Neocolonialism by Kwame Nkrumah 1965

THE king of mining in South Africa, indeed in Africa, is Harry Frederick Oppenheimer. One might almost call him the king of South Africa, even the emperor, with an ever-extending empire. There is probably hardly a corner of Southern Africa’s industrial and financial structure in which he has not got a very extended finger of his own or the hook of some affiliate or associate. These fingers and hooks attach the Oppenheimer empire firmly to other empires as great or greater.

Mr Harry Frederick Oppenheimer is director, chairman or president of some seventy companies. These directorships as well as those held by important colleagues and nominees, whose names recur monotonously on the boards of an ever-expanding complex of company boards, give the lie to the fiction of respectable separateness, even where there is no obvious financial connecting link. Dominating this complex of companies are the Anglo American Corporation of South Africa Ltd. and the Consolidated Gold Fields of South Africa Ltd., from which radiate affiliates, subsidiaries, associates, immediately or more tenuously connected, which would provide in themselves a most interesting trade, investment and banking directory. A list of direct interests, by no means complete, would include:

Anglo American Trust Ltd.

African & European Investment Co. Ltd.

Amalgamated Collieries of South Africa Ltd.

Bamangwato Concessions Ltd.

Central Mining Finance Ltd.

Consolidated Mines Selection Co. Ltd. (C.A.S.T.)

Coronation Collieries Ltd.

Consolidated Mines of South West Africa Ltd.

British South Africa Company Ltd.

Anglo Transvaal Consolidated Investment Co. Ltd.

De Beers Consolidated Mines Ltd.

Free State Development Co. Ltd.

Middle Witwatersrand (Western Areas) Ltd.

Rand Selection Corporation Ltd.

Rand Mines Ltd.

Rhodesian Anglo American Corporation Ltd.

South African Townships Mining & Finance Co. Ltd.

Vereeniging Estates Ltd.

West Rand Investment Trust Ltd.

Johannesburg Consolidated Investment Co. Ltd.

Rhodesian Broken Hill Development Co. Ltd.

Transvaal & Delagoa Bay Investment Co. Ltd.

Rhokana Corporation Ltd.

Union Corporation Ltd.

Tsumeb Corporation Ltd.

Selection Trust Co. Ltd.

Tanganyika Concessions Ltd.

Union Minière du Haut Katanga S.A.

Most of these are holding or investment outfits, established to co-ordinate a specific group of activists, but having their fingers in many other pies. It is difficult, almost impossible at times, to distinguish a delimiting line of operation. Trying to unravel the participations of the Anglo American Corporation and Consolidated Gold Fields of South Africa, for instance, leads often to the same involvements. Yet there must be a demarcation line, not only to preserve the semblance of autonomy, but to avoid a duplication of tasks and responsibilities in the interests of industrial and financial economy and profits.

As a matter of fact there is a constant rearrangement of organisational structure, either as a result of the acquisition of new interests and projects, the abandonment of exhausted mines, the expansion of existing companies and alliances, but above all in order to forestall or meet competition, to stream-line the structure and to correct the tax position.

For instance, in 1961, Consolidated African Gold Fields of South Africa Corporation underwent a thorough-going reorganisation with the intention of concentrating its administration in its various spheres of operation. Reporting to the annual meeting of the corporation’s activities for the year ending 30 June 1961, the chairman, Sir George Harvie-Watt, fixed the assets, at stock exchange value, at a total of approximately £58 million. Sixty-six per cent of this total was represented by interests in South Africa, ten per cent in North America and six per cent in Australia. Most of the remaining 18 per cent was accounted for by interests in the United Kingdom.

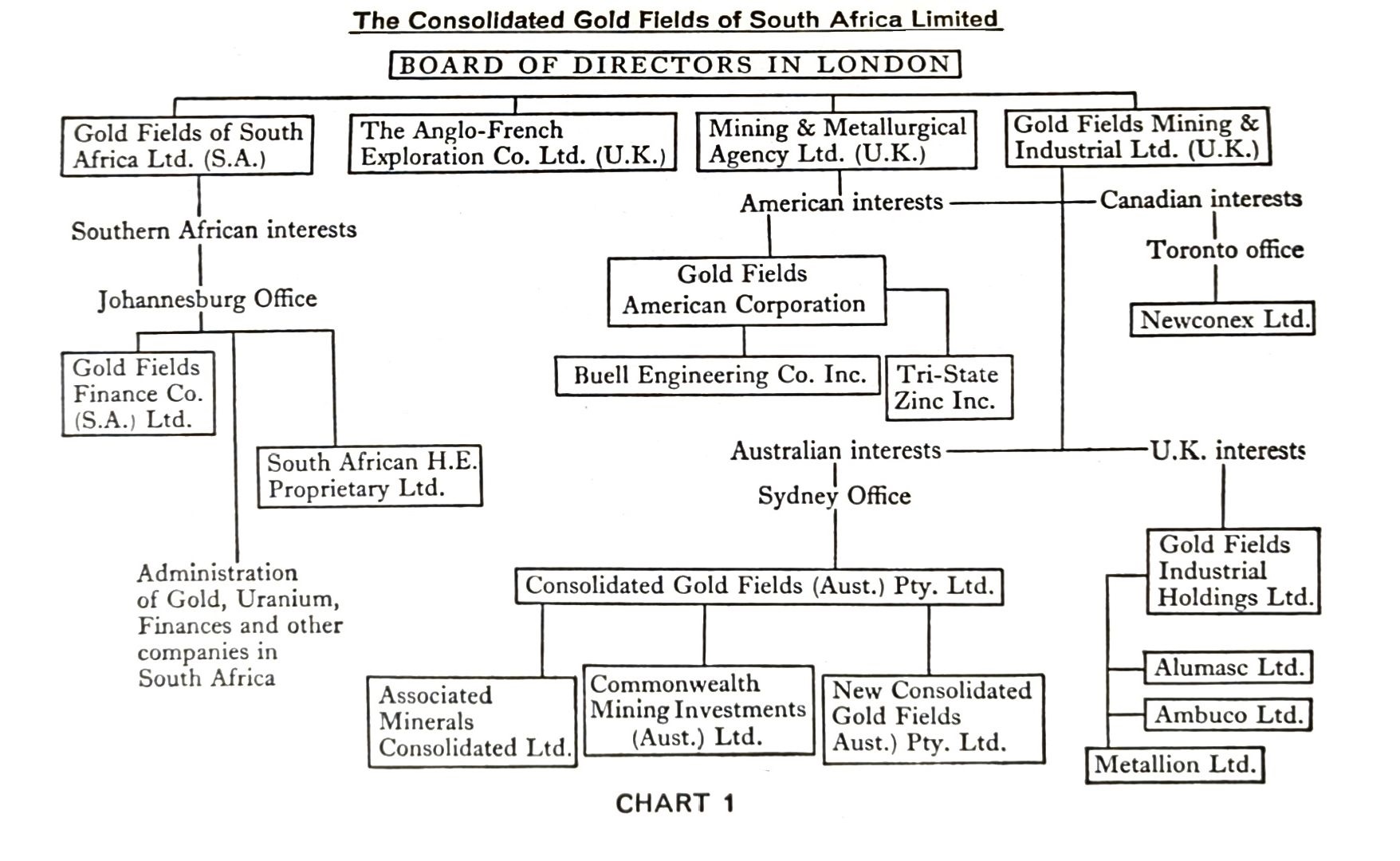

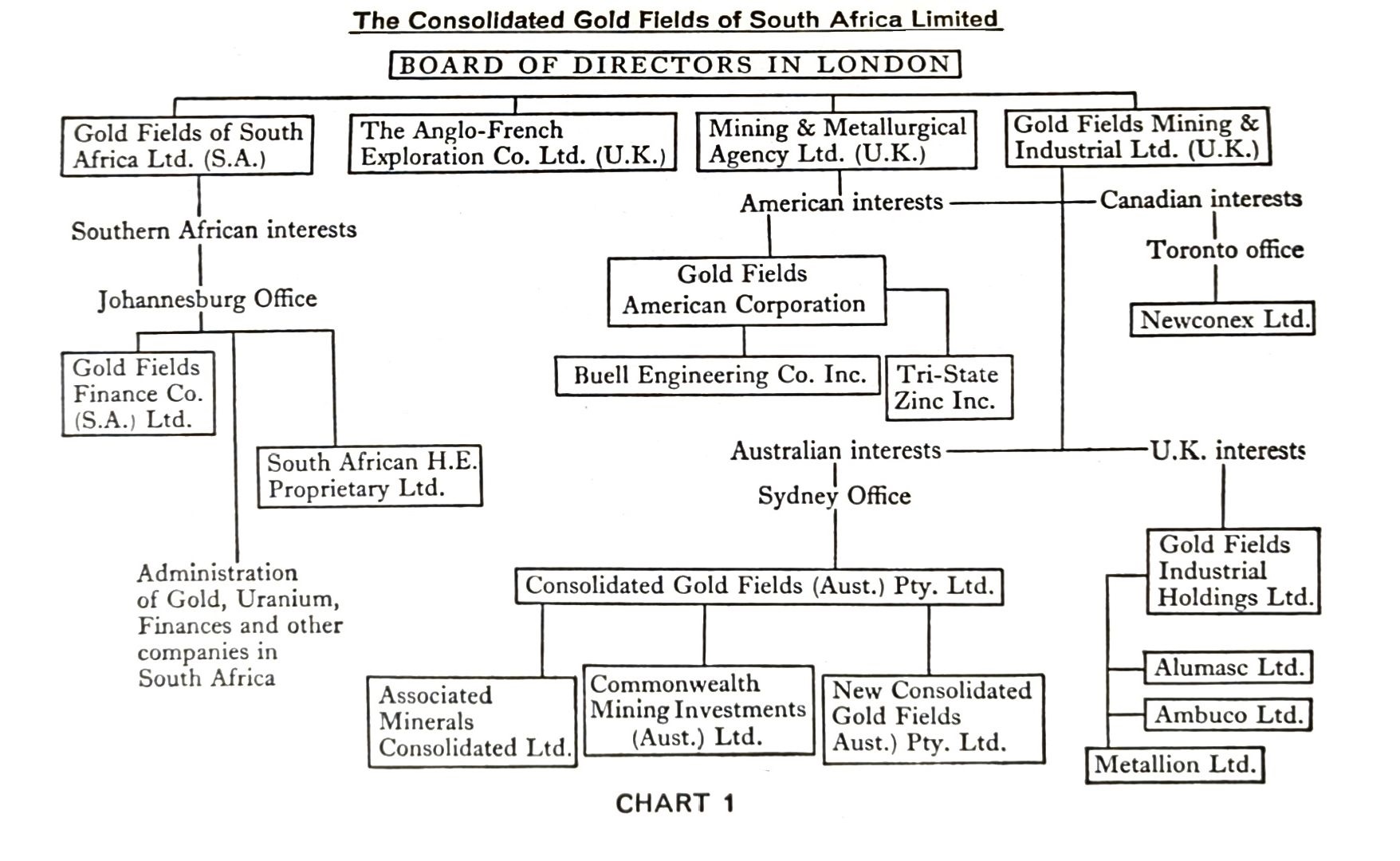

To supervise these interests and the planned absorption of others, a number of changes were made in the controlling companies, so that the group structure of Consolidated Gold Fields of South Africa Ltd. now has the appearance shown in Chart 1.

Explaining the structure to the shareholders at the annual general meeting held in London on 13 December 1962, the chairman confirmed that the operational supervision of the group’s interests in South Africa was the responsibility of óur wholly owned subsidiary, Gold Fields of South Africa Ltd., which is resident in Johannesburg’. When in 1959 the group acquired both New Union Gold Fields, since renamed Gold Fields Finance (S.A.) Ltd., and the South African H.E. Proprietary Ltd., their management was also vested in Gold Fields of South Africa, although the shares of these companies were held directly by the parent company in London.

In Australia, responsibility for administration of the group’s operations is exercised by Consolidated Gold Fields (Australia) Pty Ltd. Gold Fields’ principal investment in Australia is represented by a majority interest in Commonwealth Mining Investments (Australia) Ltd., ‘a mining finance company, which has a broadly based portfolio in Australian, North American and other overseas investments’, according to the chairman’s report.

A majority interest in another Australian concern, Associated Minerals Consolidated Ltd., gives Consolidated Gold Fields a big break into the rutile and zircon industry. Associated Minerals acquired all the outstanding shares of Z.R. Holdings Ltd., a company originally formed to take possession of Zircon Rutile Pty Ltd., together with that company’s share in, and advanced to other companies. About the same time, Associated Minerals bought the entire share capital of Titanium Materials and the assets of Rye Park Scheelite.

Experienced enterprises like Consolidated Gold Fields do not allow others to benefit from their efforts. So ‘while Associated Minerals was building up its holdings in the rutile industry’, stated Consolidated’s chairman, ‘we felt it necessary to strengthen our position in Wyong Minerals, another rutile producer in which Commonwealth Mining already had a substantial investment. Accordingly, our wholly-owned subsidiary, Consolidated Gold Fields (Australia) Pty Ltd., made an offer in February 1962 for 50 per cent of all shareholdings in Wyong Minerals other than those held by Commonwealth Mining Investments. This offer was successful and Wyong Minerals is now a subsidiary within the group.’

Congratulations are owed to Consolidated Gold Fields on their perspicacity. Their position in the rutile field is now pre-eminent. In the words of their chairman, ‘the total rutile productive capacity of our subsidiaries now represents close on one half of the total free world capacity. The expansion programme which Associated Minerals now has in hand should maintain this position.’ May we be forgiven if the qualification ‘free’ in this context looks a trifle dulled to us?

Rutile is a much sought-after material used in the manufacture of titanium pigment. The demand had the effect of increasing its open market price by some 50 per cent in the financial year 1961/62. Zircon’s price has remained stable in spite of considerably increased supplies.

A partnership with Cyprus Mines Corporation, a New York company, and the Utah Construction & Mining Co. of San Francisco, has resulted in a joint enterprise named Mount Goldsworthy Mining Associates, to explore and work the potential of iron ore deposits of Mount Goldsworthy in north-western Australia. The construction of a 125-mile railway is involved, to end up at Depuch Island, where a major seaport is under consideration. Sir George Harvie-Watt was pleased to inform Consolidated Gold Fields’ shareholders that ‘negotiations are in progress with the Japanese iron and steel industry regarding the market for this ore (from Mount Goldsworthy) which is thought will be competitive in price and quality with any now available in Japan.’

In the chairman’s words, the company’s operations in Canada had ‘taken a distinct step forward’. Their subsidiary exploration company, Newconex Canadian Exploration Ltd., was joined by a second, Newconex Holdings Ltd. A decision was made to allow the public to enjoy some of the fruits from the exploration of their country’s resources by foreign concerns. Accordingly, 36 per cent of the capital was offered to Canadians. Those who took up shares were doubtless delighted to know that the 28 1/2 per cent holdings of Newconex Canadian Exploration Ltd. in the Mount Hundere exploration will be turned over to the holding company. A high grade deposit of lead zinc (with some silver) discovered in this south Yukon region inspired the chairman to an admission of its being ‘most gratifying that so soon after its formation Newconex Holdings should be presented by Newconex Exploration with such an encouraging prospect.’

Moving southwards to the United States, a new company called Gold Fields American Corporation was formed in 1961 as a wholly-owned subsidiary of Gold Fields Mining & Industrial Ltd. Gold Fields American took over the New York organisation, set up originally in 1911, whose main function in recent years had been to provide administration for Gold Fields’ Tri-State Zinc Inc. and Buell Engineering Co. Inc., as well as secretarial services for the Fresnillo Company.

Fresnillo Company was reorganised in 1961, when it transferred 51 per cent of its diverse Mexican activities to Metalurgica Mexicana Penoles S.A., under the Mexican Government’s drive to have domestic control of its basic primary resources. A handsome compensation of $5,500,000 was awarded to Fresnillo, payable over a period of five years, for the cession of this holding to Compania Fresnillo S.A., in which it holds 49 per cent to Penoles’ 51 per cent. Fresnillo still retains a 55 per cent interest in Somberette Mining Company, owning another gold-silver property in the State of Zacatecas, Mexico.

With the ‘coming to the end of their profitable lives’ of Tri-State Zinc’s two mines in Illinois and Virginia, a replacement was sought by a new mine in the New Market area of Tennessee. This mine Tri-State are bringing into production in accordance with a joint venture agreement with American Zinc, Lead & Smelting Co. Under this agreement, Tri-State will mine and mill at least 20 million tons of zinc-bearing ores owned by American Zinc near Tri-State’s New Market property. Profits from the output of a treatment plan, designed to provide a daily capacity of 3,600 tons, will be distributed on a basis varying between 50 and 60 per cent to Tri-State and 50 to 40 per cent to American Zinc, until all capital has been returned, after which profits will be distributed equally.

American Zinc’s operations are closely connected with the mining and reduction of zinc and lead ores in several of the American States. It also has a 10 per cent interest in Uranium Reduction Co., and 50 per cent in American-Peru Mining Co., among several other affiliated and jointly-owned concerns. Buell Engineering Co., the other beneficiary of Gold Fields American Corporation, has been assisted to expand its fabricating facilities by taking over the entire common stock of the Union Boiler & Manufacturing Co.

Consolidated Gold Fields’ interests in the United Kingdom are now grouped under Gold Fields Industrial Holdings Ltd., formerly H. E. Proprietary Ltd., as a wholly-owned subsidiary of Gold Fields Mining & Industrial Ltd. Its main operations are carried on through its own subsidiaries, Alumasc Ltd., Ambuco Ltd. and Metalion Ltd. Alumasc is a producer of die-cast aluminium casks, notably for the brewing industry. It has lately expanded into the production of aluminium high-pressure bottles for commercial uses. In 1962 Alumasc, in the words of Consolidated’s chairman, ‘broadened its interests geographically and industrially’ by the acquisition of an Australian subsidiary, Lawrenson Alumasc Holdings Ltd., and of two United Kingdom subsidiaries, The Non-Ferrous Die Casting Co. Ltd. and Brass Pressings (London) Ltd., already well established in non-ferrous die-casting and brass pressing.

Two other U.K. organisational instruments radiate from the London directorate. These are Anglo-French Exploration Co. Ltd. and Mining & Metallurgical Agency Ltd. Anglo-French Exploration, a wholly-owned subsidiary of Consolidated Gold Fields, is an investment and financial business, holding, among others, interests in many of the principal gold-mining companies in South Africa. These interests also cover Northern Rhodesian copper mines, as well as tin-mining companies operating in the United Kingdom, South Africa and the Far East. Apex Mines Ltd. and Rooiberg Minerals Development Co. Ltd. of South Africa, and Anglo-Burma Tin Co. Ltd. are among its principals. Mining & Metallurgical Agency Ltd. was formed to look after the distribution of ores and purchase of supplies, as well as to run a shipping, insurance and general agency business. Fifty per cent of its capital is held by Consolidated Gold Fields.

Gold Fields of South Africa Ltd. is the wholly-owned subsidiary of Consolidated Gold Fields that is responsible for administering the operations of the group throughout the whole of South Africa. These are of a monumental size. For investments in the South Africa gold and platinum mines remain the major asset of the Consolidated Gold Fields group, and its principal source of income. At 30 June 1961 gold mining accounted for 71 per cent of the group’s quoted investments, and the chairman assured shareholders that since the end of the second world war, Consolidated Gold Fields had invested capital sums approaching £450 million in the South African gold mines. Exploration has continued in South AFrica and Rhodesia, and is in close collaboration with West Witwatersrand Areas Ltd., a company which Consolidated Gold Fields floated in 1932. Since then, West Witwatersrand has itself become an important South African finance mining company with major holdings in the gold mines of the Far West Rand and Orange Free State.

West Witwatersrand produced in 1962 gold valued at over £57 million, which was twice the size of its production of ten years ago. The Harmony Gold Mining Co. Ltd., in which West Witwatersrand has a holding of 1,247,564 shares through its subsidiary Westwits Investment Ltd., also achieved a record gold output.

Apart from its interests in the Transvaal and Orange Free State gold and platinum mines, Consolidated Gold Fields has substantial holdings in South West Africa Co. Ltd., and in Rhodesia, in Bancroft Mines Ltd., Nchanga Consolidated Copper Mines Ltd., and Rhodesian Anglo American Ltd., all falling within the sphere also of Anglo American Corporation. In Ghana, Consolidated is interested in Konongo Gold Mines Ltd., which has a concession of approximately twenty square miles in the Ashanti-Akim district. On an authorised capital of £675,000, not fully paid up (7,004,175 shares of 1s. each issued out of 13,500,000), a working profit of £110,587 was achieved in 1960, increased to £130,378 in 1961, despite an advance in working costs from 86s. 6d. per ton to 88s. 2d. per ton. In 1962, Konongo Gold Mines Ltd. informed the Ghana Government that the operation of the Konongo Gold Mine would become uneconomic after April 1965. The Company were therefore contemplating ceasing operations just before that time. In view of the loss of employment that this would mean, the Government decided to purchase the mine in order to provide continued employment for the Ghanian employees. After protracted negotiations, a purchase price of £150,000 was paid by the Ghana Government and the mine is now under the management of the State Gold Mining Corporation.

Capitalised at £15 million, Consolidated Gold Fields made consolidated profits before tax of £6,826,000 for the year to 1960/61 with dividends absorbing £1,729,299. The year 1962 proved for Consolidated Gold Fields the most profitable yet in its operations, resulting in a consolidated profit before tax of £7,030,000, while, in the chairman’s own words, ‘another satisfactory feature of the accounts is that dividends and interest exceeded £5 million for the first time’.

Consolidated Gold Fields’ income comes largely from the specialist services which it provides to companies within its own group and those within its associated groups. Varying considerably in size, they number over one hundred, and the total market capitalisation of those quoted on the stock exchange exceeded £170 million at the end of the company’s working year of 1962. It is by these means of investment and management that much larger incomes are built up than from the actual production of the mining and processing of raw materials. That is why so many of the more important mining companies, not alone in Africa but throughout the world, have coalesced into holding and investment concerns behind whom and among whom stand the most important figures in the banking and financial world.

Here we have touched only on the bare bones of the Consolidated Gold Fields skeletal structure. The flesh and brawn which clothe it are set in layers of rich fat that have created a huge corporation bulge, smugly admired by the owner, but ominous to the lean, starved African observer.