FIGURE I

Chart from Monthly Report on Civilian Production (Civilian Production Administration). Prepared by the OPA from data furnished by the Board of Governors of the Federal Reserve System.

Main FI Index | Main Newspaper Index

Encyclopedia of Trotskyism | Marxists’ Internet Archive

From Fourth International, September 1946, Vol.7 No.9, pp.267-271.

Transcribed, edited & formatted by Ted Crawford & David Walters in 2008 for ETOL.

The money of the United States was inflated on a tremendous scale during the war. The rise in prices, which is a delayed result of the inflation, began during the war, but has been speeding up since. Prices are rising at the sharpest rate now, a year after the war, although the inflation which pushes them up was accomplished through the war years. The inflation already carried out will push prices much higher before it reaches its full effect.

Government price control, through the Office of Price Administration (the OPA), along with wage control or wage-freezing, played an important part in the war program of the capitalists. But, as the evidence will show, it was not the function of these government programs to prevent inflation. They could only steer the bulk of the inflation profits to certain big capitalists, and away from the small fry among the capitalist class.

The amount of inflation, as compared with the money situation before the war, appears in the following report from the Christian Science Monitor of October 31, 1945, based on Federal Reserve Board figures:

Inflation comes when there are “more dollars than goods,” and prices are bid up. Here is the inflationary situation today:

The Federal Reserve Board estimates liquid assets in the hands of the public at 300 billion dollars. This is 8 to 10 times greater than the inflationary forces that caused difficulties 25 years ago.

Savings equal145 billion dollars. This is twice as much money as American consumer spent in 1939.

Since August,1939, balances in checking accounts have increased from 27 billion dollars to 72 billion dollars. This ready cash alone equals more than the entire amount spent by consumers in 1939.

A comparison with the situation after the first World War appears in another Monitor story of December 26, 1945:

The economic pressures that caused the decline in the value of the dollar after World War I were feeble compared with the gigantic pressures now threatening postwar stability.

After World War I, public savings were only 27 billion dollars, today they are 145 billion dollars.

After World War I, currency in circulation was only 7 billion 200 million dollars, today it is 26 billion 700 million dollars.

Checking accounts showed balances of only 27 billion 300 million dollars after World War I, contrasted to 69 billion 300 million dollars today.

Nothing quite like the present inflationary prospects were known after the previous war. It is like the steel of a trap, just waiting to be released.

The economic system of the United States is loaded with this mass of money-in-the-wallet and money-in-the-bank, without enough goods for the money to buy. This is more than an “inflationary prospect,” as the newspaper writer describes it. This is a matured inflation, already accomplished.

A glance at the amount of excess money is enough to show that it came from profits and not from wages, because workers do not get a chance to save such sums. However, there are plenty of official figures to prove the point. According to the Bureau of Agricultural Economics, 40 per cent of American families have only one per cent of the savings, amounting to $40 per family. The next 30 per cent of the families have 11½ per cent of the savings. The top ten per cent of the families have 60 per cent of the savings. They did not save out of wages. Beside these billions in personal funds stands the immense total of corporation savings, which also came from profits, not wages.

To manage the flood of wartime money, and keep it in their own hands, the capitalists used government price control.

Government price control under capitalism is not new, although in the United States it was never used before on such a large scale. Marx pointed out that the power of a monopoly brings on the interference of the state. Naturally, since the state represents the capitalists, it interferes for the benefit of the capitalists, and not to protect the mass of consumers. A classic example of capitalist price control is the regulation of railroad rates. They say this is done to protect the public. Yet the real history of railroad regulation shows that when the railroads got a monopoly of transportation, they were able to raise freight rates so as to drain all the profits of industry to the railroads. Railroad rate control was set up by the capitalist government to protect the rest of the capitalists from the railroads.

Wartime price control followed a similar pattern. It was created by the capitalists for their own protection. Only in this case they needed it to protect the big monopolies from the small capitalists and from the workers. The big monopolies needed government control over war-time prices of civilian consumers’ goods in order to keep wages from rising. True, wages were frozen by government order. But wage-freezing would have broken down if living costs had gone go high that the workers could not buy the necessities of life.

A war-time price limit on the civilian market did not hurt the giant corporations at this particular time because they were selling very little to civilians. They did not sell at controlled prices under OPA. They sold war supplies to the government, at uncontrolled prices, which they raised to high levels by cost-plus contracts.

In the main, the monopolies left food, clothing, and the rent of homes to the little capitalists. Without government price control, the little capitalists would have raised prices and rents, the corporations would have been compelled to pay out some of the war surplus in higher wages, so that the workers could meet the higher cost of living. In this way, through higher wages and prices, the little capitalists would have been able to get a large part of the war profits.

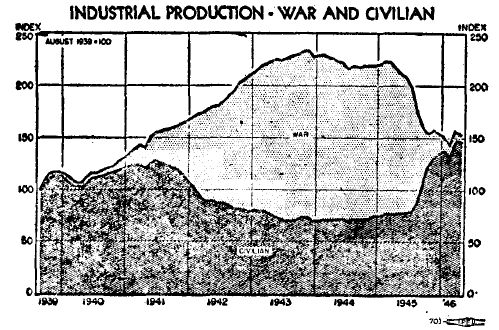

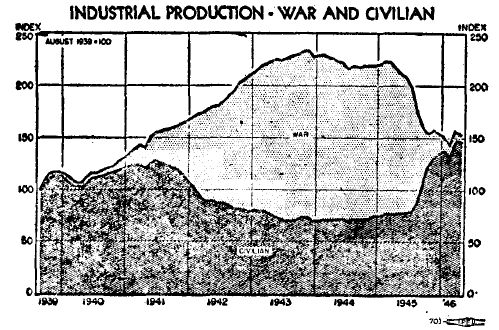

The chart in Figure 1 shows how big industry moved out of the civilian market, leaving the OPA behind to control it. It compares war production and civilian production from the middle of 1939 to the middle of 1946.

War production, the light grey section at the top of the chart, quickly grew to more than half of the total output of the nation. This war portion of production was all sold to one customer, the federal government.

The bulk of the war business went to a few monopolies. The recent report of the Senate Small Business Committee (entitled Economic Concentration and World War II), revealed that the top 100 corporations got two-thirds of the total business under government war contracts. These few corporations, in turn, are owned and controlled by eight financial groups such as the Morgans, the Rockefellers, the du Ponts, the Mellons, etc.

|

FIGURE I |

|

|

Chart from Monthly Report on Civilian Production (Civilian Production Administration). Prepared by the OPA from data furnished by the Board of Governors of the Federal Reserve System. |

Those financial groups wanted price control over civilian prices while they were selling elsewhere. Today these monopolists are moving back into the civilian market, and they take a different attitude toward the OPA, although they still have a certain use for it, for a few months.

The war function of the OPA was to hold down prices, in order to protect the wage freeze. In the main it did that, although it played favorites, allowed violations in many fields, and so on. The OPA held rents down, and it kept a firm control over prices received by farmers. The rent control afforded a contrast to conditions in World War I, when rents soared. Prices to farmers were controlled by the government during the last war, although not as tightly as under the OPA. Both these strongly-controlled fields, rent and farming, are in the hands of small owners. On the other hand, in the fields of food and clothing the OPA allowed prices to rise 100 per cent or more, which was the same rise as during World War I. Yet even in these lines the OPA actually held prices below the level they would have reached without control; for we have seen that the amount of excess money was “8 or 10 times” as much as in World War I.

When the war ended, big business started selling again in the civilian market. That finished their need for the price-limiting function of the OPA, finished it completely. From then on they could use the OPA only to raise prices. The OPA gives them official sanction for price increases. Through the OPA they put the responsibility for higher prices on the government. That is how they are using it now. The OPA hands out price increases, saying they are given “because of increased costs,” or some other excuse. Meanwhile the OPA enforces wage limitation. Employers are held to the government wage formula because the OPA will refuse to give them “price-relief” if they pay higher wages.

Wage-freezing ended when the OPA expired on June 30, 1946. A month later, when the OPA was restored, its first act was to announce that it would “roll back wages” to take away any wage gains that workers had won during the month. From now on the OPA can only furnish official cover for price raises, while it gives an excuse for, and enforces, wage-freezing.

Additional light is thrown on the character of government price control when we turn to another aspect of the question, the reason for inflation. What was the real cause of the war inflation, which the government claimed to be preventing through price control and wage-freezing?

In a recent editorial the Wall Street Journal gave a correct and compact statement of the cause of inflation: “The source of inflation is a government deficit, financed by means which amount to printing money.”

Wartime inflation by government deficit spending was the reason for the OPA. Senator Taft, the Republican floor leader, said as much on June 27, in his tirade against the OPA:

I feel very strongly that OPA during the war was essential ... I think that anyone who calmly examines the question must conclude, no matter what the faults of price control, if we are going to incur annually a 50 billion dollar deficit to conduct a war, it is necessary to have price control.

We can find testimony on one more point from official sources before we start to trace the inflation process for ourselves. The deficit did something else: it produced the war profits; and that’s the real reason behind inflation and the OPA. The government deficit was the source of the war surplus which gave war profits to the capitalists. The government created the deficit to provide the war profits.

The Treasury Department gave figures on this when it issued a summary of the total spending, government and private, during the six years of the war and pre-war period, 1941 through 1945. An Associated Press report of this summary on July 22, 1946 states that during these six years:

The federal government, while spending 365 billion dollars, took in but 156 billion dollars in taxes. So it had a deficit of 209 billion dollars.

State and local governments took in 58 billion dollars in taxes, but spent only 50 billion dollars. So they wound up about 8 billion dollars ahead.

Individuals and corporations came out 201 billion dollars better off, because their income was 773 billion dollars after their taxes were paid, and their other expenditures were 572 billion dollars.

In fact, the 8 billion dollar surplus piled up by state and local governments and the 201 billion dollar surplus accumulated by individuals and corporations exactly equaled the federal deficit of 209 billion dollars. (Italics supplied.)

That, say the treasury men, was no accident, since “total spendings and total income are really the same figures – they are the head and tail of a coin.”

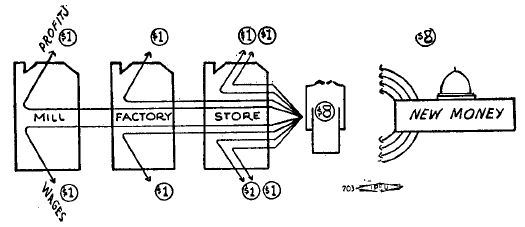

We can visualize this process in terms of the diagram, Figure 2, which is a simplified portrayal of the flow of commodities and money in a capitalist system. The section of the diagram labeled “New Money” represents inflation, and in the first discussion that part will be left out. Cover it with your hand or imagine it isn’t there.

The commodity pictured is a coat. A mill makes the cloth and sells it to a factory. The factory makes it up into a coat and sells it to a store. The store then sells the coat at retail to the consumer. The final price is eight dollars. The eight lines leading back from the coat show what happens to this money.

For the sake of simplicity we start with the mill, although in reality the mill would have to buy cotton or wool for raw material before it could start. But going back further in the stages of production would not change the point which the diagram shows.

|

FIGURE II |

|

The mill sells the cloth to the factory for two dollars. The mill gets the two dollars, which it then pays out. We can suppose half the money goes to the workers, as wages, and the other half to the owners, as profit, interest and rent. The lines show one dollar going as profit to the owners, and the other paid as wages to the workers.

The factory makes the coat and sells it for four dollars. Of this, two dollars goes back to the mill for the cloth. That leaves two dollars for the factory which can be paid as shown, one dollar to the owners and one to the workers.

The store gets the coat for four dollars and in keeping with the usual retail mark-up, sells it for twice as much, i.e., eight dollars. After paying four dollars for the coat, the store has four dollars left, which can be paid out as the lines show, two dollars to the workers, for advertising and selling, and two dollars to the owners.

Then the coat is sold for a price of eight dollars. The important point is that during the flow exactly eight dollars of net income was paid out in the economic system to owners and workers. That is just enough income to buy the coat.

We can consider the coat as standing for the total output of all commodities. The owners and workers can take their money to the market, and in total, they will have just enough money to buy the commodities that are there for sale. Under normal conditions there always is that balance between commodities and income.

The eight-dollar price of the coat is equal to the eight dollars of income paid out, for the very good reason that the income came from the coat. As the economists say, income equals output. It must, because the income comes from the output, just as this eight dollars of income comes from the sale of the eight-dollar coat.

We can trace the effect of a wage increase in this economic system. Suppose wages increased in the factory in this diagram, so that the workers got a dollar and a half, instead of a dollar. That would leave only fifty cents for the owners out of the two dollars the factory gets. The workers would be getting more, but there would not be more total buying power in the economic system. The income of the owners would go down by as much as the workers’ income went up.

Would there be a surplus of buying power because of this wage increase? No, for the total buying power would not be changed. There would still be exactly enough income to buy the output. Could the factory raise prices because goods were scarce, and thus pass the wage raise on to the consumer? No, because there would be no scarcity; there would be no excess of buying power to cause a shortage of goods or a change in the price level. In such a case, as Karl Marx summed it up in Value, Price and Profit , since the increase of the purchasing power of the workers comes from an advance of wages:

... that increase of their purchasing power must exactly correspond to the decrease of the purchasing power of the capitalists. The aggregate demand for commodities would, therefore, not increase, but the constituent parts of that demand would change. The increasing demand on the one side would be counter-balanced by the decreasing demand on the other side. (Page 15)

The typical result, Marx showed, would only be an increased demand for things the workers buy, for necessities such as food and clothing, while there would be a lowered demand for things the capitalists buy, for luxuries. This could bring only a temporary rise in prices of necessities, and a temporary fall in prices of luxuries, until production shifted to turn out more goods for workers. Then prices would be equalized again, but there would be more production of goods for workers, and less luxuries.

If the capitalist newspapers were right in saying that inflation has been caused by increased wages, we would see just such an increased demand from the workers’ side of the market, with a lowered demand from the luxury side. But the opposite is the case. Industries are stopping production of low-priced articles and changing over to high-priced goods. They rebelled against the OPA’s “maximum average price” regulation which made them keep part of their production in low-priced lines, and Congress has now killed the regulation. The stock market is booming because the owners have a mass of extra money to invest, more than they know what to do with.

Besides the extra money in the market, there is more money in the banks that doesn’t come to the market. The balance between income and output has been destroyed. It was destroyed by the methods which the government used to pay war profits. To follow the path of war profits, look back to the diagram, Figure 2, still leaving out the section “New Money.” Suppose the government needs part of the goods produced for any purpose, including war. It can levy taxes to buy the goods. Suppose it taxes 25 cents of each dollar of income from all owners and workers in the diagram. The government would get a total of two dollars to buy goods. The buying power of the owners and workers would go down by that amount, two dollars. The balance between money and goods would not be changed; there would still be no surplus of money, and no excess of money over goods.

During war a country must produce more than usual. Would there be enough income to tax to pay for this war production? Yes, just exactly enough. As the diagram shows, production creates an equal amount of income. The increased war production would be accompanied by exactly enough income to buy itself. The government could tax this income to pay for the materials it was burning up in the war.

How much taxes? The government spent roughly 66 billions a year during the war. They could not tax that from the workers, who were not getting that much. Moreover, they had to leave the workers enough to live on or they could not produce, and most of the workers were getting just enough to live on at the start. Even with the severe tax that the government put on payrolls, it could not get enough out of wages to pay for the war.

The only other kind of income to tax is profits. There were enough profits to pay for the war production. There had to be, and there were just enough and no more. The government could have taxed away those profits to pay for the war. As the Treasury reported, exactly the amount the government did not tax was left as surplus. But taxing it would have left no war profits for the capitalists.

There are just two ways to finance government spending: by taxing or by inflation. The government did not want to tax away the war profits of the capitalists. So it chose to buy without taxing income from production. That meant it had to create fictitious income, without production. Such fictitious income, or false money, is inflation.

It is sometimes said that there is a third method of government financing-borrowing. This can be done in two ways: (1) from individuals and corporations, or (2) from banks. Government borrowing from individuals and corporations is not really a third way; it merely delays the choice between taxing and inflation. At the time of paying back the loan the government must choose between one or the other. The other way, government borrowing from banks, is inflation without delay, as we shall see.

Inflation brings into the diagram the right hand portion, “New Money.” The building with the dome represents the government. The eight lines flowing out represent eight dollars of newly-created buying power from the government. No goods are flowing from the government to match the money. That’s why inflation money is false purchasing power. It is not matched by goods.

Inflation is an act of government; it comes from new money which the government creates. It comes from a deficit because that is why the government needs the new money, so that it can spend more than it receives in taxes.

As the diagram shows, inflation puts eight extra dollars of income in the market to buy the coat, besides the eight dollars that the owners and workers already have. That’s 16 dollars to buy eight dollars’ worth of goods. This produces the condition that we see in the United States: more money than goods, with a general rise in the level of all prices, instead of a rise in one type of prices and a fall in other prices.

Inflation money causes a temporary artificial demand for goods, producing a typical short boom, which also is the condition we see in the United States. Such an inflationary boom always is followed by a crash.

Money from inflation buys goods just like money from production. The result of 16 dollars in the market with only eight dollars of goods to buy, creates a high demand, and prices go up to meet it. They go up until the price of the coat is 16 dollars. Another way of saying this is that every dollar in the economic system becomes worth only fifty cents. The fictitious income from inflation takes over part of the income from production. It does it by sucking away part of the value of every dollar.

That is what the accumulated war profits are doing. When the capitalists spend their fictitious income they buy real goods. Or perhaps they pay out the fictitious money as wages and the workers then spend it for real goods. The inflation money sucks away the value of real money. Prices go up. Every dollar becomes cheaper. There is no way to stop this by limiting future government spending. The extra money is already in the bank accounts of the capitalists and their corporations. The water is out of the faucet.

The government did not issue the extra money by printing, but by borrowing from banks. It is a widespread idea that inflation comes from printing money, but this is not correct. Bank financing, not the printing press, is the normal method of inflation in modern nations. The fact is that the laws are so drawn that when a bank loans money to the government it merely creates the money. That is what the Wall Street Journal spoke of as financing a government deficit “by means which amount to printing money.”

The magazine Newsweek on March 18, 1946 summarized the amount of such operations during the war:

The government borrowed about one hundred billion dollars from banks, giving government bonds as security. A bank, on receipt of a $1,000 bond, set up a $1,000 credit for the government. That money was created, just as if it had been printed …. Because of the bank’s heavy investment in government bonds, about half of all banking income now comes from interest on them. (Italics supplied).

It would be more accurate to speak of the heavy “holdings” of the banks in government bonds, rather than calling them “investments.” They did not invest a penny, as the magazine itself makes clear. The bank loans to the government came from nothing. The banks hold a hundred billion dollars in government bonds as a clear gift.

The banks got the bonds, and paid by creating an equal amount of new money, in the form of a checking account for the government. The government wrote checks, to pay for guns, ships, planes, and other war purchases. The corporations got the government payment, and either banked it themselves, or paid it out as wages or for materials. That sent the income circulating in the economic system, and furnished the growth in bank deposits and liquid funds reported at the start of this article.

Those funds came from nothing, but are spent for goods. And when the government pays the interest and principal on the bonds, the banks will demand that the government pay them in money that will buy 100 billion dollars worth of goods.

How much goods for 100 billion dollars? Well, the capital equipment of all American industry at the start of the war was worth about 40 billion dollars (according to the Senate report already cited). So in war profits the banks alone acquired a paper empire equal to twice the industrial equipment of America. The only trouble is that as this paper is spent, it finds no corresponding goods to buy. So the paper feeds as a parasite on real income from production. It feeds by raising prices, drawing value from all money.

The government borrowing from banks is about half the war deficit, and it has produced the inflation we are now beginning to feel. The other half, borrowed from individuals and corporations, is an equally large fictitious paper empire. It does not inflate the money system yet, but it surely will as the holders of the paper collect from the government (because the government will not want to tax then any more than now).

It is clear that the capitalists, through their war policy, escaped on paper from all normal limits to accumulation. They were able to soar far beyond the possibilities of accumulation of real wealth. Now they have paper certificates for 200 billion dollars, which is four times the total of real industrial wealth in the country, the actual buildings, machinery, and goods in industry. The trouble is, when they cash this paper for real goods, the real wealth must spread out to cover their inflated mass of fictitious dollar values. That means prices go up, the cost of living goes up. Nothing can prevent the rise as long as the capitalists are spending these fictitious values.

Although the present inflation is tightly linked with war financing, the use of inflation in general should not be considered as merely a war measure. As a matter of fact, in this era of capitalist decline, the capitalist system has a chronic need for expansion, which leads to fictitious expansion of capital. The war financing was a special case. Fictitious expansion, in turn, brings on monetary inflation. So a tendency toward inflation, in war or peace, is chronic in the era of capitalist decline.

From this survey of the cause of inflation we can see how much the monopolies had at stake, and how much they needed price control during the war. Their profits were pumping colossal quantities of money, unmatched by goods, into the economic system. Large sums of money were bound to get to the market, in payments to war workers and in purchases by the capitalists. This excess demand would have supported soaring prices in the civilian market with an inevitable rise in wages. The monopolies were in a most vulnerable position. They would have lost uncounted billions without the OPA. The OPA served the monopolies well during the war by holding prices down, and now serves them well again by raising prices.

The history of past inflations shows that after money has been cheapened it stays cheapened. Sooner or later all prices go up to new levels, to match the lowered value of money. Eventually wages go up also; usually it has taken a longer time for wages to rise, because the workers have had less bargaining power. A sliding scale of wages, rising automatically with the cost of living, would eliminate the time lag which has delayed the rise of wages in previous inflationary periods. The slogan of a sliding scale of wages mobilizes the bargaining power of the labor movement in the most effective way by directing it toward the key problem.

The capitalists profit from the time lag. The more they can cripple the bargaining power of the workers, the longer they can hold down wages while prices rise, the more they increase their profits. Their present method of holding back the workers is to continue wartime wage-freezing, on a promise of price control, backed up by a shell of the old OPA as bait. The OPA is helped in this job by the prestige it holds because it really limited prices during another period. The workers recognize that it did a poor job, but they know it did do something.

The capitalist politicians are using public trust in government price control to support wage-freezing during the new period of government price-raising. It is important for the workers’ movement to make the facts clear, to show the reason for what the OPA did during the war; to show that it was not functioning for the workers at that time any more than now.

Main FI Index | Main Newspaper Index

Encyclopedia of Trotskyism | Marxists’ Internet Archive

This work is in the Public Domain under the Creative Commons Common Deed. You can freely copy, distribute and display this work; as well as make derivative and commercial works. Please credit the Encyclopedia of Trotskyism On-Line as your source, include the url to this work, and note any of the transcribers, editors & proofreaders above.

Last updated on 10.2.2009