The movement which value as capital performs has up to now been grasped as:

| M - C | < | MP LP |

... P... C1 - M1 |

(For in Capital, Vol. I it was the process of production - within the frame of commodity circulation - that was analysed). The movement of capital clearly comprises three stages (SG 84). There is:

(1) Capital in the form of money that buys the elements of production ("money-capital").

(2) Capital in the form of the industrial labour process, that combines productively the elements of production ("Productive capital").

(3) Capital in the form of industrial products, which are sold as commodities whose value contains surplus-value ("commodity-capital").

"The first and third stages were discussed in Capital, Vol. I only insofar as this was necessary for an understanding of the second stage, the process of production of capital. For this reason, the various forms in which capital dresses itself in its different stages, and which it now puts on and now strips off in the repetition of its circuit (SG 82), have not been taken into consideration. These forms are now the next matter of the analysis" (SG 81) (CII 25).

If we make a distinction between different forms of circuit according to the point of departure and return, we get (SG 83):

I. the circuit of money-capital: M - C...P...C1 - M1

II. the circuit of productive capital: P...C1 - M1 .M - C...P

III. the circuit of commodity-capital: C1 - M1 .M - C...P...C1

('-' indicating mere change of the form of value, '...' indicating interruption of the process of circulation by the production process P (SG 84), "and C1 and M1 designating C and M increased by surplus-value" (CII 25), the dot between M and M1 indicating that the comparison of magnitudes of value (SG 85) between M and M1 as well as between C and C1 comes to an end here and starts anew: a part of M1 might have been extracted from the individual circuit of capital under our present consideration).

The three forms of circuit of capital are due simply to taking different starting points in considering the ongoing circulation of capital:

which is here presented under the assumption that capital as a whole passes from one stage of its circuit into the next one (SG 86). It is only in proceeding through the stages of money-capital/productive capital/ commodity capital that value can circulate as ground-form capital (SG 87). This entails a necessary "fixation" of capital in its "functional forms" of existence (money, labour process, commodity) (SG 88).

Each fixation of value imposes limits on its circulation as capital. To unfold this contradiction between circulation and fixation is the central topic of the analysis of the circulation of ground-form capital in Capital, Vol. II (SG 89). Circulating through the three stages of its circuit capital has to take on twice the form of "unproductive" capital (SG 90). This creates further limitations for the valorisation of capital, which is tied to productively active labour-power. But this only has existence in the stage of productive capital. The necessary transformations of form of value M - C and C1 - M1 which comprise the circulation period require time and labour-power to perform (SG 91). Whether the capitalist carries out these functions himself or employs workers to do it for him, the labour involved creates no value and requires an extra outlay by the capitalist. Similarly the means of circulation (SG 92) which enable the work of circulation to be performed are costs of circulation (SG 93). "Apart from the actual buying and selling labour-time is expended in book-keeping (SG 92), which besides absorbs materialised labour such as pens, ink, paper, desks, office paraphernalia [Computers]" (CII 136) and these costs of book-keeping are another cost of circulation.

Under our present assumption or presentation (SG 86) the process of surplus-value production is interrupted by the process of circulation. Capital can only continually valorize if it exists side by side and simultaneously outside and inside the sphere of production. So capital does not circulate in one circuit, in which it "passes on in bulk from one stage to the next" (CII 50), but rather in several circuits of parts of that individual capital (SG 94). This division of capital is dependent on the ratio:

(The "time of production" is the time of fixation of any particular part of capital in the production sphere, the "time of circulation" is its time of fixation in the sphere of circulation (SG 95) ).

Marx works explicitly with the assumption of presentation that the three stages of circulation take equal time, so that:

|

time of production |

= |

1 |

In this case "The actual circuit of industrial capital [ground-form] in its continuity is therefore not alone the unity of the processes of circulation and production but also the unity of all its three circuits. But it can be such a unity only if all the different parts of capital can go through the successive stages of the circuit, can pass from one phase, from one functional form to another, so that the industrial capital, being the whole of all these parts, exists simultaneously in its various phases and functions and thus describes all three circuits at the same time." (CII 106). This is depicted in the following schema.

The sum total of the individual capital circulates in three parts and accordingly three circuits. In no one circuit can the productive stage of capital be permanent. Thus none of the three parts is permanently functioning as productive capital. But by the shift of phases one third of the total capital is permanently in the phase of productive capital.

When circulation time is not an integral multiple of production time then the division of capital cannot be done so that the different circuits are in phase. In this case there is a break in the circuit of each part during which money capital is released (SG 96). We illustrate this in the case where production time exceeds circulation time and where elements of production must be bought before the beginning of the production period.

If production time exceeds circulation time the capital need only be divided into two parts so that the circulation phase of the parts of capital facilitate continual valorisation:

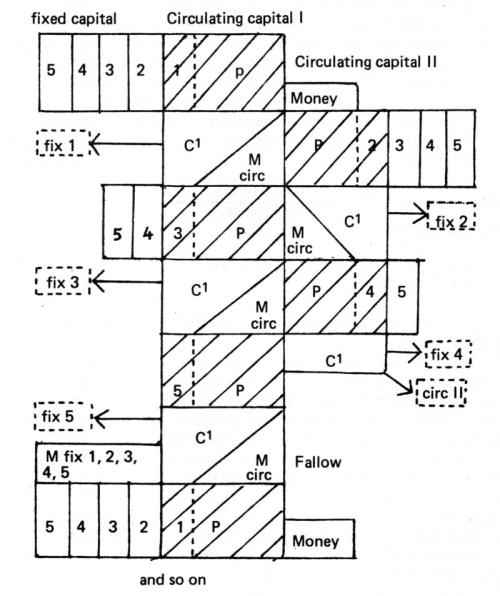

Beside the division of capital into parts that coexist in different stages of the circuit of capital, we find a division of capital according to the manner of circulation. We call what is repeatedly done in circulation "turnover", its duration "turnover time" (SG 97). That part of capital which turns over as a whole at the end of each "period of production" is called "circulating capital". That part of capital which turns over only partly with each turnover of the circulating capital and remains partly in fixation in the sphere of production is called "fixed capital" (SG 98). This distinction does not match with the distinction between variable and constant capital. The raw and auxiliary materials are "circulating constant" capital (SG 100). Variable capital and circulating constant capital together form the circulating capital as opposed to the remainder of the constant capital, mainly machinery. But note: "The elements of circulating capital are as permanently fixed in the process of production - if it is to be uninterrupted - as the elements of fixed capital. But the elements of circulating capital thus fixed are continually renewed in kind (the means of production by new products of the same kind, labour-power by constantly renewed purchases) while in the case of the elements of fixed capital neither they themselves are renewed nor need their purchases be renewed so long as they continue to exist (SG 99). There are always raw and auxiliary materials in the process of production, but always new products of the same kind, after the old elements have been consumed in the creation of the finished product. Labour-power likewise always exists in the process of production, but only by means of ever new purchases, frequently involving changes of persons. But the same identical buildings, machines, etc. continue to function, during repeated turnovers of the circulating capital, in the same repeated processes of production" (CII 172). (See Schema 3 )

| Assumptions of presentation: turnover-time of fixed capital = 5 production periods and |

time of production |

= |

1 |

There exists one fixed capital, which is circulated

one time with circulating Capital I, the subsequent time with

circulating Capital II. There is only a peculiarity in the 5th

period of production. Here the last part of the fixed capital

functions in the productive sphere and its value only circulates

back after the next circulation period (SG 101). That is why the

circulating Capital II has here a fallow, there is a gap in the

continual process of production, which could only be bridged by an

additional fixed capital that has one fifth of the magnitude of the

fixed capital applied. But this additional capital or the last

fifth of the original capital would then have a fallow of five

production periods. (In ![]() we place "latent

money-capital", capital that is fallow).

we place "latent

money-capital", capital that is fallow).

Given the division of the working day of the productive labourer into necessary labour-time and surplus labour-time, the production of surplus-value is dependent on the number of labourers employed. But this number is (with a given price of labour-power) not only dependent on the magnitude of the variable part of capital but also on how often the variable capital turns over. Turning over several times per year this capital buys (labour-power) several times. And consequently the number of labourers employed is as big as in the case of a variable capital that is n-times as big but turns over only once a year instead of n-times. With regard to the production of surplus-value per year it is not the magnitude of the variable capital advanced but the magnitude of the variable capital turned over annually that is decisive (SG 102).

It marks a significant step towards the presentation of average profit in Capital, Vol. III, when Marx distinguishes in Capital, Vol. II, chap. 16 the "annual rate of surplus value"

| = |

quantity of surplus-value produced during a

year |

from what he now calls the "real rate of surplus value"

| = |

surplus-value produced |

(SG 103). |

Valorisation ("Selbstverwertung") is the characteristic feature of capital as value that mediates by its own movement, its expansion ("self-expanding value"). Capital is not a thing, it is in some sense neither money nor factory nor commodity but it is the process of valorisation by metamorphosis through the functional forms of money-capital, productive capital, commodity capital as analysed in Capital, Vol. II, Part I. Hence circulation of capital is the only way in which valorisation can take place (SG 104). We can distinguish between three levels of the presentation of capital circulation so far.

1) Capital circulates "in bulk" through its three stages. Its stay in the sphere of circulation mediates its subsequent passing through the productive phase of the capital-circuit, but circulation-time in itself is unproductive time. It is a temporal interruption of valorisation.

(One circuit for capital as a whole cf. CII 50, 63)

2) Division of capital in such a manner that an interruption of the productive stage of capital by circulation-time no longer occurs. But as circulation is a necessary condition for valorisation this division of capital is in fact a reduction of the magnitude of capital. Looked at in this abstract way nothing is gained yet. The temporal limitation has been changed into a limitation of the quantity ( permanently) functioning as productive capital (SG 105).

(Briefly, there is more than one circuit, but all parts of capital circulate in the same manner).

3) Further division of capital according to the difference in the manner of turnover. The division of capital dealt with under 2) appears now as a division of circulating capital, to which capital as a whole was reduced. But in fact there circulates the capital fixed in the factory's machinery not "in bulk" but in several turnovers of the circulating capital, i.e. with every part (of the division of circulating capital), that leaves the productive stage of capital to enter the sphere of circulation - until fixed capital is turned over as a whole, is replaced and turns over in this distinct manner anew. The application of capital fixed in machinery is crucial for the production of relative surplus-value and it helps to increase the rate of turnover of the part of capital that functions as circulating capital by reducing the period of production (SG 106). But at the same time fixed capital is a limitation of valorisation in that it slows down the aggregate turnover of capital and hinders a greater part of the money advanced circulating as variable capital (SG 107).

Capital, Vol. II consists of three parts. In the first part three forms of circuit are distinguished according to the three forms of existence of capital that function as stage of departure and return.

The first part gives its presentation starting from the circuit of money-capital. Its three stages are distinguished from each other and that gives rise to distinguishing the three forms of circuit of capital. Circulation time (time for the purchase of the elements of production), production time and circulation time (time for selling the produced commodities) are dealt with and at the end of Part I. Marx analyses the costs of circulation which diminish the surplus of M1 over M in M-C...P...C1 - M1.

The second part's presentation of the circulation of capital is given in the framework of the circuit of productive capital. The specific manner in which the value of the MP is transferred to the product, hence the difference of the turnover of fixed capital to the turnover of circulating capital is the first central topic. The permanent existence of fixed capital is a permanent existence of productive capital which can only be made productive of surplus-value if circulating capital has also a permanent existence in the sphere of production. To take this into account the previous assumption of presentation, that capital proceeds in bulk from one stage to the other is modified. This has been illustrated in Schema 1, which has been subsequently modified to show the difference in turnover between circulating and fixed capital in Schema 3. The second central topic of this part is the influence of the turnover of the variable part of capital on the annual production of surplus-value. Again, this is something which can be best presented within the framework of the circuit of productive capital, that is with surplus-value production as its point of departure and return.

The third part of Capital, Vol. II gives a presentation of the circuit of capital within the framework of the circuit of commodity-capital, but commodity-capital taken as the expression of the social sum total of capital (SG 108). There are several reasons for the circuit of commodity-capital being the appropriate one for the study of the reproduction of the aggregate social capital:

1) The reproduction of the aggregate social capital requires an intertwining of the circuits of individual capitals and, since the circuit of commodity-capital has the circulation period of capital as its first part, the study of the intertwinings is facilitated;

2) the circuit of commodity-capital comprises not only the intertwining of circuits of individual capitals but the general circulation of commodities by which the individual consumption of the labourers and capitalists is achieved;

3) the circuit of commodity-capital includes the circulation of surplus-value embodied in C1 and hence is appropriate for considering extended reproduction.

On CII 399 Marx distinguishes "two Departments of Social Production" (SG 110) and thus considers a further Division of Capital: "The total product, and therefore the total production of society may be divided into two major departments:

I Means of Production, commodities having a form in which they must, or at least may, pass into productive consumption.

II Means of Consumption, commodities having a form in which they pass into the individual consumption of the capitalist and the working-class."

In considering the movement of the aggregate social capital within the framework of the circuit of commodity-capital "we cannot rest content any longer as we did in the analysis of the value of the product of the individual capital, with the assumption that the individual capitalist can first convert the component parts of his capital into money by the sale of his commodities, and then reconvert them into productive capitals by renewed purchase of the elements of production in the commodity-market (SG 109).

The question that confronts us directly is this: How is the capital consumed in production replaced in value out of the annual product and how does the movement of this replacement intertwine with the consumption of the surplus-value by the capitalists and of the wages by the labourers? It is then first a matter of reproduction on a simple scale." (CII 397). Presenting the circuit of capital as simple reproduction (SG 111) we assume (contrafactually but for the sake of simplification) that all surplus-value is individually consumed by the capitalist in the natural form of products of department II.

"It is furthermore assumed that products are exchanged at their values and also that there is no revolution in the values of the component parts of productive capital. The fact that prices diverge from values cannot, however, exert any influence on the movements of the social capital. On the whole, there is the same exchange of the same quantities of products, although the individual capitalists are involved in value-relations no longer proportional to their respective advances and to the quantities of surplus-value produced singly by every one of them. As for revolutions in value, they do not alter anything in the relations between the value-components of the total annual product, provided they are universally and evenly distributed. To the extent, however, that they are partially and unevenly distributed, they represent disturbances which, in the first place, can be understood as such only as far as they are regarded as divergences from unchanged value-relations, but in the second place, once there is proof of the law according to which one portion of the value of the annual product replaces constant, and another portion variable capital, a revolution either in the value of the constant or that of the variable capital would not alter anything in this law. It would change merely the relative magnitudes of the portions of value which function in the one or the other capacity, because other values would have taken the places of the original ones." (CII 397f).

It is a consequence of the natural form of the product in department I (means of production) and in department II (means of consumption) that the constant capital of department II (for short: CII) must be replaced by product of department I and that the wages (for short: VI) and the surplus-value (for short: SI) that are at the disposal of the labourers and the capitalists of department I for individual consumption can only be spent in buying products of department II. Hence the exchange between the departments (SG 112):

CII = VI + SI (Simple reproduction) cf. CII 399, 507

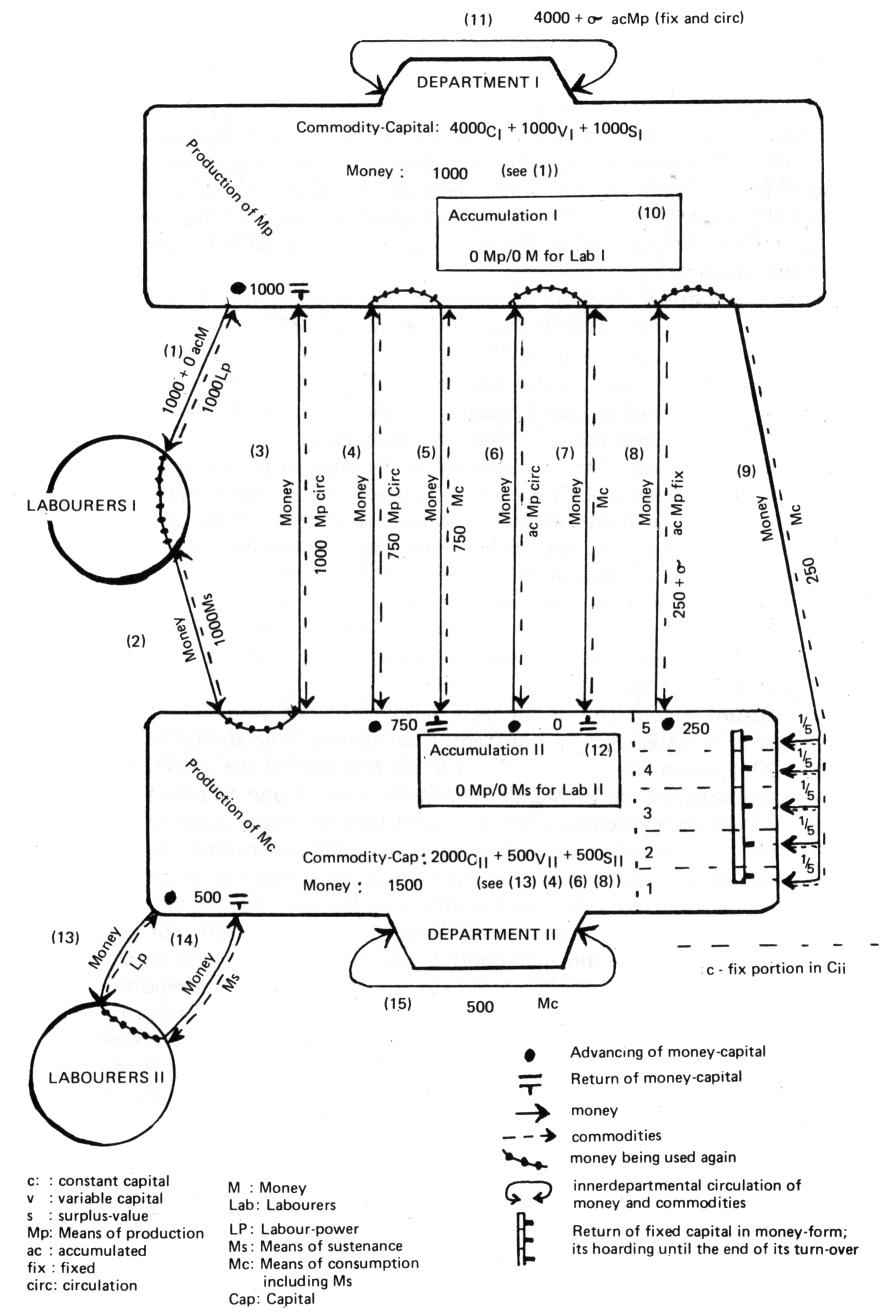

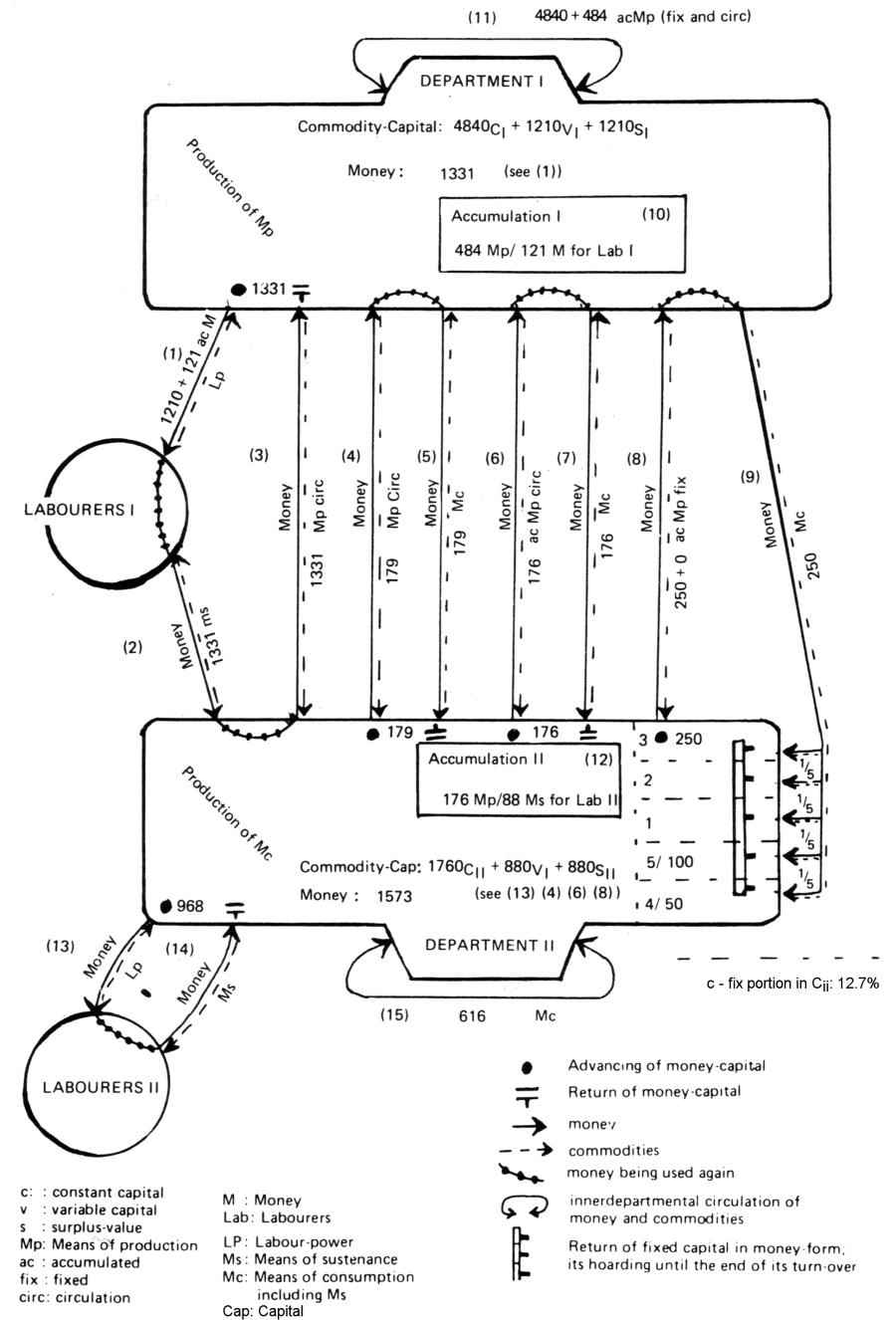

Marx did not in Capital, Vol. II, use any drawings, but dealt with figures "to facilitate the understanding" (CII 402) of his analysis of the exchange-relations between the two departments of social production. We try to illustrate the interconnections, using Marx's figures from CII 407f (and 514ff) in the following schema for simple reproduction.

Schema of Reproduction: Simple Reproduction cf. CII 401f |

|

The reproduction schema has fifteen numbered items of which four are only of concern when considering extended reproduction.

No.1 Payment of wages for the families of labourers in department I/ selling of labour-power to be used by the capitalists for one year.

No.2 The families of labourers in department I buy means of life from department II with the money received in wages (No.1) (SG 114).

No.3 Department II buys elements of circulating constant capital from department I with the variable capital (No.1) of department I, spent on means of life (No.2).

No.4 Department II buys the rest of the circulating constant capital, that has been productively consumed during the year from department I.

No.5 The capitalists of department I buy an equal value (as expended in No.4) in means of private consumption from department I.

No.6* Department II buys additional circulating constant capital from department I.

No.7* The capitalists of department I buy an equal value (as expended in No.6) of means for their individual consumption from department II in return.

No.8 Department II buys those elements of fixed capital, that were used up during the year, from department I (SG 115).

No.9 The capitalists of department I buy at equal value (as expended in No.8) of means for their individual consumption from department II in return.

No.10* Accumulation funds of department I.

No.11 Replacement of the productively consumed constant capital of department I out of the product of department I.

No.12* Accumulation funds of department II.

No.13 Payment of wages for the families of labourers in department II/ selling of labour-power to be used by the capitalists for one year.

No.14 The families of labourers in department II buy means of life with the money received in wages (No.13) from department II.

No.15 Innerdepartmental circulation of means of individual consumption for the capitalists of department II equal in value to the surplus-value produced in department II.

(* Only in expanded reproduction)

In the schema of Simple Reproduction we already find the following characteristics of the capitalist form of material reproduction: the capitalist class must "throw into circulation the money required for the realisation of its surplus-value (correspondingly also for the circulation of its capital, constant and variable) . . . For there are here only two classes: the working class disposing only of its labour-power, and the capitalist class, which has a monopoly of the social means of production and money. . . . But the individual capital makes this advance only by acting as a buyer, expending money in the purchase of articles of consumption or advancing money in the purchase of elements of its productive capital, whether of labour-power or means of production. It never parts with money unless it gets an equivalent for it. It advances money to the circulation only in the same way as it advances commodities to it. It acts in both instances as the initial point of the circulation (SG 113).

The actual process is obscured by two circumstances:

1) The appearance in the process of circulation of industrial capital, of merchants's capital (the first form of which is always money, since the merchant as such does not create any "product" or "commodity" and of money-capital as an object of manipulation by a special kind of capitalist.

2) The division of surplus-value - which must always be first in the hands of the industrial capitalist - into various categories, as vehicles of which there appear, aside from the industrial capitalist, the landlord (for ground-rent), the usurer (for interest) etc., furthermore the government and its employees, rentiers, etc. These fellows appear as buyers vis-a-vis the industrial capitalist and to that extent as converters of his commodities into money: they too throw "money" pro parte into the circulation and the industrial capitalist gets it from them. But it is always forgotten from what source they derived it originally, and continue deriving it ever anew." (CII 425 modified).

The last bit was a deviation, quoted in order to make clear the systematic level of Marx's reproduction-schema, which show:

1) The Subject of the process of material production is capital. The metabolism of products of human labour functions as bearer of the valorisation of value.

2) In each mediation of the social interconnection by the "social things" commodities and money there exists the possibility of economic crisis.

3) Within the system of capitalist reproduction of the society the existence of the exploited wage labourers depends on successful circulation of capital that exploits them. The productive wage labourers produce everything that circulates as capital. But the circulation of capital is decisive for their reproduction.

Let us now consider the case of extended reproduction (SG 116). The exchange between the departments amounts here to (SG 117):

CII + acCII = VI +acVI + (I - r)SI

where 'ac' stands for: accumulated and 'r' for the rate of accumulation (which is necessarily smaller than I because it indicates the part of surplus-value that is not consumed individually by the capitalists).

Marx remarks casually: "we had assumed in the analysis of simple reproduction that the entire surplus-value of department I and department II is spent as revenue. As a matter of fact however one portion of the surplus-value is spent as revenue, and the other is converted into capital. Actual accumulation can take place only on this assumption." (CII 507).

And in the presentation of simple reproduction, in the section "The Formulation of the Question" we read: "However, as far as accumulation does take place, simple reproduction is always a part of it ... is an actual factor of accumulation." (CII 399).

As this feature can be analysed independently from the accumulation of surplus-value it is systematically prior and "can therefore be studied by itself" (CII 399) which on the other hand is the first part of the analysis of extended reproduction, or in Marx's words: analysis of one factor of accumulation. We can now concentrate (cf. CII 514ff) on the analysis of the second factor: accumulation of surplus-value as additional capital. But in doing so, we use the results of the analysis of the first factor as a starting point. Marx once again stresses the difference between dealing with an individual capital (cf. CII 99) and considering the aggregate capital of the capitalist class: "It has been shown in Capital, Vol. I how accumulation works in the case of the individual capitalist. By the conversion of the commodity-capital into money the surplus-product, in which the surplus-value is represented, is also turned into money. The capitalist reconverts the so metamorphosed surplus-value into additional natural elements of his productive capital. In the next cycle of production the increased capital furnishes an increased product. But what happens in the case of the individual capital must also show in the annual reproduction as a whole, just as we have seen it happen on analysing simple reproduction." (CII 493).

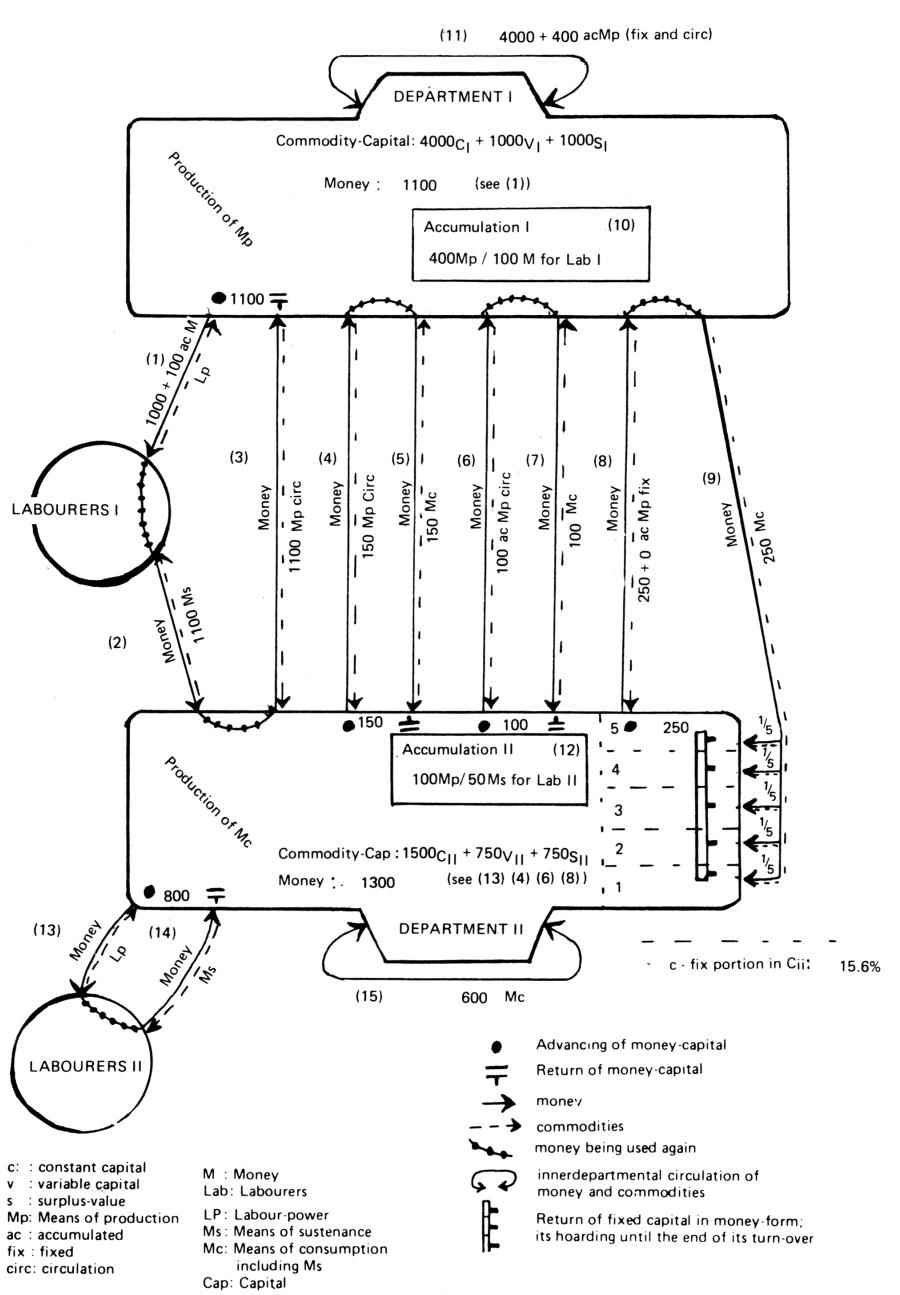

We use the same Schema to illustrate what Marx does using just the figures of CII 514ff. The first assumption of presentation regards the rate of accumulation in department I:

r=½

The second asssumption of presentation regards the organic composition of the accumulated capital in both departments:

| = |

ac CI |

= |

CI |

and

| = |

ac CII |

= |

CII |

We strongly recommend a reading of Capital, Vol. II, pp.514-517 whilst working through the following drawings of six years of extended reproduction. Marx chose an example in which there is a different organic composition in department I ((CI/VI)=(4/1)) and in department II ((CII/VII)=(2/1)). His "Initial Scheme for Reproduction on an Extended Scale" reads:

| Department I: | 4000CI + l000VI + 1000SI |

| Department II: | 1500CII + 750VII + 750SII |

Hence there is a third assumption of presentation regarding the rate of surplus-value:

|

SI |

= |

SII |

= 100% |

Schema of Reproduction: Extended Reproduction, 1st year, cf. CII 514f |

|

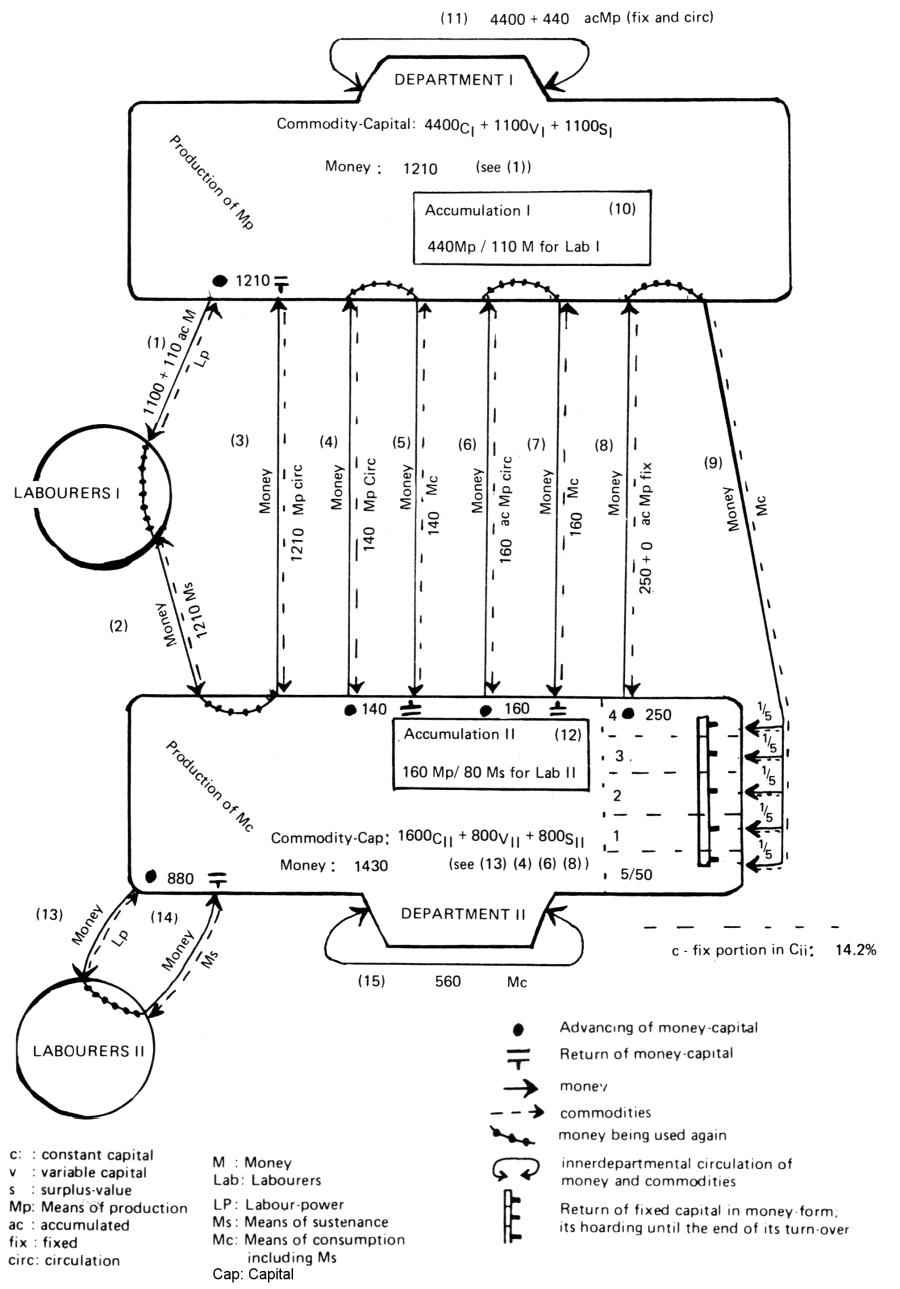

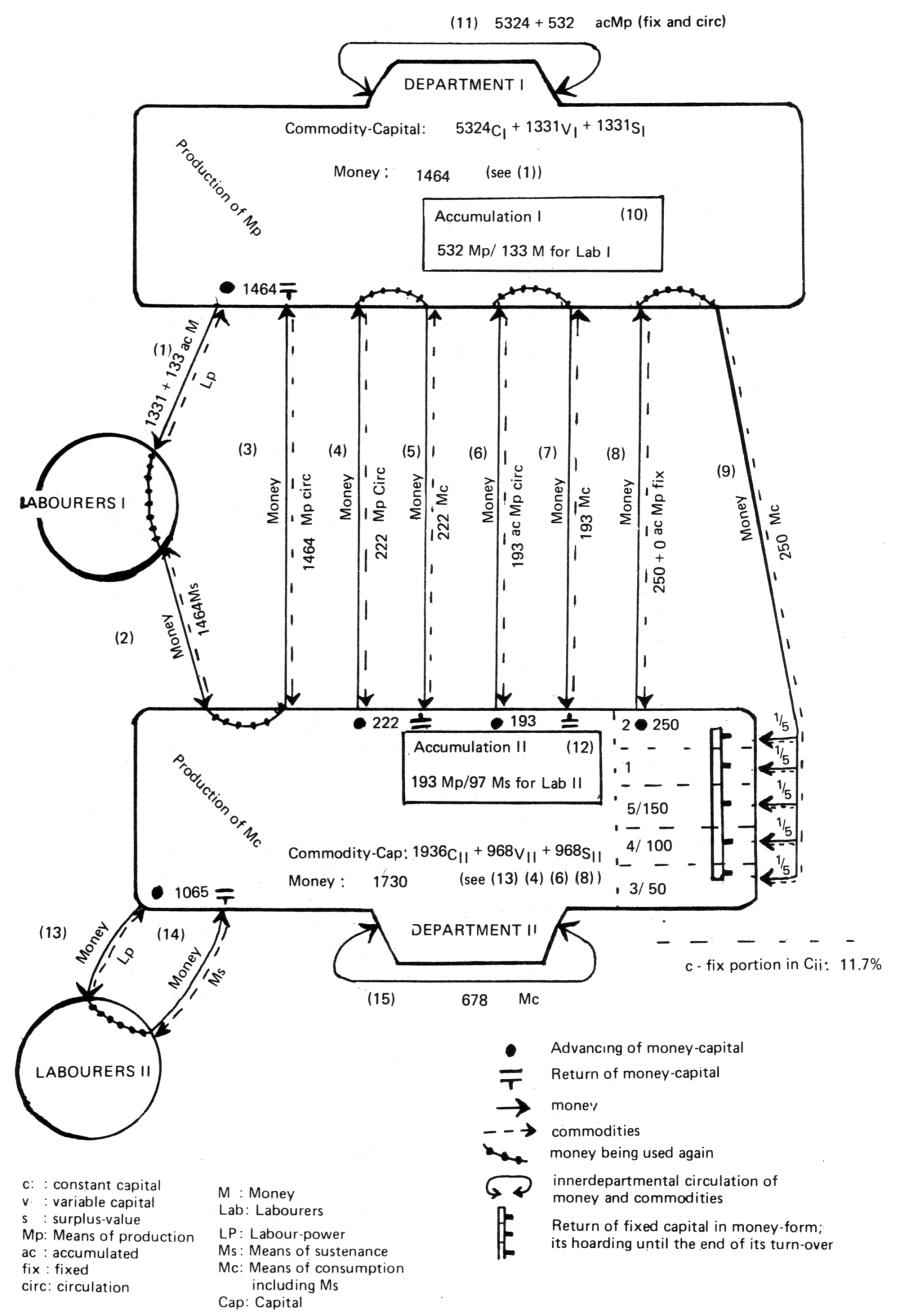

Schema of Reproduction: Extended Reproduction, 2nd year, cf. CII 515f |

|

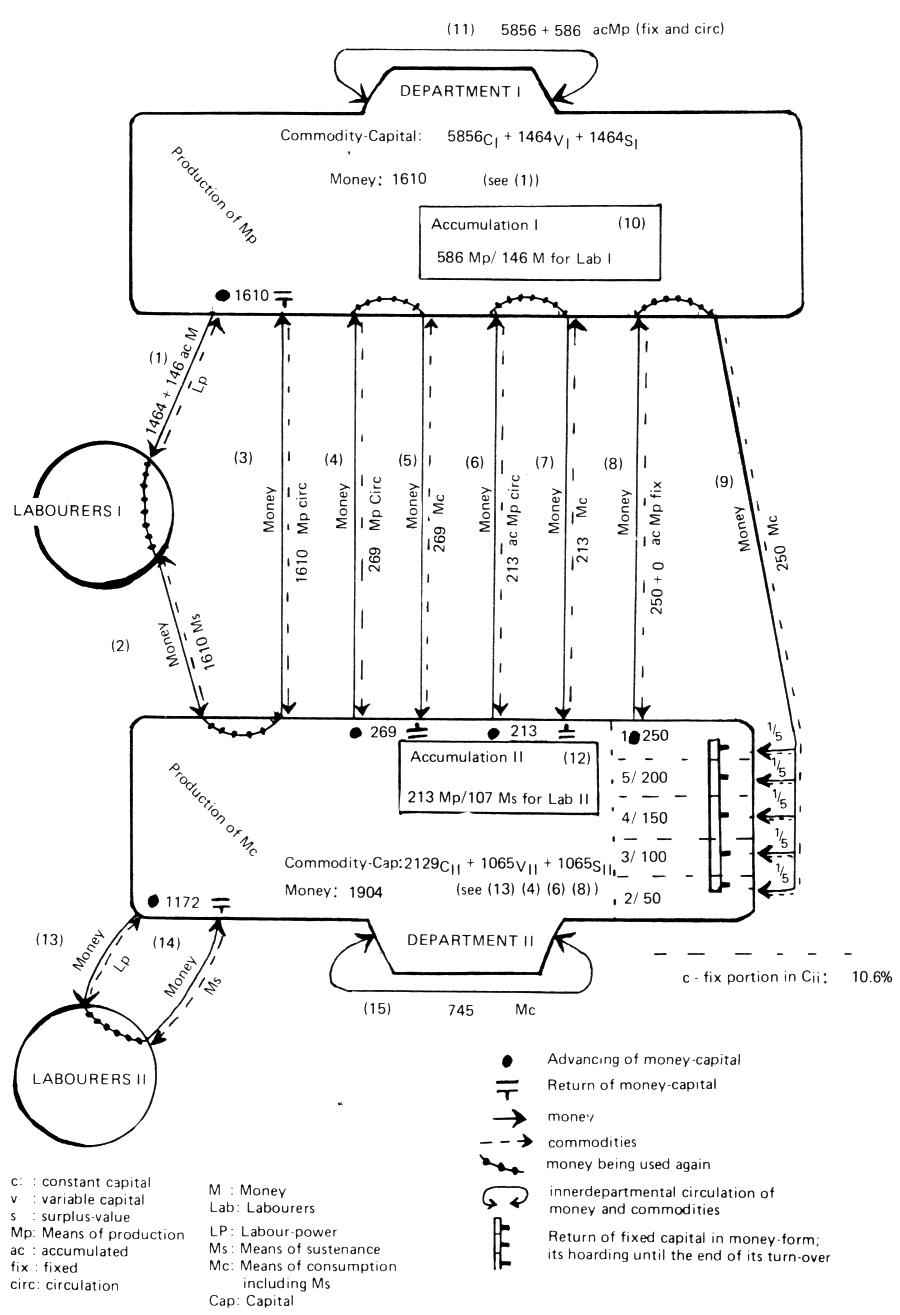

Schema of Reproduction: Extended Reproduction, 3rd year, cf. CII 516f |

|

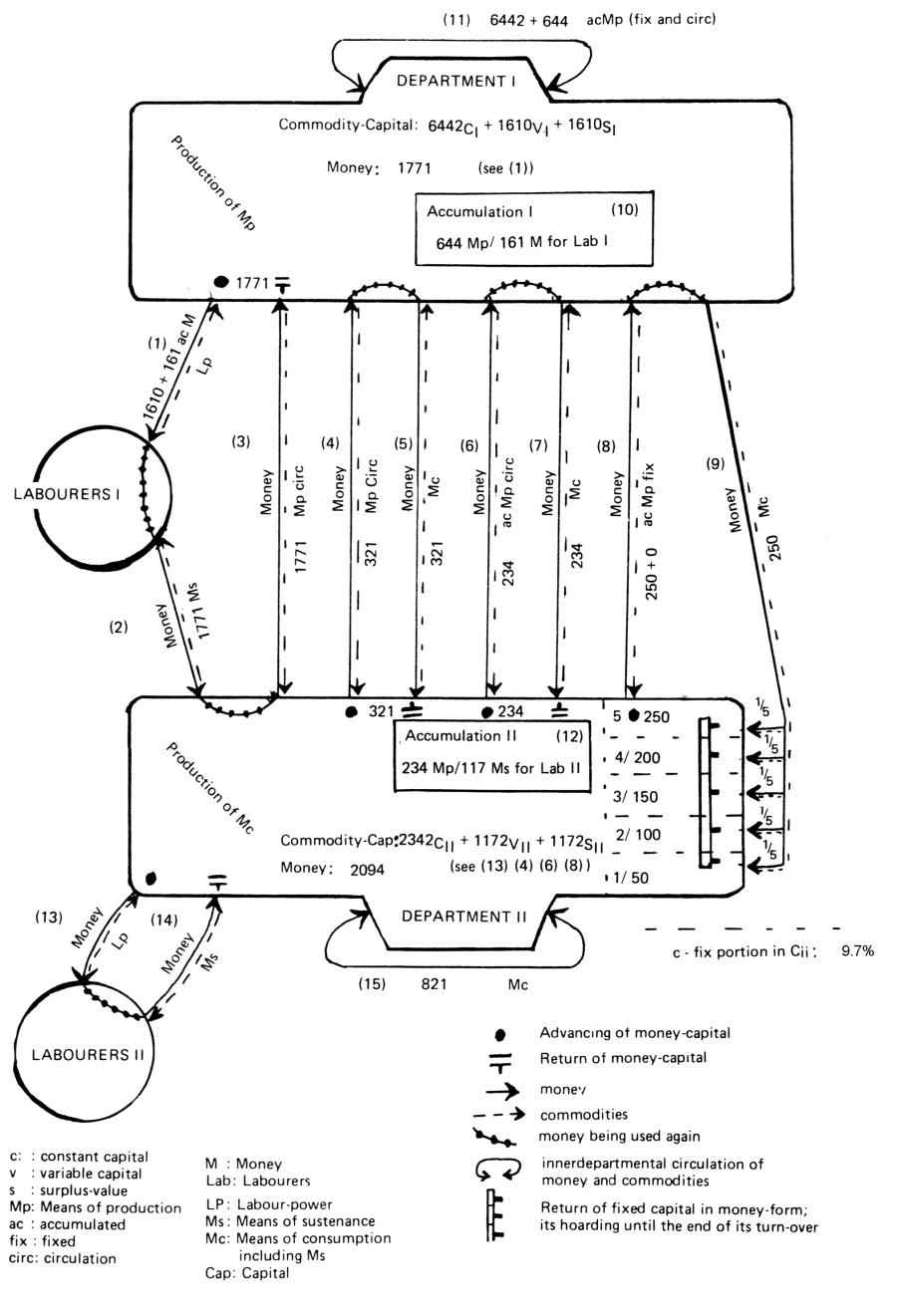

Schema of Reproduction: Extended Reproduction, 4th year |

|

Schema of Reproduction: Extended Reproduction, 5th year, cf. CII 517 |

|

Schema of Reproduction: Extended Reproduction, 6th year, cf. CII 517 |

|

A few remarks on the specific manner of the circulation of fixed capital are necessary.

We only separated the circuit of fixed capital for department II. In principle the fixed capital of department I turns over likewise. Its abbreviation in the unarticulated innerdepartmental circulation act II has been chosen for the sake of simplicity. A further - and counterfactual - simplication is the assumption of simple reproduction of the fixed part of capital, whereas the other parts are reproduced on an extended scale.

The characteristic and distinct feature of the circulation of fixed capital is the existence of latent money-capital during several turnover periods of the rest of capital. Value is here fixed in "dead labour", partly in machinery, partly in money, without circulating.

The reproduction schemata give the necessary circulations of commodities and money between various sections of capital and the working-class if social capital is to be reproduced.

Capitalist reproduction is social reproduction in an indirect form (SG 118) i.e. without a conscious social subject, but mediated by the relations of "social things" (cf. CI 79) to each other. This is expressed by Marx with reference to his reproduction schemata:

"The constant supply of labour-power on the part of labourers I, the reconversion of a portion of commodity-capital I into the money-form of variable capital, the replacement of a portion of commodity-capital II by elements of constant capital II in their natural form - all these necessary conditions demand one another, but they are brought about by a very complicated process" - without a conscious subject of action ("Subjekt der Handlung") - "including three processes of circulation which occur independently of one another but intermingle. So complicated as this process is, so many occasions for crisis it offers." (CII 499f.).

Capital continually reproduces itself by simultaneously forcing the worker not only to work under conditions of exploitation but to reproduce these conditions of servitude to capital:

"But that which at first was but a starting-point, becomes, by the mere continuity of the process, by simple reproduction, the peculiar result, constantly renewed and perpetuated, of capitalist production. On the one hand, the process of production incessantly converts material wealth into capital, into means of creating more wealth and means of enjoyment for the capitalist. On the other hand, the labourer, on quitting the process, is what he was on entering it, a source of wealth, but devoid of all means of making that wealth his own. Since, before entering on the process, his own labour has already been alienated from himself by the sale of his labour-power, has been appropriated by the capitalist and incorporated with capital, it must, during the process, be realised in a product that does not belong to him. Since the process of production is also the process by which the capitalist consumes labour-power, the product of the labourer is incessantly converted, not only into commodities, but into capital, into value that sucks up the value-creating power, into means of subsistence that buy the person of the labourer into means of production that command the producers. The labourer therefore constantly produces material, objective wealth, but in the form of capital, of an alien power that dominates and exploits him; and the capitalist constantly produces labour-power, but in the form of a subjective source of wealth, separated from the objects in and by which it can alone be realised; in short he produces the labourer, but as a wage-labourer." (CI 535f.).

Starting from the "General Formula For Capital" which served as a presentational frame for the analysis of the immediate process of capitalist production in Vol. I, chapter 1, Vol. II "The Circuit of Money-Capital" outlines both a structure for the systematic kernel of Part 1, Vol. II (chapters 1-3) and for the entire volume's division into three parts - according to the three stages of the circuit and three forms of the circuit. The three stages are dealt with in chapter 1, the three forms of circuit in chapters 1, 2 and 3. And the presentational frame for Parts 1, 2, 3 are the circuit of money-capital (Part 1), the circuit of productive capital (Part 2) and the circuit of commodity-capital (Part 3).

We think that a systematic reading of part 1 should concentrate on chapters 1-3. The central assumption of presentation is stated on CII 50 (and relaxed on CII 104f).

Chapter 4 is an anticipation of a transition to a different, more developed level of presentation in chapter 15, dealing with the "division of capital" (CII 106) in terms of "additional circulating capital" (CII 263, 269).

On CII 104-107 the assumption of presentation constitutive for the analysis in chapter 1-3 is relaxed. The argument for the division of capital based on the desire and necessity of giving surplus-value production a continuous existence is complemented by pointing to the fact that productive capital has a continual existence anyway - in the form of fixed capital. But this clearly is jumping into Part 2, precisely, chapter 15 (cf.CII 262ff).

Chapter 5 "The Time of Circulation" for its greatest part can be amalgamated with chapter 14 (which carries the same heading). We take it as an objection against the place of chapter 5, that the circuit of money-capital does not contain the "time of circulation" as a coherent period whereas the circuit of productive capital does and there is no reason for dealing with the same matter twice. The distinction between "time of production", "time of functioning" and "labour-time" (cf. CII 124-127) and its relevance for surplus-value production is focused upon in chapters 12 "The Working Period" and 13 "The Time of Production".

The material dealt with in chapter 6 "The Costs of Circulation" would then best fit in between chapter 14 and 15, maybe as a second part of chapter 14, which could be expressed by changing its heading into "The Time and Costs of Circulation". Both the costs of circulation and the fixation of capital during the turnover period (circulation time and production time) limit capital's valorisation. The application of fixed capital - treating transport here as a sphere of production, (cf. CII 155) - brings down that limitation (at the price of creating a new one). Another way in which the costs of circulation as a limitation of valorisation (of industrial capital (SG 125) ) are fought against will be dealt with in the analysis of commercial capital (SG 125) in Vol. III.

Chapter 7 is a short systematic introduction to Part 2, necessary for the subsequent analysis of fixed and circulating (SG 98) capital in chapter 8 which is one of the central chapters of Capital, Vol II.

Chapter 9 is a redetermination of the concept of turnover, modified by the distinction between fixed and circulating capital

Chapters 10 and 11 belong to the Theories of Surplus-Value, (cf. CII 2).

Chapters 12-14 give detailed distinctions of different sub-parts of the turnover period before the "Effect of Time of Turnover on Advanced Capital" is dealt with in chapter 15, another central chapter of Capital, Vol. II (Chapter 15 focuses on circulating capital, (cf. CII 298) ).

Chapter 16 finally draws attention to a simplification of the presentation of surplus-value production in Vol. I, where the distinction between capital advanced and capital functioning (SG 102) is not yet made. The consequence is that it is only now that the rate of surplus-value as a rate of exploitation ("real rate of surplus-value" CII 308) and as a rate of valorisation ("annual rate of surplus-value" CII 306ff) are distinguished from each other. The matter under consideration could very well be labelled "influence of the time of turnover on valorisation" (CII 261), as long as it is kept in mind that it is a false semblance that, with regard to surplus-value production, "added here to labour-time is a second determining element - time of circulation" (CIII 327).

"This (circulation time in the sense of: turnover time) functions, in fact, only as a negative limitation of value and surplus-value production but it carries the semblance of being an equally positive source (of surplus-value production) as labour itself and of bringing in a determination (of surplus-value production) independent of labour, springing from the nature of capital." (CIII 827f).

Chapter 17, "The Circulation of Surplus-Value" can best be understood as a transition to Part 3. Leaving aside the passages on credit and shares etc., which are systematically out of place, i.e. an anticipation of topics dealt with in Vol. III; and leaving aside the production of the money-commodity, the systematically interesting parts in chapter 17 take into consideration differences in turnover, which pose the problem of reproduction in a different manner for different individual capitals. In Part 3, which deals with the reproduction of the social aggregate capital, this difference in turnovers is ignored in the "reproduction schemata".

Chapter 18 "Introduction" is very short and worth reading.

Chapter 19 "Former Presentations of the Subject" clearly belongs to the Theories of Surplus-Value (cf. CIII 2). So do sections 9 and 13 of chapter 20. The remainder of chapters 20 "Simple Reproduction" and 21 "Accumulation and Reproduction on an Extended Scale" is bulky enough. As we believe it is here that the analysis of reproduction/accumulation has its systematic place, we remind the readers to take Part 7 of Volume I into consideration as well, when discussing this topic.

The systematic difficulty lies in Marx's treatment of gold production as the source of the money-commodity. We suggest that the reader skip these passages because the mediation of commodity-circulation by money is presented under restrictive assumptions. (The changing into the money-form is essential for the circulation of the product of capital. But mere "shortage of the money-commodity" is not an obstacle that can't be overcome.)

Although the systematic place of a Marxist theory of money is very much disputed, we take the view that money can't be properly analysed until credit, interest, banks, national banks are dealt with (cf. Capital, Vol. III, Part 5).