IMR Index | Main Newspaper Index

Encyclopedia of Trotskyism | Marxists’ Internet Archive

From Irish Marxists Review, Vol. 2 No. 6, June 2013, pp. 4–16.

Copyright © Irish Marxist Review.

A PDF of this article is available here.

The links have been slightly modified and checked (May 2020).

Transcribed & marked up by Einde O’Callaghan for the ETOL.

Despite the repeated assertions of Government ministers and orthodox commentary, we are not all in this together. We are not all being asked to make, nor have we made, an equal and proportionate contribution to resolving a crisis that originated in the global financial sector. That productive forces have had to make any sacrifice for the speculative activity in finance capital shows otherwise. We have had a series of inter-locking debates during the crisis spending and taxation, public and private sectors (usually focused on wage differentials), the level of social transfers, bank bondholders and the Eurozone; in all this there has been one issue that has failed to even surface in the mainstream discourse: the relationship between labour and capital compensation. This is largely due to the success of the ideological rhetoric that has suborned the debate under a ‘we’re all in this together’ rubric and a general lack of interest in such issues (if one maintains that we are living in a post-class society, what’s the point of looking at class impacts). The following is intended to help address this deficit, to provide some pointers and to start an alternative analysis. For the real story is how capital has succeeded in diverting the debate in order to veil a wider political agenda – to maintain and strengthen its hegemony in the Irish economy.

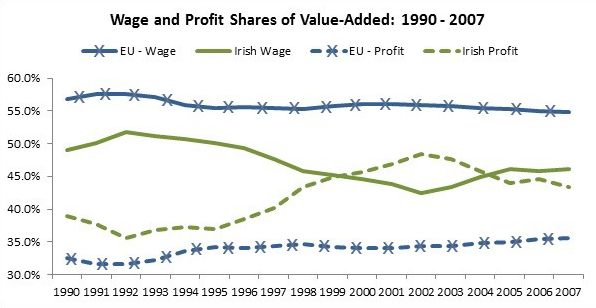

Though it has limitations, one way to measure the relationship between labour and capital is to examine their shares in value-added created in the economy. [1]

|

As seen, Irish profits have taken a larger share of value-added than the European average. [2] The gap widened substantially following the first phase of the Celtic Tiger boom (the phase associated with foreign direct investment, export growth and manufacturing activity); however, even prior to this period Irish profits held a strong position in the economy. The corollary of this was that the wage share was much lower in Ireland than in the rest of Europe. It was only in the latter phase of the economic boom that the wage share rose slightly here, reflecting the employment growth in the domestic economy fuelled by property/construction activity. Even then, the Irish wage share was significantly lower than the European wage share.

During this long period in the run-up to the recession, economic orthodoxy became entrenched in the political debate. Foreign investment was facilitated with a corporate tax regime that turned Ireland into an international hub for tax avoidance; the low-tax ideology was so prevalent that even the social democratic party, Labour, felt the need to fight the 2007 election campaign on a tax-cutting platform; the trade union movement was absorbed into social partnership agreements in which it was unable to resist privatisation, but also unable to win minimal concessions such as the statutory right to collective bargaining. The cult of the ‘entrepreneur’ was nurtured while the logic of collective action was dismissed as an historical anachronism in an atomised culture that valued consumer choice and the illusion of individual advancement.

However, it would be a mistake to overlook the real material gains accruing to workers during this period. Real wages grew; unemployment, in particular longterm unemployment, fell to historic lows; increased social transfers reduced poverty and deprivation while boosting in-work incomes; public services expanded even if they were hampered by lack of planning and perverse private profit incentives (e.g. the health sector): all these pointed to a growing prosperity, albeit prosperity that was shared unequally.

The property boom, fuelled by the Government through tax policies, papered over the historical under-achievement of the indigenous sector. Between 2000 and 2007, construction made up over 26 percent of total employment growth – and this doesn’t include employment in property-related sectors; in the EU, the equivalent ratio was less than 10 percent. Revenue from property-related activity allowed the Government to increase social transfers, increase employment in the non-market services sector, reduce taxation and increase wage-floors in Joint Labour Committees. These pro-cyclical policies which fuelled the property boom may not have been economically rational but, at root, it was a populist political project in keeping with Fianna Fail’s traditional broad-class project.

That it would fall apart was never in doubt – property busts fall in the same proportion as they rise above sustainable growth in incomes and credit. That the domestic collapse occurred at the same time as the crisis in the global financial sector meant that new strategies were needed to rehabilitate and rejuvenate capital.

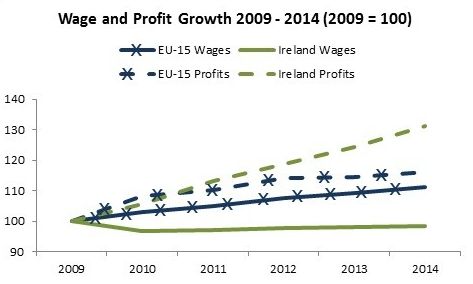

|

The collapse in employment and wages in Ireland was nothing short of extraordinary. Between 2007 and 2011, Irish employment collapsed by over 14 percent; in the EU the decline was a mere 1 percent. This was mirrored in the collapse of aggregate wages. In Ireland, during this period, wages in the economy fell by over 13 percent while wages actually grew in the EU by 4 percent. [3] This collapse was explained away by reference to the collapse in the property sector. There is much to this; however, nearly 50 percent of this employment collapse occurred outside the construction sector and, even among building workers, the substantial cuts in the Government’s capital budget would have made a significant contribution to job losses. However, as will be seen below, it was helpful to the orthodoxy to lay the blame on the property collapse.

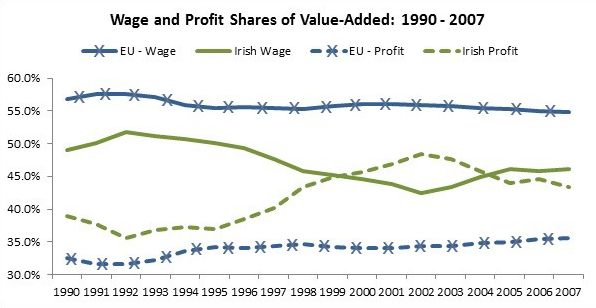

It was also helpful to explain away any divergence from European norms by simply ignoring them. When such comparisons did appear, there was an appeal to Irish ‘exceptionalism’. This was particularly true in the debate over fiscal policy – we may need expansionary fiscal policies in Europe but in Ireland it wouldn’t work ... because Ireland is an exception to traditional anti-cyclical policies. And in other cases, comparisons with European norms were just made up. For instance, commentators declared that we were pricing ourselves out of the international market. However, labour cost data showed otherwise (see chart). [4] Irish labour costs in the manufacturing sector ranked in the lower half of the EU table and well behind wage-suppressed Germany. Given that labour costs in the manufacturing sector make up only 10 to 12 percent of overall production costs (less in the modern sector such as pharmaceuticals) the argument that wages were ‘too high’ was not based on the available evidence. This didn’t stop the argument, however, from dominating the debate. With the collapse in employment and wages, profits also fell. In the first two years of the crisis Irish profits fell by 18 percent compared to an 8 percent fall in the Eurozone. The collapse in Irish profits was driven by the collapse in construction activity and the fall in consumer demand.

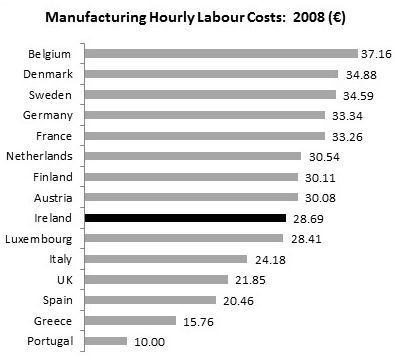

The drive to restore capital’s hegemony was enthusiastically assisted by successive governments. Ministers elevated the corporate tax rate to almost theological status (‘sacrosanct’); it opposed the proposed EU-wide consolidated tax base, an attempt to limit transfer pricing and profit-tourism; it promoted wage devaluation and ‘flexible-labour‘ policies; and privileged foreign investment through tax subsidies and shielding the private sector from fiscal consolidation. The early signs show that policies designed to restore capital’s place in the Irish economy are bearing fruit.

|

As we can see, the EU Commission expects nominal wage growth (average per employee) in Europe overall; in Ireland, however, wages are expected to remain below the 2009 levels. Profit growth in Ireland, on the other hand, is projected to rise faster than the EU average.

With profits rising and wages stagnating, capital needed a powerful narrative to maintain labour and popular quietude. It found that in the powerful asserting that ‘we were living beyond our means’. If people believe that it was their life-style that contributed to the crisis, then convincing them that we should be ‘living within our means’ (read: wage and income suppression, social transfer reduction, etc.) makes the political pro ject of enhancing capital that much easier. We ‘partied’ in the words of the Taoiseach at the Davos Summit. The alleged blow-out in wage growth helped create the bubble that, when burst, brought calamity to the productive economy and public finances. Therefore, goes the narrative, we must return to more frugal incomes.

Such narratives do not take hold just because an elite announces them. The nation was saturated with an endless stream of evidence – both factual (in a fashion) and anecdotal: public spending out of control, public sector wages (and the controversial ‘public-private pay differential’), high wages and social protection payments in European comparison, etc. This propaganda offensive was largely successful for at some turns in the national debate one would be forgiven for thinking that it was excessive unemployment benefits that was the cause of the crisis rather than unregulated finance capital.

Space does not allow us to engage in a comprehensive deconstruction of all the assertions and statistical maulings that has been put forward as evidence for the proposition that we lived beyond our means. However, below we look at a few examples.

(a) Wage Growth in the Market Economy

There is no disputing that wage growth in the Irish market economy was higher than the EU average during the boom period. Between 1995 and 2007, Irish market wages rose by an average of 8.5 percent annually while in the EU-15 the annual rise was 2.2 percent. These and similar data, produced in the forms of index growth, were presented as evidence that we were ‘pricing ourselves out of the marketplace’. What this, of course, disguises is the context in which this wage growth occurred.

For instance, in the manufacturing sector – a key sector for an exporting economy – wages rose by 56 percent in Ireland compared to an average increase of 29 percent in the other EU-15 countries. This and other isolated statistics fuelled the argument that wages were ‘pricing us out of the international marketplace’. However, the full comparison was never provided.

|

Employee Compensation: Total Economy | ||||

|---|---|---|---|---|

|

|

2000 |

|

2001 |

|

|

Average of other EU-15 countries |

18.68 |

23.44 |

||

|

Ireland |

16.03 |

24.45 |

||

During this period, wage growth in Ireland was only catching up to EU averages according to the EU Klems database. While hourly average compensation marginally exceeded the EU average by 2007, productivity compensated for this according to Forfas. Irish productivity (value-added output per hour worked) not only exceeded the EU average in absolute terms but productivity growth also exceeds the EU average between 2000 and 2007. This was a considerable achievement given the high level of relatively low value-added construction activity. [5]

(b) Consumption

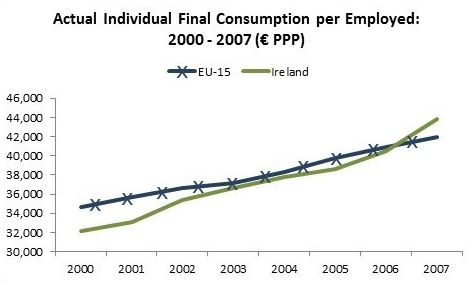

Consumption during the period of the boom increased dramatically which gave fuel to the assertion that people were living beyond their means. However, this increase was in large part due to the substantial rise in employment. Between 1995 and 2007, EU-15 employment rose by 16 percent; in Ireland employment rose by 65 percent. When this rise is factored in, consumption in Ireland rose in line with EU norms.

|

That Ireland had a younger population (on average, a younger population will consume more than economies characterised by an older demographic which disproportionately saves) provides further evidence that consumption growth was consistent with employment growth.

(c) Mortgages

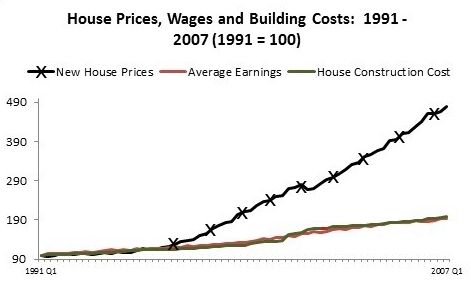

Another assertion is that as a nation we over-purchased housing. The response to this household debt crisis is to individualise responsibility rather than treat it as an issue of political economy. To what extent, however, were property prices and the resulting debt attributable to the speculative market? [6]

|

During the boom period, the cost of building a house increased at the same rate as average earnings. However, new house prices grew at an exponential rate. All three indices remain in tandem up to the mid-1990s. By 2007, however, new house prices grew at four times the rate of both building costs and wages. The gap between new house prices and construction costs can be considered as the ‘speculative premium’ – a premium that was imposed on households. Forcing households into debt was the very basis for substantial profits in the financial sector. The extent to which media commentary and social forces extolled the virtues of home ownership – not as an instrument of shelter (though, for most this was the primary purpose) but as a means of wealth accumulation – was overwhelming. This involved not only financial institutions, property and building interests, and the political elite, but other important constituencies: realtors, mortgage brokerage, media editorial policy driven by property advertisement revenue, etc. This commentary combined with lax planning regulations, a poorly developed rental sector (which meant for many that house purchase was the only realistic option) created an inexorable property consumption increase as workers tried to purchase shelter.

Households had to cope with this speculative market in one of two ways: they either had to take on mortgages that were only sustainable in a period of full employment and increasing real wages, or they had to move a considerable distance from their workplace to find relatively moderately priced houses. Even contending with speculative prices, it is worth noting the relative size of mortgages that were obtained during the latter stages of the property bubble.

|

Range of Loans Paid 2004–2008 (%) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

|

|

2004 |

|

2005 |

|

2006 |

|

2007 |

|

2008 |

|

Not exceeding €100,000 |

8.8 |

5.6 |

3.5 |

3.5 |

4 |

||||

|

€100,000–€250,000 |

79.9 |

72.7 |

64.9 |

62 |

67 |

||||

|

€250,000–€400,000 |

10.8 |

20.4 |

28.7 |

31 |

27 |

||||

|

Exceeding €400,000 |

0.4 |

1.3 |

2.9 |

3.5 |

2 |

||||

Even at the zenith of house prices two-thirds of mortgages for first-time buyers were valued at €250,000 or less. Large mortgages – over €400,000 – made up only a fraction of the total amount of loans. This does not suggest a house-purchasing constituency extending themselves for the purposes of wealth accumulation.

In all this, wage growth, consumption and housing prices, Irish households had to contend with high inflation rates. Not only did wages chase consumer price inflation, they also had to contend with the inflation of housing assets – a category that is not included in the official inflation figures at European level.

While there were serious flaws in the economic base (discussed below) during this period – not least of which was the reliance on property activity – those flaws had little to do with ‘paying ourselves too much’. But the extent to which people accepted the proposition that deflationary policies were necessary (‘correction’ was the usual way they were described, implying, there was something incorrect in what people had been doing) was the extent to which capital’s agenda succeeded.

If we must now undergo correction to rectify nearly a decade of living beyond our means, the incidence of that correction still needs to be fought over. A progressive agenda, pursued by those who accepted the ‘correction’ thesis, could still require a substantial contribution from capital: raise taxation and the social wage (employers’ PRSI) to average European standards; extend collective consumption of goods and services (i.e. create and expand public goods that can be shared at below-market costs); rebalance the relationship between labour and capital – if not between wages and profits then at least in bargaining power in the workplace. To resist the emergence of such an agenda, capital must first create divisions among social forces that might participate in such an agenda. The debate over the public-private sector pay differential was a helpful tool in this regard (one Minister claimed this differential could cause a civil war [7]) as was the debate over social transfers which were considered ‘high’ by EU standards and were acting as a disincentive to work.

But capital must also create alliances by driving narratives that certain key constituencies can identify with. The ‘squeezed middle’ was one such narrative – a highly constructed social constituency that has been given fictional attributes which bear little to relationship to the empirical middle strata in society. However, it has been instrumental in diverting attention to ‘the cost of the state’ – which is being disproportionately borne by this fictional grouping.

This story resonated. Most people do not perceive themselves as ‘rich’; nor would many accept that they are poor. They are happy to describe themselves as middle; they work, raise children, own a home – it is a modest self-image that, indeed, undermines economic theories that reduce people to aggrandizing economic units. The problem is not the self-image. However, the perception of being ‘squeezed’ between the welfare classes (who are labelled as those living a life-style existence on social protection benefits) and the ‘rich’ (who are referred to as bondholders) gives rise to a populism that programmatically targets the former while only rhetorically refers to the latter.

Popular stories describing the ‘squeezed middle’, however, present households which are not representative of the actual middle: households suffering from buy-to-let negative equity, difficulties meeting private school fees, reliance on one higher-professional income, etc. What does the ‘squeezed middle’ look like in income distribution terms?

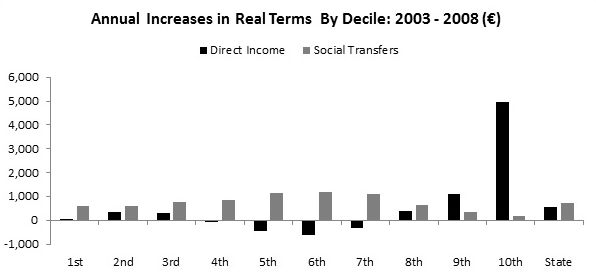

The ‘squeezed middle’ can be found primarily in the 4th to 8th deciles (which makes up more than 58 percent of the working age population). [8] Most households in these deciles experienced annual real (i.e. after inflation) declines in direct income [9] in the five years leading up to the crash. This may seem counter-intuitive as this period has been characterised as one where everyone gained. The squeezed middle, however, only gained by increases in social transfers.

|

The lowest deciles – from the 1st to the 3rd – received real increases from work. A large part of these gains would have been from increases in the minimum wage and wage floors under Joint Labour Committees. These real gains in direct income were complemented by similar gains in social transfers.

The highest decile were the real winners in this period – 85 percent of the increase in direct income in the state accrued to the top 10 percent households.

In the latest data available (2010) we find the average income per person at work in this squeezed middle lies between €14,500 and €31,600. [10] This includes those working on the minimum wage to those on average wages. The majority of the squeezed middle earned less than €28,000 a year. As a consequence, a substantial proportion of the squeezed suffer multiple deprivation experiences as measured by the CSO.

|

Percentage Experiencing Multiple |

|

|---|---|

|

Decile: |

2010 |

|

4th |

31.5 |

|

5th |

26.2 |

|

6th |

18.6 |

|

7th |

15.5 |

|

8th |

7.1 |

|

State |

22.5 |

Among the squeezed middle there are high levels of deprivation – in some cases, even higher than the state average. What is noteworthy is that all this hardly fits the popular presentation of the ‘squeezed middle’. Issues more appropriate to the reality that hundreds of thousands of people experience include employment, wage increases (including the national minimum wage and JLC wage floors, labour rights in the workplace – right to collective bargaining, policing of labour laws); an increase in public goods and services; debt write down on modest mortgages; in other words, class issues. But this would not sit so well in the popular narrative. Better to create a new ‘squeezed middle’ that better suits an agenda that poses the public realm as problematic. The fact that prior to the crisis workers in the middle strata were supported by this same public realm through social transfers, and greater access to public services (e.g. higher education), labour market interventions through statutory wage increases and state-organised collective bargaining – all this was lost in the popular debate.

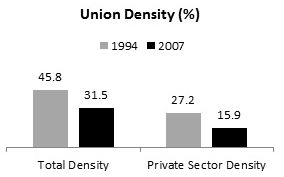

It is difficult to be optimistic. This goes beyond the question of what political vehicle can realistically drive a progressive programme. The level of trade union organisation has been chipped away at over the last two decades. Part of this can be explained by unique Irish circumstances; notably, the participation in national wage agreements and the politics of social partnership which undermined grassroots activism. However, the decline of organised labour has deeper roots in the changing structure of the labour force, a new culture of autonomy and choice accompanied by a fragmentation of the social, and a popular scepticism towards centralised institutions.

|

Whatever the dynamic of contributing factors, organised labour is disappearing from the private sector in Ireland. Union density fell from 46 percent of the workforce in 1994 to less than a third in 2007. In the private sector, density fell to 16 percent. [11] All this created a perfect storm when the crisis hit. Not only were the very instruments that supported the low and middle strata – social transfers, labour market interventions – coming under attack, organised labour had become weakened over the boom years. With social democracy entering into government only to implement fiscal contraction and wage/labour devaluation policies, the prospects for progressive change look to be limited.

However, were there to be a progressive programme capable of mounting a counteroffensive against capital – accepting that in the short-term it would be of a tentative character – what would it look like? What issues should organised labour focus on? The following looks at three particular issues within a broad-based anti-austerity coalition of policies.

First, is the strengthening of labour rights in the workplace. In the popular debate this has been reduced to ‘the power of trade unions’ or trade union ‘bosses’. It is imperative that workers pose the issue in alternative creative ways. For instance, the right to collective bargaining is about workers having the same right as employers in the bargaining environment; namely, the choice of agency through which to bargain. This right begins with the individual worker, not in the offices of trade unions, and their choice is whether to choose a collective agency or not, without external pressure. Posing the issue from a bottom-up perspective (e.g. it is the right of the cleaner, the waiter, the secretary, the factory-floor or building-site worker) turns the issue from an institutional to a popular one, based on the autonomy of the individual. This autonomy, however, must be complemented by a framework in which that choice can take place – a collective framework that can only be put forward by the organised movement. The United Kingdom model, which operates on this island, is one such framework. The right to collective bargaining, therefore, must become a fundamental demand. Such a statutory right does not automatically reverse capital’s position in the workplace, but without it organised labour faces an even more uphill struggle.

The statutory right to collective bargaining is, however, only one part of a general programme of labour rights. There are two more (among many) presented here. First, is the right to full-time work for part-time workers. This right, part of the EU Directive on Part-Time Working [12], has yet to be transposed into domestic law. Where, in a firm, a full-time job becomes available a part-time worker has the right to take up that work if they so wish (or not if they don’t). The intention is to give greater flexibility on workers’ own terms.

This has a particular impact in the low-paid sectors of retail and hospitality and addresses the issue of precariousness. Employers have resisted transposing this into domestic law (a voluntary protocol exists but unsurprisingly it has been ineffective). Currently, employers have considerable power to discipline workers by withholding or reducing hours on the roster. If a worker attempts to organise in a workplace, or is a members of a trade union, or resists employer demands they may find their weekly income reduced. The drive to precariousness cannot be explained through flexibility alone; it is an essential tool of employer control.

An indicator of rising precariousness can be seen in the rate of underemployment. In the Eurozone, 3.3 percent of the labour force is under-employed; in Ireland, this figure rises to 6.8 percent – the highest, exceeding even other peripheral countries. [13] Government has fuelled this rise, providing an incentive to employers to increase part-time work in order to reduce their social insurance liability. [14] That they did so even though the net effect of the incentive was to allow employers to externalise a number of costs on to the state (lower tax and social insurance revenue, higher part-time unemployment payments and Family Income Supplement) gives evidence of a Government preference for employers interests.

A third issue, while not a traditional labour right, is the ability of employers to avoid making public their accounts and thus hide their balance sheets. In private limited companies, employers do not have to reveal vital information such as profits, losses, etc. This is the most common form of company formation and is dominant in the domestic economy. The ability to hide vital financial information about the firm gives employers a considerable advantage in wage bargaining. For instance, Dunnes’ Stores does not have to reveal their profit line. However, in other jurisdictions they do and this revealed that company directors paid themselves multi-million bonuses in 2010. [15] Workers in the firm had to wait six years before obtaining a wage increase of three percent. [16]

Even neo-classical economists would observe that for a contract to optimise output all agents should have perfect knowledge (symmetrical flow of information). Therefore, in the contractual relations between the employer and the employee the optimal cannot be reached because of asymmetrical information flows. This is exploited by the employer to their advantage with the consequential loss of optimal economic performance. Whatever about the theory, an important tool for labour in the workplace (and for the public in the wage-policy debate) would be to argue for corporate and senior executive financial transparency.

The second main issue around which labour can mobilise is nominal wages. While average EU wages (compensation per hour) increased by over 10 percent between 2008 and 2014, in Ireland they have fallen marginally (−0.3 percent). With profits rising, labour should put wage increases back on the agenda.

|

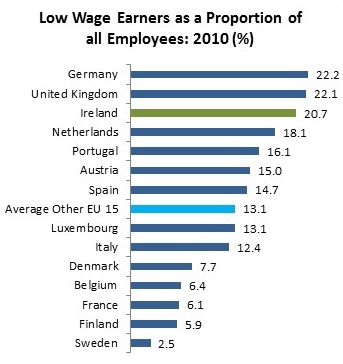

However, the manner in which this is done will be crucial to social equity and maximum economic impact. Ireland suffers from a high level of low-pay, ranking third in the EU. This is not a function of the recession; Ireland has consistently had a high level of low-pay in its labour force. This has led to a high level of deprivation. In households that suffer multiple deprivation experiences, 50 percent have at least one income from work.

A solidaristic wage strategy would seek to achieve both social equity and optimal economic impact through wage demands focused on the low paid. For instance, the national minimum wage has not been increased since 2007. It is the only country in the Eurozone, bar Greece (which is required to cut its minimum wage as part of its bail-out conditions), that has had no increase in the last five years. During this period, the national minimum wage has fallen by over 5 percent in real terms with additional reductions in disposable income due to tax increases.

Another area of struggle lies in the revived Joint Labour Committees which were struck down as unconstitutional by the High Court in 2011. The Government has placed the committees on a stronger statutory footing but in the process they have removed key protection provisions (e.g. the Sunday premium). Further, there is no guarantee that the previous basic wage floors will be re-established. The concern here is that employers’ will exercise a veto or use other obstacles to re-establishing wage floors at levels that pertained prior to the court ruling. Meantime, there is strong anecdotal evidence that the main sectors affected (retail, hospitality, etc.) have seen wages fall towards the minimum wage for new entrants.

Of course, reductions and stagnation in wage floors, combined with high levels of unemployment, puts downward pressure on wages above the floor. While the data does not allow us to track this in detail, it is worth noting that the Revenue Commissioners reports show that 50 percent (the median point) of PAYE taxpayers have incomes of less than €28,000. Given this low level of income, changes in the wage floors will have impacts for a considerable proportion of workers.

Therefore, a solidaristic wage strategy would seek in the first instance to raise the wage floor – through increases in the national minimum wage and JLC wage rates. However a wage strategy should go further – with demands for flat-rate pay increases or pay increases that contain a strong flat-rate element.

These wage strategies would not only reduce wage inequality and start to lift low-paid workers out of deprivation, they would maximise the economic benefit. With a higher marginal propensity to consume, low-paid workers will return their increased wages back into the economy at a higher proportion than wage increases for managerial and higher-professional grades. In this way, the prosperity of low-paid workers is a vital tool for increased economic activity via the consumer economy.

The third area of struggle (though this should be seen as complementary to wage increases above) lies in what can be called the ‘social wage’. The social wage refers to the employers’ payments into social insurance which in turn provides public goods and services to workers for free or at below-market price. This is also referred to as the collective consumption of goods and services. Free GP care and outpatient services, free or heavily subsidised prescription medicine, income-related social protection payments (unemployment, sickness, etc.), and income-related pensions -these are some of the benefits of the direct social wage. These are indirect but nonetheless concrete benefits and produce higher living standards. As much of social expenditure in economies with a high social wage is directed through the social insurance fund (in EU-15, 62 percent of health expenditure comes via social insurance funds; in Ireland it is 0 percent), revenue from other tax sources (income tax, VAT, corporate tax) can be deployed to provide additional public goods and services such as affordable childcare.

Therefore, a strong social wage has two functions: (a) it increases living standards by increasing consumption of goods and services with high social value-added content; and (b) it increases uncertainty avoidance, whereby people faced with certain contingencies, such as old age, need not worry about the level of retirement income or resort to inefficient private sector markets.

We can immediately see that this challenges the province of capital which has increasingly eroded the social state. Instead of purchasing private pensions, or private health insurance, or private GP care, workers can save and consume through the social insurance system with an equal or greater contribution from employers. This will, naturally, provoke strong resistance from capital.

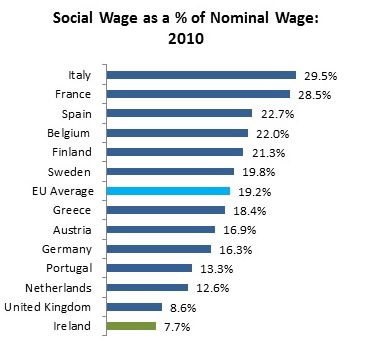

|

As seen, the social wage for Irish workers is at the bottom of the European table. Were the Irish social wage to be raised to the European average, employers would be paying €7.4 billion more into social insurance. This would result in a substantial increase in living standards for workers through increased consumption of public goods and services.

Of course, just as increasing the corporate tax rate elicits arguments that this would deter foreign direct investment and cost the economy in terms of employment and investment foregone, so a similar argument is employed with the social wage. Employers’ organisations refer to social insurance as a ‘tax on jobs’ and claim increasing the social wage would similarly deter employment and investment. There are two arguments here:

First, if the employment deterrence held – especially for small open economies which rely on net exports – then we should see negative impacts in similar economies. [17] However, the social wage in other small open economies is even higher than European norms, at 20 percent; and, yet, all these countries score higher in business competitiveness indices along with having unemployment and deprivation rates far below Irish averages.

Second, the impact of a higher social wage on the Irish traded sector would be minimal. Raising the social wage to European averages would only amount to 1 percent of total export sales in the traded sector. Even in the largely non-trade domestic service sector, the cost to employers of raising the social wage to the European average, would represent only 1.4 percent of total turnover. [18] While such a transformation could not be achieved immediately, phasing in the social wage over the medium-term is both achievable and desirable. Indeed, the more progressive bourgeoisie would not resist; many companies would find their cost base reduced in key areas. If income-related social insurance pensions were introduced – a national

defined-benefit scheme – this would lessen pressure on company pensions and reduce employee and employment payments; if income-related social protection payments were introduced, this would enhance demand resulting in larger turnover for domestic businesses.

But most of all, substantial increases in the social wage would greatly enhance workers’ living standards and show the benefits of collective activity.

If labour is to launch a fightback it will first be rooted in a struggle over labour rights and wages, both nominal and social. This has the capability of building a new platform on which the struggle against capital can deepen. A confident working class with rising living standards and greater rights in the workplace is in a stronger position to challenge capital’s hegemony than a class on the defensive. The first step in this fight back is to resist the rewriting of history (or, in many cases, fabrication of history). To explain the roots of the crisis, to undermine the dominant narrative, to challenge an apologist and duplicitous commentary is a key element in launching a fightback.

[1] EU KLEMS: Growth and Productivity Accounts.

[2] Unless stated otherwise, ‘EU’ and ‘European’ will refer to the EU-15 countries.

[3] EU: Annual Macro-economic Database (AMECO).

[4] Eurostat database: Labour costs [unable to locate this information – Note by ETOL].

[5] Forfas: Ireland’s Productivity Performance, 1980–2011 (between 2000 and 2007, value-added per hour worked in Irish manufacturing rose by nearly 20; in the EU-15 the increase was nearly 9).

[6] Department of Environment, Community and Local Government: Latest Housing Statistics.

[7] Green Party Leader and Minister John Gormley: “We already have a type of civil war in this country between the private and public sectors and I don’t want to exacerbate that any further.” Gormley attacked over claims workers in ‘civil war’, Independent.ie, 30 October 2009.

[8] CSO: Survey on Income and Living Conditions: www.cso.ie [unable to locate thsi information – Note by ETOL].

[9] Direct income is income from employee wages, self-employment and capital/investment income.

[10] The Revenue Commissioners show that in 2010, 63 percent of all PAYE employees earn below €35,000: Revenue: Irish Tax and Customs – Statistical Returns.

[11] CSO: Union Membership.

[12] Council Directive 97/81/EC. MANDATE, which organises in the retail sector, has made this the focus of their campaigning work: Decent Work? The Impact of the Recession on Low Paid Workers.

[13] Eurostat: Quarterly supplementary indicators by Member State, 2013 Q3.

[14] In the Government’s Job Initiative introduced in July 2011, the rate of employers’ PRSI was halved to 4.25% for employees earning below €356 per week.

[15] From the Weird Pile – In the Name of Job Creation, Government Subsidises Companies Which Cut Jobs.

[16] Dunnes Stores 14,000 staff to get 3% pay rise, The Journal.ie, 17 January 2013.

[17] Similar small open economies – Austria, Belgium, Finland, Denmark and Sweden – are characterised by GDP levels below €500 million with exports making up over 50 percent of GDP. This reference groups is used by the IMF.

[18] Forfas, Appendix, Annual Business Survey of Economic Impact 2010.

IMR Index | Main Newspaper Index

Encyclopedia of Trotskyism | Marxists’ Internet Archive

Last updated on 4 June 2020