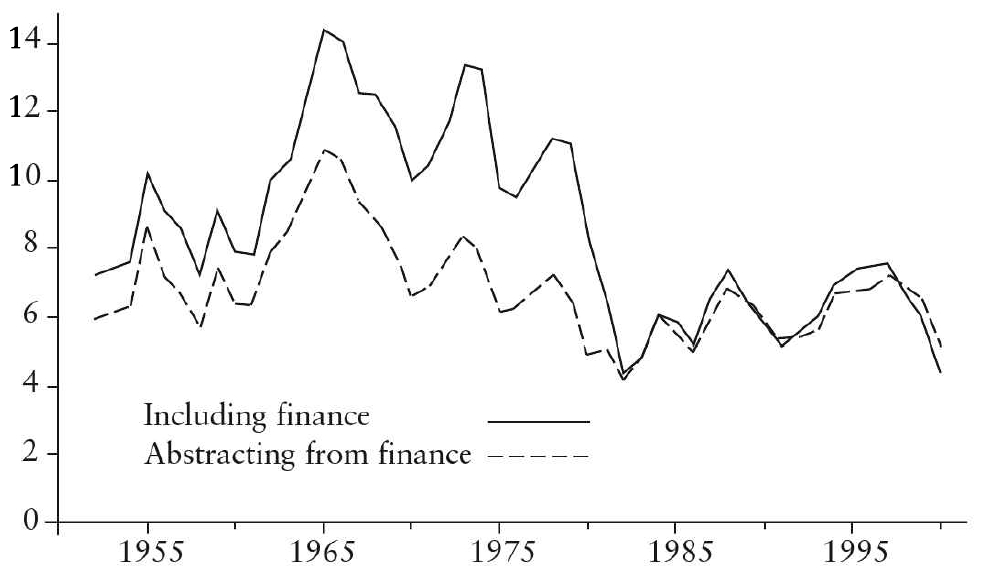

Figure 1: US profit rates accounting for (——) and abstracting from (– –)

the impact of financial relations [21]

MIA > Archive > Harman > Zombie Capitalism

“The National Bureau of Economic Research has worked itself out of one of its first jobs, namely business cycles.” So proclaimed Paul Samuelson in 1970. Less than three years later the crisis which was supposed now to be impossible broke upon the world – or at least upon the advanced capitalist countries and a big part of the Third World. The “golden age” had come to a sudden end.

The reaction of governments everywhere was to try to keep it going by resorting to the Keynesian methods they had come to believe infallible. Government budget deficits, rare in the previous three decades, now became the norm. They failed to restore the system to its previous health. Not only was there the first lapse into negative growth – a real recession as opposed to the “growth recessions” sometimes known previously – with soaring levels of unemployment, but it was accompanied by rising levels of inflation, which in a country like Britain could approach 25 percent.

There were attempts to explain what happened as a result of the impact of the sudden very big increase in the price of oil in October 1973 due to the brief “Yom Kippur” war between Israel and the Arab states and the accompanying embargo on oil exports by Saudi Arabia. But the effect of the price increase was only to reduce the national incomes of the advanced countries by about one percent – and most of the money that accrued to the oil producers ended up being recycled back to the advanced countries via the international banking system. It was hardly enough in itself to explain the scale of the impact on most of the world system – an impact which Keynesian methods should have been sufficient to deal with according to the then conventional economic wisdom. What is more, the oil price increase did not take place in isolation from other developments. Already three years earlier a “growth recession” had hit all the major economies simultaneously in a way which had not happened in the previous quarter century, and had been followed by a very sharp economic upturn and accelerating inflation even before the oil price rise. [1] In short, the recession that began at the end of 1973 was the culmination of precisely the sort of economic cycle that Keynesian-style state interventions had supposedly consigned to the history books.

Mainstream Keynesians were at a loss. They found that their theory no longer did any of the things they had claimed for it. As one Keynesian, Francis Cripps of the Cambridge Economic Policy Review, later put it, they suddenly realised that:

Nobody really understands how the modern economy works. Nobody really knows why we had so much growth in the postwar world ... how the various mechanisms slotted together. [2]

Many Keynesians dropped their former ideas overnight and endorsed the “monetarist” theories propagated by Milton Friedman and the Chicago School of economists. These held that the attempts by governments to control economic behaviour had been misconceived. There was, they argued, a “natural non-inflationary rate” of unemployment, and attempts to reduce it by government spending were bound to fail and to merely cause inflation. All states should do, they insisted, was to control the supply of money so that it grew at the same speed as “the real economy” – and take such action as was necessary to break down “unnatural monopolies” by trade unions or nationalised industries, while holding down unemployment benefits so that workers would then be persuaded to accept jobs at lower wages.

The reply of apologists for capitalism to its critics for 30 years had been that it could be made to work with state intervention. Now it was that it could only be made to work if state intervention was scrapped. As the dissident radical Keynesian Joan Robinson summed up the mainstream shift:

The spokesmen of capitalism were saying: Sorry chaps, we made a mistake, we were not offering full employment, but the natural level of unemployment. Of course, they suggested that a little unemployment would be enough to keep prices stable. But now we know that even a lot will not do so. [3]

Labour’s prime minister James Callaghan virtually admitted this when he told his party’s conference in September 1976:

We used to think you could just spend your way out of recession by cutting taxes and boosting government borrowing. I tell you in all candour that that option no longer exists; and insofar as it ever did exist, it worked by injecting inflation into the economy. And each time that has happened, the average level of unemployment has risen.

The point was repeated 20 years later by the future Labour prime minister, Gordon Brown:

Countries which attempt to run national go it alone macro-economic policies based on tax, spend, borrow policies to boost demand, without looking to the ability of the supply side of the economy, are bound these days to be punished by the markets in the form of stiflingly high interest rates and collapsing currencies. [4]

Politicians and academics who had been brought up on Keynesianism came to accept the same parameters for deciding economic policy as their old opponents, with no alternative to high levels of unemployment, welfare cuts, “flexibility” to make workers “more competitive” and laws to restrain “trade union power”. Keynesians who did not drop their old beliefs were pushed to the margins of the economic establishment. By 2007 a study showed that “72 percent of economic students” were at educational institutions without a single “heterodox economist” who challenged “the neoclassical and neoliberal assumptions”. [5]

But the rush towards monetarism by supporters of the system was not any more able to come to terms with the crisis than Keynesianism. Monetarism was, after all, little more than a regurgitation of the neoclassical school which had dominated bourgeois economics until the 1930s. Just as it had been incapable of explaining the unprecedented severity of the inter-war slump, it was incapable of explaining the crisis of the 1970s and 1980s, still less of dealing with it. In Britain the monetarist Howe budget of 1979 was followed by a doubling of both inflation [6] and unemployment, and left industrial output in 1984 15 percent below its level of 11 years before. [7] The monetarist measures did not even manage to control the money supply; its broadest measures (what economists call M3) grew in 1982 by 14.5 percent instead of the intended 6 to 10 percent. [8] The policy merely served to destroy much of local industry, exacerbate the crisis of the early 1980s and lay the ground for another crisis in 1990.

Some economists who had abandoned Keynesianism for monetarism in the mid-1970s could be seen deserting monetarism in its turn in the early 1980s. Financial Times columnist Samuel Brittan, who had done much to popularise monetarist ideas in Britain, was by 1982 criticising many monetarist policies and calling himself a “new-style Keynesian”. In the United States, Reagan’s economic advisers, faced with the failure of monetarist policies to end a severe slump, quietly ditched monetarism [9] and abandoned one of monetarism’s central principles – the balanced budget.

But much mainstream economic theory moved in a different direction. A “new classical” school gained influence that contended, very much along the lines of Hayek in the 1930s, that what was wrong with monetarism was that it left a role for the state – intervening in money markets. Friedman, they claimed, had fallen into the same trap as Keynes by urging government moves to shift the money supply: he was, in a certain sense, “a Keynesian”. [10] Such moves, they insisted, could not alter business behaviour in the hoped for way, since the “rational expectations” of entrepreneurs would always lead them to discount government intervention in advance. Fiddling with the money supply, like government deficit spending, stopped supply and demand interacting with each other properly. “Booms and slumps”, it was claimed, “are the outcome of fraudulent Central Reserve banking.” [11] It is an amazing commentary on the remoteness of most academic economics from any contact with reality that the new classicals could maintain intellectual credibility when they denied the instability and irrationality of the laissez faire economy in a period which saw three major international recessions.

The high point of these ideas was with a short-lived boom in the mid to late 1980s. It seemed to vindicate their optimism about the benefits to economic growth of deregulation, privatisation and the removal of all restraints on the greed of the rich. But they lost some of their lustre with the renewed deep recession of the early 1990s. A different school of free market economists gained some support within the mainstream. This was the variant of the “Austrian school” influenced by the ideas of Joseph Schumpeter, which saw the slump-boom cycle as inevitable – and a good thing. The system, it argued, was capable of non-stop expansion, but only on the basis of “creative destruction” which destroyed old forms of production to clear the way for new ones. [12] But it was no more able than the mainstream Keynesians, the monetarists and the new classicals to answer a central question: Why was the system plagued once again by recurrent crises and by a long term decline in average growth rates after three decades of unprecedented, almost crisis-free growth? [13]

It was the failure of the anti-Keynesians to come to terms with such problems that led some Keynesians – and some on the far left influenced by Keynesianism – to blame them for the demise of the “golden age”. It was not the system as such, they argue, that was behind the recurrent crises. But, as Notermans has pointed out:

If neither the recovery from the Great Depression or post-war growth can be attributed to Keynesian policies ... [it] cannot serve as an explanation for the termination of full employment. [14]

So where does the explanation lie?

Missing from all the most influential mainstream explanations for the end of the “golden age” was what was happening to the rate of profit. Yet various efforts at measuring it have come to a single conclusion: it fell sharply between the late 1960s and the early 1980s.

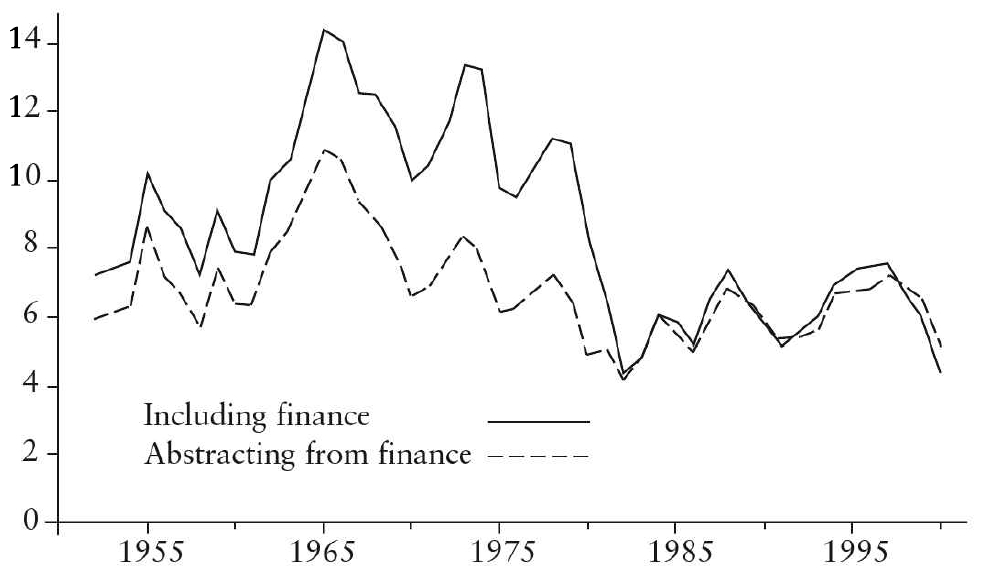

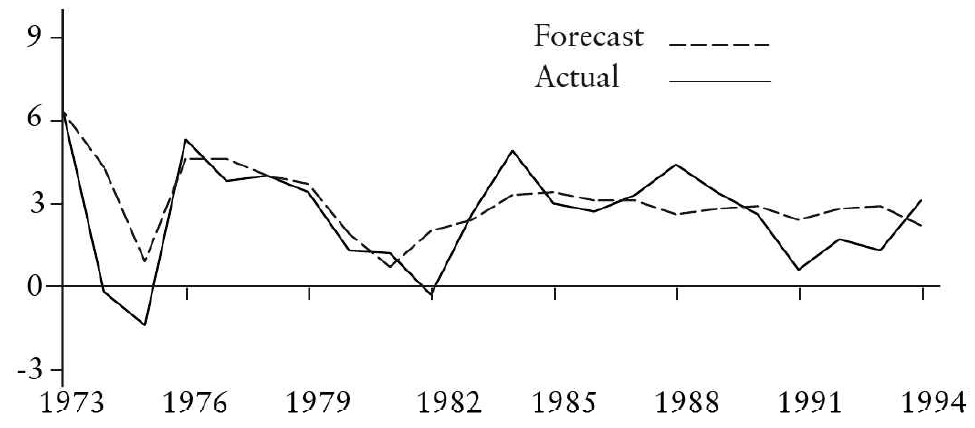

The results are not always fully compatible with each other, since there are different ways of measuring investment in fixed capital, and the information on profits provided by companies and governments are subject to enormous distortions. [15] Nevertheless, economists Fred Moseley, Thomas Michl [16], Anwar Shaikh and Ertugrul Ahmet Tonak [17], Gérard Duménil and Dominique Lévy, Ufuk Tutan and Al Campbell [18], Robert Brenner, Edwin N. Wolff [19], and Piruz Alemi and Duncan K. Foley [20] have all come to very similar conclusions. A certain pattern emerges, which is shown in graphs given by Dumenil and Levy (Figure 1) for the whole business sector in the US and by Brenner (Figure 2) for manufacturing in the US, Germany and Japan.

|

Figure 1: US profit rates accounting for (——) and abstracting from (– –) |

|

|

Figure 2: US, German and Japanese manufacturing net profit rates [22] |

|

There is general agreement that profit rates fell from the late 1960s until the early 1980s. There is also agreement that they partially recovered from about 1982 on, but with interruptions at the end of the 1980s and the end of the 1990s, and never making up more than about half the decline since the long boom. According to Wolff, the rate of profit fell by 5.4 percent from 1966 to 1979 and then “rebounded” by 3.6 percent from 1979 to 1997; Fred Moseley calculates that it “recovered ... only about 40 percent of the earlier decline” [23]; Duménil and Lévy that “the profit rate in 1997” was “still only half of its value of 1948, and between 60 and 75 percent of its average value for the decade 1956-65”. [24]

There were attempts to explain the decline in profitability in the 1970s as resulting from a wave of workers’ struggle internationally which had supposedly forced up the workers’ share of total income and cut into the share going to capital. That argument was put forward by Andrew Glyn and Bob Sutcliffe [25], by Bob Rowthorne [26] and accepted in part by Ernest Mandel. [27] Glyn’s analysis has been given a favourable mention much more recently by Martin Wolf. [28] But statistical analysis at the time suggested there had been no increase in the share of wages when tax, capital depreciation and various other factors were taken into account. [29] The argument also failed to explain why all the Western economies moved into crisis at the same point in the mid-1970s. In Italy, Britain, Spain and France there were important improvements in the level of working class organisation in the late 1960s and early 1970s. But there was no similar improvement in Japan and West Germany, while in the US “there was a sharp decline in real wages of non-agricultural workers from late 1972 to spring 1975, while productivity on the whole increased”. [30]

What did seem to make sense – and still does – was Marx’s argument about the organic composition of capital. A mainstream study of the US economy showed a rapid growth in the ratio of capital investment to workers employed in manufacturing by over 40 percent between 1957–68 and 1968–73. [31] One study of the UK showed a rise in the capital-output ratio of 50 percent between 1960 and the mid-1970s. [32] Samuel Brittan noted with bewilderment:

There has been an underlying long term decline in the amount of output per unit of capital in manufacturing ... This is a fairly general experience in the industrial countries ... One can construct a fairly plausible story for any one country, but not for the industrial world as a whole. [33]

The more recent calculations of Michl [34], Moseley, Shaikh and Tonak and Wolff [35] have all concluded that the rising ratio of capital to labour was an element in reducing profit rates. It is a conclusion that validates Marx’s position that a rising ratio of capital to labour can cut into profits – and is an empirical refutation of the position held by Okishio and others that this is impossible. But it still leaves open why this happened then and not earlier.

It is an issue that can be resolved by looking at contradictions within the long boom already being highlighted in the early 1960s by those who explained the boom in terms of the massive level of arms expenditures.

Arms spending was very unevenly distributed among the most important economies. They consumed a very high proportion of the national output of the US and the USSR in the 1950s (up to 13 percent in the first case, probably 20 percent or more in the second case), a lower proportion in Britain and France, and a much smaller proportion for Germany and Japan. This did not matter unduly in the first years after the Second World War, when there was a relatively low level of foreign trade and most firms were subject to low levels of international economic competition. The taxation to pay for the US arms budget cut into the profits of American firms, for instance, but this did not greatly disadvantage any one such firm in its domestic competition with another. And there was little for capitalists to complain about so long as the overall rate of profit did not decline much from its high level in the immediate post war period. The positive effects of arms spending more than compensated for the negative effects.

But over time the unevenness did come to matter. The US, as part of its programme to use its dominant economic position to cement its hegemony outside the Russian bloc, allowed access to its markets to the West European states and Japan. But economies with low levels of arms expenditure could invest proportionately more and achieve faster growth rates than the US could. Over time they began to catch up with its levels of productivity and to increase their relative importance in the world economy.

Capital growth in Japan over the period 1961–1971 was 11.8 percent per year, while in West Germany over 1950–62 it was 9.5 percent; these compared with figures for the US for 1948–69 of only 3.5 percent. [36] Japan accounted for 17.7 percent of the combined advanced countries’ GNP in 1977 and West Germany 13.2 percent; in 1953 the figures had only been 3.6 and 6.5 percent respectively. Meanwhile, the US share had fallen to 48 from 69 percent. [37] The shift was explained by the benefits Japan and Germany gained from the high level of worldwide arms expenditure, especially by the United States, without having to sacrifice their own productive investment to pay for it. Had all countries had comparable levels of productive investment to that of the West Germans and Japanese there would have been a very rapidly rising global organic composition of capital and a downward trend in the rate of profit. As it was, capital had grown in Japan “much more rapidly than the labour force – at more than 9 percent a year, or more than twice the average rate for the Western industrialised countries ...” [38] Non-military state capitalisms could only expand without crises because they operated within a world system containing a very large military state capitalism.

So the Japanese and German experiences did not contradict the thesis of arms expenditure as an explanation of world growth and stability. But they were a contradictory factor in this growth. Their very success meant that a growing chunk of the world economy was not wasting investible output on arms. Nor was that the end of the matter. The very success of the low arms spending economies began to put pressure on the high arms spenders to switch resources away from arms and towards productive investment. For only then could they begin to meet the challenge they faced in market competition from Japan and West Germany.

This was most clearly the case for Britain. Its economy was highly dependent on foreign trade and it ran into balance of payments crises with every spell of rapid economic growth between the late 1940s and the late 1970s. Successive British governments were forced, reluctantly, to abandon their notions of imperial grandeur and to reduce the proportion of the national product going on defence – from 7.7 percent of GDP in 1955 to 4.9 percent in 1970.

In the case of the US, the pressure was less obvious at first, since even in 1965 foreign trade only amounted to about 10 percent of GNP and the country enjoyed a trade surplus throughout the 1950s and 1960s. Nevertheless, arms spending declined from around 13 percent of GNP during the Korean War to between 7 and 9 percent in the early 1960s. The pressure of arms spending on its international competitiveness was suddenly revealed when it shot up by a third with the Vietnam War. The new level was not anything like that of the Korean War. But it was too much for a US industry facing vigorous competition for markets. There was an upsurge of inflation at home and Wall Street turned against the war. [39] Then, in 1971 for the first time since the Second World War, US imports exceeded US exports. President Nixon was forced into two measures which further undermined the stability of the world economy: he cut US arms spending [40] and he devalued the US dollar, in the process destroying the “Bretton Woods” system of fixed international currency exchange rates that had acted as a framework for the expansion of world trade throughout the postwar period.

The dynamic of market competition was relentlessly undercutting the dynamic of military competition. What some people called the “crisis of hegemony” [41] of the system in the 1970s was, in fact, the offspring of something else – the inherent instability of a world of state capitalisms engaged in two quite different dimensions of competition, economic and military, with each other.

One of the paradoxes of capitalism, we saw in Chapter Three, is that, although a rising organic composition of capital reduces average profit rates, it raises the profits of the first capitalist to introduce new machinery. So the Japanese and West Germans, by engaging in capital intensive forms of investment, cut world profit rates, while raising their own national share of world profits. [42] Their increased competitiveness in export markets forced other capitalisms to pay, with falling rates of profit, for the increased Japanese and German organic compositions of capital. But this, in turn, put pressure on these other capitalists to increase their competitiveness by raising their own organic compositions. The falling profit rates of the 1970s were the result. By 1973 the rates were so low that the upsurge in raw material and food prices caused by the boom of the previous two years was sufficient to push the advanced Western economies into recession.

Suddenly there was no guarantee for the major capitalist concerns that new investments on the scale they needed to keep up with international competition would be profitable. Investment began to fall sharply and firms tried to protect their profits by cutting back on employment and labour costs. Declining markets then led to further falls in profits and investment.

The old pattern of boom turning into slump had returned after its 30-year break. When governments reacted by trying to boost demand with budgetary deficits, firms did not immediately respond, as the mainstream Keynesians held that they should, by increasing investment and output. Instead they increased prices to try to recoup their profits, to which workers who still had a degree of confidence from long years of full employment responded by fighting for wage increases. Governments and central banks were then faced with a choice. They could allow the money supply to expand so as to allow firms to further raise prices and protect profits. Or they could try to restrict the money supply with high short-term interest rates, relying on firms then being forced to resist workers’ demands. Typically they turned from the first approach in the mid-1970s to the second in the late 1970s. But the success in restoring investment and creating a new period of growth did not last long even when governments had succeeded in subduing working class resistance. The rate of profit could not be raised above the pre-crisis level of 1973, and in 1980–82 a second “oil shock” was sufficient to push the world into a second serious recession, proving that monetarism could no more restore conditions to those of the long boom than could Keynesianism.

Capitalism was coming up against the limits of the state capitalist strategy for maintaining accumulation. That strategy had worked so long as states were able to ignore the immediate effects on the rate of profit of directing some of the mass of investible surplus value into areas that were not immediately particularly profitable (the Japanese prioritising growth over profitability) or into waste production (the arms economy). But this depended, firstly, on the rate of profit not dropping too sharply, and, secondly, on being able to ignore how the competitiveness of the production of particular goods within the national economy compared to that taking place elsewhere in the world system (or, in Marx’s language, to ignore the law of value on a world scale compared with production within the individual units of the national economy). By the mid-1970s both preconditions had been undermined by the contradictory development of the long boom itself.

The rate of profit had now fallen to a degree which made unproductive expenditures or not particularly profitable areas of investment an increasing burden on further accumulation. And the very dynamism of the long boom had produced a growing interconnectedness between national economies. By 1979 US foreign trade amounted to 31 percent of output, as against 10 percent in 1965. [43] A much larger proportion of industry than before had to worry about the international comparisons of its costs. Whole industries suddenly found that the value of their output had to be recalculated on the basis of what it would cost to produce it with the more advanced techniques and lower labour costs of other countries – and that meant it was not high enough to provide “adequate” profits.

This seems to explain the well known stagnation of labour productivity in the US in the 1970s – the value of the machinery on which labour worked was originally reckoned in terms of how much it cost to produce or replace inside the US, but with rising international trade, what mattered was the lower figure that would have been obtained if world comparisons were used. [44]

In any case, the feature described by Galbraith, of firms being able to downplay the importance of profit in the interests of growth, was undermined. And this was not only a very significant change for the state monopoly capitalism of the US. It was to have devastating consequences for those countries which had gone much further in the direction of full blooded state capitalism in the Eastern bloc and the Third World. They too were to enter into a new period of crises.

The assumption of conventional thinking on the right as well as the left was that the Soviet-type economies displayed a very different dynamic to that of the West. It was assumed, with very little dissent [45] until the 1970s and sometimes the 1980s, that they could sustain high levels of growth indefinitely, even if they were also marked by major inefficiencies and tended to produce low quality goods. Typical of the attitude on the left, even from people who were scathing about the denial of workers’ rights in such societies, was the position Ernest Mandel held. He wrote in 1956:

The Soviet Union maintains a more or less even rhythm of economic growth, plan after plan, decade after decade, without the progress of the past weighing on the possibilities of the future ... All the laws of development of the capitalist economy which provoke a slowdown in the speed of economic growth are eliminated ... [46]

Mandel still argued in the mid-70s, that “while the recession is hitting all the capitalist economies, the countries with non-capitalist economies are escaping the overall effects of the recession”. [47]

Such attitudes received a rude shock in the late 1980s when Mikhail Gorbachev, recently appointed as general secretary of the Communist Party of the USSR, revealed that the economy had been suffering from “stagnation” for some years. [48] His economic advisor, Abel Aganbegyan, said:

In the period 1981–85 there was practically no economic growth. Unprecedented stagnation and crisis occurred during the period 1979–82, when production of 40 percent of all industrial goods actually fell. [49]

The official figures for the Soviet-type economies had already in the late 1960s shown a long-term tendency for their growth rates to decline, by between a third and two thirds. [50] The long-term decline in growth rates was paralleled by – and dependent on – something else. The output/capital ratio kept falling – from 2.4 in 1951–5, to 1.6 in 1956–60 and 1.3 in 1961–65. Or, to put it another way, the amount of constant capital required to produce a certain amount of new output kept rising.

The problem was made worse because growing gross output in material terms was not good enough for the ruling bureaucracies. Their concern was with how this material output compared with that produced by their international rivals – that is with the value of the output in international terms. This led to recurrent attempts by sections of the bureaucracy to implement economic reforms, amid complaints about productivity and the quality of what was produced: in the early 1950s after Stalin’s death, in the early 1960s under Nikita Khrushchev and then in the late 1960s under Leonid Brezhnev and his prime minister, Alexei Kosygin.

The reforms had only limited effects. A rise in workers’ living standards, in contrast to the very sharp fall in the 1930s, encouraged greater commitment by the workforce and a rise in productivity. But the pressures of competitive international accumulation (military in the case of the USSR, market as well as military in the case of the East European states) led to a repeated tendency of increased consumer goods and food output to be sacrificed to the needs of industrial investment. As Soviet statisticians explained in 1969, “Owing to the international situation it has not been possible to allocate as many resources as intended to agricultural investment.” [51] Such a switching of resources from one sort of production to another necessarily led to increasing waste, undermined the morale of the workforce, and led people at every level of managerial hierarchies to hide the resources at their disposal so as to enable them to cope if inputs were suddenly curtailed. [52]

It is necessary to note in passing that such a phenomenon was not unique to the Soviet-style economies. Exactly the same pressures apply to those below the top managerial ranks in Western corporations as they are expected to be able to respond to sudden changes in the pressures on them from above in response to changing competition. Under such conditions, the firms’ costs of production can depart very widely from those which ought to be achieved. The result can be what one economist has called “x-inefficiency” – a level of inefficiency in the company amounting to 30 or 40 percent of production costs. [53] Production costs and the prices which would prevail in a “perfect market” depart massively from each other – to use Marxist terminology, there are massive short-term infringements of the law of value.

Such things are rarely studied by mainstream economists because both their micro- and macro-economics deal with what happens between firms, not within them. But there are repeated references to such problems in managerial studies. Interestingly, some Western studies concluded when it came to relationships between enterprises in the USSR “allocative efficiency” (that is, for Marxists, the law of value) did apply: “Inter-firm trade in factors of production may be as efficient as in market economies.” [54]

What produced crisis and waste inside Western enterprises and Soviet-style economies alike was the drive to accumulate at all costs. It meant, as we saw in Chapter Seven, investment expanding repeatedly at the expense of consumption, increased imbalances in the economy, a continual cyclical pattern to growth and increased alienation of the workforce. Figures given by the Russian economic journalist Vasily Selyunin in 1987 showed the increasing subordination of consumption to accumulation over nearly six decades, with only 25 percent of output going to consumption in 1985 as compared to 39 percent in 1940 and 60.5 percent in 1928. He concluded, “The economy is working more and more for itself, rather than for man.” [55]

His words echoed (probably unintentionally) those of Marx describing the logic of capitalism as “accumulation for accumulation’s sake, production for production’s sake”. [56] But the drive to such accumulation was not only an expression of the alienation of the capitalist system for Marx. It was also the force ultimately behind the outbreak of crises. For it meant that accumulation reached a point at which it attempted to proceed faster than the extraction of the extra surplus value necessary to make it possible. At such a point new accumulation could only proceed at the expense of existing accumulation, as Grossman spelt out in his theory of “capitalist breakdown”. There was “over-accumulation of capital”. The only response open to capitalists in this situation was to shut down the plant, sack some workers and try to restore profits at the expense of the wages of the others. Each of these moves had the effect of making it impossible for some of the already produced commodities to be sold (or, in Marx’s words, for the “realisation of surplus value” to take place), creating a general overproduction of goods in relation to the market.

The Soviet Union had always experienced cyclical downturns as a result of attempts to accumulate too rapidly, as we saw in the previous chapter. But as with the major Western capitalisms in the long boom, the downturns had not turned into economic contraction, a “real recession.” Now these became more difficult to avoid as the slowdown in growth had its impact.

Two young Polish Marxists, Jacek Kuron and Karol Modzelewski, produced a path-breaking study of the economic contradictions in an Eastern bloc country in 1964. They pointed to the findings of certain East European economists about the way over-accumulation affected the rest of the economy. Accumulation came up against three “barriers”. The “inflation barrier” signified that too rapid expansion of investment had led either to normal inflation (as the state printed money to pay for it, so raising prices and cutting living standards) or to “hidden inflation” (as cutbacks in the supply of goods to the shops led to shortages, queues and a growing black market.) The “raw material barrier” signified that there were just not enough inputs for production to reach the projected level. The “export barrier” meant that attempts to make up for the shortages of inputs by importing from abroad led to foreign exchange crises. Kuron and Modzelewksi concluded that a point was soon going to be reached in which the internal reserves would no longer exist for accumulation to continue without creating an immense social crisis. They argued against those who looked to reform:

What we have here is not a contradiction between the objectives of the plan and the anti-stimuli resulting from faulty directives, but a contradiction between the class goal of the ruling bureaucracy (production for production) and the interests of basic groups who achieve the production (maximum consumption). In other words, it is a contradiction between the class goal of production and consumption, and it results from existing conditions, not from mismanagement. [57]

Their analysis was partially vindicated in 1970 when attempts to resolve a crisis caused by over-investment at the expense of living standards led to workers occupying the country’s Baltic shipyards, attacks on them by the police and the enforced resignation of the country’s leader, Gomulka. But at first it seemed that the new leadership had found a way out of the crisis, with a new boom based on massively expanding trade with the West and borrowing from Western banks which permitted imports to rise by 50 percent in 1972 and 89 percent in 1973.

Polish state capitalism was overcoming the limits to accumulation created by the narrowness of its national economy by integration into the world economy through market competition. The other side of this, however, was that the Polish economy was bound to suffer whenever the world economy went into recession. And dependency on the rest of the world system for inputs to production and for export earnings prevented the state shifting resources from one sector of the economy to another so as to ward off any incipient internal recession turning into an actual one. From 1980 to 1982 there developed “a crisis unprecedented in the history of Europe since the second world war”. [58] The “national net material product” fell by nearly a third; prices increased by 24 percent in and 100 percent in 1982; and real wages fell by about a fifth. [59]

The regime attempted to place the burden of the crisis on the mass of workers – and produced a sudden upsurge of resistance through the Solidarnosc workers’ movement. The events served as a warning to the whole of the Russian bloc. Soviet-style state capitalism was not immune to a crisis similar in important ways to that then hitting Western state monopoly capitalism. Both had their roots in the system of competitive accumulation as a whole. [60] Catastrophic crisis was inevitable at some point in the not too distant future throughout the Soviet bloc – including in the USSR itself:

By 1981, the choice between maintaining the closed economy and opening up to the rest of the world was indeed the choice between the frying pan and the fire. The first option meant deepening stagnation, growing waste, an inability to satisfy the demands of the mass of the population, and the continual danger of working class rebellion. The second option meant binding oneself into the rhythm of a world economy increasingly prone to stagnation and recession – and giving up the administrative means to stop recession involving contraction of the domestic economy. That is why the Polish crisis of 1980–81 was so traumatic for all the rulers of Eastern Europe. It proved there was no easy solution to the problems besetting every state. [61]

The Soviet bureaucracy was not long in discovering this the hard way. Its levels of accumulation were reaching the limits of what could be sustained. It depended more on foreign trade than previously, using oil revenues to buy wheat abroad to feed the population in the 1970s and early 1980s (adding to worldwide inflationary pressures). A fall in the world price of oil in the course of the mid-1980s then threw its domestic economic calculations into some disarray. And the decision of the Reagan administration to reassert US hegemony by raising arms spending put pressure on the USSR to do likewise. The external factors added to the internal problems caused by trying to sustain accumulation in the face of declining growth rates.

Gorbachev’s promotion to head of the ruling Communist Party was a sign that influential people had recognised the urgency of the situation – his rise owed much to Yuri Andropov, who had witnessed what crisis could lead to as ambassador to Hungary in 1956 and as general secretary of CPSU during the Polish events of 1980–81. Gorbachev has been blamed since as a “counter-revolutionary” by some people on the left nostalgic for the Soviet style set-up. But his intention was to try to save that set-up through top- down reforms before economic, social and political crisis on Polish lines could arise. His misfortune was that the crisis had reached a point where it could not be overcome by reform.

Reports from ministerial meetings in the winter of 1988–9 provide a picture of increasing economic chaos, with the regime not seeing any way to deal with it. There were bitter clashes over “the balance (or rather the imbalance) between different sectors of the economy”, the “number of enterprises” which were “significantly refusing to supply planned output” or were “significantly reducing deliveries” and the way “the volume of new investment continued to grow”. [62] “The supply of goods to the consumer market” had “suddenly begun to deteriorate sharply and noticeably before our eyes in the second half of 1987 and especially in 1988”. [63] There was an:

increasingly strained situation as regards satisfying the public money-backed demand for goods and services ... The problem of supplying the population with food has worsened ... The money supply has reached critical dimensions ... Everything in the economy is in short supply. [64]

By October 1989 there was open talk of “the crisis in many parts of the economy, the shortages, the unbalanced market, the collapse of old relations before new ones are put in place, an atmosphere of uncertain prospects and scarcities”. [65] Prices were rising, since factories and shops found they could reduce production and simply raise prices, disrupting supplies for the rest of the economy.

The economic crisis, as in Poland, turned into a political and social crisis. Gorbachev had intended to permit a limited opening (“glasnost”) of discussion in the ruling party and the media to isolate those in the bureaucracy opposed to his reforms. But people increasingly took advantage of this to give expression to old grievances and their discontent with the deteriorating economic situation. An unprecedented series of mass demonstrations and riots took place in the non-Russian national Soviet republics of Armenia, Kazakhstan, the Baltic states, Georgia, the Ukraine, Byelorussia and Azerbaijan, fusing struggles for national rights with grievances at the social conditions people experienced. So the protests by the Armenian minority in the Karabakh region of Azerbaijan “began as protests against catastrophic mismanagement and miserable economic conditions”. [66] The newspaper Pravda said that in 1986 (even before the crisis deepened) there was 27.6 percent unemployment in Azerbaijan and 18 percent in Armenia. [67] In Kazakhstan “only half the young people had a chance to find a job in 1981–85”. [68] The head of the state-run unions said that across the USSR as a whole 43 million people were living below the poverty line. [69] Estimates of the total number of unemployed varied from 3 percent to 6.2 percent (8.4 million people). Then miners right across the USSR struck in the early summer of 1989 and soon after Abalkin complained, “A wave of strikes has engulfed the economy.” [70] This was happening as huge mass movements in Eastern Europe – partly in response to their economic crises – were breaking Soviet control on the region and deepening the general sense of political crisis, encouraging further protests in the USSR’s non-Russian republics and weakening the capacity of the central state to impose its will.

Those running the enterprises did not know how to cope with the wave of protests from below apart from making concessions which raised money wages, and they had even less of an idea about what do about the shortages of inputs needed to maintain the level of production. Stagnation gave way to economic contraction – the beginnings of a slump – in the second half of 1989.

There were calls from economists who claimed that only greater competition between enterprises, and eventually direct competition between firms inside Russia and those elsewhere in the world economy could force managers to be efficient and to produce the things that were needed. But they had no more idea than the ministries at the centre as how to find the resources to complete the investments that were meant to provide the outputs that would restore balance to the economy. The economic collapse continued regardless of what the government did, leading to ever greater discontent and political upheaval. An attempt by Gorbachev to take a hard line to restore central control in the spring of 1991 produced a new wave of discontent which forced him to retreat. A coup against him by those who hankered after a return to the past in August 1991 fell apart, lacking support from the most important generals. There was no popular constituency for trying to return to the old order. But those who preached reform did not have a way forward either, despite the brief popularity for “100-day” or “300-day” programmes promising miraculous economic recovery.

Such programmes were utopian in the extreme. The collapse of central control left the giant Soviet enterprises in a monopolistic or semi-monopolistic position. They were able to dictate to the market and to produce what they wanted rather than what was needed by the economy as a whole; they were in a position to raise prices and to simply ignore contractual obligations to other enterprises. There was no stopping the combination of deepening recession, inflation and acute shortages of consumer goods and food. Economists, planners and frightened bureaucrats began to look for any scheme to get them out of the mess, until finally they gave up attempting to control what was happening. When Yeltsin and the Communist leaders of the other national republics announced the dissolution of the USSR into its component republics at the end of 1991 they were only giving political expression to the economic fragmentation that was already under way, with the heads of each industrial sector trying to protect themselves from the general economic crisis by relying on their own resources. This was turned into a supposed economic strategy through “shock therapy” policies of Yeltsin’s “liberal” ministers and Western advisers like Jeffrey Sachs. The assumption was that, left to compete with each other without restraints from the state, enterprises would soon be pricing goods rationally in a way that would lead the efficient ones to establish links with each other, and that this would restore stability. In fact, all it did was to provide governmental blessing to a slump already under way whose only precedent anywhere in the 20th century was that of 1929–33 in the US and Germany.

The failure of economic reform was not just a failure of implementation. There was a flaw in the very notion of reform itself. The aim was to restructure the Soviet economy so that those sections of it capable of adjusting to the current international level of the forces of production would expand while others closed down. But this was bound to be an enormously painful undertaking, not just for those workers who suffered in the process but for the mass of the individual members of the bureaucracy as well. Restructuring the British economy between the mid-1970s and the mid-1980s had involved shutting down about one factory in three and destroying capital on such a scale that gross industrial investment in 1990 was still no higher than in 1972. It is very doubtful that it could have proceeded smoothly if British capitalism had not had the lucky bonus of enormous North Sea oil revenues. The USSR’s economy was much larger than Britain, and its enterprises had been much more insulated from the rest of the world for 60 years. The proportion that was to be destroyed by an immediate opening to international competition was correspondingly greater. This, in turn, did considerable damage to the remaining competitive enterprises as they lost suppliers of materials and components on the one hand and buyers for their output on the other.

The roots of the crisis lay in the pressure to accumulate for the sake of accumulation that arose from the bureaucracy’s position as part of a competitive world system. The Soviet economy had reached the point at which the precondition for a further wave of self-expansion of capital was a crisis involving the destruction of at least some past accumulation. The only difference between Russia and, say, France or Britain, was that the destruction was to be on a considerably greater scale. And this was because the Soviet Union had undergone six decades of accumulation without restructuring through crises and bankruptcies, while for the British and French economies it was only four and three decades respectively.

Few people were prepared to see things in these terms at the time. The vast majority of those who had struggled for democratic reform in Russia believed that the turn to market capitalism would open up a glorious future. What they got instead was a devastating slump, the corruption of the Yeltsin years and the domination of the economy and society by former members of the ruling bureaucracy and mafiosi reborn as private capitalist oligarchs. Meanwhile, in the rest of the world the great majority of politicians and theorists in the social democratic and former Stalinist left drew the conclusion that it was socialism that had failed and that the future lay with Western style markets, failing to perceive the depths of the crises brewing there too.

The world’s second economic power at the beginning of the 1980s was the USSR. Japan took its place as the Soviet crisis of the late 1980s turned into collapse. [71] Japan’s average growth rate throughout the 1980s was 4.2 percent as against 2.7 percent for the US and 1.9 percent for West Germany. Its annual investment in manufacturing equipment was more than twice that of the US. [72] That the future lay with Japan was the near universal conclusion of media commentators. A committee of the US Congress warned in 1992 that Japan could overtake the US by the end of the decade. “After Japan” became the slogan of European and North American industrialists trying to motivate their workforces to greater feats of productivity. The “threat” from the “rising sun” became the excuse for the job losses experienced by American auto workers. Keynesian commentators like Will Hutton and William Keegan wrote books extolling the Japanese model of capitalism.

Then in 1992–3 a financial crisis pushed Japan into its own “period of stagnation”, with a growth rate averaging just 0.9 percent a year between 1990 and 2001. [73] By 2007 its economy was only a third of the size of the US’s (and the European Union’s) [74] as against estimates as high as 60 percent in 1992. [75]

The blame for what happened is usually ascribed to faults in the running of its financial system – either due to financial markets not being “free” enough in the 1980s, or to inappropriate action by the central banks once the crisis had started. The conclusion from such reasoning is that the Japan crisis was unique and has little to tell us about the direction in which the global system is going. The sudden inability of the world’s second biggest economy to grow then becomes the result of accidents.

Yet all the elements of the Marxist account of the crisis of the inter-war years are to be found in the Japanese case. Japan had a rapidly rising ratio of capital to workers from the 1950s to the late 1980s. This grew in the 1980s by 4.9 percent a year – more than four times as fast as in the US and 70 percent faster than in Germany. [76] The result, as Marx would have predicted, was downward pressure on the rate of profit. It fell by about three quarters between the end of the 1960s and the end of the 1980s.

|

Japanese profit rate [77] |

|||

|

|

Manufacturing |

|

Non-financial |

|

1960–69 |

36.2 |

25.4 |

|

|

1970–79 |

24.5 |

20.5 |

|

|

1980–90 |

24.9 |

16.7 |

|

|

1991–2000 |

14.5 |

10.8 |

|

|

Return on gross non-residential stock [78] |

|

|

1960 |

28.3 |

|

1970 |

18.0 |

|

1980 |

7.8 |

|

1990 |

3.9 |

The decline seemed manageable until the end of the 1980s. The state and the banks worked with private industry to sustain growth without much attention to profit rates. So long as there was a mass of profit available for further investment, the Japanese system ensured that it was used. Japan had been hit hard by the global recession of the mid-1970s, but was able not only to recover from it before most other countries but also to restructure industry in such a way as to keep expanding throughout the early 1980s when the US and Europe were in recession:

The crisis [of 1973–5] indicated that future growth on the basis of heavy and chemical industrialisation was untenable. The role of the state in changing the strategic direction of Japanese capitalism was fundamental. Administrative guidance by MITI [Ministry of International Trade and Industry – CH] began to nudge Japanese capital in the direction of electronics, automobiles, capital equipment and semiconductors ... [79]

This required high levels of investment. The United States, for example, invested just 21 percent of its GDP during the 1980s compared with a Japanese figure of 31 percent. According to one estimate, the ratio of capital stock to GNP in Japan was nearly 50 percent higher than in the US. [80] The concentration of investment into certain industries in this way raised their productivity, even though it remained fairly low in the rest of the Japanese economy. [81] But such high investment could only be sustained by holding down the consumption of the mass of people. Partly this was done by keeping down real wages; partly it was done through providing minimal state provision for sickness and pensions, forcing people to save. As Rod Stevens pointed out when the boom was at its height:

Real wages in Japan are still at most only about 60 percent of real wages in the US, and Japanese workers have to save massively to cope with the huge proportion of their lifetime earnings which is absorbed by such things as housing, education, old age and health care. [82]

But this level of real wages restricted the domestic market for the new goods Japanese industry was turning out at an ever increasing speed. The only way to sell them was to rely on exports. As Stevens also pointed out:

Because of capital’s increasingly strict wage control and authority in the workplace, growing labour productivity in the consumer goods branches of the machinery industries (e.g. motor cars and audio-visual equipment) had to find outlets in export markets if the Japanese working class’s limited buying power was not to interrupt accumulation. [83]

High productivity in the select range of prioritised industry made the required level of exports possible, with Japanese cars and electronics increasingly penetrating the US market. But it brought complications in its wake. Japanese economic success was very dependent on US good will. When the US demanded that Japan accept an upward revaluation of its currency to make its goods less competitive against American goods, Japanese capitalism had little choice but to comply and the volume of exports suffered (even though revaluation meant their value in dollar terms did not).

The reaction of the state to this was to provide cheap funds to keep industrial investment and expansion going. As Karel van Wolferen has said, “To compensate the corporate sector for the squeeze of the exchange rate, the Ministry [of Finance] encouraged the banks vastly to increase their lending.” [84] But there had been a weakening of the old mechanisms which directed bank lending into industrial development – caused in part by the growing integration of Japanese capitalism into the world system. [85] The expanded bank lending found its way into speculation on a massive scale:

The explosion of liquidity helped set off an upward spiral of real-estate values, long used as collateral by the big companies, which then justified inflated stock values. [86]

In what was later called the “bubble economy”, property values soared and the stock exchange doubled in value – until the net worth of Japanese companies was said to be greater than that of the US companies, although by any real measure the US economy was about twice the size of the Japanese one. But while the bubble lasted the Japanese economy continued to grow – and even after the bubble had started deflating, bank lending enabled the economy to keep expanding throughout 1991–2 as recession hit the US and Western Europe. Then it became clear that the banks themselves were in trouble. They had made loans for land and share purchases that could not be repaid now these things had collapsed in price. The banking system was hit by recurrent crises right through the 1990s, writing off a total of around 71 trillion yen (over $500 billion) in bad loans. The total sum owed by businesses in trouble or actually bankrupt were set at 80 to 100 trillion yen ($600 to $750 billion) by the US government, and at 111 trillion yen (nearly $840 billion) by the IMF. [87]

The role of the financial system in producing the bubble and then the long drawn out banking crisis has led most commentators to locate the origin of the Japanese crisis in faults within that system. The problem, neoliberal commentators claim, was that the close ties between those running the state, the banking system and industry meant that there was not the scrutiny about what the banks were up to which a truly competitive economy would have provided. [88] It was this which enabled such a massive amount of dodgy lending to take place. As an explanation, it fails because very similar bubbles have happened in economies like the US which supposedly fulfil all the norms of “competitiveness”. It is difficult to see any fundamental difference between the Japanese bubble of the late 1980s and the US housing bubble of the mid-2000s.

The neoliberal reasoning that blames the crisis on the state believes there was a solution – the state should simply have walked away and allowed some of the big banks to go out of business. But this assumes that some banks going bust would not bring down other banks to which they owed money, leading to a cumulative collapse of the whole banking sector. No advanced industrial state dare even contemplate that happening. Whenever it has seemed possible, other states have behaved in general as the Japanese have.

In any case, there is no reason to believe that the banking crisis was the ultimate cause of Japanese stagnation. The neoclassical economists Fumio Hayashi and Edward C. Prescott have argued that firms that wanted to invest could still do so, since “other sources of funds replaced bank loans to finance the robust investment by non-financial corporations in the 1990s”. [89] But they have had to recognise that “those projects that are funded are on average receiving a low rate of return”. [90] In fact, there was a fall in productive investment, although not anything like a complete collapse. In such a situation, restructuring the banking system, whether through allowing the crisis to deepen, as the neoliberals wanted, or gradually as those of a more Keynesian persuasion suggested, would not solve the crisis. On this American economist Paul Krugman rightly made the point:

The striking thing about discussion of structural reform, however, is that when one poses the question, “How will this increase demand?” the answers are actually quite vague. I at least am far from sure that the kinds of structural reform being urged on Japan will increase demand at all, and see no reason to believe that even radical reform would be enough to jolt the economy out of its current trap. [91]

The reason was that the trap lay outside the banking system, in the capitalist system as a whole. The rate of profit had fallen to a point in the late 1980s which precluded further substantial increases in workers’ living standards. But that in turn prevented the domestic economy from being able to absorb all of the increased output. A new massive round of accumulation could have absorbed it, but for that profitability would have had to have been much higher than it was. Richard Koo’s study of the crisis, The Holy Grail of Macroeconomics, by stressing the hidden debts of major corporations, hints at what had really gone wrong, but fails to ground the problem of insolvency in the long-term decline of profitability. [92]

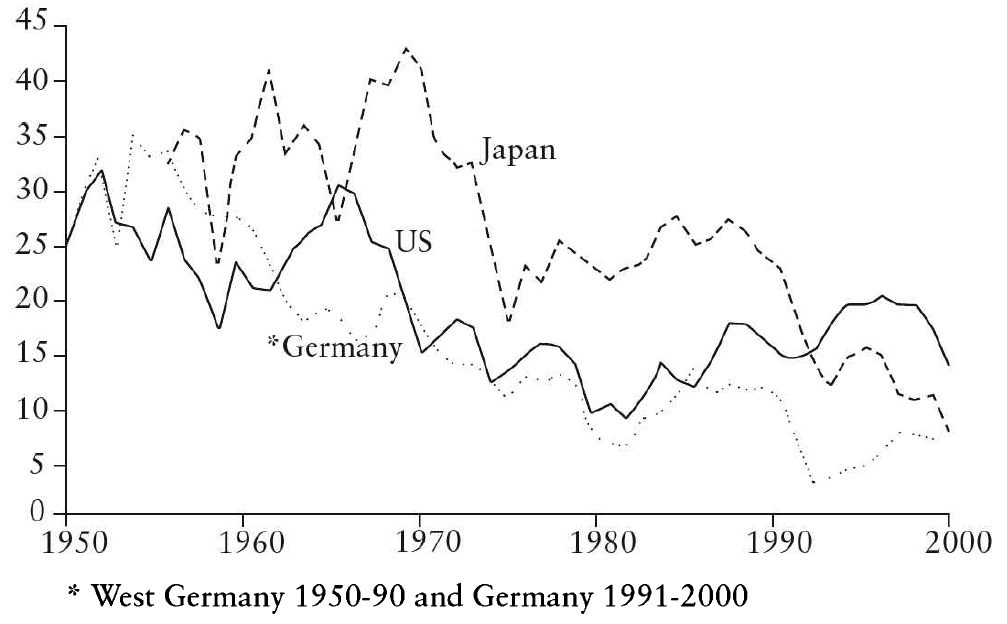

The Japanese state did turn to some Keynesian type solutions, with a big programme of public works construction (bridges, airports, roads, etc.). Gavan McCormack writes, “With the onset of chronic recession after the bubble burst at the beginning of the 1990s, the government turned to ever larger – and decreasingly effective – Keynesian deficits”, and that “Japan’s public works sector has grown to be three times the size of that of Britain, the US or Germany, employing 7 million people, or 10 percent of the workforce, and spending between 40 and 50 trillion yen a year – around $350 billion, 8 percent of GDP or two to three times that of other industrial countries”. [93] According to one estimate the state’s share of output increased from an average of 13.7 percent in the 1984–1990 period to 15.2 percent in the 1994–2000 period. [94]

But it was not enough to fill the gap created by the limited stimulus to investment from the rate of profit, as the graph below shows.

|

|

Source: Fumio Hayashi and Edward C. Prescott: The 1990s in Japan: A Lost Decade |

The economy did not collapse in the 1990s in the way that the US and German economies did in the early 1930s. The state still seemed able to stop that. But it could not lift the economy back to its old growth path. Sections of Japanese capital believed they could escape from this trap by investing abroad – as the gap between Gross Investment and Gross Domestic Investment shows. But it was not an answer for the great bulk of Japanese capital which did its utmost to try to raise the rate of profit through raising the rate of exploitation, even though it could only reduce domestic demand still further and deepen its problems. Nor was it an answer for the Japanese working class, which whether it liked it or not would be compelled to struggle if it was to avoid life getting worse. Economic growth did not rise from the doldrums until the mid-2000s, when Chinese imports of machinery gave a boost to Japanese industry – but this was to prove to be very short-lived.

Japan’s crisis was not as devastating to the lives of its people as that which broke out a couple of years earlier in the USSR. Yet, unnoticed by nearly all economists, mainstream and Marxist alike, there was a similarity between them. Capital accumulation had reached the point where it could no longer extract a surplus from those it exploited on a sufficiently rising scale to keep abreast of the internationally competitive level of accumulation it looked to. The barrier to capital accumulation had indeed become capital itself. Those who presided over accumulation had two choices. They could allow their bit of the system to restructure itself through blind competition, taking on trust ideological claims that it would produce new miracles. Or they could play safe, knowing they might never get out of long-term stagnation. The rulers of Russia chose the first path and saw their economy, already halved with the loss of the rest of the USSR, halve in size again. Japan’s rulers took the other path, and their economy went through a decade and a half of debilitating stagnation without seeming any closer to a solution to its problems at the end than it was at the beginning. The big question both raised was, how would other countries, particularly the US, react if they fell into the same stagnation trap?

The collapse of the two state-oriented ideological models, Keynesianism and Stalinism, had a profound effect on political forces aspiring after the “development” of Third World economies into full and equal components of the world system. It pushed them to look for new models of capital accumulation in place of the state-directed import-substitutionist model, which was already displaying problems.

In Asia the tightly regulated Chinese economy and the less tightly regulated, but still centrally directed, Indian economy both began to show worrying signs of stagnation by the mid- 1970s [95], forcing governments to look for alternatives; in Latin America the import-substitutionist model was found wanting in its Argentinian homeland as economic and political crises erupted; in Africa the promises made by proponents of “African socialism” were not fulfilled as industrial growth was restricted by the narrowness of national markets and the meagre resources left after the depredations of imperialism. Adding to these problems was a decline in the price on the world market for raw materials and foodstuffs – the main source of the export earnings needed to import equipment for new industries. Particularly after the onset of recession in the advanced countries in 1974, non oil producing Third World countries were caught between increased oil costs and a decline in the terms of trade for primary commodity exports of nearly 50 percent. [96]

Those running industries which had grown up within the protective barriers of the old model began pragmatically establishing links with foreign capital. Argentina, Brazil and Mexico were typical. Their industrial bases had been established in the 1940s, 1950s and 1960s by the state intervening to direct investment in industry, often into state-owned companies. But the more far-sighted industrialists – whether in the state or private sectors – saw that they could not get the resources and modern technologies needed to keep up with worldwide productivity levels unless they found ways of breaking out of the confines of the national economy. They began increasingly to turn to foreign multinationals for licensing agreements, joint production projects and funds – and they began themselves to operate as multinationals in other countries.

The trend was reinforced by the success of a number of countries which had long oriented themselves to the world market in achieving very fast growth rates. In Asia four bastions of anti-Communism – South Korea, Taiwan, Hong Kong and Singapore – registered growth rates easily as large as those in Stalin’s USSR. And in Europe countries like Spain, Greece and Portugal, which Paul Baran had included as part of the underdeveloped world, grew rapidly enough to join that rich man’s club, the European Community. Brazil began following a similar export-oriented path under the military regime that had seized power in 1964. Its still very large state sector and private capital alike increasingly oriented towards the rest of the world system rather than to a protected national market. The Western financial press rejoiced in this, assuring its readers that Brazil was the great rising Third World country whose industries were destined to challenge those of the West. And there certainly was growth. “For almost 15 years (1965–80) the average rate of growth was 8.5 percent, making Brazil the fourth fastest growing country.” [97]

Other Latin American states began to emulate the Brazilian policy. The military coups in Chile (1973) and Argentina (1976) were followed by an opening to external capital. And again the outcome seemed encouraging at first. Under the Videla regime in Argentina “the rate of inflation was lowered, real output grew, and a current account surplus was generated” [98], while Chile’s real GDP grew 8.5 percent a year between 1977 and 1980. [99]

It seemed that a way had been found to achieve national accumulation by breaking out of the confines of the national market – and, when the policies were undertaken under military regimes, of crushing popular resistance to rising levels of exploitation. There was a similar swing of the intellectual pendulum as in the West and the former Communist states, with the wholesale conversion of “dependency theory” economists to the wonders of free markets. The conversions continued even as the Latin American “miracle” came unstuck.

Growth after 1974 had come to depend on foreign borrowing (as in Poland and Hungary in the same period). Many Latin American countries gambled on ambitious growth targets by borrowing heavily in international financial markets. The external debt of Chile and Argentina almost trebled over a few years, from 1978 to 1981. [100] But this did not seem to matter at the time – either to the national governments or the international banking system:

Up to the second oil price shock (1979–80) the gamble was worth taking. Export growth was sustained in world markets at favourable prices ... As a consequence the ratio of debt outstanding to export proceeds was more favourable for all non-oil developing countries in 1979 than in 1970–72. [101]

The IMF assured people in 1980, “During the 1970s ... a generalised debt management problem was avoided ... and the outlook for the immediate future does not give cause for alarm.” [102] This was written just months before the second international recession, in the early 1980s, and caught all these states unprepared. As export markets shrank and international interest rates began to rise, the debts they had incurred in the 1970s crippled their growth, threw them into recession and blighted their economies right through the 1980s, which became known as “the lost decade” in Latin America, with a fall in GNP per person for the continent as a whole of 10 percent. [103]

The impact on local capitalists and mainstream political forces was not, however, to question the new opening to the world market. Rather it was to insist, as in Russia and Eastern Europe that the opening had not gone far enough. The new doctrine was accepted in one form or another by the late 1980s by populist politicians and even former guerrillas in Latin America, by the politburo in China, by the Congress Party leadership in India, by those who had once proclaimed their commitment to “socialism” in Africa and by the successors to Nasser in Egypt.

The conversions were not always voluntary. The International Monetary Fund and the World Bank intervened where they could, making offers, mafia style, to debt-laden countries which their rulers rarely found themselves able to refuse, since doing so would rule out any sort of accumulation strategy. The various debt programmes were more concerned with protecting the interests of Western banks than with ameliorating conditions in the indebted countries. But more was involved than just a surrender to imperialism on the part of the governments that accepted them. Those capitals, private and state alike, that had grown during the period of state-directed “development” did not see any way of continuing to expand within the confines of limited national markets. They wanted access to markets and to technological innovations outside national borders. They might allow, even encourage, national governments to haggle over the terms on which capital in the metropolitan countries allowed this to happen, but they would not reject them outright. And in the process some of them were indeed able to develop more than a national profile.

So the Argentinian steel maker TechNet took control of the Mexican steel tube maker Tamsa in 1993, acquired the Italian steel tube maker Dalmikne in 1996, and then went on to expand into Brazil, Venezuela, Japan and Canada, adopting the name Tenaris. [104] There is a similar pattern for some Mexican companies. In the late 1980s Alfa, the largest industrial group in Mexico, with 109 subsidiaries spanning automotive components, food, petrochemicals and steel, embarked on a growing number of joint operations with foreign firms. The glass maker Vitro, which had bought two American companies, became “the world’s leading glass container manufacturer, with its market almost equally split between the US and Mexico”. [105] The logical outcome of this in Mexico was for its ruling class to forget its old nationalism and to join the North American Free Trade Area and increasingly to operate as a subordinate component of US capitalism.

Occasionally the collaboration produced positive results for wider sections of local capital, provided some job opportunities for the aspirant middle classes (in Ireland, South Korea, Malaysia, Singapore, Taiwan and coastal China), and even created conditions under which workers could boost their living standards through industrial action. All too often, however, it created still further indebtedness to foreign banks which the national states had to cope with. In such cases a narrow stratum of people gained a taste of the fleshpots of multinational capital while the conditions of the mass of people deteriorated, or at best remained unchanged. A yuppie class lived in protected enclaves as if it were in the wealthiest parts of the industrialised world (and often went a step further and lived part of the year there), while much of the population festered in ever proliferating slums and shantytowns.

The assumption of the new economic ideology – most forcefully addressed in the “neoliberal” notions of the “Washington Consensus” of the IMF and World Bank – was that if some capital accumulation in some countries had been able to gain a new lease of life by reinsertion into the world system, it could do so anywhere if only the last restrictions on trade and the movement of capital were removed. But the reality proved to be rather different. A few areas attracted new productive investment, but only a few. At the end of the century only a third of worldwide foreign direct investment went to the “emerging markets” of the Global South and the former Communist countries, and of this more than half went to just four countries – China/Hong Kong, Singapore, Mexico and Brazil. Another quarter went to just seven countries (Malaysia, Thailand, South Korea, Bermuda, Venezuela, Chile and Argentina), leaving 176 countries to share out the remaining 25 percent. [106] And much of the investment was not new investment at all, but simply the buying up of already operating companies by multinationals based in the metropolitan countries.

These problems were most felt in the poorest regions of the world, especially Africa. However much they dismantled their old, protectionist, import-substitutionist policies, they still remained unattractive to the multinationals they wanted to woo: “Small, poor countries face increased barriers to entry in industries most subject to the global forces of competition.” [107]

Much the same applied to exports. China and a few other countries did continue to break into world markets. But the export orientation of these countries meant that their own internal markets for foreign-produced consumer goods did not grow at a corresponding speed and that their expansion was, in part, at the expense of other countries in the Global South. So African countries which had begun to enjoy some export growth in manufactured goods found themselves losing markets to China. The “combined and uneven development” that had characterised the long boom continued into its aftermath, with the difference that many economies actually contracted even as others grew rapidly. It was as if the “Third World” itself had split in two, except that immense pools of poverty remained even in the part that was growing.

Those who ran the local states could often feel insecure even when the developmentalist strategy was successful in its own capitalist or state capitalist terms. Their success depended upon a high level of domestic accumulation – and the other side of that, a high level of exploitation that could only be achieved by holding down workers’ and peasants’ living standards. But even when they succeeded in getting high levels of accumulation (which was the exception rather than the rule) they remained weak in their bargaining position with the multinationals. As multinationals took over local firms, their proportion of the local capital investment could rise to 40 or even 50 percent of the total, increasing their leverage over local decision making. But states in the poorer parts of the world did not have anything like the same leverage over multinationals, since the small size of their domestic economies meant they probably accounted for no more than 1 or 2 percent of the multinationals’ worldwide investments and sales.

Huge gaps usually opened up between what those who ran the state had promised the mass of people and what they could deliver. High levels of repression and corruption become the norm rather than the exception. When the developmentalist strategy ran into problems, something else accompanied the repression – the hollowing out of the mass organisations that used to tie sections of the middle class to the state and, via them, some of the working class and peasantry. The oppressive state became a weak state and looked to foreign backing to reinforce its hold.

All this happened as problems of profitability in the advanced countries drove their capitalists to look for any opportunity, however limited, to grab surplus value from elsewhere. There was not much to be got from the poorest of the poor anywhere in the world, but what there was they were determined to get. Imperialism meant that at the top level of the system rival capitalist powers argued vehemently with each other about how to satisfy their different interests. At a lower level, it meant constraining the local ruling classes of the Third World to act as collectors of debt repayments for the Western banks, royalty payments for the multinationals and profits for Western investors as well as for their own domestic capitalists. Debt servicing alone transferred $300 billion a year from the “developing countries” to the wealthy in the advanced world. [108] A website dedicated to defending US overseas investment boasted:

Most new overseas investments are paid for by profits made overseas. Foreign direct investment by US companies was only $86 billion in 1996 ... If you subtract out the reinvested earnings of foreign operations, the result was only $22 billion ... US companies’ overseas operations also generate income that returns to the US ... In 1995, this flow of income – defined as direct investment income, royalty and license fees, and charges and services – back into the US amounted to $117 billion. [109]

There could be no end to the squeezing. The share of foreign investors in the trading on the Brazilian stock exchange rose from 6.5 percent in 1991 to 29.4 percent in 1995 [110], and the share of new Mexican government debt held by non-residents grew from 8 percent at the end of 1990 to 55 percent at the end of 1993. [111]

Under such circumstances, the instability of the world economy in the aftermath of the “golden age” found heightened expression in the countries of the Global South. Even those expanding rapidly and extolled by neoliberal media commentators could suddenly be faced with near insuperable debt problems, deepening slump and possibly accelerating inflation – as happened in Mexico in the early 1990s, Indonesia in the late 1990s and Argentina at the beginning of the 2000s. And the fate of the mass of people in countries regarded as marginal by international capital, like most of sub-Saharan Africa, was deepening poverty, repeated famines and, all too often, recurrent bouts of ethnic conflict spilling over into civil wars, often financed by foreign firms interested in control of raw materials. There may never have been a golden age for such parts of the world. But there was certainly a leaden one.

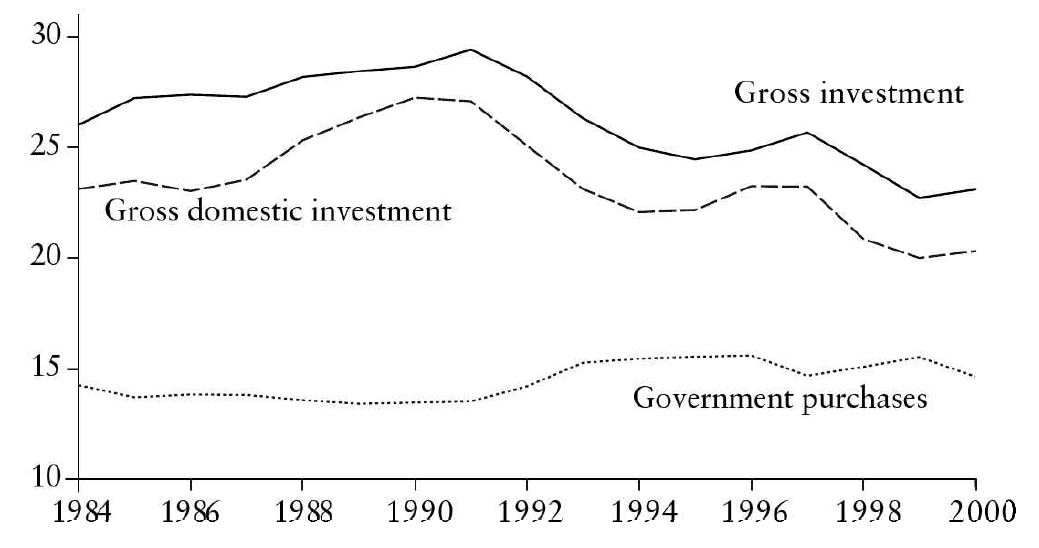

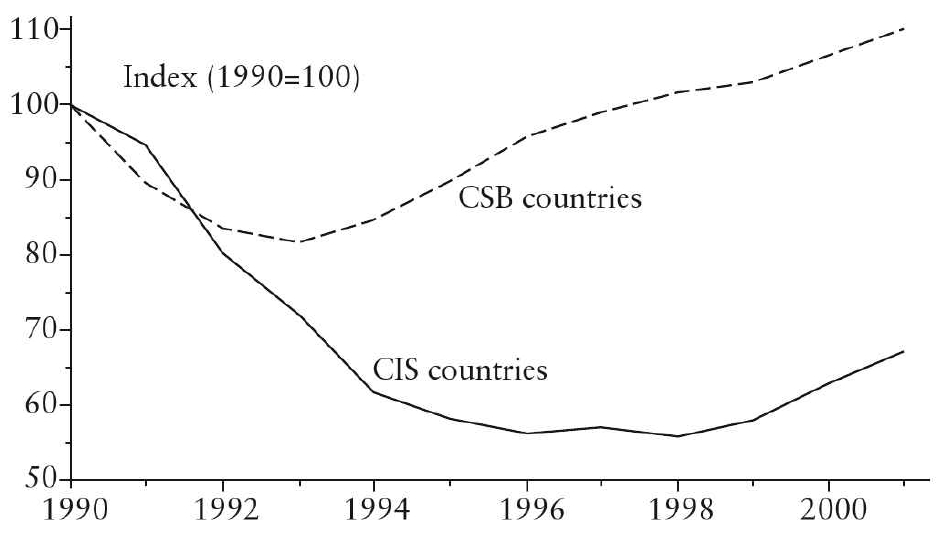

Global capitalism in the last quarter of the 20th century was marked once again by many of the features Marx had described. There were recurrent economic crises, and the restructuring through crisis of capitals, big and small, privately owned and state owned.

|

Graph: Economic growth of industrial countries (——) |

|

All the major industrial economies suffered at least three real recessions, except for France and Canada which each experienced one “growth recession” and two real recessions, and Japan which avoided a real recession for nearly 20 years after the crisis of the mid-1970s, only then to enter a 13-year period of near stagnation after 1992.