Source: Department of the Environment, Community

& Local Government: Housing Statistics, CSO, 2015

IMR Index | Main Newspaper Index

Encyclopedia of Trotskyism | Marxists’ Internet Archive

From Irish Marxists Review, Vol. 4 No. 13, July 2015, pp. 5–17.

Copyright © Irish Marxist Review.

The links have been slightly modified and checked (July 2021).

A PDF of this article is available here.

Transcribed & marked up by Einde O’Callaghan for the ETOL.

The recent declaration by the media of the appearance of a ‘housing crisis’ in Ireland, particularly in Dublin, is indeed evidence that our housing system is seriously failing. In May 2013, almost 90,000 households were on social-housing waiting lists in Ireland, mainly comprising (75 percent) households residing in the privately rented sector, now facing an escalation in rents. By 2011, over 70,000 owner-occupied households were over 90 days in arrears with their mortgage payments and it was estimated at that time that some 50 percent of home owners who had mortgages were in negative equity. In April of that year, 3,808 persons were in accommodation providing shelter for homeless people or were sleeping rough.

Source: Department of the Environment, Community |

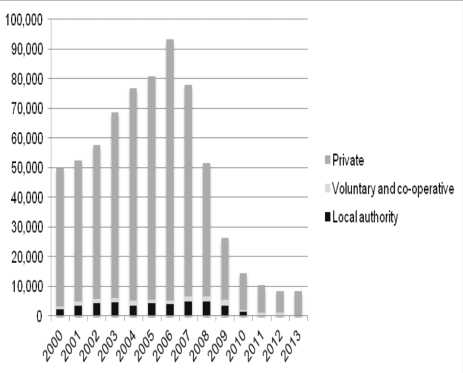

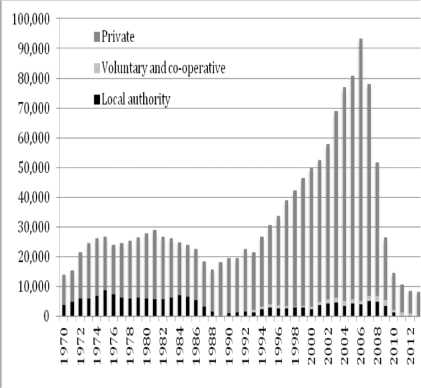

A dramatic reduction in the supply of social housing under the direction of a series of dogmatically neoliberal governments can be cited as the immediate cause of the under-provision of much-needed public-sector housing. In 2013, only 293 local-authority dwellings were completed while the voluntary and co-operative sector contributed an additional 211 units.

However, the cause of the housing ‘crisis’ runs far more deeply and is actually inherent to a housing system which relies almost completely on the private market to meet housing requirements and in which housing shortages are imperative to the maintenance of high prices, benefitting those forms of capital involved in its supply.

This paper addresses the contextual roots of housing crises and points to the radical restructuring required to address its perpetual nature.

In fact, there has always been a ‘crisis’ of housing affordability for poorer sections of society. In a system where the provision of accommodation is left largely to market forces, this is bound to be the case. Under a market-based system, the provision (supply) of housing adjusts to meet ‘demand’. However, in mainstream (bourgeois) economics, ‘demand’ is defined as desires backed up by money. ‘Demand’ makes no reference to need. Markets do not respond to need, unless there’s cash to back it up. And, of course, this is the great ‘void’ at the very heart of neo-classical economics. [1] Individual and social needs are not taken into account. There will often be some reference to ‘market breakdown’ but this fig leaf fails utterly to hide the profoundly ideological bias located in the very foundations of mainstream economics. If you haven’t the purchasing power, your need is completely ignored; it simply does not exist.

A market-based provision of anything always serves the interests of those with market power (people with money) and those involved in private-sector supply. The housing system is no different and, in a capitalist system, we should expect nothing less than continuing housing crises for poorer groups and a recurrent crisis for many others. Nevertheless, we should also note that the current scale of crisis owes much to the policies of recent overtly neoliberal Irish governments and their policies which marginalise those with least economic power.

So, at a very basic level, the housing crisis is simply the result of the unequal distribution of wealth and income, allocating advantageous levels of living (of which housing quality is an important component) to some, while obliging others to live in intolerable conditions or even consigning them to homelessness. Thus, the housing problem is deeply embedded in the very structures of capitalism.

The ‘housing crisis’ is not a recent phenomenon. For a large section of the working class, housing provided by the market has always been expensive and unaffordable. Writing about The Housing Question in the nineteenth-century, Friedrich Engels (1872, reprinted 1887) noted that:

The so-called housing shortage, which plays such a great role in the press nowadays, does not consist in the fact that the working class generally lives in bad, overcrowded and unhealthy dwellings. This shortage is not something peculiar to the present; it is not even one of the sufferings peculiar to the modern proletariat in contradistinction to all earlier oppressed classes ... this housing shortage gets talked of so much only because it does not limit itself to the working class but has affected the petty bourgeoisie also.

For the working class in capitalism, there always exists a housing problem and that if the ‘crisis’ is deep enough, the chronic housing affordability problems experienced by the working class can begin to bite more widely. As the distribution of social product towards capital and the downward pressure on wages means that there will always be a cohort of labour unable to generate enough income to cover the maintenance of housing, let alone its cost of construction and cost of urban land. Uneven processes of capitalist development will continue to generate housing questions at different points of the business cycle and, if deep enough, these can also affect the middle class.

In short, the so-called ‘housing crisis’ is simply a reflection of the deep inequities of the capitalist economic system seen in the unequal distribution of income and wealth, made visible in the unequal access to all the necessities of life, of which housing is an important part.

The recent ‘re-emergence’ of the housing crisis as a media issue merely reflects the fact that it is once again impacting on the middle class. It has grabbed the attention of the Irish media in a similar manner to the way in which the drugs crisis ‘emerged’, following many years and numerous deaths of the children of working-class families, only after it had started to spread beyond being a working-class issue to affect the middle class and its children. Now impacting on the middle class and no longer merely constituting a problem affecting a residual minority of ‘ne’er-do-wells’, the ‘housing affordability crisis’ becomes redefined as one which now demands the attention of the media and therefore requires appropriate state intervention! Meanwhile, this ‘crisis’ has, of course, immensely deepened for poorer groups.

Of course, the housing system itself is a reflection of the dominant ideology. It is one which promotes housing as a commodity, which regards ‘demand’ (wants backed by the power of money) as the dominant determinant of who gets what, reflecting a business model of society in which individualism, economic growth and capital accumulation are prioritised. It is a model that stresses the legitimacy of the profitability requirements of the key actors holding market power: landowners, developers, builders, lending institutions and landlords. As an increasingly commodified system, those with few economic resources have little or no power and are of little concern to those with economic and political power.

Of course, housing is not like a bunch of bananas or a pair of socks. The price of a house is enormously expensive in relation to people’s flow of income. It’s not something that can be bought outright from your weekly wage packet, unless you’re a Premiership soccer player or CEO of a multinational company. It embodies a huge amount of labour power in its construction and in manufacturing the building materials embedded in its development. It also embodies the price of land on which it is built, and we’ll return to this later because the cost of a site can comprise an unnecessarily high proportion of the price of a house.

Because housing is so costly, a market-based system requires the intervention of certain intermediaries to make access to housing feasible to more than the very few who can afford to pay the cash price outright. Using funds borrowed in the form of a mortgage from a financial institution, individuals can purchase the property directly and become owner occupiers, repaying the borrowed finance (plus interest) over 25, 30, 35 or even 40 years. Alternatively, developers can sell their dwellings to landlords, who pay the price (again commonly using borrowed finance, a ‘buy to let’ mortgage) and receive a flow of rental income from tenants.

The provision of housing therefore creates a highly profitable outlet for finance capital: lending to landlords and to owneroccupiers in return for interest payments. But the role of finance capital is not confined to the private tenures. Insofar as the state operates to a considerable extent on the basis of funds borrowed on capital markets, public-sector housing is also funded by capital and, through interest payments on the debt so incurred, also serves the interests of capital. [2]

In Ireland, owner-occupation really expanded in the 1960s in close association with the growth of the main mortgage-lending institutions, the building societies. Owner-occupiers needed financiers (building societies) to provide credit but in order to expand, as single-product financial institutions that were constrained from lending more generally, building societies also required the expansion of owner occupation. From the 1980s, the promotion of owner occupation became an explicit policy of government, set out by the Department of the Environment (1980):

The basic aim of the government’s housing policy is to ensure that, as far as the resources of the economy permit, every family can obtain a house of good standard, located in an acceptable environment, at a rent or price they can afford. A secondary aim is to encourage owner occupation.

Far from being simply the result of some Irish ‘mystical desire’ to own property, owner occupation has in fact long been encouraged by being highly subsidised by Irish governments, making it a financially desirable form of tenure to wider and wider social groups. Grant aid to builders had existed from 1924 and by the early 1960s amounted to 30 percent of housing cost. It has been promoted through first-time buyer’s grants, mortgage interest tax relief, certain exemptions from stamp duty and from domestic rates for owners of newly developed houses. There were also schemes promoting owner occupation among lower-income households, such as the affordable housing scheme, the mortgage allowance scheme, the shared ownership scheme as well as the sale of publicsector housing to sitting tenants. Additionally, untaxed capital gains realised on the sale of the principal private residence further encouraged the treatment of housing as a financial asset.

However, as we have seen in Ireland during the past decade, owner occupation is not ubiquitously advantageous. House prices can fall as well as rise, exemplified by the 50 percent fall in house prices during the recent crash. This can create ‘negative equity’ where the value of the outstanding mortgage loan is greater than the re-sale price of the house, becoming especially widespread among those who had taken out their mortgages just a few years before the housingprice crash. Under such conditions, people may become trapped in a dwelling or location where they no longer wish to reside, or decide to move away and rent out the property to help defray the cost of the continuing mortgage payments, or after selling the property, repay the outstanding ‘excess’ loan from savings. In the case of a severe economic downturn, as we have seen recently, reductions in take-home pay and rising levels of unemployment are likely to result in increased rates of mortgage payment default, possibly leading to foreclosure, repossession and even homelessness.

The Insolvency Service of Ireland reported recently (27th May 2015) that there were 110,000 mortgages in repayment arrears, of which 38,000 were in arrears of 720 days (almost 2 years) or more. Mike Allen of Focus Ireland (27th May 2015) highlighted the growing number of families seeking its help, numbering 71 during April 2015, more than double the monthly figure of around 32 during 2014, which was also double the figure of 16 per month for 2013. Such a trend is highly worrying in the light of the likelihood of the growing willingness of mortgage lenders to undertake foreclose proceedings against those in mortgage payment arrears now that house prices are increasing.

But even among those fortunate enough to steer a path through changing economic circumstances, for many, the reality of low-income owner occupation is not always entirely advantageous, as the Scottish geographer John Short has noted:

If you are screwed at work, the likelihood is that you are screwed in your housing construction. And being an owner-occupier does not compensate for living in a shoddily built high-density box in the middle of a housing estate, with the dim prospect of a real capital gain at the end of your housing career.

Owner occupation also creates important niches for private-sector exchange professionals: estate agencies, valuers, surveyors and solicitors dealing with the legal aspects of transactions. These represent a hidden cost of private-sector housing ‘management’ and have to be paid for by prospective purchasers or sellers. Moreover, as they commonly work for fees which are determined in relation to the cost of the property, such actors have a strong vested interest in rising house prices.

However, there has been little recognition that these professional costs might be limited in some way. For example, while the cost of a second-hand Ferrari or Lamborghini can well exceed the price of a house, the transfer of ownership (by simply having the log-book ownership documents updated) costs virtually nothing. One has to wonder whether the prospective loss of fee income for the private legal business interests of TDs might have something to do with this.

We have already seen that the financing of housing provision, through mortgage lending to owner-occupiers and landlords, or even to the state itself to fund public-sector housing development, creates huge opportunities for finance capital. But the provision of shelter through a market-based system also creates a means by which property capital (landed interests, developers and financiers) can tap that element of ‘value’ created by labour which returns to people in the form of wages and salaries. People are obliged to pay for their shelter, either in the form of rent or as mortgage payments.

Additionally, the form in which accommodation is provided for individual ‘households’ further maximises people’s spending on consumer goods and durables, many of which are only infrequently used: everything from washing machines to ladders and lawnmowers. (I can’t actually remember when I last used our electric iron or, for that matter, the vacuum cleaner!) This is, of course, highly desirable for commercial and industrial capital as it widens their markets by maximising sales of consumer commodities.

Furthermore, the ways in which people have been socialised into ‘wanting’ to live in individual ‘family’ housing, rather than in a more communally-friendly manner, encourages the individuation of people (and their problems), isolating them into separate household units, encouraging them to focus their primary loyalty on the ‘family’ (I’d do anything for ‘my’ kids) and away from broader concerns for the community and society more generally.

As a privatised form of tenure, owner occupation also minimises the opportunity for co-operative action among residents. This effectively diffuses conflict around housing issues. In contrast to the phenomenon of rent-strikes by tenants, such as that which occurred during the successful 1973 UK miners’ strike which put additional pressure on their National Coal Board landlord, the idea of a ‘mortgage payment strike’ is almost unthinkable, especially as a group of neighbours may have mortgages with completely different financial institutions.

More fundamentally, owner occupation creates huge indebtedness which rests at the level of the individual owner. Debt slavery is a powerful force for social control, as was clearly recognised by Sir Harry Bellman, Chairman of the UK Building Society Movement and of the Abbey Road Building Society in the 1930s when he observed that

The man who has something to protect and improve, a stake of some sort in the country – naturally turns his thoughts in the direction of sane, ordered and perforce economical government. The thrifty man is seldom or never an extremist agitator – to him, revolution is anathema. And as in the earliest days, when building societies acted as a stabilising force – so today they stand as a bulwark against Bolshevism and all that Bolshevism stands for.

Long-term indebtedness helps to ensure that labour remains docile in the event of attempts to worsen employment conditions and levels of pay. The toleration of low rates of pay, enforced pay reductions, the increasing use of zero- or low-hours contracts and the precariousness of serial 9-month temporary contracts, has become an unpleasant feature of Irish austerity and has been made possible because of the imperative to keep hold of that job at almost any cost.

Urban areas are divided into an array of different types of functional space. Industrial areas comprise factories engaged in production and warehousing space involved in distribution. Retail areas are also part of the distribution system, to the end users of commodities. Office districts accommodate functions relating to the private and public sectors roles in administration and management. Likewise, residential areas can be regarded as a multitude of households producing labour power. It is where labour power recuperates from day to day and is reproduced from generation to generation. And all of these different types of functional space are linked together through spaces which provide for circulation: paths, cycle tracks, roads etc.

At the most basic of levels, shelter is a requirement for human survival. There are actually very few ‘necessary’ human activities which characterise all societies at every stage of their social evolution. These, briefly, comprise the three essential ‘esses’ of human life: scoffing, sleeping and screwing. If the house is a ‘machine for living in’ (Le Corbusier, 1887–1965), as levels of economic well-being have improved, so the house itself has become separated into different functional spaces: places for food preparation (kitchen) and consumption (dining room); places for relaxation and recuperation (living room) where we can unwind while unintentionally imbibing the insidious dominant mainstream ideology broadcasted through television; and places of sexual enjoyment and recuperation through sleep (bedroom).

But the house is much more than this. It is an intimate element of the whole system of social reproduction. The housing unit occupies a location in space: a location in a residential milieu which differs from other residential spaces. Whether we rent from a private landlord or from the local authority or whether we are owner-occupiers, our precise residential location reflects our purchasing power. Locale intimately reflects our class position. I’m pretty certain that a child growing up in an affluent well-kept salubrious suburb, when seeing those of rundown working-class housing estates, is likely to be instilled with at least some idea of personal superiority and develop through time a certain degree of personal entitlement to the better things in life as of right. Inequality becomes internalised as a legitimacy grounded in a rightfully inherited social position. Even the boundaries to our roadways speak volumes. The granite walls of Dublin’s south suburbs contrast sharply with the concrete blocks decorating workingclass suburbs. And, of course, the eventual inheritance of a privately owned residence generates an economic advantage unavailable to the children of those who rent.

The home environment, of course, also has a powerful role to play in the socialisation of children. Long before starting school, children have become socialised by parents and family in their use of language and in the norms that they regard as ‘natural’. Our ideas of what is ‘natural’, to be taken for granted in our social world (religious practice, concepts of ‘right’ and ‘wrong’, ideas of individualism and personal ‘rights’ etc.), are largely absorbed in the first few years of life even prior to commencing formal indoctrination through ‘education’. Even our use of language is a powerful transmitter of ideology, helping to legitimate a social world grounded in individualised ‘rights’ of possession. Relatives are described using the possessive pronoun (‘my’ brother, ‘my’ mother) just as the home space itself becomes referred to as a possession (‘my house’, ‘my garden’). Such ideas run very deeply, strongly influencing modes of behaviour and social practice. What we believe to be self-evident and ‘natural’ we cannot dare to believe might be changed.

Historically, of course, reliance on a marketbased system of housing provision resulted in many Irish people having to live in appalling conditions in over-crowded and insanitary tenements. The slums were nevertheless enormously profitable for their landlord owners, as the scale of returns to landlords from the tenements in Henrietta Street reveal. In nineteenth-century British cities, local authorities often adopted slumclearance projects at the very time that the chronic housing shortages were beginning to disappear. Perhaps the fact that many of those councillors were also landlords had some role to play. Demolition acted as a certain cure to the unthinkable scenario that housing shortages, a highly important factor in maintaining high levels of rent, might actually disappear and that people might even be able to obtain somewhere affordable to reside – Lord help us!

Recognition by those with a certain degree of wider social conscience did lead to the development in the nineteenth century of better quality housing. This was undertaken by philanthropic individuals, by companies such as Guinness, Pim’s textiles, Watkin’s brewery and the Great Western Railway Company and by philanthropic societies, such as the Dublin Artisans’ Dwelling Company (1876) and the Iveagh Trust (1890). However, because most of these still required to make a profit (the so-called 5-percent philanthropists requiring a return a low as 5 percent) most of their activities were targeted at housing the skilled artisan class who had regular wages and could afford to pay a regular ‘reasonable’ rent.

In Dublin, one such society actually attempted to house the poorest of Dublin’s nineteenth-century population. In 1898, the Association for Housing the Very Poor Ltd. developed 118 single-room flats at Rialto in the southwest inner city. Yet even these rather mean dwellings were still too expensive to be afforded by the very poor!

Thus, towards the end of the nineteenth century, it became all too clear that housing built to an acceptable standard by the private or philanthropic sectors was not going to be affordable to the poorest sections of society and that the provision of decent accommodation would clearly require subsidy. From the 1880s, Dublin Corporation embarked on the provision of dwellings, initially as flats with shared facilities exterior to the dwelling, and a little later in the form of small cottages based on the Irish rural cottage, similar to those constructed by the Dublin Artisans’ Dwelling Company.

But the intervention of the philanthropists and of the local state itself failed to eradicate the housing problem. The public sector was never provided with the scale of resources which might impact adversely on the general system in which housing was provided as a commodity. Thus, public-sector housing in Ireland was available only for the poor [3] and, importantly, usually made to look different.

In fact, the provision of public-sector housing in nineteenth-century rural Ireland was far more advanced than in urban areas, the wide-scale provision of cottages having been an attempt by the British state to buy-off rural discontent, threat of violent insurrection and the demand for land reform – which conveniently brings us back to the whole issue of ‘land’.

We noted earlier that the cost of a site often comprises a significant proportion of the price of a house. As cities expand, the price of land increases as developers compete with one another to purchase it. As land is converted from rural land-extensive operations (such as farming and forestry) to urban land-intensive functions (such as housing, industrial or commercial functions), the price of land might increase ten or twenty fold. The original owners (farmers and land speculators) have individually done nothing to contribute to this potentially enormous increase in price. Instead, it has been the consequence of a wider societal process of urban growth and expansion. Yet, because of their power of ownership (which is merely a legally-defined expression of the social relationship between ‘owners’ and other non-owners) they individually reap the benefit by being able to extract an enormous price from transferring that ownership title when selling it to a developer. This is known as ‘betterment’ value. Over a hundred years ago, Ebenezer Howard, a parliamentary stenographer in the UK, recognised that this was not inevitable. In his book Tomorrow: A Peaceful Path to Social Reform (1898) later slightly revised as Garden Cities of Tomorrow (1902), he recognised that towns had advantages but also their problems, as did the countryside, enumerated in his ‘Three Magnets’ diagram. His solution was the TownCountry, a fusion of the best of both in the Garden City.

He believed in the need to build completely new cities in rural areas. By purchasing agricultural land well beyond the city limits and converting it urban functions, the ‘betterment’ could be captured by the community (rather than by farmers or speculators), being held in trust by commissioners to fund the payment of pensions to residents.

The idea of capturing for the wider society the betterment accruing from urban development was taken up in the post-WWII British New Towns policy. The New Towns Act, 1946, empowered new-town development corporations, to purchase land or acquire it compulsorily at current-use value plus a small disturbance allowance to occupiers. Compensation following a compulsory acquisition of land would be based on the principle of equivalence, that the owner or occupier should be neither better nor worse off in financial terms after the acquisition than previously. Thus, the land was bought at a price amounting to just 5–10 percent of full development value. The savings could then be used to provide high-quality homes and all the amenities expected of an urban area.

Development corporations were empowered to provide water and sewerage, build roads, houses, factories, shops, schools, to act as a landlord or sell houses to owner occupiers, and the land-cost savings could fund the provision of necessary social, recreational and cultural amenities and provide landscaped open space which preserved important landscape features. This is a far cry from the way in which Irish new towns, such as Tallaght, Lucan-Clondalkin and Blanchardstown were predominantly developed by private-sector developers and which long lacked even basic facilities such as shops.

The new-town movement in the UK created some 25 new towns, a third of a million high-quality homes complete with all necessary urban amenities (shops, theatres, libraries etc). By 1971, the total cost had amounted to only £1bn and the earliest new towns of 1940s were actually making a ‘profit’ for the state, particularly where the development corporations had retained ownership of the office, retail and industrial buildings and were gaining significant rental income from them. Regrettably, under Margaret Thatcher and her ideologically right-wing neoliberal governments, as public-sector entities were to be regarded as inherently ‘parasitic’ on the private sector and meant to be loss-making, the 1980s witnessed the sale of such assets.

Similar state ‘interference’ with the power of private ownership took place in France after in the 1950s. In fact, the post-war transformation of the French economy was outstanding. Its pre-war rural economy had been poorly commercialised and its industry was under-capitalised, using out-dated technology, based on inefficiently small industrial units dominated by a class of conservative dynastic family proprietors. Transformation was based on strong national planning under a series of National Plans, facilitated by direct state control over important elements of economic life within the banking, manufacturing industry and infrastructural development sectors. Indeed, France was more reminiscent of a Soviet planned system than anything existing elsewhere in Europe. Growth ensued, with output in both agricultural and industrial sectors increasing by 6 percent annually through the 1950s, giving rise to nearly 30 years of unhindered economic expansion (les trentes glorieuses). By 1960, manufacturing productivity in France was higher that of UK and exceeded German levels by 1980.

This post-war reconstruction also required the provision of new housing and large-scale urban expansion. In 1958, urbanisation priority zones (ZUPs – zones á urbaniser á priorité) facilitated comprehensive development planning at the periphery by allowing the state to acquire land at the average market price which had prevailed over the previous five years. In 1962, deferred development zones (ZADs – zones d’aménagement deferés) were also established, commonly for the development of new towns in order to control land speculation where very long-term planning was required. Here, the state was given preemptive right to purchase land for 8 years after designation (later extended to 14 years) at a price equal to that prevailing during the year prior to ZAD designation. By 1977, over 500,000 ha. had been designated in ZADs, greatly reducing the costs of state provision of urban housing and infrastructure by eliminating the unwarranted transfer of vast amounts of capital gain to landowners.

At least one reason why the price of housing in Ireland rose to such phenomenally high levels is that there has been an utter failure to address the question of where the gains from ‘betterment’ should go: to the individual land owner or to the wider public. Yet, as long ago as 1973, Justice Kenny in his Report of the Committee on the Price of Building Land, suggested that land in designated ex-urban expansion zones should be taken into public ownership at current agricultural use value plus a 25 percent disturbance allowance. Needless to say, the close links between certain politicians and the property-development sector ensured that his proposal was ignored by the mainstream political parties and greeted with horror by those with vested interests in the ‘rights of private property’, the report being left to gather dust on the shelves of the Dáil.

Certainly, there might be some constitutional difficulties in enacting such legislation. But when a constitution so overtly protects the powers of individual property owners over and against the well being of the great mass of the population, one has to question whether such protection and favouritism needs seriously to be addressed.

During the late 1990s and early 2000s, Irish economic growth had stemmed the historic phenomenon of large-scale emigration, giving way to net immigration. New household formation among the indigenous population together with immigration resulted in an increasing requirement for accommodation (Downey, 1998). An ‘affordability’ problem soon began to emerge among young aspirant owner occupiers. Now impinging adversely on the children of the Irish government’s conservative parties’ middle-class voting base, a series of reports was commissioned from Bacon and Associates which resulted in proposals to increase the supply of private housing, to increase the supply of serviced land, to speed up the review of planning applications, to eliminate mortgage-interest tax relief for those buying second homes and to introduce a tax to deter speculators. This essentially ‘supply-side’ intervention effectively favoured aspiring owner occupiers over prospective landlords who commonly provided accommodation to social groups with lower levels of income.

However, the manner in which rising residential affordability problems were addressed under the neoliberal ‘light-touch’ regulatory regime was mainly through a massive expansion of credit: a ‘demand side’ solution which gave developers, households and landlords access to increasing amounts of credit.

Financial institutions borrowed cheaply on international money markets and lent on the cash at a significant mark-up (see Kelly, 2014; Downey, 2014). The larger the loans, the greater would be the amount of profit. Historic norms in loan to value ratios (90 percent maximum to first-time buyers and 75 percent for previous owners) were discarded as 100 percent (or more) mortgages made their appearance. Borrowing requirements were also relaxed. In the early 1980s, applicants for a building-society mortgage had commonly been required to be regular savers for a minimum of 12 months and to build up a 10 percent deposit. The maximum loan was calculated at 2.5 times the income of the main earner plus that of the second earner. By the late 1990s, mortgages were available to applicants ‘off the street’ with no record of saving. Loan-to-income ratios leapt to a figure of ten times, or more, of household income, often being exaggerated and massaged by ‘notional’ rental income that might be gained from renting out a spare bedroom. Few checks were made on the veracity of income statements. Lending managers were pressured to ‘push’ as much credit as possible out to borrowers.

All this fuelled the supply of credit, much to the advantage (initially at least) of the financial institutions and to those receiving bonus payments based on the amounts of money they were lending. Mortgage lending rose from €3bn in 1996 to €25.5bn in 2006. Of course, this money pressure merely fuelled further price rises, driving them to absurdly high levels and running well ahead of housing construction costs. Annual price increases were met by further rounds of credit creation, leading to yet higher prices, which merely emphasised the imperative to ‘get onto the housing ladder as soon as possible’.

Parents were even encouraged to remortgage their own homes to help children get a foot on the housing ladder. While helping a few, this additional credit in the form of mortgage equity release merely added to the weight of money pressure and exacerbated the inflation in house prices. This created a surge in residential development rising from 40,000 dwellings in the late 1990s to 93,000 units in 2006, often in places stimulated by tax incentives and where there was no real requirement for housing, creating a legacy of ‘ghost’ estates of empty and unfinished dwellings.

While undoubtedly a significant element of the price paid for a dwelling was being taken in the form of highly inflated profit by housing developers, undoubtedly, much of that cash was being absorbed in the form of land price. By the later stages of the boom, as much as 50 percent of the price paid for a newly developed house in suburban Dublin simply comprised the price of the plot. Recent purchasers have therefore paid handsomely for the failure of governments to address the land betterment issue discussed above.

Thus, under a heavily marketised housing system, housing policy has failed to recognise the deficiencies of an inherently commodified system of providing shelter which malfunctions perpetually for poorer groups and intermittently for those on higher incomes.

Undoubtedly, the current ‘housing crisis’ has had a long gestation. As we have seen, the failure to address the land-ownership problem has resulted in the transfer of enormous amounts of wealth (social value) from purchasers of housing to those who merely held title to land.

Moreover, since the 1980s, the rise of a right-wing neoliberal ideology which overtly propounds the superiority of the market as the best way in which to allocate resources has exacerbated the precarious position of the poor (those lacking market power) in accessing housing and, indeed, other social services. Neoliberal ideology stressed that open, competitive and unregulated markets, unhindered by state interference, represented the optimal mechanism for economic development.

This theory of economic practices proposed that human well being is best advanced by liberating individual entrepreneurial freedoms and skills within an institutional framework characterised by strong private property rights, free markets and free trade. Under neoliberalism, the functions of the state are restricted to guaranteeing the quality and integrity of money (i.e. its value by eliminating inflation), to guaranteeing private rights in property, by force if necessary (through use of the courts, police and army if required) and to establish markets or market relationships where they had hitherto not existed (e.g. water supply, health care, education, infrastructure provision, prisons, social-service provision etc.). In Ireland, neoliberalism has brought about the privatisation of public-sector assets, the withdrawal of the state from the direct provision of many aspects of social services and led to the ‘light-touch regulation’ (de-regulation) of capitalist enterprises in which the state relaxed its controls over capital.

In fact, the proclaimed desire for the state to absent itself from ‘interference’ in the market was little more than a figment because, when things did not go so well, the state obliged its citizens (and its future citizens as yet unborn) to pay the enormous cost of mopping up the mess and bailing out the Irish financial system. It seems that the dictatorship of the market should be applied to labour power but clearly not to capital!

Austerity has caused misery for the multitude and left the rich (as a class in aggregate) virtually untouched. In his book A Brief History of Neoliberalism the geographer David Harvey (Oxford University Press, 2005, p. 202) unashamedly highlights the reality of neoliberalism as nothing less than class war:

The first lesson we must learn, therefore, is that if it looks like class struggle and acts like class war then we have to name it unashamedly for what it is. The mass of the population has either to resign itself to the historical and geographical trajectory defined by overwhelming and everincreasing upper-class power, or respond to it in class terms.

Harvey’s view of neoliberalism and class antagonism has been echoed by another, rather surprising, source. Questioned about the relaxation of American tax codes and the benefits that this has brought to the rich and the fact that anyone querying these arrangements are accused of nothing less than fomenting class warfare, in an interview published in the New York Times (November 26th, 2006) the billionaire Warren Buffet commented that ‘there’s class warfare, all right, but it’s my class, the rich class, that’s making war, and we’re winning.’

Debt slavery for nation states to finance capital is as real a phenomenon as for households, at least insofar as states remain controlled by right-wing politicians and economists who fail to recognise that debt relationships are nothing more than any other social relationship and can be changed completely if required. The inevitable result is that under austerity policies, funds and services are taken away from citizens in the form of additional taxes and levies or through pay cuts. These are then conveyed by those governments to their bond-holder creditors. Thus, the state actively takes on the role of ‘bailiff’ by enforcing the dispossession of ordinary people in order to safeguard the investments of the wealthy.

Finally, but not least significantly, has been the running down of social housing provision. As the crisis of affordability bit ever harder, prospective owner occupiers who were unable to afford to purchase a house were frequently deflected into the private-rental sector. Here they were able to outbid poorer groups which had long used the private-rental sector as a tenure of long-term residence. These either had incomes too low ever to be able to access owner occupation but had incomes too high to qualify for local-authority housing or that there was simply no public-sector housing available.

During the 1930s and 1950s, when Ireland was a relatively impoverished state with a languishing economic base, public-sector housing development actually outpaced that of the private sector. While the peak output of public-sector development was reached in the 1970s in terms of the number of dwellings completed, it was by this time far outstripped by private-sector development. As the role of the private sector increased during the following decades, the role the public sector diminished. The local-authority sector shrank from 18 percent of the housing stock in the 1960s to just 8 percent currently. Local-authority housing development, which had accounted for 20 to 30 percent of total output during the 1970s, dwindled to less than 5 percent after 2010.

Additionally, the sale of local-authority housing to sitting tenants, often at fire-sale discount prices, resulted in the loss of two-thirds of that public-sector stock. Housing choice was becoming ever more constrained and located firmly within the private sector. (So much for capitalism as the creator of choice!)

The number of households on the waiting list for social housing rose inexorably through the 1990s, from 17,500 households at the start of the decade, to 48,400 by 2002. Of course, following the crash when there was little residential development taking place, the social-housing 20 percent rule meant that there was very little provision through this route as 20 percent of very little results in next to nothing. By 2011, the waiting list had topped 98,000 households. Austerity policies exacerbated the problem as government funding for local-authority housing was slashed from €1.3bn in 2007 to just €83M in 2013.

However, rather than investing in additional public-sector homes, government expenditure instead shifted towards subsidising the private rental sector, at a considerable cost to the state, rising from €7.8M in 1989, to €354M in 2004 to some €500M in 2009. This effectively subsidised the potential for landlords periodically to raise rents, many of whom had also availed of the property-related tax incentives available at certain designated urban sites to promote development. [4]

Source: Department of the Environment, Community & |

This paper has tried to show the nature of the housing ‘crisis’ and, for the poorest, its perpetual existence under capitalism. There are clear limitations to the degree of success of historical attempts by philanthropic and state policy to address it. The neoliberal emphasis on treating housing as a mere commodity like any others has deeply exacerbated the problem for poorer and middle-income groups alike. If we truly want to solve the housing ‘crisis’, this will require a de-commodification of the housing system itself and its reorientation towards the meeting of basic human needs. And this, of course also applies to the health-care system and the other elements of provision for human well-being which are increasingly becoming commodified.

The current ‘housing crisis’, caused in large measure by the ‘class-war’ politics promoted by right-wing neoliberal ideologues and enacted by Irish governments, is now of such a scale that major interventions are required in order to alleviate the appalling conditions in which growing numbers of households find themselves.

This will necessarily involve a transfer of increasing amounts of social product away from wealthier sections of Irish society towards those who actually create value through their labour. After all, it is through the expenditure of labour power that value is created, yet an increasing proportion of that social product has over recent decades been taken in the form of profits rather than going as wages and salaries. [5]

As envisaged in the Kenny Report, this should include tackling the land betterment issue to ensure that the community benefits rather than individual private landowners. It requires immediate measures to control private-sector levels of residential rents and must also involve the large-scale development of high-quality public-sector housing. However, while reforms such as these are immediately essential, ultimately the ‘housing crisis’ is insoluble under capitalism.

However, as we have seen in recent years, reforms which deliver improvements in the conditions of life of the wider population tend to be liable to sudden cancellation. Thus, measures such as those mentioned above must be understood in the context of a strategic longer-term imperative to transform our social project away from the rapacious search for profit (a system which is so destructive of the quality of people’s lives and of nature itself) and the aggrandisement of enormous wealth for the few, towards the creation of a social system in which the meeting of human needs becomes the fundamental driving force. This requires nothing less than the transcendence of the capital-wage relationship itself. Only with social (rather than private) control over the resources of our society – the means of production and distribution – might a true ‘political democracy’ be constructed which is grounded within an ‘economic democracy’.

1. Worryingly, it is to the same mainstream economists that the government still turns for advice despite their abject failure to foresee the recent crash.

2. Construction is also normally contracted out to private-sector companies and is a valuable source of profit to the building industry.

3. In the UK, two systems of local-authority housing allocation existed. ‘Special needs’ housing was for poorer households and those being re-housed from slum-clearance areas. ‘General needs’ housing was available to all, irrespective of income. So, in a Labour controlled city like Dundee in the early 1970s, 60 per cent of the stock was public-sector housing, 20 percent was privately rented and only 20 percent was in owner occupation.

4. While the Department of Finance estimated that community gain payments by developers of inner-city apartments amounted to €4,400 per apartment, the tax revenue foregone amounted to €40,917 per apartment. Thus, although the Liberties Integrated Area Plan was estimated to possess the capacity to generate €6.38M in community gain, this would have cost €71.3M in tax benefits to developers and investors.

5. Thus wages and salaries as share of Gross Domestic Product (GDP) fell from 76 percent during the 1971–80 period (compared to the EU 15-state average of 75 percent), to just 54 percent by the period 2001–2007 (the lowest ranked in the 15-state EU). Additionally, spending on social protection as a proportion of GDP fell from 19.6 percent in 1991 to 16 percent by 2002. Notably, all of this relative decline in the position of labour in relation to capital happened prior to the crash and the subsequent austerity policies which Irish governments unleashed on their citizens.

IMR Index | Main Newspaper Index

Encyclopedia of Trotskyism | Marxists’ Internet Archive

Last updated on 19 July 2021