Capital Volume II

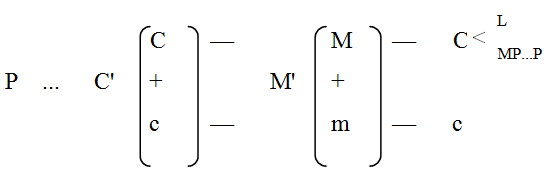

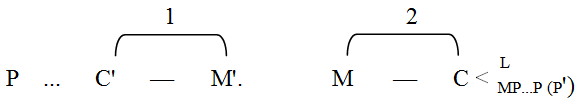

The circuit of productive capital has the general formula P ... C' — M' — C ... P. It signifies the periodical renewal of the functioning of productive capital, hence its reproduction, or its process of production as a process of reproduction aiming at the self-expansion of value; not only production but a periodical reproduction of surplus-value; the function of industrial capital in its productive form, and this function performed not once but periodically repeated, so that the renewal is determined by the starting-point. A portion of C' may (in certain cases, in various branches of industrial capital) re-enter directly as means of production into the same labour-process out of which it came in the shape of a commodity. This merely saves the transformation of the value of this portion into real money or token-money or else the commodity finds an independent expression only as money of account. This part of value does not enter into the circulation. Thus values enter into the process of production which do not enter into the process of circulation. The same is true of that part of C' which is consumed by the capitalist in kind as part of the surplus-product. But this is insignificant for capitalist production. It deserves consideration, if at all, only in agriculture.

Two things are at once strikingly apparent in this form.

For one thing, while in the first form, M ... M', the process of production, the function of P, interrupts the circulation of money-capital and acts only as a mediator between its two phases M — C and C' — M', here the entire circulation process of industrial capital, its entire movement within the phase of circulation, constitutes only an interruption and consequently only the connecting link between the productive capital, which as the first extreme opens the circuit, and that which closes it as the other extreme in the same form, hence in the form in which it starts again. Circulation proper appears but as an instrument promoting the periodically renewed reproduction, rendered continuous by the renewal.

For another thing, the entire circulation presents itself in a form which is the opposite of that which it has in the circuit of money-capital. There it was: M — C — M (M — C. C — M), apart from the determination of value; here it is, again apart from the value determination: C — M — C (C — M. M — C), i.e., the form of the simple circulation of commodities.

Let us first consider the process C' — M' — C, which takes place in the sphere of circulation between the two extremes P ... P.

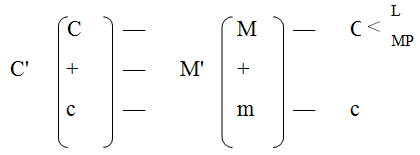

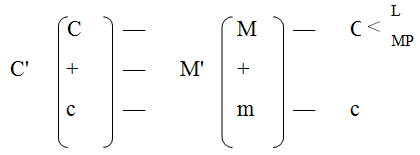

The starting-point of this circulation is commodity-capital; C' = C + c = P + c. The function of commodity-capital C' — M' (the realisation of the capital-value contained in it equals P, which now exists as the constituent part C of C', as well as of the surplus-value contained in it, which exists as a constituent part of the same quantity of commodities and has the value c) was examined in the first form of the circuit. But there this function formed the second phase of the interrupted circulation and the concluding phase of the entire circuit. Here it forms the second phase of the circuit but the first phase of the circulation. The first circuit ends with M', and since M' as well as the original M can again open the second circuit as money-capital, it was not necessary at first to see whether M and m (surplus-value) contained in M' continue in their course together or whether each of them pursues its own course. This would only have become necessary if we had followed up further the first circuit in its renewed course. But this point must be decided in the circuit of the productive capital, because the determination of its very first circuit depends on it and because C' — M' appears in it as the first phase of the circulation, which has to be complemented by M — C. It depends on this decision whether the formula represents simple reproduction or reproduction on an extended scale. The character of the circuit changes according to the decision made.

Let us, then, consider first the simple reproduction of productive capital, assuming that, as in the first chapter, conditions remain constant and that commodities are bought and sold at their values.

On this assumption the entire surplus-value enters into the individual consumption of the capitalist. As soon as the transformation of the commodity-capital C' into money has taken place, that part of the money which represents the capital-value continues to circulate in the circuit of industrial capital; the other part, which is surplus-value changed into money, enters into the general circulation of commodities, constitutes a circulation of money emanating from the capitalist but taking place outside of the circulation of his individual capital.

In our illustration we had a commodity-capital C' of 10,000 lbs. of yarn, valued at £500; £422 of this represent the value of the productive capital and continue, as the money-form of 8,440 lbs. of yarn, the capital circulation begun by C', while the surplus value of £78, the money-form of 1,560 lbs. of yarn, the excess of the commodity-product, leaves this circulation and describes a separate course within the general circulation of commodities.

m — c represents a series of purchases by means of money which the capitalist spends either for commodities proper or for personal services to his cherished self or family. These purchases are made piecemeal at various times. The money therefore exists temporarily in the form of a supply, or hoard, destined for current consumption, since money whose circulation has been interrupted assumes the form of a hoard. Its function as a medium of circulation, which includes its transient form of a hoard, does not enter the circulation of capital in its money-form M. This money is not advanced but spent.

We have assumed that the total advanced capital always passes wholly from one of its phases to the other; and so here too we assume that the commodities produced by P represent the total value of the productive capital P, or £422 plus £78 of surplus-value created in the process of production. In our illustration, which deals with a discrete commodity, the surplus-value exists in the form of 1,560 lbs. of yarn; if computed on the basis of one pound of yarn, it would exist in the form of 2.496 ounces of yarn. But if the commodity were for instance a machine valued at £500 and having the same value-composition, one a part of the value of this machine, £78, would be surplus-value, but these £78 would exist only in the machine as a whole. This machine cannot be divided into capital-value and surplus-value without breaking it to pieces and thus destroying its value together with its use-value. For this reason the two value-components can be represented only ideally as components of the commodity, not as independent elements of the commodity C', like any pound of yarn, which represents a separable independent element of the 10,000 lbs. of commodity. In the first case the aggregate commodity, the commodity-capital, the machine, must be sold in its entirety before m can enter upon its separate circulation. On the other hand when the capitalist has sold 8,440 lbs., the sale of the remaining 1,560 lbs. would represent a wholly separate circulation of the surplus-value in the form of c (1,560 lbs. of yarn) — m (£78) — c (articles of consumption). But the elements of value of each individual portion of the 10,000 lbs. of yarn, the product, can be represented by parts of the product as well as by the total product. Just as the latter, 10,000 lbs. of yarn, the product, can be represented by parts of the product as well as by the total product. Just as the latter, 10,000 lbs. of yarn, can be divided into the value of the constant capital (c), 7,440 lbs. of yarn worth £372, variable capital-value (v) of 1,000 lbs. of yarn worth £50, and surplus-value (s) of 1,560 lbs. of yarn worth £78, so every pound of yarn may be divided into c, equal to 11.904 ounces worth 8.928 d., v equal to 1.600 ounces of yarn worth 1.200 d., and s equal to 2.496 ounces of yarn worth 1.872 d. The capitalist might also sell various portions of the 10,000 lbs. of yarn successively and successively consume successive portions of the surplus-value elements contained in them, thus realising, also successively, the sum of c plus v. But in the final analysis this operation likewise premises the sale of the entire lot of 10,000 lbs., that therefore the value of c and v will be replaced by the sale of 8,440 lbs. (Buch I, Kap. VII, 2.) [English edition: Ch. IX, 2. — Ed.]

However that may be, by means of C' — M' both the capital-value and surplus-value contained in C' acquire a separable existence, the existence of different sums of money. In both cases M and m are really a converted form of the value which originally in C' had only a peculiar, an ideal expression as the price of the commodity.

c — m — c represents the simple circulation of commodities, the first phase of which, c — m, is included in the circulation of commodity-capital, C' — M', i.e., included in the circuit of capital; its complementary phase m — c falls, on the contrary, outside of this circuit, being a separate act in the general circulation of commodities. The circulation of C and c, of capital-value and surplus-value, splits after the transformation of C' into M'. Hence it follows:

First, while the commodity-capital is realised by C' — M' = C' — (M + m), the movement of capital-value and surplus-value, which in C' — M' is still united and carried on by the same quantity of commodities, becomes separable, both of them henceforth possessing independent forms as separate sums of money.

Secondly, if this separation takes place, m being spent as the revenue of the capitalist, while M as a functional form of capital-value continues its course determined by the circuit, the first act, C' — M', in connection with the subsequent acts, M — C and m — c, may be represented as two different circulations C — M — C and c — m — c; and both of these series, so far as their general form is concerned, belong in the usual circulation of commodities.

By the way, in the case of the continuous, indivisible commodities, it is a matter of practice to isolate the value constituents ideally. For instance in the London building-business, which is carried on mainly on credit, the building contractor receives advances in accordance with the stage of construction reached. None of these stages is a house, but only a really existing constituent part of an inchoate future house; hence, in spite of its reality, it is but an ideal fraction of the entire house, but real enough to serve as security for an additional advance. (See on this point Chapter XII below.) [See pp. 237-38 of this book. — Ed.]

Thirdly, if the movement of capital-value and surplus-value, which still proceeds unitedly in C and M, is separated only in part (a portion of the surplus-value not being spent as revenue) or not at all, a change takes place in the capital-value itself within its circuit, before it is completed. In our illustration the value of the productive capital was equal to £422. If that capital continues M — C, as, say, £480 or £500, then it strides through the latter stages of its circuit with an increase of £58 or £78 over its initial value. This may also go hand in hand with a change in the composition of its value.

C' — M', the second stage of the circulation and the final stage of circuit I (M ... M'), is the second stage in our circuit and the first in the circulation of commodities. So far as the circulation is concerned, it must be complemented by M' — C'. But not only has C' — M' the process of self-expansion already behind it (in this case the function of P, the first stage), but its result, the commodity C'; has already been realised. The process of the self-expansion of capital and the realisation of the commodities representing the expanded capital-value are therefore completed in C' — M'.

And so we have premised simple reproduction, i.e., that m — c separates entirely from M — C. Since both circulations, c — m — c as well as C — M — C, belong in the circulation of commodities, so far as their general form is concerned (and for this reason do not show only value differences in their extremes), it is easy to conceive the process of capitalist production, after the manner of vulgar economy, as a mere production of commodities, of use-values designed for consumption of some sort, which the capitalist produces for no other purpose than that of getting in their place commodities with different use-values, or of exchanging them for such, as vulgar economy erroneously states.

C' acts from the very outset as commodity-capital, and the purpose of the entire process, enrichment (the production of surplus-value), does not by any means exclude increasing consumption on the part of the capitalist as his surplus-value (and hence his capital) increases; on the contrary, it emphatically includes it.

Indeed, in the circulation of the revenue of the capitalist, the produced commodity c (or the fraction of the produced commodity C' ideally corresponding to it) serves only to transform it, first into money, and from money into a number of other commodities serving private consumption. But we must not, at this point, overlook the trifling circumstance that c is commodity-value which did not cost the capitalist anything, an incarnation of surplus-labour, for which reason it originally stepped on the stage as a component part of commodity-capital C'. This c is, by the very nature of its existence, bound to the circuit of capital-value in process and if this circuit begins to stagnate or is otherwise disturbed, not only the consumption of c restricted or entirely arrested, but also the disposal of that series of commodities which serve to replace c. The same is true when C' — M' ends in failure, or only a part of C' can be sold.

We have seen that c — m — c, representing the circulation of the revenue of the capitalist, enters into the circulation of capital only so long as c is a part of the value of C', of capital in its functional form of commodity-capital; but, as soon as it acquires independence from m — c, hence throughout the form c — m — c, the circulation of that revenue does not enter into the movement of the capital advanced by the capitalist, although it stems from it. This circulation is connected with the movement of advanced capital inasmuch as the existence of capital presupposes the existence of the capitalist, and his existence is conditioned on his consuming surplus-value.

Within the general circulation C', for example yarn, functions only as a commodity; but as an element in the circulation of capital it performs the function of commodity-capital, a form which capital-value alternately assumes and discards. After the sale of the yarn to a merchant, it is extruded out of the circular movement of capital whose product it is, but nevertheless, as a commodity, it moves always in the sphere of the general circulation. The circulation of one and the same mass of commodities continues, in spite of the fact that it has ceased to be a phase in the independent circuit of the spinner’s capital. Hence the real definitive metamorphosis of the mass of commodities thrown into circulation by the capitalist, C — M, their final exit into consumption may be completely separated in time and space from that metamorphosis in which this mass of commodities functions as his commodity-capital. The same metamorphosis which has been accomplished in the circulation of capital still remains to be accomplished in the sphere of the general circulation.

This state of things is not changed a bit if this yarn enters the circuit of some other industrial capital. The general circulation comprises as much the intertwining of the circuits of the various independent fractions of social capital, i.e., the totality of the individual capitals, as the circulation of those values which are not thrown on the market as capital but enter into individual consumption.

The relation between a circuit of capital forming part of a general circulation and a circuit forming links in an independent circuit is shown further on when we examine the circulation of M, which is equal to M plus m. M as money-capital continues capital’s circuit; m, being spent as revenue (m — c), enters into the general circulation, but comes flying out of the circuit of capital. Only that part enters the latter circuit which performs the function of additional money-capital. In c — m — c money serves only as coin; the object of this circulation is the individual consumption of the capitalist. It is typical of the idiocy of vulgar economy that it gives out this circulation, which does not enter into the circuit of capital — the circulation of that part of the value produced which is consumed as revenue — as the characteristic circuit of capital.

In the second phase M — C, the capital-value M, which is equal to P (the value of the productive capital that at this point opens the circuit of industrial capital), is again present, delivered of its surplus-value, therefore having the same magnitude of value as it had in the first stage of the circuit of money-capital M — C. In spite of the difference in place the function of the money-capital into which the commodity-capital has now been transformed is the same: its transformation into MP and L, into means of production and labour-power.

In the functioning of commodity-capital C' — M', the capital-value, simultaneously with c — m, has consequently gone through the phase C — M and enters now into the complementary phase M — C<LMP. Its complete circulation is therefore C — M— C<LMP.

First: Money-capital M appeared in Form I (circuit M ... M') as the original form in which capital-value is advanced; it appears here from the outset as a part of that sum of money into which commodity-capital transformed itself in the first circulation phase C' — M', therefore from the outset as the transformation of P, the productive capital, through the medium of the sale of commodities, into the money-form. Money-capital exists here from the outset as that form of capital-value which is neither its original nor its final one, since the phase M — C, which concludes the phase C — M, can only be performed by again discarding the money-form. Therefore that part of M — C which is at the same time M — L appears now no longer as a mere advance of money by the purchase of labour-power, but as an advance by means of which the same 1,000 lbs. of yarn, valued at £50, which form a part of the commodity-value created by labour-power, are advanced to labour-power in the form of money. The money advanced here to the labourer is only a converted equivalent form of a part of the commodity-value produced by himself. And for that reason if no other the act M — C, so far as it means M — L, is by no means simply a replacement of a commodity in the form of money by a commodity in the use-form, but it includes other elements which are independent of the general commodity circulation as such.

M' appears as a converted form of C', which is itself a product of a previous function of P, the process of production. The entire sum of money M' is therefore a money-expression of past labour. In our illustration, 10,000 lbs. of yarn worth £500 are the product of the spinning process. Of this quantity, 7,440 lbs. of yarn are equal to the advanced constant capital c worth £372; 1,000 lbs. of yarn are equal to the advanced variable capital v worth £50; and 1,560 lbs. of yarn represent the surplus-value s worth £78. If of M' only the original capital of £422 is again advanced, other conditions remaining the same, then the labourer is advanced the following week, in M — L, only a part of the 10,000 lbs. of yarn produced in the given week (the money-value of 1,000 lbs. of yarn). As a result of C — M, money is always the expression of past labour. If the complementary act M — C takes place at once in the commodity-market, i.e., M is given in return for commodities existing in the market, this is again a transformation of past labour, from one form (money) into another form (commodities). But M — C differs in the matter of time from C — M. They may exceptionally take place at the same time, for instance when the capitalist who performs M — C and the capitalist to whom this act means C — M ship their commodities to each other at the same time and M is used only to square the balance. The difference in time between the performance of M — C and C — M may be more or less considerable. Although M, as the result of C — M, represents past labour, it may, in the act M — C, represent the converted form of commodities which are not as yet in the market, but will be thrown upon it in the future, since M — C need not take place until C has been produced anew. M may likewise stand for commodities which are produced simultaneously with the C whose money-expression it is. For instance in the exchange M — C (purchase of means of production) coal may be bought before it has been mined. In so far as m figures as an accumulation of money, is not spent as revenue, it may stand for cotton which will not be produced until the following year. The same holds good on spending the revenue of the capitalist, m — c. It also applies to wages, to L equal to £50. This money is not only the money-form of past labour of the labourers but at the same time a draft on simultaneous and future labour which is just being realised or should be realised in the future. The labourer may buy with his wages a coat which will not be made until the following week. This applies especially to the vast number of necessary means of subsistence which must be consumed almost as soon as they have been produced to prevent spoilage. Thus the labourer receives, in the money which is paid to him in wages, the converted form of his own future labour or that of other labourers. By giving the labourer a part of his past labour, the capitalist gives him a draft on his own future labour. It is the labourer’s own simultaneous or future labour that constitutes the not yet existing supply out of which he will be paid for his past labour. In this case the idea of hoarding disappears altogether. [Here Marx made the following note in the manuscript: “All this, however, belongs to the last part of Book Two.” — Ed.]

Secondly: In the circulation C — M — C<LMP the same money changes place twice; the capitalist first receives it as a seller and passes it on as a buyer; the transformation of commodities into the money-form serves only for the purpose of retransforming it from the money-form into the commodity-form; the money-form of capital, its existence as money-capital, is only a transient phase in this movement; or, so far as the movement is fluent, money-capital appears only as a medium of circulation when it serves as a means of purchase; it acts as a paying medium proper when capitalists buy from one another and therefore only have to square accounts.

Thirdly, the function of money-capital, whether it is a mere circulating medium or a paying medium, effects only the replacement of C by L and MP, i.e., the replacement of the yarn, the commodity which represents the result of the productive capital (after deducting the surplus-value to be used as revenue), by its elements of production, in other words, the retransformation of capital-value from its form as a commodity into the elements that build this commodity. In the last analysis, the function of money-capital promotes only the retransformation of commodity-capital into productive capital.

In order that the circuit may be completed normally, C' must be sold at its value and in its entirety. Furthermore C — M — C includes not merely replacement of one commodity by another, but replacement with value-relations remaining the same. We assume that this takes place here. As a matter of fact, however, the value of the means of production vary. It is precisely capitalist production to which continuous change of value-relations is peculiar, if only because of the ever changing productivity of labour that characterises this mode of production. This change in the value of the elements of production will be discussed later on, [See Section V of Chapter XV of this volume. — Ed.] and we merely mention it here. The transformation of the elements of production into commodity-products, of P into C', takes place in the sphere of production, while the transformation from C' into P occurs in the sphere of circulation. It is brought about by a simple metamorphosis of commodities, but its content is a phase in the process of reproduction, regarded as a whole. C — M — C, being a form of circulation of capital, involves a functionally determined exchange of matter. The transformation C — M — C requires further that C should be equal to the elements of production of the commodity-quantum C', and that these elements should retain their original value-relations to one another. It is therefore assumed that the commodities are not only bought at their respective values, but also do not undergo any change of value during the circular movement. Otherwise this process cannot run normally.

In M ... M', M represents the original form of the capital-value, which is discarded only to be resumed. In P ... C' — M' — C ... P, M represents a form which is only assumed in the process and which is discarded before this process is over. The money-form appears here only as a transient independent form of capital-value. Capital in the form of C' is just as anxious to assume the money-form as it is to discard it in M', after barely assuming that garb in order again to transform itself into productive capital. So long as it remains in the garb of money, it does not function as capital and its value does not therefore expand. The capital lies fallow. M serves here as a circulating medium, but as a circulating medium of capital. [Here Marx made the following note in the manuscript: “Against Tooke.” — Ed.] The semblance of independence which the money-form of capital-value possesses in the first form of its circuit (the form of money-capital) disappears in this second form, which thus is a criticism of Form I and reduces it to merely a special form. If the second metamorphosis, M — C, meets with any obstacles — for instance if there are no means of production in the market — the circuit, the flow of the process of reproduction, is interrupted quite as much as when capital is held fast in the form of commodity-capital. But there is this difference: It can remain longer in the money-form than in the transitory form of commodities. It does not cease to be money, if it does not perform the functions of money-capital; but it does cease to be a commodity, or a use-value in general, if it is delayed too long in the exercise of its function of commodity-capital. Furthermore, in its money-form it is capable of assuming another form in the place of its original one of productive capital while it cannot budge at all if held in the form of C'.

C' — M' — C includes acts of circulation only for C' in accordance with its form, acts which are phrases of its reproduction; but the real reproduction of C, into which C' transforms itself, is necessary for the performance of C' — M' — C. This however is conditioned on processes of reproduction which lie outside of the process of reproduction of the individual capital represented by C'.

In Form I the act M — C<LMP prepares on the first transformation of money-capital into productive capital; in Form II it prepares the retransformation from commodity-capital into productive capital; that is to say, so far as the investment of industrial capital remains the same, retransformation of the commodity-capital into the same elements of production as those from which it originated. Consequently here as well as in Form I, the act appears as a preparatory phase of the process of production, but as a return to it, as a renewal of it, hence as a precursor of the process of reproduction, hence also of a repetition of the process of self-expansion of value.

It must be noted once more that M — L is not a simple exchange of commodities but the purchase of a commodity, L, which is to serve for the production of surplus-value, just as M — MP is only a procedure which is materially indispensable for the attainment of this end.

With the completion of M — C<LMP M is reconverted into productive capital, into P, and the circuit begins anew.

The expanded form of P ... C' — M' — C ... P is therefore:

The transformation of money-capital into productive capital is the purchase of commodities for the production of commodities. Consumption falls within the circuit of capital itself only in so far as it is productive consumption; its premise is that surplus-value is produced by means of the commodities so consumed. And this is something very different from production and even commodity production, which has for its end the existence of the producer. A replacement — commodity by commodity — thus contingent on the production of surplus-value is quite a different matter from the bare exchange of products brought about merely by means of money. But the economists take this matter as proof that no overproduction is possible.

Apart from the productive consumption of M, which is transformed into L and MP, the circuit contains the first member M — L, which signifies, from the standpoint of the labourer, L — M, which equals C — M. In the labourer’s circulation, L — M — C, which includes his consumption, only the first member falls within the circuit of the capital as a result of M — L. The second act, M — C, does not fall within the circulation of individual capital, although it springs from it. But the continuous existence of the working class is necessary for the capitalist class, and so is therefore the consumption of the labourer made possible by M — C.

The only condition which the act C' — M' stipulates for capital-value to continue its circuit and for surplus-value to be consumed by the capitalist is that C' shall have been converted into money, shall have been sold. Of course, C' is bought only because the article is a use-value, hence serviceable for consumption of any kind, productive or individual. But if C' continues to circulate for instance in the hands of the merchant who bought the yarn, this at first does not in the least affect the continuation of the circuit of the individual capital which produced the yarn and sold it to the merchant. The entire process continues and with it the individual consumption of the capitalist and the labourer made necessary by it. This point is important in a discussion of crises.

For as soon as C' has been sold, been converted into money, it can be reconverted into the real factors of the labour process, and thus of the reproductive process. Whether C' is bought by the ultimate consumer or by a merchant for resale does not affect the case. The quantity of commodities created in masses by capitalist production depends on the scale of production and on the need for constantly expanding this production, and not on a predestined circle of supply and demand, on wants that have to be satisfied. Mass production can have no other direct buyer, apart from other industrial capitalists, than the wholesaler. Within certain limits, the process of reproduction may take place on the same or on an increased scale even when the commodities expelled from it did not really enter individual or productive consumption. The consumption of commodities is not included in the circuit of the capital from which they originated. For instance, as soon as the yarn is sold the circuit of the capital value represented by the yarn may begin anew, regardless of what may next become of the sold yarn. So long as the product is sold, everything is taking its regular course from the standpoint of the capitalist producer. The circuit of capital-value he is identified with is not interrupted. And if this process is expanded — which includes increased productive consumption of the means of production — this reproduction of capital may be accompanied by increased individual consumption (hence demand) on the part of the labourers, since this process is initiated and effected by productive consumption. Thus the production of surplus-value, and with it the individual consumption of the capitalist, may increase, the entire process of reproduction may be in a flourishing condition, and yet a large part of the commodities may have entered into consumption only apparently, while in reality they may still remain unsold in the hands of dealers, may in fact still be lying in the market. Now one stream of commodities follows another, and finally it is discovered that the previous streams had been absorbed only apparently by consumption. The commodity-capitals compete with one another for a place in the market. Late-comers, to sell at all, sell at lower prices. The former streams have not yet been disposed of when payment for them falls due. Their owners must declare their insolvency or sell at any price to meet their obligations. This sale has nothing whatever to do with the actual state of the demand. It only concerns the demand for payment, the pressing necessity of transforming commodities into money. Then a crisis breaks out. It becomes visible not in the direct decrease of consumer demand, the demand for individual consumption, but in the decrease of exchanges of capital for capital, of the reproductive process of capital.

If the commodities MP and L, into which M is transformed to perform its function of money-capital, of capital-value destined to be retransformed into productive capital — if those commodities are to be bought or paid for on different terms, so that M — C represents a series of purchases and payments, then a part of M performs the act M — C, while another part persists in the form of money and does not serve to perform simultaneous or successive acts of M — C until such time as the conditions of this process itself may determine. This part is only temporarily withheld from circulation, in order to go into action, perform its function, in due time. This storing of it is then in its turn a function determined by its circulation and intended for circulation. Its existence as a fund for purchase and payment, the suspension of its movement, the interrupted state of its circulation, will then constitute a state in which money exercises one of its functions as money-capital. As money-capital; for in this case the money temporarily remaining at rest is itself a part of money-capital M (of M' minus m, equal to M), of that portion of the value of commodity-capital which is equal to P, to that value of productive capital from which the circuit starts. On the other hand all money withdrawn from circulation has the form of a hoard. Money in the form of a hoard therefore becomes here a function of money-capital, just as in M — C the function of money as a means of purchase or payment becomes a function of money-capital. This is so because capital-value exists here in the form of money, because the money state here is a state in which industrial capital finds itself at one of its stages and which is prescribed by the interconnections within the circuit. At the same time it is here proved true once more that money-capital within the circuit of industrial capital performs no other functions than those of money and that these money-functions assume the significance of capital-functions only by virtue of their interconnections with the other stages of this circuit.

The representation of M' as a relation of m to M, as a capital-relation, is not directly a function of money-capital but of commodity-capital C', which in its turn, as a relation of c and C, expresses but the result of the process of production, of the self-expansion of capital-value which took place in it.

If the continuation of the process of circulation meets with obstacles, so that M must suspend its function M — C on account of external circumstances, such as the conditions of the market, etc., and if it therefore remains for a shorter or longer time in its money-form, then we have once more money in the form of a hoard, which happens also in simple commodity circulation whenever the transition from C — M to M — C is interrupted by external circumstances. It is an involuntary formation of a hoard. In the case at hand money has the form of fallow, latent money-capital. But we will not discuss this point any further for the present.

In either case however persistence of capital in its money state appears as the result of interrupted movement, no matter whether this is expedient or inexpedient, voluntary or involuntary, in accordance with its functions or contrary to them.

Since the proportions which the expansion of the productive process may assume are not arbitrary but prescribed by technology, the realised surplus-value, though intended for capitalisation, frequently can only by dint of several successive circuits attain such a size (and until then must therefore be accumulated) as will suffice for its effective functioning as additional capital or for entrance into the circuit of functioning capital-value. Surplus-value thus congeals into a hoard and in this form constitutes latent money-capital — latent because it cannot act as capital so long as it persists in the money-form. [6a] The formation of a hoard thus appears here as a factor included in the process of capitalist accumulation, accompanying it but nevertheless essentially differing from it; for the process of reproduction itself is not expanded by the formation of latent money-capital. On the contrary, latent money-capital is formed here because the capitalist producer cannot directly expand the scale of his production. If he sells his surplus-product to a producer of gold or silver, who puts new gold or silver into circulation or, what amounts to the same thing, to a merchant who imports additional gold or silver from foreign countries for a part of the national surplus-product, then his latent money-capital forms an increment of the national gold or silver hoard. In all other cases, the £78 for instance, which were a circulating medium in the hands of the purchaser, assume only the form of a hoard in the hands of the capitalist. Hence all that has taken place is a different distribution of the national gold or silver hoard.

If in the transaction of our capitalist the money serves as a means of payment (the commodities having to be paid for by the buyer on longer or shorter terms), then the surplus-product intended for capitalisation is not transformed into money but into creditor’s claims, into titles of ownership of an equivalent which the buyer may already have in his possession or which he may expect to possess. It does not enter into the reproductive process of the circuit any more than does money in invested in interest-bearing securities, etc., although it may enter into the circuits of other individual industrial capitals.

The entire character of capitalist production is determined by the self-expansion of the advanced capital-value, that is to say, in the first instance by the production of as much surplus-value as possible; in the second place however (see Buch I, Kap. XXII) [English edition: Ch. XXIV. — Ed.] by the production of capital, hence by the transformation of surplus-value into capital. Accumulation, or production on an extended scale, which appears as a means for constantly more expanded production of surplus-value — hence for the enrichment of the capitalist, as his personal aim — and is comprised in the general tendency of capitalist production, becomes later, however, as was shown in Book I, by virtue of its development, a necessity for every individual capitalist. The constant augmentation of his capital becomes a condition of its preservation. But we need not revert more fully to what was previously expounded.

We considered first simple reproduction, assuming that the entire surplus-value is spent as revenue. In reality under normal conditions a part of the surplus-value must always be spent as revenue, and another part must be capitalised. And it is quite immaterial whether a certain surplus-value produced in any particular period is entirely consumed or entirely capitalised. On the average — the general formula can represent only the average movement — both cases occur. But in order not to complicate the formula, it is better to assume that the entire surplus-value is accumulated. The formula: P ... C' — M' — C'<LMP ... P' stands for productive capital, which is reproduced on an enlarged scale and with greater value, and which as augmented productive capital begins its second circuit, or, what amounts to the same, renews its first circuit. As soon as this second circuit is begun, we once more have P as the starting-point; only this P is a larger productive capital than the first P was. Hence, if in the formula M ... M' the second circuit begins with M', M' functions as M, as an advanced money-capital of a definite magnitude. It is a larger money-capital than the one with which the first circular movement was opened, but all reference to its augmentation by the capitalisation of surplus-value ceases as soon as it assumes the function of advanced money-capital. This origin is expunged in its form of money-capital, which begins its circuit. This also applies to P' as soon as it functions as the starting-point of a new circuit.

If we compare P ... P' with M ... M', or with the first circuit, we find that they have not the same significance at all. M ... M' taken by itself as an isolated circuit, expresses only that M, the money-capital (or industrial capital in its circuit as money-capital), is money generating money, value generating value, in other words, produces surplus-value. But in the P circuit the process of producing surplus-value is already completed upon the termination of the first stage, the process of production, and after going through the second stage (the first stage of the circulation), C' — M', the capital-value plus surplus-value already exist as realised money-capital, as M', which appeared as the last extreme in the first circuit. That surplus-value has been produced is depicted in the first-considered formula P ... P (see expanded formula, [M — C<LMP ... P ... (C + c) - (M + m)]) by c — m — c, which, in its second stage, falls outside of the circulation of capital and represents the circulation of surplus-value as revenue. In this form, where the entire movement is represented by P ... P, where consequently there is no difference in value between the two extremes, the self-expansion of the advanced value the production of surplus-value, is therefore represented in the same way as in M ... M', except that the act C' — M', which appears as the last stage in M ... M', and as the second stage of the circuit, serves as the first stage of the circulation in P ... P.

In P ... P', P' does not indicate that the surplus-value has been produced but that the produced surplus-value has been capitalised, hence that capital has been accumulated and that therefore P', in contrast to P, consists of the original capital-value plus the value of the capital accumulated because of the capital-value’s movement.

M', as the simple close of M ... M', and also C', as it appears within all these circuits, do not if taken by themselves express the movement but its result: the self-expansion of capital-value realised in the form of commodities or money, and hence, capital-value as M plus m, or C plus c, as a relation of capital-value to its surplus-value, as its offspring. They express this result as various circulation forms of the self-expanded capital-value. But neither in the form of C' nor of M' is the self-expansion which has taken place itself a function of money-capital or of commodity-capital. As special, differentiated forms, modes of existence corresponding to special functions of industrial capital, money-capital can perform only money-functions and commodity-capital only commodity-functions, the difference between them being merely that between money and commodity. Similarly industrial capital in its form of productive capital can consist only of the same elements as those of any other labour-process which creates products: on the one hand objective conditions of labour (means of production), on the other productively (purposively) functioning labour-power. Just as industrial capital can exist in the sphere of production only in a composition which meets the requirements of the production process in general, hence also of the non-capitalist production process, so it can exist in the sphere of circulation only in the two forms corresponding to it, viz., that of a commodity and of money. But just as the totality of the elements of production announces itself at the outset as productive capital by the fact that the labour-power is labour-power that belongs to others and that the capitalist purchased it from its proprietor, just as he purchased his means of production from other commodity-owners; just as therefore the process of production itself appears as a productive function of industrial capital, so money and commodities appear as forms of circulation of the same industrial capital, hence their functions appear as the functions of circulation, which either introduce the functions of productive capital or emanate from them. Here the money-function and the commodity-function are at the same time functions of commodity-capital, but solely because they are interconnected as forms of functions which industrial capital has to perform at the different stages of its circuit. It is therefore wrong to attempt to derive the specific properties and functions which characterise money as money and commodities as commodities from their quality as capital, and it is equally wrong to derive on the contrary the properties of productive capital from its mode of existence in means of production.

As soon as M' or C' have become fixed as M plus m or C plus c, i.e., as the relation between the capital-value and surplus-value, its offspring, this relation is expressed in both of them, in the first case in the money-form, in the second case in the commodity-form, which does not change matters in the least. Consequently this relation does not have its origin in any properties or functions inherent in money as such or commodities as such. In both cases the characteristic property of capital, that of being a value, is expressed only as a result. C' is always the product of the function of P, and M' is always merely the form of C' changed in the circuit of industrial capital. As soon therefore as the realised money-capital resumes its special function of money capital, it ceases to express the capital-relation contained in M' = M plus m. After M ... M' has been passed through and M' begins the circuit anew, it does not figure as M even if the entire surplus-value contained in M' is capitalised. The second circuit begins in our case with a money-capital of £500, instead of £422, as in the first circuit. The money-capital, which opens the circuit, is £78 larger than before. This difference exists on comparing the one circuit with the other, but no such comparison is made within each particular circuit. The £500 advanced as money-capital, £78 which formerly existed as surplus-value, do not play any other role than would some other £500 with which another capitalist inaugurates his first circuit. The same happens in the circuit of the productive capital. The increased P' acts as P on recommencing, just as P did in the simple reproduction P ... P.

In the stage M' — C'<LMP, the augmented magnitude is indicated only by C', but not by L' or MP'. Since C is the sum of L and MP, C' indicates sufficiently that the sum of L and MP contained in it is greater than the original P. In the second place, the terms L' and MP' would be incorrect, because we know that the growth of capital involves a change in the constitution of its value and that as this change progresses the value of MP increases, that of L always decreasing relatively and often absolutely.

Whether or not m, the surplus-value turned into money, is immediately added to the capital-value in process and is thus enabled to enter the circuit together with capital M now having the magnitude M', depends on circumstances which are independent of the mere existence of m. If m is to serve as money-capital in a second independent business, to be run side by side with the first, it is evident that it cannot be used for this purpose unless it is of the minimum size required for it. And if it is intended to be used for the expansion of the original business, the relations between the material factors of P and their value-relations likewise demand a minimum magnitude for m. All the means of production employed in this business have not only a qualitative but also a definite quantitative relation to one another, are proportionate in quantity. These material relations as well as the pertinent value-relations of the factors entering into the productive capital determine the minimum magnitude m must possess to be capable of transformation into additional means of production and labour-power, or only into the former, as an accretion to the productive capital. Thus the owner of a spinning-mill cannot increase the number of his spindles without at the same time purchasing a corresponding number of carders and roving frames, apart from the increased expenditure for cotton and wages which such an expansion of his business demands. To carry this out the surplus-value must therefore have reached a considerable figure (generally calculated to be £1 per newly installed spindle). If m does not reach this minimum size the circuit of capital must be repeated until the sum of m successively produced by it can function together with M, hence M' — C'<LMP. Even mere changes of detail, for instance in the spinning machinery, introduced to make it more productive, require greater expenditures for spinning material, more roving machinery, etc. In the meantime m is accumulated, and its accumulation is not its own function but the result of repeated P ... P. Its own function consists in persisting in the money state until it receives sufficient increment from the repeated surplus-value-creating circuits, i.e., from outside, to possess the minimum magnitude necessary for its active function, the magnitude in which alone it can really enter as money-capital — in the case at hand as the accumulated part of the functioning of money-capital M — into the functioning of M. But in the interim it is accumulated and exists only in the shape of a hoard in process of formation, of growth. Hence the accumulation of money, hoarding, appears here as a process by which real accumulation, the extension of the scale on which industrial capital operates, is temporarily accompanied. Temporarily, for so long as the hoard remains in the condition of a hoard, it does not function as capital, does not take part in the process of creating surplus-value, remains a sum of money which grows only because money, come by without its doing anything, is thrown in the same coffer.

The form of a hoard is simply the form of money not in circulation, of money whose circulation has been interrupted and which is therefore fixed in its money-form. As for the process of hoarding, it is common to all commodity production and figures as an end in itself only in the undeveloped, pre-capitalist forms of this production. In the present case, however, the hoard appears as a form of money-capital and the formation of a hoard as a process which temporarily accompanies the accumulation of capital because and so far as the money here figures as latent money-capital; because the formation of a hoard, the state of being a hoard, in which the surplus-value existing in money-form finds itself, is a functionally determined preparatory stage gone through outside of the circuit described by the capital and required for the transformation of the surplus-value into really functioning capital. By its definition it is therefore latent money-capital. Hence the size it must acquire before it can take part in the process is determined in each case by the value constitution of the productive capital. But so long as it remains in the condition of a hoard it does not yet perform the functions of money-capital but is still idle money-capital; not money-capital whose function has been interrupted, as was the case before, but money-capital not yet capable of performing it.

We are here discussing the accumulation of money in its original real form of an actual hoard of money. It may also exist in the form of a mere outstanding money, of claims on debtors by capitalists who have sold C'. As for other forms in which this latent money-capital may exist in the meantime even in the shape of money-breeding money, such as interest-bearing bank deposits, bills of exchange or securities of any description, these do not belong here. Surplus-value realised in the form of money in such cases performs special capital-functions outside the circuit described by the industrial capital which originated it — functions which in the first place have nothing to do with that circuit as such but which in the second place presuppose capital-functions which differ from the functions of industrial capital and which have not yet been developed here.

In the form in which we have just discussed, the hoard, as which the surplus-value exists, is a fund for the accumulation of money, the money-form temporarily assumed by capital accumulation and to that extent a condition of this accumulation. However this accumulation-fund can also perform special services of a subordinate nature, that is to say can enter into capital’s movement in circuits without this process assuming the form of P ... P', hence without an expansion of capitalist reproduction.

If the process C' — M' is prolonged beyond its normal duration, if therefore the commodity capital is abnormally delayed in its transformation into the money-form or if, for instance, after the completion of this transformation the price of the means of production into which the money-capital must be transformed has risen above the level prevailing at the beginning of the circuit, the hoard functioning as accumulation-fund can be used in the place of money-capital or of part of it. Thus the money-accumulation fund serves as a reserve fund for counter-balancing disturbances in the circuit.

As such a reserve fund it differs from the fund of purchasing or paying media discussed in the circuit P ... P. These media are a part of functioning money-capital (hence forms of existence of a part of capital-value in general going through the process) whose parts enter upon their functions only at different times, successively. In the continuous process of production, reserve-money capital is always formed, since one day money is received and no payments have to be made until later, and another day large quantities of goods are sold while other large quantities are not due to be bought until a subsequent date. In these intervals a part of the circulating capital exists continuously in the form of money. A reserve fund on the other hand is not a part of constituent capital already performing its functions, or, to be more exact, of money-capital. It is rather a part of capital in a preliminary stage of its accumulation, of surplus-value not yet transformed into active capital. As for the rest, it needs no explaining that a capitalist in financial straits does not concern himself about what the particular functions of the money he has on hand are. He simply employs whatever money he has for the purpose of keeping his capital circulating. For instance in our illustration M is equal to £422, M' to £500. If a part of the capital of £422 exists as a fund of means of payment and purchase, as a money reserve, it is intended, other conditions remaining the same, that it should enter wholly into the circuit, and besides should suffice for this purpose. The reserve fund however is a part of the £78 of surplus-value. It can enter the circular course of the capital worth £422 only to the extent that this circuit takes place under conditions not remaining the same; for it is a part of the accumulation-fund, and figures here without any extension of the scale of reproduction.

Money-accumulation fund implies the existence of latent money-capital, hence the transformation of money into money-capital.

The following is the general formula for the circuit of productive capital. It combines simple reproduction and reproduction on a progressively increasing scale:

If P equals P, then M in 2) equals M' minus m; if P equals P', then M in 2) is greater than M' minus m; that is to say m has been completely or partially transformed into money-capital.

The circuit of productive capital is the form in which classical Political Economy examines the circular movement of industrial capital.

6a The term “latent” is borrowed from the idea of latent heat in physics, which has now been almost replaced by the theory of the transformation of energy. Marx therefore uses in the third part (a later version), another term, borrowed from the idea of potential energy, viz.: “potential” or analogous to the virtual velocities of D’Alembert, “virtual capital.” — Ed.