strategy for this country,’ agrees LSI Logic’s Mr Corrigan. [18]

The result of that strategy is to be seen today. The world’s top semiconductor company is no longer NEC (Japanese) but Intel (American), with Motorola and Texas Instruments (both American) in third and fifth position. And Microsoft is, of course, the world’s top software company, with Japanese companies dominant only in the narrow area of computer games.

A few years later the US state managed to bring about a similar rationalisation of the US aerospace industry, culminating in the merger of Boeing and McDonnell Douglas into a firm that controls 60 percent of global civil aircraft sales, and with a turnover in military aircraft production twice as great as the whole of the European industry. The New York Times wrote that the merger ‘signified the near completion of one of the swiftest and most rapid transformations ever of an industry – as a matter of explicit government policy’.

President Bill Clinton’s administration has largely succeeded in turning America’s military contractors, over a span of just four years, into instruments of one of its most important goals: making the economy more competitive globally ... The emphasis has been placed on efficiency, cost cutting and exports ... [19]

As Felix Rohatyn, a major investment banker close to government circles, puts it:

You have one national aircraft company now ... Our policy is based on a definition of markets on a global basis. Ultimately, the market place would have demanded it, but the Clinton administration saw the need and responded. [20]

Behind the free market, neo-liberal rhetoric designed to impose US trade policies on the rest of the world lay a willingness to rely on state intervention, on state capitalism, when it came to bolstering the power of domestic capital.

The economic revival of the US was not separate from its reassertion of its global military hegemony. It tried to show in the great international crises of the 1990s that it alone had the power to pull the chestnuts out of the fire for the other big powers, and to keep the smaller powers in line. It did this with the Gulf War of 1991, when it exploited Japan’s greater dependence on Middle East oil to get it to help pay for a war waged mainly by US troops: it was US oil companies and US contractors who got the most lucrative contracts in the aftermath of the war. It did it again when its interventions in Bosnia in the mid-1990s and its war against Serbia in 1999 showed that it could impose a settlement in the backyard of the European Union. Its actions on each occasion served to emphasise how circumscribed were the possibilities for independent action by the European powers and Japan – and how difficult things would be for any Third World government that trod on US toes.

The results were to be seen at the succession of international summit meetings held through the 1990s. The US did not get its way on everything. It did not succeed in establishing such a degree of military or economic hegemony as to be able always to override the pressures of the other powers. One reason the World Trade Organisation conference in Seattle in November 1999 collapsed was because of European resistance to some key US demands. And the US was forced to turn to Russia when it came to reaching a satisfactory endgame to its war against Serbia in the same year. But the US was able to get its way on most things. That translated into making life easier for the giants of US industry. The other major powers were compelled to tolerate an effective devaluation of the US dollar (making US exports cheaper and more competitive) throughout the first half of the 1990s, and the smaller powers to accept opening up their economies through International Monetary Fund/World Bank free trade and structural adjustment programmes.

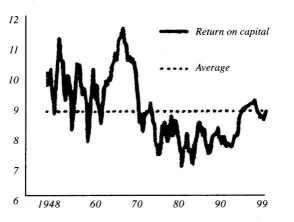

But neither the restructuring of US industry nor the reassertion of US global power would have been possible without something else – a massive shift in the distribution of income and wealth from labour to capital (or, in Marxist terminology, an increase in the ‘rate of exploitation’ – see graph 1).

|

|

Graph 1: United States: Labour’s Share |

As the 1999 IMF report on the US economy says, ‘Labour’s share in the national income has declined quite sharply relative to the previous cycle ... One strong development of the current expansion has been the steady decline in labour’s share of national income’. [22]

Throughout the boom the benefits of increased productivity went to capital rather than its workers. As one calculation has shown, ‘Productivity grew 46.5 percent between 1973 and 1998,’ while the median wage fell by about 8 percent. ‘If wages had kept rising with productivity ... the median wage would have been $17.27 in 1998, rather than $11.29 ... a difference of $5.98 an hour’. [23]

The IMF report shows non-wage benefits, such as health insurance and unemployment benefits, continuing to fall right through the decade.

This increase in what Marx would have called ‘relative surplus value’ has been accompanied by something else. There has been an incredible increase in ‘absolute surplus value’ – the working week needed to maintain the workers’ living standard: ‘Mothers in married family couple families increased their average annual paid work by 223 hours – by nearly six weeks – between 1983 and 1997. Fathers increased their work by 158 hours – four weeks – in the same period’. [24]

These long working hours are as important as the level of capital investment in explaining the renewed international competitiveness of major US industries in the last decade. Output per head of population is considerably higher in the US than elsewhere – if Britain’s output per head in 1996 was 100, then France’s was 105, Germany’s 113 and the US’s 137.

But, as Samuel Brittan has pointed out, when it comes to output per hour worked, the US actually lags behind: with Britain as 100, France is 132 and Germany 129, but the US only 121. This is because the capital for each hour worked is 30 to 40 percent higher in France and Germany than in Britain, and even 15 to 20 percent more than in the US.

The US advantage can be explained by the fact that American workers work much longer than their European counterparts – 40 percent more than French workers, 29 percent more than German workers and 13 percent more than British workers. Only Japanese workers do the same 2,000-hour year as US workers. [25]

The US boom depended on investment, and investment depended on recovery of profit rates from the steep falls of the late 1970s and 1980s. That recovery was brought about by the increased rate of exploitation.

This is something noted, for instance, by Stephen Roach, chief economist of Morgan Stanley, at the height of the boom:

The American restructuring model has three attributes: massive headcount reductions, real wage compression, and outsized currency depreciation that took the value of the dollar down 50 percent from the early 1985 highs. And the US system of flexible labour is the glue that holds the whole thing together. [26]

A boom centred round such massive increases in the rate of exploitation was necessarily very different to that known during the first 30 years after World War Two. Average growth remained lower than in the early 1960s – 3.25 percent a year in 1995-2000, as against 5.25 percent a year in the boom of the 1960s. As the Bank of International Settlements pointed out last year, ‘Even during the last four years, average growth only just matched that of the 1980s and remained well short of that of the 1960s’. [27] And its impact on the living standards of the mass of Americans was completely different.

Between 1947 and 1973 median family income grew ... by 104 percent ... 2.8 percent a year on average ... After 1973, however, the growth rate ... slowed markedly. Over the 24 years from 1973 to 1997, median family income rose an average of 0.35 percent year. [28]

What is more, the very limited growth on family income that occurred depended on more members of the family working. In 1998 ‘men had a lower median income than in 1969, adjusting for inflation. If not for men and women’s increased work, families would be far worse off’. [29]

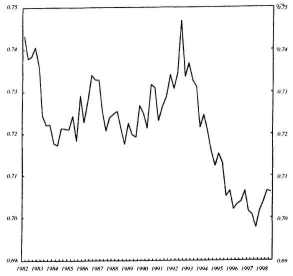

|

|

Graph 2: Median Wage 1973-1998 |

|

|

Graph 3: Real Value of the Minimum Wage |

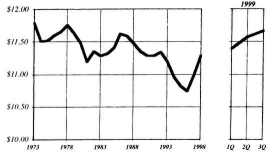

|

|

Graph 4: Change in After-Tax |

It was only in the last three years of the 1990s that there was any recovery in the median wage, with growth of about 4 percent in 1999, taking it back to the level it was in the late 1980s and still leaving it lower than a quarter of a century before (see graphs 2 and 3).

The contrast is all important. The great post-war boom transformed the lives of tens of millions of US workers, making it seem that things would continually get better under capitalism and that the American Dream could become a reality. The boom of 1990s did not have anything like that effect. In fact, it leaves one in eight Americans below the poverty line and nearly 45 million without health insurance. The fact that the top 5 percent of American families have seen a 64 percent increase in their incomes since 1979 does not in any way mitigate the way the bottom 60 percent of American families have been running to stand still – with the bottom 20 percent going backwards (the minimum wage in 1998 was worth about 22 percent less than in 1968), as graph 4 shows.

One byproduct of the boom has been falling unemployment rates. Some unemployment is hidden (for instance, by the 2 million, mainly black, males who are kept out of the labour force by incarceration). But many millions of new jobs were created during the course of the boom. These jobs are, however, overwhelmingly jobs at very low wages – in some cases at wages lower than the unemployment benefits people would get in some European countries.

This limitation from the point of view of workers can, of course, be a positive benefit for the capitalist class. The pool of low paid workers can provide cheap domestic help (as is shown by the recurrent revelations of top government figures employing illegal immigrants) and provide a massive range of luxury services. People who have work routines hammered into them in McJobs can be then be used as cheap labour in other sections of industry (40 percent of Microsoft’s employees are temporary workers). People in work, however badly paid, are less likely to turn to the sorts of crimes that disturb the upper classes than are the long term unemployed. And, of course, the state does not have to raise taxes to pay out doles to keep them alive.

Booms dependent upon a massively increasing rate of exploitation of the workforce always contain a potential inbuilt problem. They make it possible for firms to raise profit rates, up to a point. But the goods produced then have to be sold.

This problem can be solved so long as the high profit rates continue to encourage new investment – or, for that matter, encourage the rich to embark upon an endless orgy of luxury consumption. The growth in the markets for machine tools or luxury goods provides an outlet for big sectors of the economy; these employ people who in turn buy goods produced in other sectors. That is why economic theories which merely see economic crises as arising from the ‘underconsumption’ of the masses, as some versions of Keynesianism do, are mistaken. For quite long periods of time, capitalism can expand by producing things to produce more things, even though the living standards of most people show no improvement.

But if anything creates doubts about the growth of profits, both investment and luxury consumption can fall, leaving many goods unsold. Those who produced these goods then lose their jobs and cannot buy things themselves, causing a wave of unemployment and plant closures to sweep through the economy.

So long as profits are high, such doubts are kept at bay. The frenzy of profit-seeking itself means new investment and new opportunities for some capitalists to make money. Others cater for their needs as investment advisers, corporate lawyers, providers of corporate hospitality, compliant politicians and the like. Non-productive capitalists feed off the backs of productive capitalists, parasitic speculation off the back of non-productive capital. One inevitable byproduct is a fog of financial flows and counterflows that hides from view the real levels of profit being extracted from the workforce.

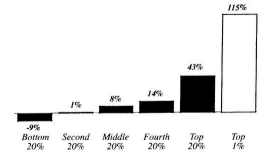

This has been absolutely true of the US boom. The massive increase in the rate of exploitation of the workforce certainly led profit rates to rise in the 1990s. They were able to recover to roughly the level of the early 1970s – but not to the higher level of the 1950s and 1960s (see graph 5).

|

|

Graph 5: Return on US Corporation Capital – |

As the Financial Times complains:

The rapid rise in profits as a share of gross domestic product in the 1990s has far from redressed the balance of the fall in the 1970s. Profits are still only about 8 percent of GDP compared with about 10 percent in the 1950s and 1960s. [34]

But the operations of the stock exchange and financial markets served to obscure this fundamental point through the latter part of 1990s. Exuberance over the recovery of profit rates led to US share prices booming. Funds from all over the world flooded into the stock exchanges, raising share prices still further – and giving easy capital gains to those who had bought first. More funds flooded it, causing still more capital gains. Speculating in shares came to seem like a no-lose one-way bet.

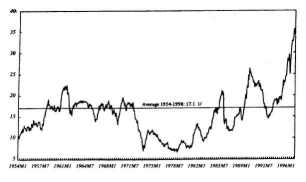

The visible indication of this was the rise in the ratio of share prices to profits – what bourgeois economists (misleadingly) refer to as the ‘price-earnings’ ratio. As graph 6 shows, this has averaged about 17 for the US over the last 40 years. By the end of the 1990s it had shot up to 35. Speculation on rising stock markets was making wide swathes of the capitalist class act as if the basic extraction of profit from workers was not the driving force of their system, as if they had discovered a perpetual motion machine for creating value out of nothing.

|

|

Graph 6: United States: Standard and Poor’s 500 |

A few capitalist investors were far-sighted enough to see that things could not continue like this for ever. [36] One major financial firm tried to hold back from investing in a boom it knew would come to a bad end. Even Alan Greenspan of the US Federal Reserve bank warned at one point about ‘irrational exuberance’. But as share prices proceeded to double again, standing back while making dire warnings was a recipe for losing out on immediate access to vast paper profits – and paper profits that some people at least would be able to cash in to their own advantage. All hesitation was forgotten in the rush to bet on the rising exchanges. As the Financial Times reported after the event, ‘The extraordinary, technology-led surge in US equity indices tended to cover up the increasingly delicate credit situation’. [37]

By 1999 a whole economic theory had been developed to justify this – the theory of the ‘new economic paradigm’. The new technologies associated with the microchip and the internet had, it was claimed, made obsolete old methods of calculating the value of shares and their relationship to profits. So Fortune magazine could argue in 1998, ‘The chip has transformed us at least as pervasively as the internal combustion engine or electric motor’. [38] Rising productivity, it was claimed, would enable profits to rise sufficiently to justify the stock exchange levels. [39] But previous waves of innovation that raised productivity – notably that associated spread of the petrol and electric motors in the 1920s – had in their time led to similar such optimism, as when John Moody, founder of the credit ratings agency, wrote in 1927, ‘No one can examine the pattern of business and finance in America during the past half dozen years without realising that we are living in a new era’. [40]

Theorists of ‘the new paradigm’ were reliving a blind optimism that has always afflicted capitalists at the very point in which boom is about to turn into slump. Shortly before Christmas 2000, Prakash Loungani noted in the Financial Times that:

Only two of the 60 recessions that occurred around the world during the 1990s were predicted a year in advance ... two thirds of those remained undetected seven months before they occurred. As late as two months before each recession began about a quarter of the forecasts still predicted positive growth for the country concerned. In addition they were too optimistic in 50 out of the 60 cases.

Alan Greenspan, chairman of the Federal Reserve, told his colleagues in late August 1990 – a month into a recession – that ‘those who argue that we are already in a recession are reasonably certain to be wrong’. [41]

There could hardly be better confirmation of Karl Marx’s point of more than 130 years ago: ‘... business always appears almost excessively sound right on the eve of a crash ... Business is always thoroughly sound until suddenly the debacle takes place’. [42]

By the summer of 1999, even the IMF was noting ‘investors’ believed their real ‘earnings’ would ‘grow by between 6.25 percent and 7.75 percent a year, but this ‘would require an unrealistic sustained increase in the share of corporate profits in GNP’. [43]

In other words, the only way to keep the boom going would have been to raise the already massive rate of exploitation of US workers even more.

|

|

Graph 7: Debt Escalation – |

|

|

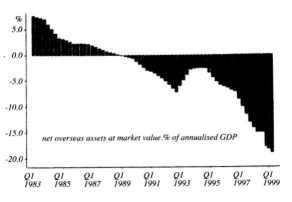

Graph 8: Overseas Net Assets of US [46] |

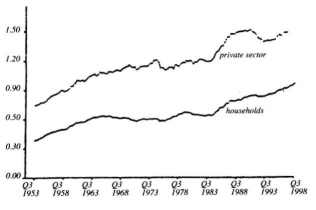

There was one other important feature to the boom – its dependence on a flow of funds from abroad. US imports have been growing more rapidly than US exports. The deficit on the US’s current balance of payments rose from around zero in 1991 to over 3 percent in 1999. US capitalism was able to cope with the deficit because of a vast and continuing inflow of lending to firms and banks, and through them to consumers, from other major economies. In the early 1990s the biggest source of the lending was Japan. More recently the European component has grown to match the Japanese one – a reflection of the way in which the European economies have stagnated and investors have hoped for higher profits in the US. It was this lending which enabled US consumption to continue to rise, despite stagnating real wages, and US industrial investment to exceed the ‘saved’ part of firms profits (see graph 7).

According to the IMF, ‘the proportion of gross savings in the rest of the world’ absorbed by ‘the US current account deficit ...has risen sharply since 1997 ... It reached 4.5 percent in 1998’ and was ‘envisaged to increase further to about 5.5 to 6 percent in 1999’ [45] (see graph 8).

What in effect was happening was that capitalists across the world feared for the prospects for profits in their own countries and instead put their faith in raking in money from the US boom. Up to a certain point this could be a self fulfilling prophecy. As they poured money into buying on the US stock exchanges, they drove share prices ever higher, enabling financial institutions and rich people throughout the world to make enormous paper profits. As some of these profits accrued to American capitalists and better off sections of the American middle class, they gave a further boost to the growth of both industrial investment and consumption in the US. One of the absurdities of capitalism is that what the bourgeois economist of the inter-war years Keynes called the ‘herd instinct’ of speculators can create a real expansion of output – but only up to a certain point.

Already a year ago there were a few mainstream economists who dared look beneath the surface appearance of the boom. They were horrified by what they saw. They pointed out that the stock exchange boom has lost all contact with the real profitability of US industry.

Samuel Brittan wrote of a ‘macroeconomic time bomb ticking away’. Wynne Godley and Bill Martin warned of a ‘shock’ that could ‘easily overwhelm policy makers’ attempts at stabilisation’. The Bank of International Settlements found ‘cause for concern in the world’s reliance on continuing US growth ... Both the dollar and Wall Street are vulnerable to a sharp fall’. [47] Even the IMF had doubts, drawing attention to ‘concern about a bubble in the market and the potentially adverse consequences for the economy in the event that such a bubble bursts’. [48]

Their fear was that a sudden fall in the stock exchange would lead to a withdrawal of foreign funds from the US, triggering in turn a fall in the dollar, which would turn the withdrawal into a tidal wave, massively undermining the markets and the profitability of US firms.

But the US economy was more fundamentally askew than even they thought.

Difficulties inevitably arise for any capitalist boom whose markets depend on the investment and luxury consumption produced by rising profits. For the base on which the boom rests becomes narrower and narrower, rather like a pyramid standing on its end or a bicycle crossing a tightrope.

What keeps the whole economy going is profitability. This depends on two things – in the first place, the extraction of surplus value off workers at the point of production. This becomes more difficult to sustain as the boom proceeds because investments tend to pile up more rapidly than the workforce grows. Investment per worker, what Marx called ‘the organic composition of capital’, grows greater. Ever more surplus value has to be extracted from each worker if the rate of profit (the ratio of total surplus value to total investment) is not to fall.

We can see these factors at work in the US through the last decade. US firms have raised investment per worker in order to push up productivity: the 1999 IMF report on the US economy noted that what it calls ‘investment-specific productivity’ growth ‘held relatively steady at an annual rate of 2 percent in the 1960s, 1970s and 1980s. In the 1990s, however, it has picked up sharply, averaging 3.5 percent a year’. [49] By increasing the rate of exploitation even more rapidly than investment per worker, capitalists were able to push up productivity – just as you can move up a downward-moving escalator on the tube network if you put enough effort in (only, in this case, it was the workers, not the capitalists, who had to put the effort in). But there are limits to how long you can keep up the effort.

Eventually a point is always reached at which workers will resist any further increase in the rate of exploitation, especially since falling unemployment encourages them to put up such resistance – either directly through increasing class struggle or indirectly by taking advantage of labour shortages to seek better jobs. At that point the only way for firms to protect profits is to try to raise prices.

Mainstream economists reflect fear of this happening when they claim there is a ‘natural rate of unemployment’ below which ‘inflationary pressures’ set in. This is also why some of them claim that if the government can keep inflation at bay by stopping the economy expanding too rapidly during the boom, then expansion can proceed forever at a more or less even pace. This is the rationale for Britain’s New Labour chancellor Gordon Brown giving the Bank of England independent power to influence interest rates so as to achieve ‘inflation targets’.

But profitability for firms does not depend simply on the extraction of surplus value at a sufficiently high rate through increasing exploitation. It also depends upon them being able to sell the goods they produce – what Marx called ‘the realisation of surplus value’.

The stablest market for firms are those which cater for the everyday needs of the mass of the population – those concerned with the consumption of workers. Once workers have received their wage packets they have little choice but to spend them, since they cannot defer eating for a few months and are unlikely to decide they want to sleep in an open field. Any saving is likely to be short term and involve a relatively small portion of their income (for instance, for a holiday) – and borrowing is likely to be more common than saving.

By contrast, those responsible for investment and luxury consumption can, if they so wish, hoard rather than spend their incomes (what mainstream economists refer to as ‘displaying liquidity preference’). And if they do so, suddenly large chunks of firms’ output cannot be sold.

The more a boom is based upon an increasing rate of exploitation to push up profitability, the more it comes to depend upon such expenditure on investment and luxuries – and the more it is at risk from any shock that leads companies to curtail investment and the rich to cut back on luxury expenditure. As with the inverted pyramid or the bicycle on the tightrope, the initial shock can be quite small and apparently accidental. Its impact, however, is enormous and not accidental, but results from the huge disproportion between the size of the structure and the narrowness of its base.

Once the shock has occurred, there is no easy way to rectify matters. The panic over profit levels leads to pressures to increase exploitation still more through cutting production costs, sacking workers, reducing welfare benefits, and so on. But these measures make realisation of surplus value more difficult since they reduce the market for consumer goods without automatically producing a resumption of investment and luxury expenditure. At the same time, the panic over markets produces calls for governments to boost consumption – by ‘tax and spend’ or ‘borrow and spend’ measures to increase government investment, by raising benefits etc. But these measures threaten to cut into profits and often provoke the capitalist class to cut still further its investments. The whole system gets caught between a rock and hard place.

This does not mean there is nothing governments can do. They can often take measures that seem to be effective when the first signs of a crisis show themselves. Thus the US Federal Reserve Bank did rush in to cut interest rates in October 1987 after Wall Street experienced the biggest fall in share prices since 1929, and it did so again in 1998 when the spread of the Asian crisis threatened to bring down the giant hedge fund Long Term Capital Management and, with it, much of the US financial world. But such interventions have only been able temporarily to suppress the symptoms of crisis (in the late 1980s for another two and a half years), not to cure the underlying illness. This is because they affect the way in which the movements of capitalist production express themselves on the surface of society, through the market, and so give a confidence boost to certain sections of capital. But they do nothing to alter the fundamental underlying factors concerned with the production and circulation of surplus value. These eventually reassert themselves.

The immediate reaction of the US state to the sudden panic about a new crisis at the turn of the year was to attempt ameliorative measures. Greenspan of the Federal Reserve stunned everyone by announcing a 0.5 percent cut in its interest rate, so reducing pressure on both firms and indebted consumers.

The Financial Times said:

The US Federal Reserve moved with unusual urgency yesterday to halt the slide in the American economy with a surprise half-point cut in its interest rate and a promise there could be more to follow. For the first time since the world economy hit the depths of the Asian financial crisis in 1998 the US central bank reduced short-term interest rates between scheduled meetings of its policy-making open market committee. In acknowledgement of the severity of the economic conditions the US faces, the rate cut was twice the quarter-point reduction it authorised then. [50]

The immediate reaction of many capitalist and media commentators was to rejoice. The head of the Federal Reserve, Greenspan, they claimed, had shown once again that he knew how to manage the economy:

A wave of relief washed through Wall Street ... the Dow Jones leaping more than 3 percent ... The Nasdaq jumped 14 percent, the biggest one-day gain in its 29-year history. [51]

But within 24 hours doubts had set in and ‘the financial markets began to have second thoughts about the unheralded cut in US interest rates on Wednesday night’. [52]

The doubts were of two sorts.

On the one hand, there were those who feared Greenspan had not done (and perhaps could not do) enough to stop the collapse of markets. ‘Investors’, reported the Financial Times, were ‘nervous about the risk of a hard landing for the economy’. [53] The Observer told of rumours sweeping the markets about ‘difficulties’ for one of the great banks: ‘Euphoria after the surprise cut on Wednesday had been replaced by Friday with neurosis about liquidity problems in the financial sector’. [54]

On the other hand, there were those who feared that he was taking measures that would stoke up inflation unnecessarily. ‘Labour Department figures reporting a rise in wage gains came as weak employment growth prompted fears that the slowdown might be accompanied by rising inflation’. [55]

The Economist gave angry expression to those who saw him as taking inflationary risks:

What on earth was Mr Greenspan up to? America’s economy is clearly slowing. But it is supposed to be ... The labour market is still tight, other inflationary pressures have yet to abate ... Does the evidence ... suggest that the slowdown so far is much too abrupt? Not really, not yet.

In December consumer confidence fell to its lowest for two years and retail sales were much weaker than expected. Unemployment insurance claims have been rising rapidly. Car sales are falling. And inventories are building up ... Yet numbers of this sort are not inconsistent with a soft landing – the measured slowdown in growth in the overheated economy that the Fed has been trying to engineer.

A shock which blasts America’s stock markets back upwards ... not merely delays the necessary economic adjustment, it runs the clear risk of worsening the existing financial stresses. Later, when adjustment can be delayed no longer, the jolt is all the more shattering ... Erring on the side of too much stimulus carries with it not just the danger of higher inflation, but also, more seriously, the risk of a worse recession down the road. [56]

The debate, crudely, was between those who believed the US economy needed a stimulus in order to ease a crisis of profitability caused by problems in realising surplus value and those who believed it needed to be allowed to sink a little in order to avoid a crisis of profitability caused by resistance to increasing exploitation by the workforce.

No one knows which side in this ruling class debate is making the most accurate assessment of its situation. The sheer complexities of an economic system in which hundreds of major firms and tens of thousands of minor ones compete with each other and try to inflate their profit figures makes it impossible for anyone to tell what real levels of profitability are. And so no one knows what the exact path of the US economy will be in the period ahead. What can, however, be asserted with confidence is that both sides in this debate are fixing on real and central problems for US capitalism. The rate of exploitation (and consequently the rate of profit) in the US economy is simultaneously too high and too low. It is too high for American workers any longer to provide the markets required for firms to sell their products (‘realise their surplus value’). But it is too low to provide the level of profitability to enable investment and luxury consumption to fill the gap. Hence the sudden combination of unsold stocks of goods (‘inventories’), excess industrial capacity and falling profits. The most likely short term outcome of the debate seems to be measures designed to ward off a full blown recession.

The US state and the Federal Reserve bank will be terrified of the impact of giant corporations or financial institutions going bankrupt. However much publications like The Economist might preach to them about the need to discipline those who have engaged in ‘irresponsible’ speculation, and however much hard line free market gurus will rant about the ‘moral hazards’, they will do their utmost to avoid giant bankruptcies, with the risk of economic black holes pulling profitable firms down with the unprofitable. And if big bankruptcies look about to materialise, they are likely to step in to mount rescue operations as they did with Long Term Capital Management.

What is more, George W Bush in office on a minority vote wants to placate his backers by implementing the tax cuts he has promised, and certainly wants to try to avoid a recession if he can. Hence his use of scarcely veiled Keynesian language. [57] He is also pressing for an increase in arms expenditure for the ‘Son of Star Wars’ anti-missile defence project which would boost certain sectors of US industry. As professor Paul Rogers has pointed out, a section of the American ruling class see this as a way of combining military and economic strategies:

US defence industry is dominated by a few contractors such as Boeing, Lockheed and TRW. All have suffered in recent years, but they have immense lobbying power, close links with the Republicans and a persistent vested interest in playing up threats to US interests ...

There are powerful lobbies based on the defence laboratories, not least the nuclear weapons labs at Los Alamos and Lawrence Livermore. They are already designing new weapons for ‘small nuclear wars in far off places’ ... Many on the Republican right think the only threats to US dominance will come from China if it develops into an economic giant. One way to curb its growth is to force it to commit more money to defence, and the National Missile Defence system is one way doing this. That may stimulate a dangerous nuclear arms race but, after all, the Soviet giant was successfully ‘spent into an early grave’ and perhaps the same strategy can be applied to China. [58]

Such measures cannot prevent a recession at some point. The real levels of profitability make it inevitable. So do the levels of overcapacity in key sections of production, like autos. But they do make the Economist scenario a runner, with a period of rising inflation followed, later rather than sooner, by an even sharper recession than the pessimists are predicting.

What form will the recession take? This no one can tell. But there must be a fair chance of the experience of Japan over the last nine years repeating itself. State intervention would be able to prevent a complete slide as occurred in 1929-1932 – particularly given the continuing way arms production in the US provides a floor below which key sections of manufacturing industry cannot fall. But it would not be able to overcome the imbalance between investment and profitably that arose in the final, speculative, phase of the boom and so would open up a long period of stagnation interspersed with phases of falling output and employment.

In any case, the results could be political dynamite in the US itself, creating the sort of conditions in which mass disaffection with the system can mushroom – disaffection feeding forces on both the left and the right of mainstream politics, as in Europe in the early 1990s.

‘I think it is still true that if America really sneezes, we all catch cold. We’ve had a good run. Enjoy it while it lasts because you cannot always expect it to be as good.’ So said Eddie George, governor of the Bank of England, at the very end of last year. [59]

Many mainstream commentators, however, are insistent that a US recession need not cause devastation elsewhere. In an editorial which should have been titled Always Look On The Bright Side, the Financial Times argued on 30 December 2000:

If the ‘soft’ landing turns bumpy, there is still a good chance that it will not end in a crash. Developed economies are equipped with better shock absorbers than in previous crises. Apart from Japan, budget deficits are well under control. A steady shift towards liberal market economic policies, even in social democratic Europe, offers the hope that in any recession, the mistakes of the 1970s will avoided. [60]

A news item in the same issue reported that ‘exports by British industry to North America leapt 7.6 percent to their highest volume ever in November, dispelling fears that the beginnings of a US economic slowdown had already dented demand’. [61]

A week later Ed Crooks argued:

For all the talk of the US as the engine of the world economy, the economic cycles of America, Europe and Asia have not been particularly closely linked over the past two decades ... For most developed countries, the US market is far from being the mainstay of the economy. The euro zone is relatively closed in global terms, exporting about 17 percent of its GDP, and the UK is its biggest market. Exports to the US account for 2.6 percent of Germany’s national income and 1.7 percent of France’s. [62]

This reasoning suggests the conclusion that the European economy can go on growing regardless of what happens in the US – a claim that starts in sharp contrast to all the hype about globalisation that has been used as an excuse by all the European governments and the European Commission for implementing neo-liberal policies of deregulation and labour flexibility. It is the sort of reasoning that has led Eddie George recently to suggest the impact of a US recession would not be as great as he seemed to suggest earlier.

But Crooks did recognise two big exceptions to this optimistic scenario. The first concerned the Asian and Latin American newly industrialising countries (NICs):

The huge US trade deficit – equivalent to some 1.5 percent of the rest of the world’s output this year – means the US is now very important for some emerging market countries. Exports to the US provide a quarter of the entire national income of Mexico and Malaysia, 8 percent for South Korea, 12 percent for Thailand and Taiwan. The concentration of emerging Asian economies on manufacturing electronics, which helped them recover rapidly after the 1998 downturn, is also likely to mean they suffer badly from a technology industry downturn. [63]

But it is not only the NICs themselves that would be hit by the recession in this way. So, most probably, would the giant Japanese economy. As The Guardian reported in January:

The Tokyo stock market slumped to a 27-month low yesterday as fears grew of a simultaneous recession in the world’s two biggest economies – the US and Japan – that could tip Asia back into crisis.

‘The possibility that a financial system crisis will be induced is strong,’ said Hiroshi Okuda, chairman of the Japan Federation of Employers’ Association and of the Toyota motor company.

‘At the end of last year exports were the only thing propping up the Japanese economy,’ said Noriko Hama, director of the Mitsubishi Research Institute. ‘If the US goes, the whole horror story of the Japanese economy will come out’. [64]

Gillian Tett in the Financial Times echoed the pessimism over the Japanese economy:

Another issue triggering unease was the state of Japan ... For although Japan appeared to be on a recovery path last year after a decade of stagnation, the picture has started to turn sour in recent weeks ... Last month the Tankan survey of corporate sentiment showed that business optimism had stalled. Industrial production, investment and export growth have been worse than expected. The fall in the Nikkei has provoked renewed fears about the fragility of Japanese banks ... [65]

The other proviso Crooks had to acknowledge was the financial interconnections between the US and the European economies. For one correct element in the hype about globalisation has been its stress on the extent to which finance capital moves from country to country, even while industrial capital is much more rooted in particular national or regional economies. [66]

Europe’s links with the US through financial markets may be more significant than those through trade. The enthusiasm of European companies for acquiring US assets means that they are more exposed to the US markets than before. [67]

The Bank of England warned in December:

... the risks to Britain’s financial system have grown over the past six months. In its latest Financial Stability Review, the Bank says that the worsening outlook for US economy, the surge in borrowing by telecommunications companies, and the financial turbulence in countries such as Argentina and Turkey, make the outlook for companies and financial markets more uncertain. [68]

Some commentators have gone further and claimed Britain is ‘the world’s largest hedge fund’, with nearly a quarter of GDP dependent upon ‘financial intermediation’, so that ‘the currency would be extremely vulnerable in the event of world financial turmoil’. [69]

This may be an overstatement. But there is no doubt British capitalism has bet very heavily on the US boom, with investment flows from Britain across the Atlantic far exceeding the much-hyped investment into Britain from abroad. This means that some, possibly very large, British firms could suddenly find themselves in great danger of being pulled down by sudden problems on the other side of the Atlantic.

In any capitalist boom the production and consumption of goods become increasingly separated by long chains of intermediaries involved in buying and selling, and each of these intermediaries depends, in turn, upon short term borrowing and lending. Credit transactions expand at a much more rapid pace than production itself. There are long chains of lending and borrowing alongside those buying and selling. No firm can pay off what it owes and stay in business unless others pay what they owe it. So long as business generally is expanding this is no problem. There is a general belief that what is owed will be paid. But that trust can evaporate once a single link in the chains of buying and selling or borrowing and lending is shown to be weak. Even the biggest firm can then suddenly find itself unable to cough up the hard cash demanded of it and risk going bust, so making it impossible for other firms to get what it owes them. A chain reaction of bankruptcies can follow. Just as during the boom, financial expansion seemed to take on a life of its own, growing out of all proportion to the productive activity it depended on at the end of the day, so in the recession the financial collapse can be deeper than the initial decline in production and markets, but then pull these further down with it. British capital, which showed so much faith in the quick profits to be made from the US boom, must be in considerable danger of being badly hit as that boom ends, regardless of its dependence or otherwise on the US market for sales.

The financial pages of the supposedly serious newspapers have been full of speculation about what will happen next to the US economy and, with it, the rest of the world. Marxists are often tempted to join in such speculation. After all, we have greater insight into the system than its defenders. And part of that insight consists in tearing apart the ‘new’ theories arising with monotonous regularity in every boom that purport to show the system has become crisis free.

But we should resist the temptation to overindulge ourselves in prophesy. The crisis-prone character of the system is beyond doubt. When and how the crisis erupts depends upon the complex interaction of multiple factors that no one can decipher and upon contingencies that no one can foresee with any degree of accuracy. The important thing for us is to understand the political implications raised by the likelihood of crisis.

Economic crises shake people’s lives up. Like great wars, they suddenly make it impossible for millions to live in the old way, according to the patterns of behaviour and customs of thought they had previously taken for granted. The politics of complacency that accompanies the boom can suddenly be burst open by sudden upsurges of anger from below and a widespread questioning of institutions and ideas. Whole new layers can turn to the left. But they do not automatically do so. They can also react by turning to the radical right, blaming scapegoats or clinging to nationalist myths in a desperate attempt to find a way out of their predicament. So the great crisis of the 1930s led to the growth of both the far left and the far right, to different degrees in different countries.

Trotsky made the point some 80 years ago that the political impact of a crisis does not depend upon economic factors, but the concrete conditions of the class struggle in the preceding period. So the political impact of the crisis of 1929-1933 was very different in the US and Germany. The US saw a wave of worker militancy in mid-1930s which created mass trade unionism. By contrast, the failures of the left in Germany allowed the Nazi Party to establish a regime of unparalleled barbarity.

The background today in the advanced industrial countries is characterised by three general features. First, there is a recovery of the workers’ movement from the defeats and demoralisation of the late 1970s and 1980s. The recovery is enormously uneven from country to country, with France at one extreme and Britain at the other. But everywhere there seems to be some sense of reawakening.

Second, in most countries the organisations of the fascist right have some strength. This is usually much greater in electoral than in street fighting terms and is often less than it was half a dozen years ago. But their implantation is sufficient across Europe for them to hope to make big gains if crisis leads to high levels of unemployment and demoralisation. Whether they achieve such gains depends to a considerable degree on the response of the left, not only to the crisis but also to what is happening at present, before the crisis has matured.

This relates to the third feature – the growth of a new anti-capitalist minority for the first time since the late 1960s and early 1970s. There are people in every factory, college, school and office in the world who identify with the challenges to the global system made at the series of demonstrations from Seattle through Millau and Prague to Nice, Davos and Porto Alegre. This minority is usually not yet an organised movement. But the potential is there for new movements – as was shown, for instance, in the Nader presidential campaign in the US or the sudden growth of the organisation against financial speculation, ATTAC, in France over the last two years.

The political impact of the crisis, whenever it finally breaks in earnest, will depend upon the ability of this minority to build movements that relate to the activists involved in the revival of working class struggle, and with them to provide large scale political alternatives to much greater numbers of people. The signs of incipient crisis confront revolutionary socialists with the challenge of fulfilling these tasks. If we succeed, a whole new world of possibilities is open to us. If we fail, there might be a very heavy price to pay.

1. The Wall Street Journal Europe, 18 December 2000.

2. US figures given in C. Kossis, A Miracle Without End? Japanese Capitalism and the World Economy, International Socialism 54 (Spring 1992), p.119.

3. Figures for gross domestic product per man-hour given in A. Maddison, Dynamic Forces in Capitalist Development: A Long Run View (1991), table 3.3.

4. M. Porter, Financial Times, 5 July 2000.

5. See Pentagon Takes Initiative In War Against Chip Imports, Financial Times, 27 January 1987; for the worries of US chip-makers, see Financial Times, 12 September 1990.

6. Financial Times, 8 December 1998.

7. R. Heilbroner, Lifting the Silent Depression, The New York Review of Books, October 24 1991, p.6.

8. This was the message of William Keegan’s The Spectre of Capitalism (London 1992) – and even of Will Hutton’s The State We’re In a couple of years later.

9. Quoted in Slow Motion But Not A Standstill, Financial Times, 21 February 1992.

10. Financial Times, 4 November 1991.

11. Quoted in the Financial Times, 8 May 1992.

12. There were many people, including Keegan and Hutton, who hardly noticed that in the late 1980s the US economy had overcome its relative decline vis-à-vis Europe, with substantially faster growth rates (although not productivity growth rates) than West Germany. For details, see my article Where Is Capitalism Going?, International Socialism 58 (Spring 1993).

13. Ibid.

14. Ibid.

15. A clip of the speech containing these claims was broadcast last year on a BBC programme about, of all things, the American novelist Norman Mailer.

16. Financial Times, 13 December 1999.

17. See Pentagon Takes Initiative In War Against Chip Imports, op. cit.

18. Financial Times, 12 September 1990.

19. International Herald Tribune, 17 December 1996.

20. Ibid.

21. Labour’s share is defined as total remuneration to labour expressed as a percent of the value of output in the corporate sector. IMF Staff Country Report No 99/101: United States, Selected Issues (Washington 1999).

22. Ibid.

23. Collins, Hutman and Sklar, Divided Decade (Boston,1999).

24. Ibid.

25. See S. Brittan, Financial Times, 11 November 1999.

26. Lessons In Restructuring, Financial Times, 22 October 1996.

27. Quoted by William Keegan in The Observer, 11 June 2000.

28. Collins, Hutman and Sklar, op. cit.

29. Ibid.

30. Ibid.

31. Ibid.

32. Ibid.

33. M. Wolf, Financial Times, 28 June 2000.

34. Financial Times, 6 January 2001.

35. IMF, op. cit.

36. For devastating critiques of the claims of the ‘new paradigm’ see the three reports produced for the stockbroking firm Phillips and Drew, Bill Martin and Wynne Godley: America and the World Economy (December 1998), America’s New Era (October 1999), and America’s New Era Revisited (April 2000).

37. Financial Times, 12 December 2000.

38. Quoted in B. Martin, Drivers of the New Economy (UBS Asset Management, October 2000).

39. For an analysis of these arguments, which already seem dated by the collapse in hi-tech shares, see my article Paradigm Lost, Socialist Review 238, February 2000.

40. Quoted in B. Martin, op. cit., p.2.

41. Financial Times, 18 December 2000.

42. K. Marx, Capital, vol.III (Moscow 1962), p.473.

43. IMF, op. cit.

44. IMF, op. cit.

45. Ibid.

46. Phillips & Drew Research Group, America’s New Era (London 1999), p.5.

47. Quoted in the Financial Times, 8 June 2000.

48. IMF, op. cit.

49. Ibid., p.29.

50. Financial Times, 4 January 2001.

51. Ibid.

52. The Guardian, 5 January 2001.

53. Financial Times, 6 January 2001.

54. The Observer, 7 January 2001.

55. Financial Times, 6 January 2001.

56. The Economist, 6 January 2001.

57. See, for instance, W. Keegan, The Observer, 17 December 2000.

58. P. Rogers, The Guardian, 13 January 2001.

59. Quoted in the Financial Times, 30 December 2000.

60. Financial Times, 30 December 2000.

61. D. Turner and C. Swann, Financial Times, 30 December 2000.

62. E. Crooks, Financial Times, 6 January 2001.

63. Ibid.

64. The Guardian, 12 January 2001.

65. Financial Times, 15 January 2001.

66. For an elaboration of these arguments, and sources to back them up, see my article Globalisation: A Critique of a New Orthodoxy, International Socialism 73 (Winter 1996).

67. E. Crooks, op. cit.

68. Financial Times, 14 December 2000.

69. D. Murray and A. Smithers, Britain: The World’s Largest Hedge Fund (London 2000).

Last updated on 4.3.2012