Neocolonialism by Kwame Nkrumah 1965

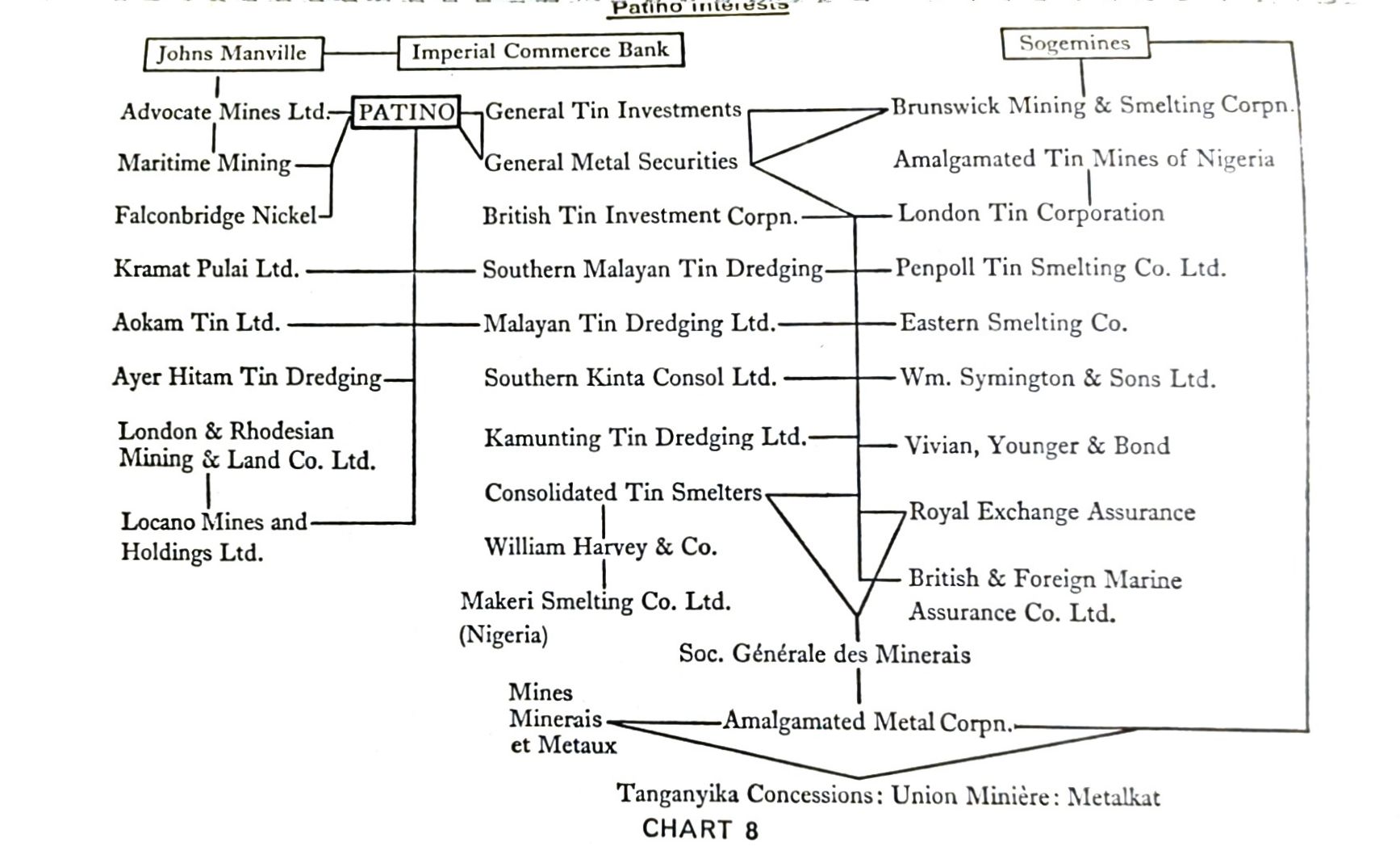

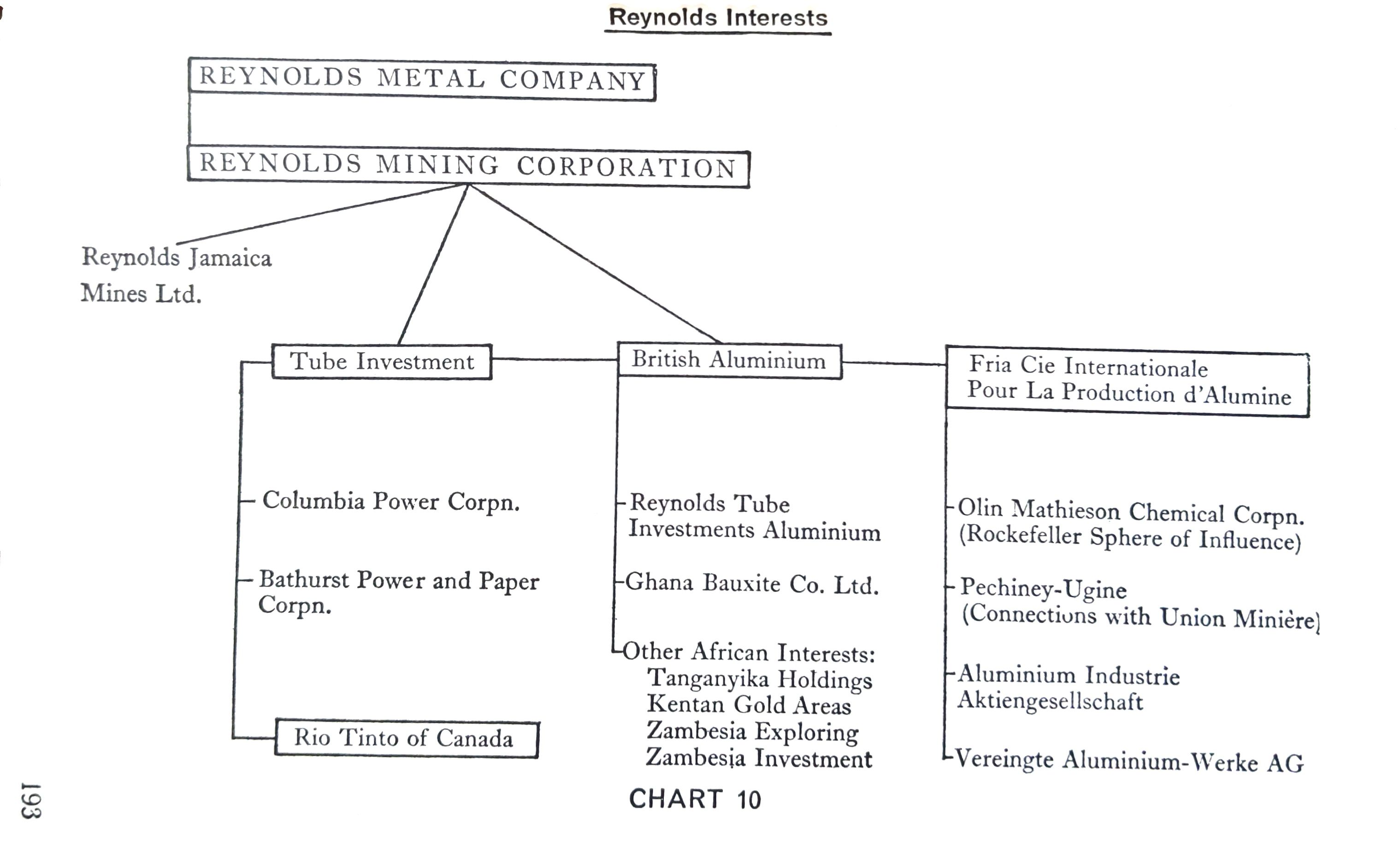

The tin empire of Patino of Canada Ltd. and its associates spreads from South America to the United Kingdom and North America and across Africa into the Pacific and Asia. Capitalised at $10 million, Patino of Canada has issued and paid up 1,971,839 shares of $2. Of these 47·2 per cent are held by a Panamanian financing house within the Patino group, Compania de Bonos Acciones y Negocios Industriales – COBANISA. Patino’s purchase into General Tin Investments Ltd. in 1962 brought this tycoon into a large share of the United Kingdom spread in the tin-mining and dealing world. General Tin Investments is charged with acquiring and holding shares in mining, finance and industrial companies, its principal holdings being in those companies connected with the tin industry. It carries out its financing operations through a wholly-owned subsidiary, General Metal Securities (London) Ltd. A. Patino presides over both boards where he has as colleagues Count G. du Boisbouvray, J. Ortiz-Linares and E. R. E. Carter. Carter is president of Brunswick Mining & Smelting Corporation and of several other companies associated with the Patino group. Brunswick comes within the Morgan sphere of influence through the interest maintained by St Joseph Lead Co. We also know that Sogemines has concerned itself with a substantial investment with the New Brunswick Mines of Brunswick Mining. The spokes that lead out from the Société Générale de Belgique’s African hub into the affairs of the most powerful financial monopolies in the world seem ever-increasing.

Patino’s direct investments in Canada cover substantial holdings in Copper Rand Chibougama Mines Ltd., Advocate Mines Ltd., Nipissing Mines Co Ltd. and Brunswick Mining. By financial jugglery consolidation of the principal Canadian companies of the group was achieved in 1960. This was done through an agreement between Copper Rand, Nipissing Mines, Chibougama Jaculet Mines Ltd., Portage Island (Chibougama) Mines Ltd., Patino of Canada and Bankmont & Co. a financial house. Copper is the chief mineral mined, but gold and silver are also produced. The Copper Rand property covers some 10,000 acres held in four concessions. Portage Island is a copper-gold property of Copper Rand, and the Jaculet mine a copper property.

Nipissing enters into the picture as a financial contributor to the development of the Portage Island property. It is the holder of a number of mining claims in Quebec and holds diverse share interests. Its operations branch into the U.S.A. though a wholly-owned subsidiary, Appalachian Sulphides Inc., with mining rights to ore deposits in the States of Vermont and North Carolina. Nipissing bought into Brunswick Mining by acquiring from a Patino subsidiary, Patino Mines & Enterprises Consolidated (Inc.), 137,143 shares and $537,429 worth of 5 per cent bonds of Brunswick, giving to Patino 1,061,145 shares of Nipissing. Patino’s holdings in the Chibougama group and association with Maritimes Mining Corporation and the Irving Oil Co. Ltd. in a 40 per cent purchase of Brunswick mining shares extend the Patino empire substantially into fields other than tin.

American and Belgian mining and financial interests as powerful as Patino’s have linked together with Patino of Canada in investigating and developing mineral deposits on an exclusive basis across 750 square miles of land on the north-eastern coast of Newfoundland, under rights granted to Advocate. At the end of 1960 proven ore reserves totalled 35 million tons of commercial grade. Advocate is developing asbestos under a project undertaken by Patino of Canada in conjunction with Canadian Johns-Manville Co. Ltd., Amet Corporation Inc. and Financière Belge de l'Asbestos-Ciment S.A. The participants have agreed to place the property on an operating basis by furnishing to Advocate a total sum of $17,900,000. Canadian Johns-Manville will contribute 49·62 per cent, Patino 17·3 per cent, Amet and Financière Belge 16·54 per cent each. Advocate has been capitalised at $23 million and the parties to the agreement share in the capital ratio to the amount of their contributions, based on denominations of $100.

Canadian Johns-Manville, which is tied up with the Imperial-Commerce Bank, the largest in Canada, upon which sits a director of Johns-Manville, is a fully-owned subsidiary of the Johns-Manville Corporation of the United States. Its main interests are in asbestos, which it processes into fibre and manufactures into building and industrial materials. IT is in control of Advocate’s management, and has also a majority interest in and management control of Coalinga Asbestos Co of California, U.S.A., a joint venture with Kern County Land Co. The part Johns-Manville, of America, manufactures products from asbestos, magnesia and perlite, having manufacturing plants in America, Canada and elsewhere.

Advocate has advanced certain monies to Maritime Mining, which has close relations with Patino by reason of its associations with the purchase of the St Joseph Lead holdings in Brunswick Mining. Maritimes’ share of this purchase was 46 per cent at a cost of $4,848,000. Maritime works copper on claims in New Brunswick, Canada, and properties in Newfoundland owned directly and also indirectly via a fully-owned subsidiary, Gull Lake Mines Ltd., through which it also owns all the shares of Gullbridge Mines Ltd. It has an arrangement with Falconbridge Nickel Mines giving the latter the right to a maximum one-third participation in any future financing which Maritime might undertake. Maritime and Patino of Canada share a director in W.F. James who is also on the Falconbridge board.

Quebec Metallurgical is another holding company having wide interests inside and outside Canada. These include a platinum property in South Africa’s Transvaal, a small gold mine in Brazil, and nickel and cobalt interests in New Caledonia, where, through links with Patino, it is associated with Le Nickel.

Unfortunately for Patino, certain assets in Bolivia have had to be relinquished under a nationalisation programme. Bolivia was for many more years than its people cared about drained by foreign interests of its mineral resources, in which tin predominates, but which also include silver, lead, zinc, antimony, and copper. Its oil deposits were large enough to entice Rockefeller’s Standard Oil Co., who entrenched themselves by working a large concession, while the Guggenheim Brothers of America, as well as British, French and others, gathered in tin and copper over a long period, paying the Indian workers around sixpence a day for their labour.

The properties of the Delaware incorporated Patino Mines & Enterprises Consolidated were nationalised by the Bolivian Government on 31 October 1952 and vested in a State-owned property, the Corporacion Minera de Bolivia Comibol. These Patino properties consisted of mining and placer claims, water rights, mill sites, reduction, concentrating and hydro-electric plants, as well as a railway connecting the mines with a point on the main line of the Antofagasta-Bolivian Railroad Co. Ltd. Patino Mines formed another Delaware subsidiary in 1959, Patino Enterprises Inc.

As one of the largest entrepreneurs in the tin industry, A. Patino has a seat on the main consolidated organisations looking after the interests of those engaged in this field, usually in the company of the Count of Boisbouvray and J. Ortiz-Linares. All three of them are to be found on the board of British Tin Investment Corporation Ltd., a United Kingdom company formed in 1932 to take over British-American Tin Corporation Ltd. Together with its wholly-owned subsidiaries, Tin Industrial Finance & Underwriting Ltd. and B.T.I.C. (Overseas) Ltd., British Tin holds large blocks of shares in the Malayan tin-mining industry, as well as investments in companies producing other metals and minerals.

General Tin Investments has a 55 per cent interest in eastern Smelting Co. Ltd., owning smelting works at Penang, Malaya. A wholly-owned subsidiary of Consolidated Tin, Williams Harvey & Co. Ltd., holds 75 per cent of the issued share capital of Makeri Smelting Co. Ltd. incorporated in Nigeria in 1961. Makeri has built a tin smelter on the Jos Plateau, Northern Nigeria, which began production in December 1961. Vivian, Younger & Bond Ltd., the sole selling agents of Consolidated Tin, are well established in Nigeria.

London Tin Corporation Ltd. board does not include any of the Patino directors, but the relationship with the Patino interests are obviously established when we note on its board C. Waite, chairman and managing director of Consolidated Tin Smelters and its subsidiary Williams Harvey & Co., and a director of British Tin Investment Corporation and General Tin Investments. Mr Waite also sits on the board of Consolidated Tin subsidiaries: the Penpoll Tin Smelting Co. Ltd., Eastern Smelting Co., Wm. Symington & Sons Ltd. (rubber merchants) and that of the distributing agents, Vivian, Younger & Bond.

As director of Southern Kinta Consolidated Ltd., Southern Malayan Tin Dredging Ltd., Kamunting Tin Dredging Ltd., Malayan Tin Dredging Ltd., Mr Waite obviously represents on those boards the interests (including those of Patino) of Consolidated Tin. A director, moreover, of the Chartered Bank and a member of the London Board of British & Foreign Marine Insurance Co. Ltd., he certainly represents the financial interests supporting them. This conclusion is backed by the directorial presence of Francis G. Charlesworth on British Tin and as chairman of Malayan Tin Dredging and Southern Malayan Tin. Mr Charlesworth is also a director of certain other tin companies operating in the Malayan area, namely Kramat Pulai Ltd., Ackam Tin Ltd. and Ayer Hitam Tin Dredging Ltd. He is, moreover, a member of the board of Locana Mineral Holdings Ltd., which is honoured by including a scion of the Austro-Hungarian empire, H.I.R.H. The Archduke Robert Charles of Austria.

Locana is an investment and holding company, connected principally with the Canadian mining industry. Mr Charlesworth is a direct link with the world of tin mining and dealing through his association with British Tin and its interests in Malaya. Sitting alongside Mr Charlesworth on the Locana board are Messrs N. K. Kindhead-Weekes and J. N. Kiek. Both also sit on the boards of important South African and Rhodesian companies.

Mr. Kiek is a chairman of Chicago-Gaika Development Co. Ltd., a company existing since 1897 and having seventeen gold claims in the Sebakwe district of Matabeland, Rhodesia, which was at one time within the jurisdiction of the British South Africa Company. Mr Kiek’s other associations are with the London and Rhodesian Mining and Land Co. Ltd., owning directly 384 gold-mining claims, base-metal claims and lands covering 757,000 acres in Rhodesia. Some of the properties are leased on a royalty basis, and ranching operations are also carried on.

Subsidiary companies of London & Rhosdesian include Mazoe Consolidated Mined Ltd., Lonrho Exploration Co. Ltd. and African Investment Trust Ltd., which took over all the company’s investments in 1958, except shares in subsidiaries and trade investments. Its associates include Arcturus Mines Ltd., Homestake Gold Mining Co. Ltd., Coronation Syndicate Ltd. and North Charterland Exploration Co. (1937) Ltd. Among further interests acquired by London & Rhodesian in 1961 were 90 per cent of Consolidated Holdings (Pvt) Ltd., 100 per cent of Mashaba Gold Mines (Pvt) Ltd., which operates the Empress Gold Mine at Mashaba, near Fort Victoria, Rhodesia, 37 per cent of Kanyemba Gold Mines and 51 per cent of Associated Overland Pipelines of Rhodesia (Pvt) Ltd., in exchange for 1,500,000 shares in London & Rhodesian and an option on another 2 million.

That London & Rhodesian Mining comes within the Oppenheimer group interests there can be no doubt, despite the separate front that is kept up. G. Abdinor, a director of Arcturus Mines, Coronation Syndicate, Homestake, Kenyemba and Mazoe, is also a member of the boards of Calcon Mines Ltd. (Northern Rhodesia), Spaarwater Gold Mining Co. Ltd. and West Spaarwater Ltd., as is also S. F. Dench, who is chairman of West Spaarwater and of Coronation Syndicate and Kanyemba. Spaarwater Gold is among the interests of Consolidated Gold Fields, while Henderson’s Transvaal Estates Ltd., of which Mr Dench is a director, comes within the Oppenheimer African Investment Trust group of holding companies, on whose board sits Mr Kiek. It is, in fact, the total owner of African Exploration Co. Ltd. which gives secretarial aid to West Spaarwater and Coronation Syndicate.

Interestingly enough, Henderson’s Transvaal Estates has a fully-owned subsidiary, Mineral Holdings Ltd., owning freehold lands in Transvaal and Orange Free State, totalling 3,706 acres, and mineral rights over a further 689,380 acres. In addition, it has two mineral concessions in Swaziland, totalling 84,019 acres.

Another direct wholly-owned subsidiary of Henderson’s Transvaal is Mineral Holdings Investments Ltd., which holds 720,000 shares in Leslie Gold Mines Ltd. and 200,000 in Bracken Mines Ltd., both of them belonging to the Union Corporation group of the Oppenheimer empire. Both mines enjoy a loan of £1 million each from the National Finance Corporation of South Africa, in which Anglo American Corporation and a number of other groups and institutions associated with it have substantial interests.

J. N. Kiek also occupied the managing director’s position on Rhodesia Railways Trust Co. Ltd., and two other Oppenheimer financial concerns, Willoughby’s Consolidated Co. Ltd. and Willoughby’s (Investments) Ewell Ltd. Mr Kiek’s associate director N. K. Kindhead-Weekes, is a director of such important Oppenheimer enterprises as Wankie Colliery (linked with Tanganyika Concessions and Union Minière), Chibuluma Mines, Chisangwa Mines and Chambishi Mines, and also Charterland Exploration Ltd., all of them in Rhodesia. Charterland Exploration has been granted exclusive prospecting rights by British South Africa Co. over areas totalling some 118,000 square miles in Zambia.

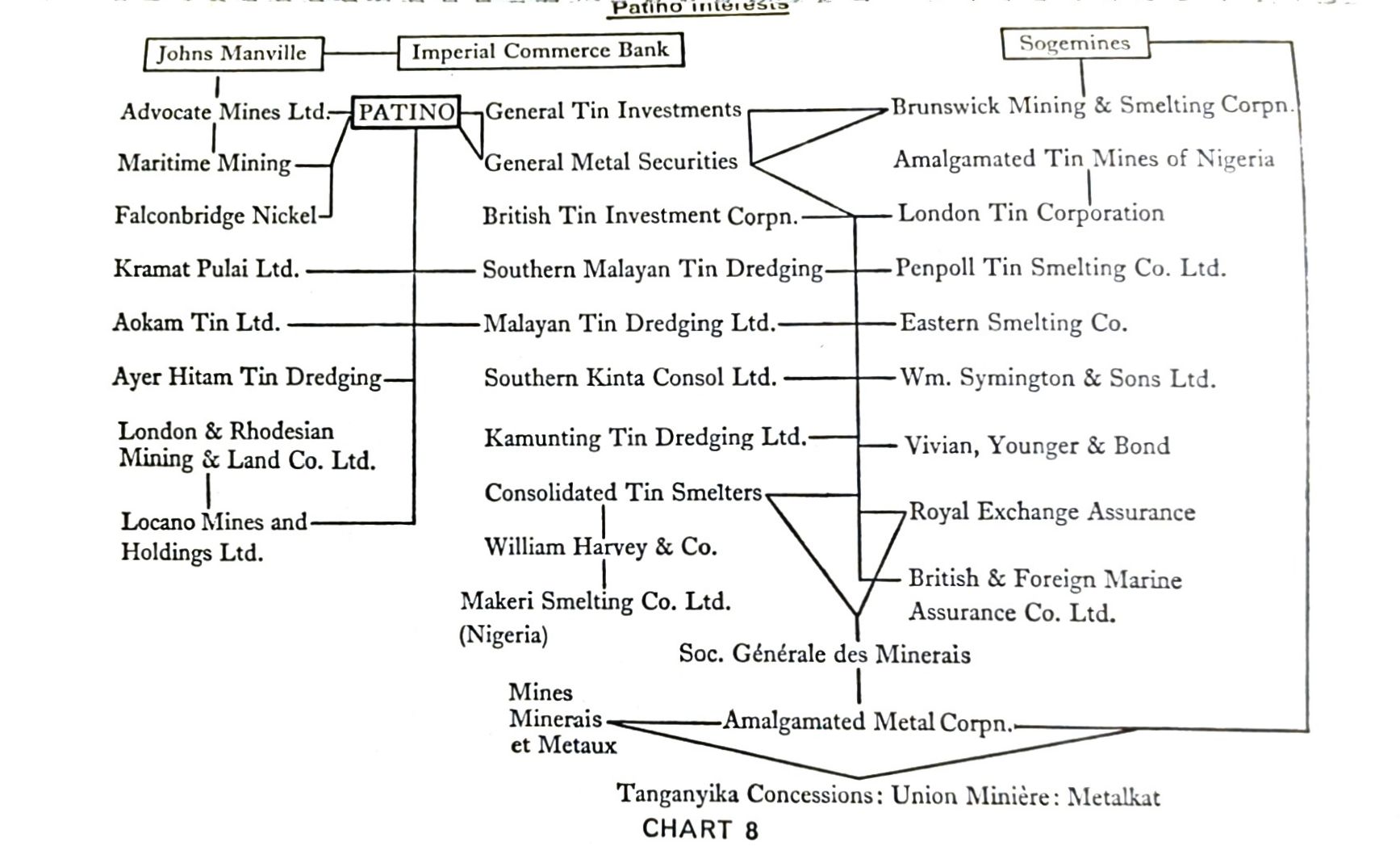

The Patino network is shown in Chart 8. Of the organisations dominating the aluminium industry we note first the Aluminium Co. of America (ALCOA) and the aluminium empire of Mellon.

This company mines bauxite in Arkansas and has subsidiaries digging and bringing out ore from far-flung places to feed the smelting and processing works in the United States. These are sited mainly in the southern States, though there are works at Massena, New York. Casting and fabricating plants are operating in twelve of the American States, while wholly-owned subsidiaries are exploring for raw materials in Europe, Central and South America, the Caribbean, Australia and Africa.

Surinam Aluminium Co. is the principal ore-producing subsidiary. It mines bauxite in the Dutch-held territory of Surinam, part of Guiana, which stretches over the north-eastern corner of the South American continent lying north of the Amazon and south of the Orinoco. Under an agreement with the Surinam Government, Surinam Aluminium has a 75-year bauxite-mining concession. It is building power facilities and will construct a 60,000-ton aluminium smelter. The eventual construction of a bauxite refinery utilising local ores is envisaged, according to the company’s publicity material. Another full subsidiary is mining bauxite in the Dominican Republic and, in May 1960, mining rights were acquired over 30,000 acres of Jamaica. Chart 9 shows the extent of Alcoa’s foreign interests.

Because of the anti-trust laws there is legally no direct connection between Alcoa and Aluminium Ltd., but they are both owned by the same Mellon-Davis dominated group of United States shareholders. Two brothers, Arthur V. Davis of Alcoa and Edward K. Davis of Aluminium Ltd., were for many years president of the respective companies. When the latter died in 1947 he was succeeded by his son, Nathaniel V. Davis. The size of the Davis block of shares in the Mellon aluminium companies is about a third of that of the Mellons. In 1957 Fortune, the American journal read by all who would be well-informed on matters of big business, listed Arthur V. Davis as one of seven persons with fortunes between $400 million and $700 million. Of the other six, four were Mellons. Aluminium Ltd’s Davis is a director of the Mellon Bank.

United Kingdom provides as a subsidiary Alcan Industries Ltd. and France contributes a further wholly-owned subsidiary in S.A. des Bauxites et Alumines de Provence, in which Aluminium Ltd. has invested some $100 million. Its mines produced 300,000 tons in 1960, from which alumina is processed. Making itself independent in the sphere of transport Alcan created Saquenay Shipping Ltd., fully financed by itself, to own and charter a fleet of ships for carrying the group’s bauxite, alumina and ingot.

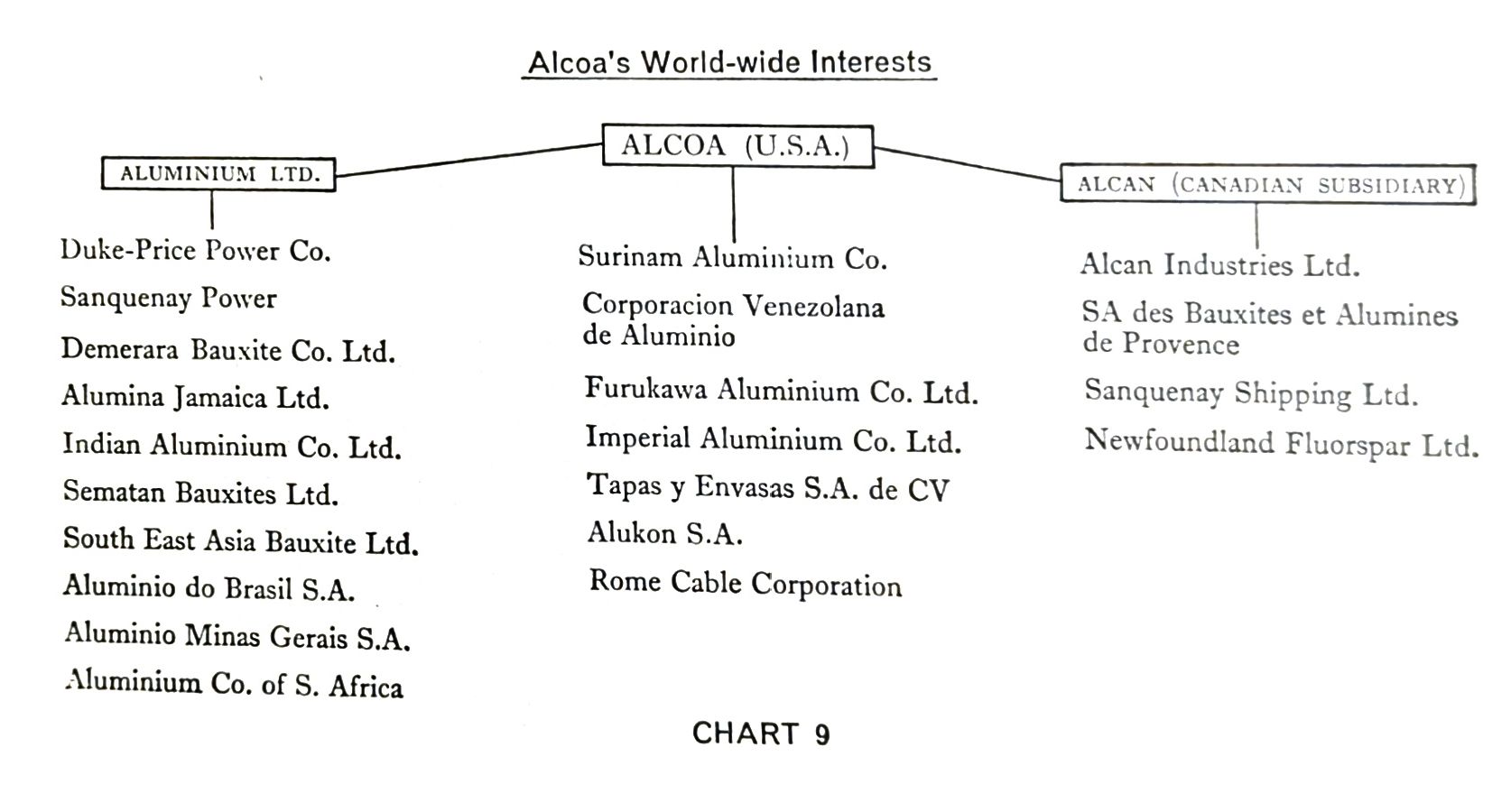

Though Kaiser and Reynolds set up aluminium companies as an attempt at independence from the Mellon empire, in the case of Kaiser financial alliance was formed early. Reynolds also has not found it possible to keep entirely aloof from the Mellon tentacles. Formed in mid-1928, Reynolds Metals Co. created in 1940 its subsidiary, Reynolds Mining Corporation, to work 6,100 acres of bauxite land which it had obtained in Arkansas and to mine fluorspar in Mexico, which is shipped for processing at the company’s works in America.

Abroad, Reynolds owns bauxite mines and exploration tracts in north-east British Guiana, as well as in Haiti and Jamaica. The dried ores are shipped to plants in Massachusetts, Delaware, Arkansas and Texas, U.S.A., more than 3 million tons have been mined and shipped during 1961. Other subsidiaries and affiliates operate in Bermuda, Venezuela, Philippines, Mexico, Canada, Australia, Africa, Columbia and other parts of the world. Reynolds Jamaica Mines Ltd. in 1957 acquired the right from the Jamaican Government to mine bauxite for 99 years on all lands then owned or held by it under option in return for ore royalties and taxes. These lands amounted to 74,000 acres. Mining leases have been obtained on 5,822 acres.

The United Kingdom end of the Reynolds’ aluminium activities is operated through British Aluminium Ltd. At one time it looked as though Mellon would take over the British company, but an alliance between Tube Investment Ltd. and Reynolds secured them 96 per cent control of British Aluminium, T.I. taking 49 per cent and Reynolds 47 per cent. The Commonwealth, Europe, Asia and Africa are embraced within the company’s sphere of activities, its subsidiaries and affiliates controlling power resources, bauxite properties, processing works, even a Grand Hotel, and a pension trust, all of which are listed among Tube Investment’s interests as the major parent company.

British Aluminium took over Reynolds T.I. Aluminium in mid-1961, owned at the time 51 per cent by T.I. and 49 per cent by Reynolds. Members of the Reynolds’ family sit on the British Aluminium board, which accommodates W. B. C. Perrycoste, director of Ghana Bauxite Co. Ltd., a wholly-owned subsidiary of the company, registered in London in 1933. Other African interests are represented by E. F. O. Gascoigne, chairman of Tanganyika Holdings, Kentan Gold Areas, Zambesia Exploring and Zambesia Investment, all within the Tanganyika Concessions sphere. The ‘objective’ British press is also represented by the presence on British Aluminium’s board of Sir Geoffrey Crowther, one-time editor of The Economist and now its deputy chairman. Commercial Union Assurance is also among Sir Geoffrey’s and Lord Plowden’s directorships.

FRIA Cie Internationale pour la Production de l'Alumine, Guinea, is one of British Aluminium’s biggest interests in Africa, in which it holds 10 per cent of the shares. The project is to produce, initially, 480,000 tons of alumina annually, of which 10 per cent will be available to British Aluminium.

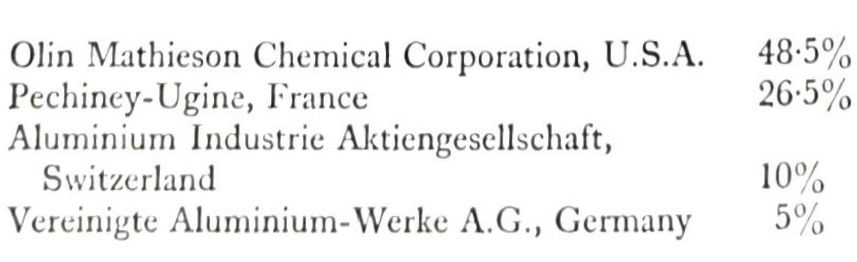

The Mellons were the original party directly interested in developing Guinea’s bauxite resources but, unable to force the pressure on the newly independent African State, their people were forced to retire, having fruitlessly disbursed, according to their own estimates, some $20 million. Other partners in Fria are:

Olin Mathieson is within the Rockefeller sphere of influence represented on the chemical company’s board by Lawrence Rockefeller, who acts for the family in its activities outside oil. Control, however, is shared with the Morgans. Thus, the Mellon group gave way to an overwhelmingly more powerful compact of interests hidden behind the Olin Mathieson facade.

The second-largest holder of Fria is a combination of the Pechiney and Ugine companies. Pechiney is an abbreviation of Compagnie des Produits Chimiques et Electrometallurgiques. Among its directors is Paul Gillet, an honorary governor of Société Générale de Belgique, chairman of Union Minière, and associate of many of the foremost concerns exploiting Africa’s resources. Its chairman is Paul de Vitry, a director of the Banque de Paris et des Pay Bas. This bank, of which Henry Lafond was also a director, besides sitting with Paul de Vitry on Pechiney, operates in the Congo and South Africa. In fact it is ubiquitous in the new ventures going forward in Africa, especially those in the new States bordering the Sahara.

Pechiney, registered in Paris at the opening of the year 1896, is the continuation of a company formed over a hundred years ago in 1855 and, like the other leading mining and metallurgical companies in France, has links with the country’s leading banking houses. Its proliferations are manifold, covering the production of bauxite, barytes and lignite, chemicals manufacture, the processing of aluminium and other metals and electrometallurgical products. It manufactures almost everything from plastics, through iron alloys, graphite products, up to new metals and nuclear products. It holds part and total portions of affiliated companies in France and other countries in Europe, Africa and elsewhere. Its mining operations spread from north to south of France and into Africa.

Responsible today for four-fifths of France’s output of aluminium, Pechiney’s trading in the metal accounts for nearly 60 per cent of its turnover. Its only sizeable French competitor is Ugine, which collaborates with Pechiney on investment policy, as we note above, and in a joint sales subsidiary, Aluminium Français. Both firms are expanding rapidly, and Pechiney has as widespread operations as the British and American aluminium companies, though the latter have greater output. It is expected that Pechiney-Ugine capacity may reach 300,000 tons by 1963. Pechiney uses 15 per cent of a total French power output, so that the discovery of natural gas as Lacq in south-western France made a considerable contribution to its expansion. It had pushed the aluminium sector of its exports to 37 per cent and hopes to save on its production costs by the introduction of a new process for reducing bauxite to aluminium. A pilot plant has been put into operation and its success will enable Pechiney to expand into new aluminium industries.

Through the Banque de Paris, which is said to be the biggest shareholder in the important Franco-Norwegian chemical concern, Norsk Hydro, majority-controlled by the Norwegian Government, Pechiney may become linked with the project. The Norwegians are anxious to increase their output from its present level of 200,000 tons to 600,000 tons by 1970. Already Pechiney is in consortia operating in Greece, Spain and the Argentine, and has holdings in Senegal and Madagascar projects. As a matter of fact, there is hardly a new consortium springing up in Africa today, particularly in the Maghreb, in which Pechiney does not have an oar. It certainly has a watchful eye on the vast natural gas deposits of the Sahara, which are not uneconomically distant from the bauxite fields of Mali.

The international nickel field binds a select coterie of extractive, processing and financing concerns whose control keeps it within fairly exclusive numerical limits. Grouped around the International Nickel Co. of Canada Ltd. – INCO – Falconbridge, Sherritt Gordon Mines Ltd. of Canada and Faraday Uranium Mines Ltd. and Freeport Sulphur Co. of the United States are not geographically confined. In unravelling their engagements, we find their penetrations in Africa as well as in other parts of the world.

Inco’s direct link with the Oppenheimer mining interests in Africa has already been made apparent through the interlocking directorships of Sir Ronald L. Prain and Sir Otto Niemeyer. We will see further how, through its interests in certain mines, these are connected indirectly with combinations having definite ties with the exploitation of Africa’s mineral resources. It is when the financial interests behind them are examined that we find the continuity of power.

The name Mond immediately brings to mind nickel, as well as explosives, chemicals and arms, and we find it linked to the most powerful international nickel organisation under the form of International Nickel Co. (Mond) Ltd. It was under the founder of Brunner Mond & Co. Ltd., Ludwig Mond, who, having invented the ammonia soda process and found a cheap source of power from small coal, discovered a method of recovering nickel from low-grade ores. This led to the finding, acquisition and development of mines in Canada, the world’s present chief source, the ores coming almost totally from the Sudbury district of Ontario. Brunner Mond, together with Novel Industries, United Alkali Co. Ltd. (an amalgamation of forty-eight works) and British Dyestuffs Corporation Ltd., were knit together in December 1926 to form Imperial Chemical Industries Ltd.

Mond Nickel Co. Ltd. was established in 1914 to exploit the mine that adjoined Inco’s properties on the Sudbury range. The interests of both companies were fused in 1928. Change of name to its present form was made in February 1961, and the company is a subsidiary of Anglo Canadian Mining & Refining Co. Ltd., which owns the 9 million shares issued out of the 11 million authorised to compose the capital of £5 million. Anglo-Canadian is itself a wholly-owned subsidiary of Inco.

Among the extensive properties and plants owned by International Nickel Mond in the United Kingdom are a refining works in South Wales and a precious metals refinery in a London industrial area, a number of rolling mills in various parts of Britain, as well as the entire share capital of Henry Wiggin & Co. Ltd., manufacturers of nickel and nickel alloys and other products. Two interesting items in Nickel Mond’s treasury are the entire capital of Clydach Estates Ltd. and Mond Nickel (Retirement System) Trustees Ltd. This is the United Kingdom end of Inco, which has appointed its delegate board and consolidates the U.K. accounts with its own.

In order to keep its plants working to fullest capacity Inco has arrangements with associates for the treatment of their products. Hence certain nickel concentrates in excess of its own treatment facilities are worked for Sherritt Gordon Mines, and there is an agreement with Texas Gulf Sulphur Co., covering the operation of a pilot plant to investigate processes for the recovery of elemental sulphur. These agreements issue out of certain common holdings that give identity of interest to apparently competitive concerns, tied up with oil and its allied financial groups.

The controlling interests in Inco are not apparent as there is no obvious United States parent, although American capital from most of the leading financial groups predominates, and Inco owns the entire capital stock of The International Nickel Co. Inc. which owns the operating assets located in the United States, and of Whitehead Metal Products Co. Inc., American distributors of non-ferrous metals. Laurence Rockefeller is on the United States Inco board. The Canadian company’s chairman is H. S. Wingate, a director of the American banking house of J. P. Morgan & Co., and of the Canadian Pacific Railway. William C. Bolenius, an Inco director, also sits on directorates of various Bell Telephone companies, as well as on that of the Guaranty Trust Co. of New York, Morgan-controlled. Another Inco director, R. S. McLaughlin, is a director of General Motors and on the board of the Toronto-Dominion Bank, which links with du Pont interests. Du Pont itself is under heavy Morgan influence. Donald Hamilton McLaughlin is President of the American Trust Co., which has three interlocking directorates with Morgan banks and insurance companies. He also presides over the board of Homestake Mining Co., linked through its holdings in Idarado Mining Co., with Newmont Mining Co. within the Morgan sphere of influence. Cerro de Pasco, another of D. H. McLaughlin’s directorships, owns a number of companies operating mining and oil properties in Peru. Newmont Mining has a substantial interest in Cerro de Pasco.

Theodore Giles Montague, another American on Inco’s board, is chairman of the Borden Co., a trustee of the Bank of New York and a director of American Sugar Refining Co. All three of these companies is within the family control of the Rockefellers. John Fairfield Thompson also reflects U.S. interests on the Inco board. Another trustee of the Bank of New York, he represents the same interests on Inco’s American distributing organisation, Whitehead Metal Products Co., and points the link with Texas Gulf Sulphur, under Morgan and Standard Oil (Rockefeller) domination. J. F. Thompson reveals the African interests of these groups by his directorships on American Metal Climax, and its British associates, Amalgamated Metal Corporation and Henry Gardner & Co. Lt., who are also connected with French tin and nickel interests. These are some of the giant combinations involving tin, aluminium and nickel, which are draining away the mineral resources of Africa.