Finance Capital, Hilferding 1910

Up to the present, economics has sought to distinguish between the individually owned enterprise and the joint-stock company (or corporation) only in terms of differences in their organizational forms and of the consequences which flow directly from them. It has indicated the !good' and the 'bad' features of the two forms of enterprise, emphasizing partly subjective factors such as the greater or lesser degree of interest and responsibility of their managers, and the relative ease or difficulty of exercising a general supervision over the enterprise, and partly objective factors such as the ease of access to capital, and their relative capacity for accumulation. But it has neglected to investigate the fundamental economic differences between the two forms of enterprise, even though these differences are crucial to any understanding of modern capitalist development, which can only be comprehended in terms of the ascendancy of the corporation and its causes.[1]

The industrial corporation, our first object of inquiry, involves above all a change in the function of the industrial capitalist. For it converts what had been an occasional, accidental occurrence in the individual enterprise into a fundamental principle; namely, the liberation of the industrial capitalist from his function as industrial entrepreneur. As a result of this change the capital invested in a corporation becomes pure money capital so far as the capitalist is concerned. The money capitalist as creditor has nothing to do with the use which is made of his capital in production, despite the fact that this utilization is a necessary condition of the loan relationship. His only function is to lend his capital and, after a period of time, to get it back with interest; a function which is accomplished in a legal transaction. So also the shareholder functions simply as a money capitalist. He advances money in order to get a return (to use a very general expression at this stage). Like any money capitalist who risks only such sums of money as he sees fit, the shareholder makes the decision as to how much money he will advance and be held liable for. Nevertheless, a distinction already emerges here. The rate of interest paid on money capital which is provided in the form of shares is not fixed in advance; it is only a claim on the yield (profit) of an enterprise. A second difference as against loan capital is that the return of capital to the money capitalists is not guaranteed. Neither the contract which defines their relationship to the enterprise, nor the relationship itself, gives them any such assurance.

Let us consider the first point. To begin with, it should be realized that the return on money capital offered in the form of shares is by no means completely indeterminate. A capitalist enterprise is founded in order to make a profit, and its creation is undertaken on the assumption that it will achieve a profit; in normal circumstances, the prevailing average rate of profit. In any case, the shareholder is in a situation similar to that of the money capitalist, who counts on the realization of his capital in production so long as the debtor remains solvent. Generally speaking, the somewhat greater insecurity of the shareholder by comparison with the money capitalist will bring him a certain risk premium. But one should not suppose that this premium is somehow fixed and known in advance to the shareholder as a definite measurable claim. The risk premium is simply a result of the fact that the supply of free money capital, which the founders of companies are seeking, which is available for investment in shares, will normally be smaller, other things being equal, than that for particularly safe, fixed interest investments. It is just this difference in supply which explains the variations in interest rates and in the market quotations of interest-bearing securities. Greater security or insecurity is the reason for a larger or smaller supply, and from the variations in this relation between supply and demand results the diversity of interest yields. The probable profit yield on a share is therefore determined by industrial profit and this profit, other things being equal, is determined by the average rate of profit.

The shareholder, however, is not an industrial entrepreneur (capitalist). He is primarily a money capitalist, and one of the essential characteristics which differentiates the loan capitalist from the industrial capitalist is that he holds his capital - money capital - in an entirely different way, available for use just as he pleases. The industrial capitalist invests his entire capital in a particular enterprise. Unlike the shareholder, who need have only a negligible amount of capital available, the industrial capitalist must command a capital which is large enough to function independently in the given branch of industry. The industrial entrepreneur has, tied up his capital in his enterprise, he works productively only in that enterprise, and his interests are bound up with it over a long period. He cannot withdraw his capital unless he sells the enterprise, and this means only that the person of the capitalist changes, that one industrialist is replaced by another. He is not a money capitalist but an industrial (productive, functioning) capitalist, who draws a return from his enterprise in the form of industrial profit. The shareholder, on the other hand, if we consider him only as a money capitalist, will make his capital available to anyone so long as he gets interest on it.

For the shareholder to become a money capitalist, however, he must be able to regain possession of his capital as money capital at all times. But his capital, like that of an individual capitalist, seems to be tied up in the enterprise, as indeed it is. His money has gone to buy machines and raw materials, to pay workers etc. ; in short it has been converted from money capital into productive capital (M elP)and enters into the cycle of industrial capital. Once the shareholder has parted with this capital, he cannot recover it. He has no claim upon it, but only a claim to a pro-rata share of its yield. In capitalist society, however, every sum of money has the capacity to bear interest; and conversely every regularly recurring income which is transferable (as is usually the case, so far as it is not tied to a purely personal, and therefore transitory and indeterminate condition, such as wages, etc.) is regarded as interest on capital and has a price which is equal to the yield capitalized at the current rate of interest.[2] This is easily explained by the fact that large sums of money are always available for realization and find such realization in a claim upon the profit. Consequently, the shareholder is in a position to recover his capital at any time by selling his shares or claims to profit, and to that extent he is in the same position as the money capitalist. This possibility of selling is created by a special market, the stock exchange. The establishment of this market endows share capital, which the individual can now always realize, completely with the character of money capital. Conversely, the money capitalist retains his character even when he invests in shares. Liquid money capital competes, as interest-bearing capital, for investment in shares, in the same way as it competes in its real function as loan capital for investment in fixed interest loans. The competition for these various investment opportunities brings the price of shares closer to the price of investments with a fixed interest, and reduces the shareholders' yield from the level of industrial profit to that of interest.

This reduction of the share yield to the level of the rate of interest is a historical process which accompanies the development of stocks and the stock exchange. When the joint-stock company is not the dominant form, and the negotiability of shares is not fully developed, dividends will include an element of entrepreneurial profit as well as interest.

To the extent that the corporation is prevalent, industry is now operated with money capital which, when converted into industrial capital, need not yield the average rate of profit, but only the average rate of interest. This appears to be a patent contradiction. The money capital which is provided in the form of share capital is transformed into industrial capital. The fact that in the minds of its owners it functions in exactly the same way as does loan capital, certainly cannot affect the yield of the industrial enterprise. Just as before, the enterprise will yield, under normal conditions, an average profit. We cannot possibly assume that the corporation will sell its commodities at below the average profit, and voluntarily sacrifice a part of the profit, simply in order to distribute among its shareholders a return no higher than the rate of interest. After all, every capitalist enterprise seeks to maximize its profit, which it can succeed in doing if it sells its output at prices of production (cost price plus average profit). Apparently, then, the factors previously mentioned which make money capital, invested in shares appear subjectively as simple loan capital yielding interest, are not adequate to explain the reduction of the yield from shares to the level of interest. What they would leave unexplained is where the other part of the profit (average profit minus interest), in other words the actual entrepreneurial profit, had gone. Let us examine the matter more closely.

With the transformation of an individually owned enterprise into a corporation a doubling of the capital seems to have occurred. The original capital advanced by the shareholders has been definitively converted into industrial capital, and actually exists only in that form. The money was used to purchase means of production, and thus disappeared definitively from the circulation process of money capital. When these means of production are converted into commodities in production, and the commodities are then sold, money - quite different money - can flow back from circulation. Thus the money which is acquired from subsequent sales of shares is not the same money which was originally supplied by the shareholders and then used in production. It is not a constituent part of the corporation's capital, but rather an additional quantity of money required for the circulation of the capitalized claims to income. Similarly, the price of a share is not determined as if it were part of the capital of the enterprise, but rather as a capitalized claim to a share in the yield of the enterprise. In other words, the price of a share is not determined as an aliquot part of the total capital invested in the enterprise and therefore a relatively fixed sum, but only by the yield capitalized at the current rate of interest. Since the share is not a claim to a part of the capital in active use in the enterprise, its price does not depend upon the value, or price, of the industrial capital which is actually being used. It is a claim to a part of the profit, and therefore its price depends, first, on the volume of profit (which makes it far more variable than it would be if it were part of the price of the elements of production of the industrial capital itself), and second, on the prevailing rate of interest.[3]

The share, then, may be defined as a title to income, a creditor's claim upon future production, or claim upon profit. Since the profit is capitalized, and the capitalized sum constitutes the price of the share, the price of the share seems to contain a second capital. But this is an illusion. What really exists is the industrial capital and its profit. But this does not prevent the fictitious 'capital' from existing in an accounting sense and from being treated as 'share capital'. In reality it is not capital, but only the price of a revenue; a price which is possible only because in capitalist society every sum of money yields an income and therefore every income appears to be the product of a sum of money. If this deception is assisted in the case of industrial shares by the existence of genuinely functioning industrial capital, the fictitious and purely accounting nature of this paper capital becomes unmistakable in the case of other claims to revenue. State bonds need not in any way represent existing capital. The money lent by the state's creditors could long ago have gone up in smoke. State bonds are nothing but the price of a share in the annual tax yield, which is the product of a quite different capital than that which was, in its time, expended unproductively.

The turnover of shares is not a turnover of capital, but a sale and purchase of titles to income. The fluctuations in their price leave the actually functioning industrial capital, whose yield, not value, they represent, quite unaffected. Aside from the yield their price depends upon the rate of interest at which they are capitalized. The movements of the rate of interest, however, are quite independent of the fate of any particular industrial capital. These considerations make it obvious that it is misleading to regard the price of a share as an aliquot part of industrial capital.

If this is so, then the total sum of 'share capital', that is, the aggregate price of capitalized claims to profit, need not coincide with the total money capital, which was originally converted into industrial capital. The question then arises how this discrepancy comes about and how large it is. Let us take, for example, an industrial enterprise with a capital of 1,000,000 marks, and assume that the average profit is 15 per cent and the prevailing rate of interest 5 per cent. The enterprise makes a profit of 150,000 marks. The sum of 150,000 marks capitalized as annual income at 5 per cent, will have a price of 3,000,000 marks. Usually, at a rate of 5 per cent money capital would seek out only absolutely secure paper at a fixed rate of interest. But if we add a high risk premium, say of 2 per cent, and take into account various costs of administration, directors' fees, etc., which would have to be deducted from the profit of the corporation (and which an individually owned enterprise would be spared), and assume that this results in the available profit being reduced by 20,000 marks, then 130,000 marks can be distributed giving shareholders a return of 7 per cent. The price of the shares would then be 1,857,143 marks, or in round figures, 1,900,000 marks. But only 1,000,000 marks are needed to produce a profit of 150,000 marks, and 900,000 marks are left free. This balance of 900,000 marks arises from the conversion of profit-bearing capital into interest- (or dividend-) bearing capital. If we disregard the higher administrative costs of a corporation, which reduce the total profit, the 900,000 marks represent the difference between the yield capitalized at 15 per cent and the same yield capitalized at 7 per cent; or in other words, the difference between capital which earns the average rate of profit and capital which earns the average rate of interest. This is the difference which appears as 'promoter's profit', a source of gain which arises only from the conversion of profit-bearing into interest-bearing capital.

The prevalent view, which emphasizes so strongly the higher administrative costs of the corporation as compared with an individually owned enterprise, has neither recognized nor explained the remarkable problem of how a profit arises with the change from a cheaper to a more expensive form of productive enterprise, but has been content with mere phrases about costs and risks. But promoter's profit is neither a swindle, nor some kind of indemnity or wage. It is an economic category sui generis.

In so far as they make any distinction at all between interest and entrepreneurial profit, economists conceive dividends simply as interest plus entrepreneurial profit, or in other words, the equivalent of profit for an individual entrepreneur. It is evident that such a view overlooks the distinctive features of the corporation. Rodbertus, for example, says :

For the sake of agreement on terminology, I wish at this point merely to remark that while the dividend on a stock contains not only interest but also an entrepreneurial profit, the interest on a loan is without any trace of entrepreneurial profit.[4]

This of course, makes it impossible to explain promoter's profit.

The technical form[5] of the corporate enterprise makes it possible for the owner of capital (who would receive only the current rate of interest had he loaned it to an individual entrepreneur) to receive entrepreneurial profit as well, with the same ease as he would get the interest. This is why the corporate form of enterprise is so attractive to our capitalists, and may be expected increasingly to dominate the industrial field. The so-called swindle of company promotion is merely foam, or rather dross, on the surface of genuine business.[6]

Beyond the moral judgment, there is no attempt to explain promoter's profit, which is not itself a swindle, although it certainly makes swindles possible. Rodbertus's view is one-sided and thus misleading:

In short, what was once ordinary loan capital ceases to be loan capital when it is converted into shares, and becomes in the hands of its owners something which creates its own value, and indeed in a form which allows them, in their godlike existence as loan capitalists, to pocket almost the entire capital income.[7] [By income from capital, Rodbertus means entrepreneurial profit plus interest - R.H.]

Rodbertus sees only the content of the process; the transformation of money capital into industrial capital. He fails to notice that what is essential is the form in which it is done, which enables the money capital to become fictitious capital and at the same time to retain for its owners the form of money capital.[8]

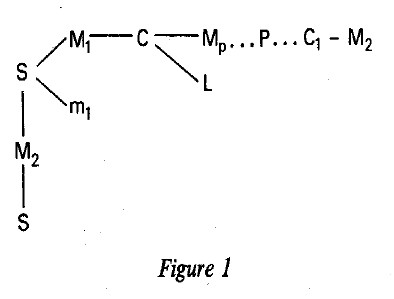

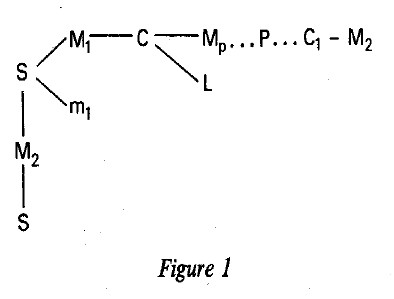

Turning now to the peculiar form which the circulation of fictitious capital takes, we find the following: The shares (S) are issued; that is, sold for money (M). One part of this money (m1) constitutes the promoter's profit, accrues to the promoter (say, the issuing bank) and drops out of circulation in this cycle. The other part (M1) is converted into productive capital and enters the cycle of industrial capital which is already familiar to us. The shares have been sold ; if they are to circulate again then additional money (M2) is needed as a medium of circulation. This circulation (S-M2-S) takes, place in its own specific market, the stock exchange. Hence, the scheme of circulation in Figure1.

Once a share has been issued it has nothing more to do with the real cycle of the industrial capital which it represents. None of the developments or misfortunes which it may encounter in its circulation have any direct effect on the cycle of the productive capital.

The commerce in shares, and in all certificates of fictitious capital, requires new money, both cash and credit money (for instance, bills of exchange). But whereas bills were previously covered by the value of commodities, they are now covered by the 'capital value' of the shares, which in turn depends upon the yield. Since the yield depends upon the realization of the commodities which the corporation produces, that is upon the sale of the commodities at their values or prices of production, so this credit money is only indirectly covered by the value of commodities. Furthermore, while the volume of payments in trade is determined by the value of commodities, in the commerce in shares it is determined by the capitalized amount of the net yield. But the amount of money needed in this case is greatly reduced by the negotiability of these papers.

If we remember that capital is equal to one hundred times the interest, divided by the rate of interest, the formula for promoter's profit is:

P = 100

Y - 100

Y

d

p

where P is the promoter's profit, p the average profit, d the dividend, and Y the yield of the enterprise. If the gross yield of the enterprise is considered to be reduced by the costs of administration, Y - e may be substituted for the first Yin the formula. It is evident that the separation of the entrepreneurial function, which economics has so far dealt with only in a descriptive manner, involves at the same time a transformation of the industrial capitalist into a shareholder, into a particular kind of money capitalist, so that there emerges a tendency for shareholders to become increasingly pure money capitalists. This tendency is reinforced by the fact that shares are always readily saleable on the stock exchange.

My analysis of the economics of the corporation goes considerably beyond that provided by Marx. In his brilliant sketch of the role of credit in capitalist production, which he was unfortunately denied the opportunity to elaborate, Marx conceives the corporation as a consequence of the credit system, and describes its effects as follows :

1 An enormous expansion of the scale of production and enterprises which were impossible for individual capitals. At the same time, such enterprises as were formerly carried on by governments are socialized.

2 Capital, which rests on a socialized mode of production, and presupposes a social concentration of means of production and labour-power is here directly endowed with the form of social capital ( a capital of directly associated individuals) as distinguished from private capital, and its enterprises assume the form of social enterprises as distinguished from individual enterprises. It is the abolition of capital as private property within the boundaries of capitalist production itself.

3 Transformation of the actually functioning capitalist into a mere manager, an administrator of other people's capital, and of the owners of capital into mere owners, mere money capitalists. Even if the dividends which they receive include the interest and profits of the enterprise, that is, the total profit (for the salary of the manager is, or is supposed to be, a mere wage of a certain kind of skilled labour, the price of which is regulated in the labour market like that of any other labour), this total profit is henceforth received only in the form of interest, that is, in the form of a mere compensation of the ownership of capital, which is now separated from its function in the actual process of reproduction, in the same way in which this function, in the person of the manager, is separated from the ownership of capital. The profit now presents itself (and not merely that portion of it which derives its justification as interest from the profit of the borrower) as a mere appropriation of the surplus labour of others, arising from the transformation of means of production into capital, that is, from its alienation from its actual producer, from its antagonism as another's property opposed to the individuals actually at work in production, from the manager down to the last day labourer.

In the joint stock companies, the function is separated from the ownership of capital, and labour, of course, is entirely separated from ownership of the means of production and of surplus labour. This result of the highest development of capitalist production is a necessary transition to the reconversion of capital into the property of the producers, no longer as the private property of individual producers, but as the common property of associates, as social property outright. On the other hand, it is a transition to the conversion of all functions in the process of reproduction, which still remain connected with capitalist private property, into mere functions of the associated producers, into social functions.

Before we proceed any further, we call attention to the following fact which is economically important; since profit here assumes purely the form of interest, enterprises of this sort may still be successful, if they yield only interest, and this is one of the causes which stem the fall of the rate of profit since these enterprises, in which the constant capital is so enormous, compared to the variable, do not necessarily come under the regulation of the average rate of profit.[9]

What Marx considers here are primarily the economic and political effects of the corporations. He does not yet conceive dividends as a distinct economic category and hence fails to analyse promoter's profit. As regards the concluding remarks concerning the influence upon the formation of the average rate of profit, and the tendency of the rate of profit to fall, it is clear that with the spread of the corporation its profit, just like that of an individually owned enterprise, must contribute to the equalization of the general rate of profit. We have seen already that the output of the corporation, under normal conditions, is subject to exactly the same price laws as is that of the individually owned enterprise. Marx was thinking of the railway corporations of his day, and in this connection his comments were perhaps partly justified. I say 'partly' because even then promoter's profit had already absorbed some part of the profit, and this was bound to be reflected in railway prices.

When a corporation is founded its share capital is calculated so that the profit of the enterprise will be adequate to distribute a dividend on the capital which will provide each individual shareholder with interest on his investment.[10] Should an economic boom, or other favourable circumstances, make it possible later on to distribute a larger dividend, the price of the shares will rise. If we assume that the shares of a corporation yielding a dividend of 6 per cent stand at 100, then they will rise to 150 if the dividend is raised to 9 per cent. These variations in dividends reflect the varying fortunes of individual enterprises. Such variations, however, are overridden, in the case of new purchasers of shares, by the rise or fall of the general level of share prices.[11]

The difference between the value of the capital in actual use and the (fictitious) share capital can increase during the lifetime of a corporation. If the enterprise yields dividends much higher than the average, and if the necessity, or opportunity, of increasing its capital then arises, this higher yield becomes the basis of the new capitalization, and the nominal share capital is increased far beyond the extent of the capital in actual use. Conversely, it is also possible to increase the functioning capital without any increase in the nominal share capital. This is the case, for example, when the net profit is ploughed back into the operations of the enterprise rather than being distributed as dividends to the shareholders. But as such a use of profit encourages the expectation of an increased future yield, there is a simultaneous rise in the market quotation of the shares.

Share prices will fluctuate not only as a result of changes in the yield, or of increases and decreases in the amount of capital in active use, but also because of changes in the general rate of interest. A low rate of interest over a long period will make it possible, ceteris paribus, for share prices to rise, while a high rate of interest will have the opposite effect.

From the nature of dividends it is obvious that there are no average dividends in the sense in which there is an average rate of interest or an average rate of profit. A dividend is originally equal to interest plus a risk premium, but it may either increase or decrease, and then remain at this level, in the course of time, because in this case competition does not equalize the yield, as it does with the interest rate or the rate of profit, but only the price of shares.

The market price of share capital is therefore always higher, under normal conditions, than the value of productive capital ; that is, of capital which yields an average profit. On the other hand, given the yield of the enterprise and the rate of interest, the market price of the share capital depends upon the number of shares issued. Thus, if the interest rate is 5 per cent the shares of an enterprise which has a productive capital of 1,000,000 marks and yields a profit of 200,000 marks will have a market price of 4,000,000 marks. If 1,000,000 marks of shares are issued, a share with a nominal value of 1,000 marks will sell for 4,000 marks; if 2,000,000 marks of shares are issued, it will sell for 2,000 marks ; if 4,000,000 marks of shares are issued, it will sell for 1,000 marks., etc.

The issue of shares in such a quantity as to depress the price below the nominal value, below par, is referred to as 'stock watering'. It is clear that this is purely a matter of accounting. The yield is given, and this determines the price of the shares as a whole. Naturally, the larger the number of shares, the lower the price of each individual share. The practice of 'watering' stock has nothing to do with promoter's profit, which arises whenever a corporation is formed, through the transformation of productive, profit yielding capital into fictitious, interest-yielding capital. In fact the watering of stock is not at all essential, and unlike promoter's profit it can as a rule be prevented by law. The provision in the German law relating to shares which requires that any premium on shares must be credited to the reserves has simply had the effect that shares are turned over at par, or at a small premium, to a bank consortium which then sells them to the public at a profit (promoter's profit).

Under certain conditions, however, stock watering is a convenient financial device for increasing the share of the founders of a corporation beyond the normal promoter's profit. In the United States, for example, two distinct kinds of shares are usually issued when large corporations are formed; preferred and ordinary shares. Preferred shares have a limited rate of interest, usually between 5 per cent and 7 per cent. They are also frequently cumulative, in the sense that if in any year the whole dividend to which they are entitled has not been paid they have a right to have it made up from the yield of subsequent years. Only after the claims of the preferred shares have been met can dividends be paid on the ordinary shares. The volume of preferred shares is usually calculated when the corporation is founded, so that it exceeds the capital actually required for the conduct of the business. The greater part of the promoter's profit is embodied in the preferred shares. The ordinary shares are usually issued for a similar amount. In most cases, the price of ordinary shares is at first very low, but preferred and ordinary shares together stand somewhat above par. A large part of the ordinary shares is usually retained by the promoters, and this makes it easier for them to ensure their majority control.[12] Moreover, in the more important flotations the preferred shares earn the equivalent of a fixed interest rate, whereas ordinary shares do not have a fixed dividend. Their yield depends upon general business conditions ; and since the yield is subject to extremely sharp fluctuations, ordinary shares are a favourite with speculators. Well-informed large shareholders, who paid nothing for the shares anyway, can use them for lucrative speculation. Furthermore, this method of financing guarantees to the founders, who own the ordinary shares, the extra profit which accrues from the foundation of the corporation and the return from all future progress and favourable market conditions. The public, on the other hand, which owns the preferred shares, must content itself with a fixed rate of return which is little higher than the current rate of interest. To some extent, finally, the real situation of the enterprise can be concealed,[13] and this concealment makes possible various fraudulent activities. Nevertheless, overcapitalization has no effect whatsoever on prices. It is a curious notion that the inflation of the nominal value of fictitious capital can alter in any way the laws of price. Of course, it is self-evident that holders of large blocks of share capital will desire high prices so that they can be assured of a return. But even if the capital were written down to zero, no capitalist will sell more cheaply than he has to, whether he directs an individually owned enterprise, a joint-stock company, or a trust.

The corporation is an association of capitalists. It is formed by each capitalist contributing his share of capital, and the extent of his participation, his voting rights, and the degree of his influence, are determined by the amount of capital he contributes. The capitalist is a capitalist only in so far as he owns capital, and he is differentiated from other capitalists only in a quantitative way. Hence the control of the enterprise as a whole is in the hands of those who own a majority of the shares. This also means that a corporation can be controlled by those who own half the capital, whereas in an individually owned enterprise it is necessary to own the whole capital. This doubles the power of the large capitalists. Disregarding here the role of credit, a capitalist who decides to turn his enterprise into a joint-stock company needs only half his capital in order to retain complete control. The other half becomes disposable and can be withdrawn from the enterprise. It is true, of course, that he would then lose the dividends on this half. Nevertheless, the control of outside capital is extremely important, and his domination of the enterprise is, aside from everything else, a crucial means of influencing the sale and purchase of shares on the stock exchange.

In practice, the amount of capital necessary to ensure control of a corporation is usually less than this, amounting to a third or a quarter, or even less. Whoever controls the corporation also has control over the outside capital as if it were his own. But this kind of control is by no means synonymous with control over outside capital in general. With the development of the credit system in an advanced capitalist society every unit of owned capital is at the same time the exponent [in the mathematical sense - Ed.] of outside loan capital; and other things being equal, the amount of credit depends upon the size of one's own capital, although the former increases more rapidly than the latter. The capital of the large shareholder is such an exponent in two senses. His own capital controls that of the other shareholders, and in turn the total capital of the enterprise serves to attract outside capital in the shape of loan capital which is made available to the enterprise.

The large capital dominating a corporation has an even greater impact when it is no longer a question of a single corporation, but of a system of interdependent companies. Suppose that capitalist X controls, with 5,000,000 shares, corporation A whose share capital is 9,000,000. This corporation now establishes a subsidiary company, B, with a share capital of 30,000,000, and retains 16,000,000 of these shares in its own portfolio. In order to pay for these 16,000,000 shares, A issues 16,000,000 fixed-interest debentures without voting rights. With his 5,000,000 capitalist X now controls both corporations, or a total capital of 39,000,000. Following the same procedure, A and B can now create other new companies, so that X, with a relatively small capital, acquires control over an exceptionally large amount of outside capital. With the development of the joint-stock system there emerges a distinctive financial technique, the aim of which is to ensure control over the largest possible amount of outside capital with the smallest possible amount of one's own capital. This technique has reached its peak of perfection in the financing of the American railway system.[14]

Along with the development of the corporations on one side, and the increasing concentration of property on the other, the number of large capitalists who have distributed their capital among diverse corporations also increases. Substantial ownership of shares gives access to the management of the company. As a member of the board of directors, the large shareholder first of all receives a share of the profit in the form of bonuses;[15] then he also has the opportunity to influence the conduct of the enterprise, and to use his inside knowledge of its affairs for speculation in shares, or for other business transactions. A circle of people emerges who, thanks to their own capital resources or to the concentrated power of outside capital which they represent (in the case of bank directors), become members of the boards of directors of numerous corporations. There develops in this way a kind of personal union,[16] on one side among the various corporations themselves, and on the other, between the corporations and the bank; and the common ownership interest which is thus formed among the various companies must necessarily exert a powerful influence upon their policies.

In order to achieve the concentration of capital in an enterprise the corporation assembles its capital from individual particles of capital, each of which is too small, taken separately, to function as industrial capital, either generally or in the branch of industry where the corporation is located. It should be borne in mind that initially the corporations assembled their capital by direct appeals to individual capitalists, but this changed at a later stage, when the individual sums of capital were already accumulated and concentrated in the banks. In these conditions, the appeal to the money market is mediated by the banks.

No bank can think of raising the capital for an individually owned enterprise. The most it can do as a rule is to provide it with commercial credit. With the corporation it is an entirely different matter. To provide the capital in this case, the bank need only advance it, divide the sum into parts, and then sell these parts in order to recover the capital, thus performing a purely monetary transaction (M--M1). It is the transferability and negotiability of these capital certificates, constituting the very essence of the joint-stock company, which makes it possible for the bank to 'promote', and finally gain control of, the corporation. Similarly, a corporation can obtain bank loans far more readily than the individually owned enterprise. The latter, generally speaking, must be able to cover such loans out of its earnings, and their extent is consequently restricted. But precisely for this reason, because the debts are small, they leave the private entrepreneur relatively independent. The corporation, on the other hand, is able to repay these bank loans not only out of its current earnings, but also by increasing its capital through the issue of shares and bonds, by issuing which the bank also gains an additional promoter's profit. The bank can therefore provide more credit, with much greater security, to a corporation than to an individually owned enterprise, and above all a different type of credit; not only credit as a means of payment, commercial credit, but also credit for the expansion of the enterprise's productive capital, that is, capital credit. For if it seems necessary, the bank can always curtail this credit and insist that the enterprise should obtain fresh capital by a new issue of shares or bonds.[17]

The bank can not only extend more credit to a corporation than to an individual entrepreneur, but can also invest a part of its money capital in shares for a longer or shorter period. In any event, the bank acquires a permanent interest in the corporation, which must now be closely watched to ensure that credit is used for the appropriate purpose, and so far as possible controlled by the bank in order to make the latter's profitable financial transaction secure.

The interests of the banks in the corporations give rise to a desire to establish a permanent supervision of the companies' affairs, which is best done by securing representation on the board of directors. This ensures, first, that the corporation will conduct all its other financial transactions, associated with the issue of shares, through the bank. Second, in order to spread its risks and to widen its business connections, the bank tries to work with as many companies as possible, and at the same time, to be represented on their boards of directors. Ownership of shares enables the bank to impose its representatives even upon corporations which initially resisted. In this way there arises a tendency for the banks to accumulate such directorships.[18]

Industrialists who serve on the boards of directors of other corporations have a different role, namely to establish business relations between the companies involved. Thus, the representative of an iron firm who sits on the board of directors of a colliery aims to ensure that his firm obtains its coal from this colliery. This type of personal union, which also involves an accumulation of positions on boards of directors in the hands of a small group of big capitalists, becomes important when it is the precursor or promoter of closer organizational links between corporations which had previously been independent of one another.[19]

At its foundation the corporation does not have recourse to the relatively small stratum of working capitalists who must combine ownership with the entrepreneurial function. From the beginning, and throughout its life, the corporation is quite independent of these personal qualities. Death, inheritance, etc., among its owners, have absolutely no effect upon it. But this is not the decisive difference between the corporation and the individually owned enterprise, since the latter can also replace the personal qualities of its owners, at a certain stage of development, by those of paid employees. Equally unimportant in practice is another distinction made in the literature on the subject: naively, that on one side there is the individual entrepreneur, who is an independent and responsible agent with a stake in his enterprise, and on the other side a crowd of uninformed, powerless entrepreneurs (shareholders) who have only a minor interest in their enterprise, and understand nothing about its management. In fact the corporations - especially the most important, profitable and pioneering ones - are governed by an oligarchy, or by a single big capitalist (or a bank) who are, in reality, vitally interested in their operations and quite independent of the mass of small shareholders. Furthermore, the managers who are at the top of the industrial bureaucracy have a stake in the enterprise, not only because of the bonuses they earn, but, still more important, because of their generally substantial shareholdings.

The objective difference between the two kinds of enterprise is much more important. Recourse to the money market is a recourse to all those who have money (including the credit at their disposal). The corporation is independent of the size of individual amounts of capital, which must first be brought together in a single hand if they are to function as the industrial capital of a privately owned enterprise. Not only does it broaden the circle of people involved (anyone who has money can be a money capitalist), but every sum of money above a certain minimum (which need only amount to a few schillings) is capable of being combined with other sums in a joint-stock company and used as industrial capital. It is therefore much easier to establish, or to expand, a corporation than a privately owned enterprise.

In their capacity to assemble capital the corporations have a similar function to that of the banks. The difference is that the banks retain the accumulated capital in its original form as money capital, and make it available as credit for production after it has been assembled, whereas the corporations combine the atomized money capital in the form of fictitious capital. But this should not lead us to identify the combination of small capitals into a large capital with the participation of small capitalists. These small amounts of capital may belong to very big capitalists. The small sums of the petty capitalists are more likely to be assembled by the banks than by the corporations.

The corporations can accumulate capital just as easily as they acquire it in the first place. The privately owned enterprise has to accumulate capital out of its profits. Assuming that it has reached a certain size, that part of its profit which is not consumed is brought together as potential money capital until it becomes large enough for new investment and expansion. The corporation, on the other hand, usually distributes dividends to its shareholders, but in this case, too, a part of the profit can be accumulated, especially during periods when the dividends are well above the average rate of interest. The main point, however, is that the expansion of the corporation does not depend upon its own accumulation out of earnings, but can take place directly through an increase of its capital. The limitation which the amount of profit produced by the enterprise places upon the growth of the privately owned firm is thus removed, giving the corporation a much greater capacity for growth. The corporation can draw upon the whole supply of free money capital, both at the time of its creation and for its later expansion. It does not grow simply by the accumulation of its own profits. The entire fund of accumulated capital which is seeking to realize value provides grist for its mill. The obstacles which arise from the fragmentation of capital among a host of indifferent and casual owners are removed. The corporation can draw directly upon the combined capital of the capitalist class.

The size of an enterprise which does not have to depend upon individual capital is independent of the amount of wealth already accumulated by an individual, and it can expand without regard to the degree of concentration of property. Hence it is through the joint-stock company that enterprises first become possible, or possible on a scale which, because of the magnitude of their capital requirements, could never have been achieved by an individual entrepreneur, and were, therefore, either not undertaken at all, or else had to be undertaken by the state, in which case they were removed from the direct control of capital. The outstanding example is evidently the railways, which provided such a powerful stimulus to the growth of corporations. The significance of the corporation in breaking through the personal limits of property, and thus being constrained not by the extent of personal capital, but only by the aggregate social capital,[20] was greatest in the early stages.

The expansion of the capitalist enterprise which has been converted into a corporation, freed from the bonds of individual property, can now conform simply with the demands of technology. The introduction of new machinery, the assimilation of related branches of production, the exploitation of patents, now takes place only from the standpoint of their technical and economic suitability. The preoccupation with raising the necessary capital, which plays a major role in the privately owned enterprise, limiting its power of expansion and diminishing its readiness for battle, now recedes into the background. Business opportunities can be exploited more effectively, more thoroughly, and more quickly, and this is an important consideration when periods of prosperity become shorter.[21]

All these factors play an important part in the competitive struggle. As we have seen, a corporation can procure capital more easily than can a privately owned enterprise, and is able, therefore, to organize its plant according to purely technical considerations, whereas the individual entrepreneur is always restricted by the size of his own capital. This applies even when he uses credit, since the amount of credit is limited by the size of his own capital. No such limitation of personal property hampers the corporation, either when it is founded or when it later expands and makes new investments. It can, therefore, acquire the best and most modern equipment and is free to install it whenever it chooses, unlike the private entrepreneur who must wait until his profit has reached a level sufficient for accumulation. The corporation can thus be equipped in a technically superior fashion, and what is just as important, can maintain this technical superiority. This also means that the corporation can install new technology and labour-saving processes before they come into general use, and hence produce on a larger scale, and with improved, modern techniques, thus gaining an extra profit, as compared with the individually owned enterprise.

In addition, the corporation has a great superiority in the use of credit, which deserves attention at this point. The private entrepreneur, as a rule, can obtain loans only up to the amount of his circulating capital. Anything beyond this would turn the borrowed capital into fixed industrial capital, and would de facto deprive it of its character as loan capital so far as the loan capitalist is concerned. The loan capitalist would, in effect, be transformed into an industrial capitalist. Consequently, credit can only be extended to private entrepreneurs by people who are thoroughly familiar with all their circumstances and ways of running their business. This being so, credit for the private entrepreneur is provided by small local banks, or private bankers, who have a detailed knowledge of the business affairs of their customers.

The corporation can obtain credit more easily, because its structure greatly facilitates supervision. One of the bank's employees can be delegated for this purpose, and the private banker is thus replaced by a bank official. The bank will also provide large amounts of credit more readily to a corporation, because the corporation itself can easily raise capital. There is no danger that the credit which has been provided will be immobilized. Even if the corporation were to use the credit for the creation of fixed capital, it could, under favourable conditions, mobilize capital by issuing shares, and repay its bank debts, without having to wait for the fixed capital to return from circulation. In fact, this is a daily occurrence. Both these factors - easier supervision, and the possibility of using credit for purposes other than circulation - enable the corporation to obtain more credit and so enhance its competitive advantage.

Thus, from the economic advantages attributable to the greater accessibility of credit when the corporation is formed, and its greater capacity to expand, there also results a technical superiority. Thanks to its structure the corporation also has an advantage in price competition. As we have seen, the shareholder is, in a sense, a money capitalist who does not expect more than interest on his invested capital. In favourable circumstances, however, the earnings of a corporation may well exceed considerably the rate of interest, in spite of deductions from total profit in the form of promoter's profit, high administrative costs, bonuses, etc.

But as we have already noted, the increasing yield does not always benefit the shareholders. A part of it may be used to strengthen the enterprise, or to build up reserves, which enable the corporation to face a period of crisis more successfully than an individually owned enterprise. These large reserves also make possible a more stable dividend policy and thus raise the market price of the shares. Alternatively, the corporation can accumulate a part of its profit, and so increase its productive, profit-yielding capital, without increasing its nominal capital. This also increases, even more than does the growth of reserves, the real value of the shares. This rise in value, which perhaps only becomes manifest at a later stage, benefits the large, permanent shareholders, while the small, temporary owners of shares contribute by being deprived of a part of their profit.

If business conditions deteriorate, and competition becomes keener, a corporation which has followed the dividend policy just outlined, thereby reducing or eliminating the original difference between its share capital and its actually functioning capital, can reduce its prices below the price of production c + p (cost price plus average profit) to a price equal to c + i (cost price plus interest), and will still be able to distribute a dividend equal to, or a little below, the average interest.

The power of resistance of the corporation is thus much greater. The individual entrepreneur strives to realize the average profit, and if he realizes less, he must consider withdrawing his capital. This motive, however, is not present with the same degree of urgency in the corporation, certainly not among its directors and probably not among its shareholders. The private entrepreneur must make his living from the yield of his business, and if his profit falls below a certain level, his working capital will dwindle, since he has to use part of it for his own sustenance. Eventually he goes bankrupt. The corporation does not face this problem, because it seeks only to earn interest on its shares. It can generally continue in business so long as it does not operate at an actual loss. There is no pressure upon it to operate at a net profit,[22] the kind of pressure which threatens the individual capitalist with immediate disaster if he eats into his capital. Such pressure might perhaps affect the shareholder and oblige him to sell his shares, but this would have no effect on the functioning capital. If the net profit has not been eliminated, but only reduced, the corporation can continue in business indefinitely. If the net profit has fallen below the average rate of dividend, the share prices will fall, and new buyers as well as the existing owners will now calculate their yield on a lower capital value. In spite of the lower share price, and even though an industrial capitalist would pronounce the enterprise unprofitable because it no longer produces the average rate of profit, it remains quite profitable for the new purchasers of shares, and even the existing shareholders would lose more by disposing of all their shares. Even when it is operating at a loss- the corporation still has greater powers of resistance. The individual entrepreneur, in such a case, is usually lost, and bankruptcy is inevitable, but the corporation can be 'reorganized' with comparative ease. The facility with which it can raise capital makes it possible to assemble the amounts of money which are necessary in order to maintain and reorganize production. As a general rule, the shareholders must give their approval, because the price of their shares expresses the condition of the enterprise and reflects, if only nominally, the real losses it has sustained.

The usual procedure is to deflate share values so that the total profit can be calculated on a smaller capital. If there is no profit at all, new capital is obtained which, together with the existing deflated capital, will then produce an adequate profit. In passing, it is worth mentioning that these reorganizations are important in two ways for the banks ; first as profitable business, and second as an opportunity to bring the companies concerned under bank control.

The separation of capital ownership from its function also affects the management of the enterprise. The interest which its owners have in obtaining the largest possible profit as quickly as possible, their lust for booty, which slumbers in every capitalist soul, can be subordinated to a certain extent, by the managers of the corporation, to the purely technical requirements of production. More energetically than the private entrepreneur they will develop the firm's plant, modernize obsolete installations, and engage in competition to open up new markets, even if the attainment of these goals entails sacrifices for the shareholders. Those who manage capital drawn from outside pursue a more vigorous, bold, and rational policy, less influenced by personal considerations, especially when this policy meets with the approval of the large, influential shareholders, who can very easily sustain temporary reductions in their profits, since in the long run they are rewarded by higher share prices and larger profits, resulting from the sacrifices made by small shareholders who have long since had to dispose of their property. The corporation, then, is superior to the individually owned enterprise because it gives priority to purely economic conditions and requirements, even in opposition to the conditions of individual property, which in some circumstances may come into conflict with technological-economic needs.

The concentration of capital is always accompanied by the detachment of units of capital which then function as new and independent capitals :

the division of property within capitalist families plays a great part . . . Accumulation and concentration accompanying it are, therefore, not only scattered over many points, but the increase of each functioning capital is thwarted by the formation of new and the subdivision of the old capitals. Accumulation, therefore, presents itself, on the one hand, as an increasing concentration of the means of production, and of the command over labour; on the other, as repulsion of many individual capitals one from another.[23]

The growth of the corporate form of enterprise has made the course of economic development independent of contingent events in the movement of property, the latter being now reflected in the fate of shares on the market, not in the fate of the corporation itself. Consequently the concentration of enterprises can take place more rapidly than the centralization of property. Each of these processes follows its own laws, although the tendency towards concentration is common to both; it seems, however, to be more fortuitous and less powerful in the movement of property, and in practice is frequently interrupted by accidental factors. It is this surface appearance which leads some people to speak of a democratization of property through shareholding. The separation of the tendency towards industrial concentration from the movement of property is important because it allows enterprises to be guided only by technological and economic laws, regardless of the limits set by individual property. This type of concentration, which is not simultaneously a concentration of property, must be distinguished from the concentration and centralization[24] which ensue from, and accompany, the movement of property.

As a result of the transformation of property into share ownership the rights of the property owner are curtailed. The individual, as a shareholder, is dependent upon the decision made by all other shareholders; he is only a member of a larger body, and not always an active one. With the extension of the corporate form of enterprise, capitalist property becomes increasingly a limited form of property which simply gives the capitalist a claim to surplus value, without allowing him to exercise any important influence on the process of production. At the same time, this limitation of property gives the majority shareholders unlimited powers over the minority, and in this way, the property rights and unrestricted control over production of most of the small capitalists are set aside, and the group of those who control production becomes ever smaller. The capitalists form an association in the direction of which most of them have no say. The real control of productive capital rests with people who have actually contributed only a part of it. The owners of the means of production no longer exist as individuals, but form an association in which the individual has only a claim to his proportionate share of the total return.

As intermediaries in the circulation of bills and notes, the banks substitute their own bank credit for commercial credit, and as intermediaries in the conversion of idle funds into money capital, they furnish new capital to producers. They also perform a third function in supplying productive capital, not by lending it, but by converting money capital into industrial capital and fictitious capital, and taking charge of this process themselves. On the one side, this development causes all funds to flow into the banks, so that only through their mediation can they be transformed into money capital. On the other side, when bank capital is converted into industrial capital it ceases to exist in the form of money and hence ceases to be part of bank capital. This contradiction is resolved by the mobilization of capital, by its conversion into fictitious capital or capitalized claims to profit. Since this conversion process is accompanied by the growth of a market for such claims, in which they become convertible into money at any time, they can again become components of bank capital. In all this the bank does not enter into a credit relationship, nor does it receive any interest. It merely supplies the market with a certain amount of money capital in the form of fictitious capital which can then be transformed into industrial capital. The fictitious capital is sold on the market and the bank realizes the promoter's profit which arises from the conversion of the industrial capital into fictitious capital. The expression 'flotation credit', therefore, does not describe a credit relationship, but simply indicates the more or less well founded confidence of the public that it will not be defrauded by the bank.

This function of the bank, to carry out the mobilization of capital, arises from its disposal over the whole money stock of society, although at the same time it requires that the bank should have a substantial capital of its own. Fictitious capital, a certificate of indebtedness, is a commodity sui generis which can only be reconverted into money by being sold. But a certain period of circulation is required before this can happen, during which the bank's capital is tied up in this commodity. Furthermore, the commodity cannot always be sold at a particular time, whereas the bank must always be prepared to meet its obligations in money. Hence it must always have capital of its own, not committed elsewhere, available for such transactions. Moreover, the bank is compelled to increase its own capital to meet the increasing demands which the growth of industry makes upon it.[25]

The more powerful the banks become, the more successful they are in reducing dividends to the level of interest and in appropriating the promoter's profit. Conversely, powerful and well-established enterprises may also succeed in acquiring part of the promoter's profit for themselves when they increase their capital. Thus there emerges a kind of competitive struggle between banks and corporations over the division of the promoter's profit, and hence a further motive for the bank to ensure its domination over the enterprise.

It is self-evident that promoter's profit is not only produced by founding corporations in the strict sense, whether this involves the creation of completely new enterprises or the transformation of existing privately owned enterprises into joint-stock companies. Promoter's profit, in the economic sense, can be obtained just as readily by increasing the capital of existing corporations, provided its yield exceeds the average interest.

To some extent what appears as a decline in the rate of interest is only a consequence of the progressive reduction of dividends to the level of interest, while an ever increasing share of the total profits of the enterprise is incorporated, in a capitalized form, in the promoter's profit. This process has as its premise a relatively high level of development of the banks, and of their connections with industry, and a correspondingly developed market for fictitious capital, the stock exchange. In the 1870s, for example, the interest on railway bonds in the United States stood at 7 per cent, as against 3.5 per cent today[26] and this reduction is due to the fact that the part of the 7 per cent which once constituted the entrepreneurial profit has been capitalized by the founders. The importance of these figures lies in the fact that promoter's profit is on the increase because the yield on stocks and bonds is being continuously depressed to the level of simple interest. This upward trend in promoter's profit runs counter to the falling rate of profit, but it may be assumed that this fall, which is frequently interrupted or even checked by counter tendencies, will not in the long run put an end to the rising trend of promoter's profit. The latter has shown a continuous increase in recent times, especially in those countries where there has been a very rapid development of banks and stock exchanges, and where the influence of the banks on industry has been most marked.

While the money capitalist receives interest on the money he lends, the bank which issues shares lends nothing and therefore does not receive interest. Instead, the interest goes to the shareholders in the form of dividends. The bank receives a flow of entrepreneurial profit, not in the form of an annual revenue, but as capitalized promoter's profit. Entrepreneurial profit is a continuous stream of income, but it is paid to the bank as a lump sum in the form of promoter's profit. The bank assumes that the capitalist distribution of property is eternal and unchangeable, and it discounts this eternity in the promoter's profit. The bank is thus compensated once and for all, and it has no claim to further compensation if this distribution of property is abolished. It already has its reward.

[1] This sentiment seems also to have guided Erwin Steinitzer when he entitled his work on the corporation Okonomische Theorie der Aktiengesellschaft. Nevertheless, he too fails to recognize the distinctive economic characteristics of the joint-stock company, although his work is otherwise rich in cogent and perceptive observations.

[2] 'The value of money or of commodities employed in the capacity of capital is not determined by their value as money or commodities but by the quantity of surplus value which they produce for their owner.' Capital, vol. III, p. 418. [MECW, 37, p353]

[3] The only relation between the price of a share and the value of the productive capital is that the share price cannot fall below that part of the value of the capital which, if the enterprise became bankrupt, and after its other creditors had been satisfied, would fall due to it as an aliquot part.

[4] Briefe and sozialpolitische Aufsatze von Dr Rodbertus-Jagetzow, R. Meyer (ed.), vol. I, p. 259.

[5] This is not correct. A corporation is not a technical form of production, but a form of business enterprise.

[6] ibid., p. 262.

[7] ibid., p. 285.

[8] Nevertheless, this conservative socialist had an accurate premonition of the revolutionary significance of the corporation: 'This form of business which can merge tributaries from a thousand small sources of capital into a single stream, has a mission to perform. It will have to complete God's handiwork by penetrating land barriers and countries which the Almighty had forgotten or regarded as unready for penetration. It will have to connect countries separated by oceans, through submarine or surface links. It will have to pierce mountain barriers and so forth. The pyramids and the squared blocks of the Phoenicians were as child's play compared with what share capital will create.' In this vein, Rodbertus abandons himself to romantic fantasies reminiscent of Saccard in Zola's L'Argent. He continues: `Moreover I have a very special personal enthusiasm for them. And why? Because they do such a thorough job of sweeping away all obstacles. And what sweepers they are! Traditional free trade, without the benefit of the corporate form, is a miserably inadequate handbroom. Combined with corporations, it becomes a steam-driven sweeper which will sweep away in 10 years what it would take the Sabbath broom 100 years to do. The hand of the corporation is indeed powerful! The solution of the social problem requires this scavenger. After all, even without the corporation, we would need a thoroughgoing cleaning' (ibid., p. 291). Equally apposite is the following remark: 'The corporate enterprise will eliminate both the individual entrepreneur and the loan capitalist' (ibid., p. 286).

Van Borght therefore was incredibly naive when he wrote in the chapter on corporations in the Handworterbuch der Staatswissenschaften: 'The task and objective of corporate enterprises can be just as much the enlargement and improvement of personal labour power, and of the knowledge and experience of the entrepreneur, as the strengthening of the power of capital.' This is just about as brilliant as would be the statement in a scientific cookery book that the task and objective of a plum pudding is to stimulate the appetite and to provide a livelihood for the cook !

[9] Capital, vol. III, pp. 516 et seq. [MECW, 37, p434]

[10] The following report in the evening edition of the Berliner Tageblatt (16 May 1908) will illustrate the schematic presentation in the text: 'Recently the shares of the Kopenick nitrate plant were introduced on the stock exchange at a premium of more than 80 per cent. From 1901 to 1906, this enterprise operated as a limited company with a modest capital of 300,000 marks. After operating at a loss for several years, the company made a gross profit of 100,000 marks one year, followed by another of 300,000 marks, and paid dividends of 15,000 marks and 75,000 marks. The founders of the enterprise accordingly decided that it was time to transform it into a joint-stock company with a capital of 1,000,000 marks, in which the original capital of 300,000 marks was included. In order to balance the assets and liabilities of the new corporation, the corporation had to take over the land, with a book value of 60,000 marks, for 210,000 marks; the buildings, valued at 45,000 marks, for 140,000 marks ; and the machinery, equipment and materials, valued at 246,000 marks, for 400,000 marks. The new corporation has now been operating for two years, during which period it has distributed dividends of 15 per cent and 16 per cent respectively, although the account for the land (exclusive of improvements) still carries a deficit of 200,000 marks, that for the building a claim of 150,000 marks. Only the equity on the machines and equipment (the overvaluation of which seemed most questionable) was written down to 250,000 marks. The output of the corporation is based on two patents, one of which will expire in a year, the other having been purchased from the inventor for 50,000 marks. On the basis of these facts, the issue houses felt themselves entitled to stipulate a price of 180 per cent; in other words they allowed themselves to be paid 1,800,000 marks for the original capital of 300,000 marks, including 100,000 marks in cash, which were the basis of the corporation!' In this instance, the promoter's profit is increased because the enterprise makes an extra profit from its exploitation of the patents, which is, of course, also capitalized.

[11] The following table, taken from the Berliner Tageblatt of 1 June 1907, shows that the capital invested in shares for the first or new investment yields its owner a dividend which is not very much above the average rate of interest. The discount rate of the Reichsbank was 5½ per cent at the time.

|

Share price index per cent (May 30) |

Dividend per cent |

Yield per cent |

|

|---|---|---|---|

|

Berliner Handelsgesellschaft

|

150.75 |

9 |

5.97 |

|

Darmstädter Bank |

129.30 |

8 |

6.18 |

|

Deutsche Bank |

223.60 |

12 |

5.36 |

|

Diskontogesellschaft |

169 |

9 |

5.32 |

|

Dresdner Bank |

141 |

8.5 |

6.02 |

|

Nationalbank |

121.50 |

7.5 |

6.17 |

|

Bochumer Gussstahl |

224.25 |

9 |

5.97 |

|

Laurahiitte |

225.30 |

12 |

5.32 |

|

Harpener Bergbau |

207.60 |

11 |

5.29 |

|

Gelsenkirchener Bergwerk |

195.50 |

11 |

5.62 |

|

PhOnix Bergbau |

205.30 |

15 |

7.30 |

|

Rombacher Hfittenwerke |

204.50 |

14 |

6.84 |

|

Donnersmarckhiitte |

264.50 |

14 |

5.29 |

|

Eisenwerk Kraft |

166 |

11 |

6.62 |

|

Eisenhatte Thale (preferred) |

123 |

9 |

7.31 |

|

Allgemeine Elektrizitdts‑ gesellschaft |

198.50 |

11 |

5.54 |

|

Lahmeyer Elektrizitat |

122 |

8 |

6.55 |

|

Hoffmann Waggonfabrik |

335 |

22 |

6.56 |

|

Gaggenauer Eisenwerk |

105 |

8 |

7.61 |

|

Schering Chemische Fabriken |

263 |

17 |

6.46 |

|

Chemische Fabrik Oranienburg |

184.50 |

10 |

5.42 |

|

Schulteiss Brauerei |

288.50 |

18 |

6.23 |

|

Vereinsbrauerei, Aktien |

210.50 |

12 |

5.70 |

[12] The same thing has occurred in the formation of English joint-stock companies. In describing the community of interests between a mixed pig-iron enterprise and a steel company, Macrosty says: 'It is to be observed that while the aid of the public was called in to assist in the extension of the business [through the issue of debentures, preferred shares - R.H.] control lay solely with the vendors (the firm of Bill Bros and Dorman Long & Co.) so long as debenture interest and preference dividends were maintained. This is quite a common feature of British flotations, and it demands from the cautious investor a careful scrutiny of the purchase conditions.' Henry W. Macrosty, The Trust Movement in British Industry, p. 27. 'In many cases, the ordinary stock is held largely or solely by the original vendors in order that they may retain control, in which case the amount of the ordinary dividend is of less consequence to the public' (ibid., p. 54).

Similar in purpose to ordinary shares - the monopolization of the benefits resulting from the development of the corporation by the promoters - were the so-called 'promoters' rights' in the former German (and Austrian) company law. The promoters stipulated certain privileges for themselves; for example, that new share issues had to be offered to them at par. However, such privileges conflicted with the process of mobilizing capital and were therefore eliminated. The Berliner Tageblatt of 24 September 1907, had this to say on the subject: 'Like a memorial of an age long past, the institution of promoters' rights survives today, still observed by many corporations. These rights derive from a period when company law was not as developed as it is today. In the past, it was considered permissible to grant the founders of a corporate enterprise permanent special privileges, a condition which in view of the mobility inherent in shares, was bound to prove onerous and unjustified. The 1884 amendment of company law already made a breach in the system of promoters' privileges, but it was first completely abolished as regards the founding of new corporations by the Commercial Code which came into force on 1 January 1900. It is true that this new commercial law was not retroactive, so that the promoters' privileges of former times remain unchanged, and in so far as they have not been eliminated by voluntary agreement they are still unpleasant reminders to shareholders in corporations "blessed" with promoters' rights . . . . In the case of Berliner Elektrizitatswerken - to mention one typical example of the effects of these promoters' rights - the Allgemeine Elektrizitatsgesellschaft has the privilege of taking for itself half of any newly issued shares at par. The profit which this privilege brought to the Allgemeine Elektrizitatsgesellschaft as a result of the issue of shares by the Berliner Elektrizitätswerken in the years 1889, 1890, 1899 and 1904 alone is estimated at about 15,000,000 marks. Neither the founders nor their heirs can be blamed for profiting from their duly acquired privileges. Nevertheless, it has become obvious that the modern view of the stock market rightly demands the abolition of perpetual promoters' privileges.'

[13] The most notable example is provided by the history of the American Steel Trust (See Report of the Industrial Commission, 1901, vol. XIII, pp. xiv-xv). It combined companies which were already overcapitalized. The report calculates the 'real worth' by adding together only the preferred shares of the constituent companies, which would give a real share capital standing at par, and comes to the conclusion that $398,918,111 are counted for 'goodwill' alone. The following account in the Frankfurter Zeitung of 29 March 1909 gives an even better idea of the 'overcapitalization', or more precisely of the difference between the capital which was actually at work and the share capital: 'The Gary works will cost about $100,000,000 and produce over 2,000,000 tons of steel. The other plants of the trust are capitalized at almost $1,500,000,000 and have a capacity of 10,000,000 tons. The disparity is glaring.' It remains glaring even if we take into account that valuable ore property and other items are also included in the capitalization.

This has not prevented the Steel Trust from regularly paying a dividend of 7 per cent on its preferred shares, nor has it hindered the ordinary shares from yielding dividends on an increasing scale. The trust was organized in the spring of 1901. The period 1901 to 1903 was one of prosperity and the ordinary shares received dividends of 4 per cent. In 1903 the dividends dropped to 3 per cent, and in 1904 and 1905 no dividends were paid, but by 1905 there was an improvement in business conditions and the Steel Trust would have had about $43,000,000 available to distribute as dividends, equivalent to a dividend of 8.5 per cent. But the trust used the amount for write-offs, new investments, and the building of reserves. Then, in 1906, it again paid 2 per cent.