Source:

Michael Roberts’ Blog Post –

Saving glut on Investment Dearth –

the World Rate of Profit by Maito

[48]

IMR Index | Main Newspaper Index

Encyclopedia of Trotskyism | Marxists’ Internet Archive

From Irish Marxists Review, Vol. 5 No. 15, June 2016, pp. 21–23.

Copyright © Irish Marxist Review.

The links have been slightly modified and checked (July 2021).

A PDF of this article is available here.

Transcribed & marked up by Einde O’Callaghan for the ETOL.

Economists occasionally quip that they have successfully predicted seven of the last five recessions. By its nature, economic forecasting can be fraught with uncertainty, but there is widespread agreement amongst financial commentators concerning the ongoing crisis in the global economy. Citi-Bank analysts have put the likelihood of another US recession in 2016 at 65%. In Latin America their figure rises to 100%. [1] The Bank for International Settlements is no more optimistic, arguing that we may now be witnessing the ‘calm before another storm’ as a ‘plunge in stock prices and a slowdown in global growth are taking place at the same time that investor confidence in central banks is waning’. [2] The International Monetary Fund (IMF) has cut its growth forecasts no less than four times since 2015, citing a combination of faltering trade, contracting industrial production and low economic sentiment. [3] Summing up its concerns, the Fund stressed that ‘global growth has remained too slow for too long.’ [4] The World Bank is equally pessimistic, beginning its Global Economy Perspectives (2016) with the following gloomy assessment,

Global growth again fell short of expectations in 2015, decelerating to 2.4 percent from 2.6 percent in 2014. Today, the [global economy] remains subject to substantial downside risks, including a disorderly slowdown in major emerging market economies, financial market turmoil arising from sudden shifts in borrowing costs amid deteriorating fundamentals, lingering vulnerabilities in some countries, and heightened geopolitical tensions. Weakening growth and sharply lower commodity prices have also narrowed the room for policy makers to respond [5]

A slowdown in China is causing particular concern. Unlike any of its principal rivals, China entered the Great Recession on the back of three decades of unbroken economic progress. Since the early 1980’s, the Chinese economy has expanded rapidly, leaving the authorities there with an impressive array of policy options to combat the crisis when it eventually arrived. Their economic intervention would, however, prove to be double edged. For example, the Chinese Communist Party sanctioned a vast expansion of public and private sector liquidity to protect themselves from the international turbulence. This helped to shield Chinese corporations from a dramatic collapse in their export earnings, but it also led to a dangerous rise in the country’s debt. According to the Financial Times, Chinese debt has risen by $10trillion in the last eight years. This represents an increase of 60%, as the debt-to-GDP ratio went from 148% to 237% ($25 trillion). [6] This has left the Peoples Bank of China with far less wriggle room to cope with the next big crisis. To make matters worse, the Chinese economic juggernaut – once thought to be on an unstoppable trajectory towards global dominance – is gradually slowing down, pulling a number of emerging economies down with it. This slowdown, combined with faltering oil prices, is having a negative impact on commodity producers as raw material prices remain weak due to chronically low investment demand.

Japan – the world’s third largest economy – is also in trouble. There, stagnation continues, despite the much vaunted promise of ‘Abenomics’, the populist right wing program for economic restructuring, initiated by Japanese Prime Minister Shinzo Abe. Abenomics, however, has amounted to very little. [7] The Bank of Japan, has for example, moved to negative interest rates in a desperate attempt to reverse the trend of chronic deflation. As of May 2016, the prospects for success seem slim at best. The deep structural and political problems that plague the Eurozone have not gone away either. At first glance, it might appear as though the worst of the recession is over, with small growth figures being recorded in some countries. In reality, the EU remains gripped in a vice, with low growth on one side and colossal debt on the other. Prices have also failed to recover under the impact of austerity, deleveraging and fiscal consolidation. Herein lies the importance of China. Should it continue to lose any more momentum, it will be difficult to find a viable alternative to drive the recovery.

Until recently the United States might have been expected to take up this slack. US growth levels have been stronger that those recorded in either Europe or Japan. Unemployment has also come down considerably more quickly. Yet even here the news is no longer very promising. Late last year, the Federal Reserve initiated its first rate rise in almost a decade, as Janet Yellen sought to bring monetary policy slowly into line with historical norms. They expected little resistance from the markets as money became only marginally more expensive (0.25%). The reality was outright financial panic, as trillions were wiped off US equity prices in the first three months of 2016. Growth rates have also slipped, as businesses and consumers reduce their spending in the face uncertainty. This suggests that the US economy is nowhere near ready to come off the life-support of endlessly cheap liquidity. It also signals potential trouble in the not-too-distant future, as the world’s four major areas of accumulation collectively run out of steam. This has created a difficult conundrum for the world’s central bankers. According to the orthodoxy, cheap money pumped into an economy over many years should lead to runaway inflation as the speed of consumer and producer spending outstrips the pace at which the economy produces. In reality, inflation has been more or less stagnant, despite central banks creating trillions of dollars in extra liquidity. To put this slightly differently, central bankers have exhausted most of their policy options without creating sustainable recoveries.

This is increasing the pessimism amongst the world’s capitalist classes as investors get increasingly jittery about the authorities ability to push the system onto its pre-crisis growth path. Fiscal policy (taxes and government spending) is also reaching breaking point, as states come up against the limits of their national debts. Labour markets have been significantly restructured in favour of capital at the same time as credit and energy costs have never been cheaper. Corporations have seemingly never had it so good and yet investment is still considerably weaker than it needs to be to drive a recovery. For mainstream economists the global picture is extremely perplexing, as all of their certainties are being thrown out the window. Everything from population changes to ‘secular stagnation’ have been posited as ‘explanations’ for persistently lower levels of growth, but none of their purported ‘solutions’ seem to be working. For Marxists, on the other hand, the longevity of the Great Recession has been entirely (if depressingly) predictable. [8] Despite corporations often sitting on massive cash piles, the current crisis is the result of a long-standing crisis of profitability, itself brought on by an over-accumulation of unprofitable capital. [9] This statement will be defended in more detail below. Before this, it is useful to survey some of the pressure points currently blocking a sustainable upswing.

Over the last four decades, China has been transformed from an impoverished and largely agrarian backwater into the world’s second largest economy. Above everything, this was made possible by the enormous suffering and exploitation enforced on its vast population. Mao Tse-Tung’s Soviet inspired ‘Great Leap Forward’, was an unmitigated disaster. However, the absolute devastation that it wrought on Chinese people opened the door to the neoliberal restructuring initiated by his successors. [10] Since 1978, the Chinese economy has expanded an incredible 5000%. In absolute terms, Gross Domestic Product has been increased from just over $200 billion annually, to more than $10 trillion. [11] To achieve this extraordinary growth, the Chinese ruling class offered global capital a vast supply of cheap and disciplined labour power. Hundreds of millions of Chinese peasants have been brought into the capitalist system in what has rightly been described as the greatest migration in human history. [12] China’s growth has relied overwhelmingly on the manufacture of consumer durables and on domestic property construction. To put this in context, China uses 60% of the world’s concrete; 54% of its aluminium; 50% of its copper; 49% of its coal, 48% of its nickel and 46% of its steel – despite having only 13% of the world’s population. [13] It is also by far the world’s largest exporter, eclipsing the US by more than 42%, despite having an economy that is considerably smaller (roughly only 58% of US GDP). [14]

China has therefore been a key driver of global growth in the neoliberal era. This, in turn, has meant that the country has benefited from foreign investors seeking new markets, helping to sustain global profitability and bringing hundreds of millions of new Chinese labourers into the economy. In addition, China has become the ‘workshop of the world’, hauling major commodity producers forward in a seemingly never ending upswing. China is now the central hub for a whole series of emerging economies through its voracious consumption of primary commodities. This is particularly true of the so-called BRIC’S (Brazil, Russia, India and South Korea), but it’s also true of more developed nations like Australia.

China was also crucial to saving global capitalism from complete melt-down during the crash of 2008: pumping trillions of dollars into its financial markets. Officially, the Chinese government announced a package of $568 billion, but in reality the state spearheaded a policy many multiples of that number. From 2008 onwards, the Communist Party instructed the major banks under its control to lend on a massive scale to its major corporations. On foot of this, the share of Chinese GDP accounted for by investment has risen to almost 50%. This figure is unheard of in any other major economy and it signals the fact that Chinese growth rates are being artificially inflated by corporate investments that often don’t make commercial sense. Many firms currently exist on a drip line of credit that could easily be withdrawn. On the flip side, many banks are living dangerously, as they seeks ever more exotic avenues – often in the shadow banking sector to service their customers. Figures released by the Financial Times suggest that unperforming loans already account for up to 20% of Chinese banking assets (a whopping 60% of GDP). This really matters, moreover, as one of the primary reasons for the growing indebtedness is the gradual slowdown in the real economy.

Cheap credit arrested the slump in 2008, but it has not reversed the fundamental slowdown in Chinese capital accumulation. From a highpoint in 2007, Chinese growth rates have fallen roughly 50% to 6.5% per annum. [15] Like its Western counterparts the Chinese economy is struggling to cope with an over accumulation of (unprofitable) capital, partly built up during the crisis years. [16] Martin Wolf, of the Financial Times, takes up the story,

It is precisely when an economy slows that its disequilibria are thrown into sharpest relief. China invests more than 45% of GDP. This is extraordinarily high and it is hard to justify as growth slows. Furthermore, this high investment level is associated with explosively rising debt and falling growth in total factor productivity, a measure of technical progress. Such a path is unsustainable. [17]

Things came to a head at the start of 2016 when fears of an economic slowdown caused carnage in financial markets. Having fallen nearly 40% last summer, the Shanghai and Shenzhen Composite Indexes each fell sharply in January as investors sought to exit companies burdened with increasing indebtedness. [18] Since then, the authorities have managed to stabilise the situation, but they face what appears to be an increasingly difficult balancing act. Fundamentally, the Chinese authorities need to re-balance the economy away from investment if they are to have any chance of following the western consumption model. The economy’s current (over)reliance on investment is clearly unsustainable, but in the absence of any major alternative, the authorities seem to be caught in a bind – turn off the credit and watch the economy slow down even further, or keep up the credit and risk the potential of a major financial collapse. For now, policy makers seem intent on a middle position, managing the slowdown whilst firefighting any signs of distress. Either way, Chinese savers are currently amassing in the region of $5 trillion annually, making any move to reduce investment likely to undermine global demand even further. Financial market turbulence and falling commodity prices are merely the most visible signs that the Chinese economy is increasingly unable to sustain its role as the growth engine of the global economy. Whatever happens, double digit growth rates will not be returning and in this context the capitalist system will need to find alternatives sources of economic dynamism and profitability.

China is not the only region causing concern. Emerging markets (EM’s) have also experienced turbulence in their financial sectors, as investors increasingly look for safer havens amid a reduction in economic activity. Emerging markets have now had five straight years of economic slowdown constituting their worst performance in three decades. Figures released by the European Central Bank (ECB) suggests that EM growth, still the most dynamic sector of the global economy, has fallen from 7% in 2010 to 4% in 2015. This pattern has become generalised, moreover, affecting 21 of the 23 economies surveyed. [19] Falling commodity prices are a major factor in this retreat, but so too are concerns about spiralling debt, worsening demographics and a structural decline in productivity. [20] Like China, emerging markets have contracted significant amounts of debt over the last eight years. According to the Bank for International Settlements, corporate borrowing has more than doubled in that time to $22 trillion – of which $5 trillion is denominated in dollars. [21] Corporate defaults have also reached their highest levels in over a decade, creating a vicious cycle of faltering growth and tightening credit conditions as money spills out of the region. [22] In 2015, capital flows turned negative for the first time since the early 1980’s. In aggregate, around $540 billion departed emerging markets, according to the Institute of International Finance, which publishes the data. US Investment Bank, Goldman Sachs, has argued that the extent of the slowdown in EM’s represents the ‘third phase’ of the Great Recession, after the US subprime collapse in 2007-2008 and the Eurozone crisis of 2010–2011. [23] This may well be overblown given the recent rally in the sector, but the fact remains that emerging markets will be unlikely to power the global economy in the way that they did during the worst of the crisis.

The fate of the major economies therefore becomes crucial. After eight years of stop-go recovery, the Eurozone finally surpassed its pre-crisis GDP in the first quarter of 2016. [24] Cheaper oil prices, quantitative easing and a depreciating euro have helped to lift the Eurozone temporarily out of recession, however the economic fundamentals remain extremely weak. [25] Despite creating €80 billion of extra liquidity every month, the ECB has been unable to move the Eurozone anywhere near its 2% inflation target. Prices in the Eurozone actually fell in May, as a chronic lack of effective demand weighs heavily on the continent. [26] The response from ECB governor, Mario Draghi, has been to reaffirm his determination to pump €1.5 trillion into the system in a variety of monetary stimuli. On top of this, he has reduced the interest deposit rate to -0.3%, effectively making it cost free for banks to borrow money. [27] In spite of this, European corporations have steadfastly refused to invest at a high enough rate to drive a recovery. In the main, this problem rests on an over accumulation of unprofitable capital, but Germany’s insistence on selling more than they are prepared to buy is also choking off economic growth. [28] The Eurozone entered the crisis on the back of longstanding problems associated with falling growth rates, sluggish productivity and persistently high unemployment.

Since then, each of these problems have been severely compounded, as the European elites used a crisis of neoliberalism to further attack wages and conditions. Imbalances within the Eurozone helped to create the crisis, as the ECB imposed conservative fiscal and monetary rules for integration. Yet instead of reversing these policies during the downturn, the ECB ramped up its ‘fiscal rules’ in an effort to shift the burden of adjustment away from the bankers. Put slightly differently, the ECB worked hand in glove with elites in the PIGS to drive through the kinds of austerity measures deemed necessary for competitiveness. [29] They also used austerity policies to discipline workers into paying for the crisis. This may have been politically expedient, but it has not been remotely successful as an economic strategy.

Growth rates remain extremely weak, compounded by internal imbalances associated with EMU and a chronic lack of effective demand. Olivier Blanchard takes up the story,

Productivity growth has been much lower since 2007, [particularly] in Europe where the rate has declined by over 1% in major countries ... This decline in part reflects cyclical factors [but it is also] the effect of lower capital accumulation on the continent ... Despite eight years of crisis Europe is still a long way from recovering ... [30]

Compared with its principle rivals the US recovery has been more solid. A combination of stronger monetary interventions, slightly better productivity levels and stronger deleveraging have meant that the US economy has added roughly 4.5% more economic growth than Europe since 2013. [31] Unlike the ECB, the Federal Reserve acted quickly and decisively to its subprime crisis, pumping trillions into its financial system from the very start of 2009. This procedure was designed to support financial restructuring, which has allowed millions of firms and consumers to get out of bankruptcy earlier. Overall, the deleveraging process has been carried out far more aggressively in the US than in Europe, reducing the depressing effect of excessive indebtedness. Fed policy coupled with relatively less neoliberal restructuring has created some economic energy on the back of a private consumption revival. Since 2014 unemployment has also come down to 5% as millions of Americas have taken low paid work or fallen out of the labour market altogether. [32] It is important not to get carried away, however. Benchmarked against its economic rivals, the US economy looks relatively successful. Benchmarked against its own historical growth path the recovery has been dismally weak.

Jason Furman, Chair of the Council of Economic Advisors, has shown that US civilian employment and domestic purchases had both recovered their pre-recession levels by 78 months after the recession began, while the same variables in the Euro area still remained below the January 2008 levels after the same amount of time. [33] But this bar is intolerably low as the performance of the Euro Area has been shockingly bad. When its own past performance is the comparator, Blecker has shown that the US recovery ‘has been the slowest and longest of any cyclical upturn ... since the Great Depression’. [34] More ominously, ‘each business cycle since the early 1980’s has exhibited slower growth in the expansion phase than the one before it’. [35] Ex-US Treasury Secretary, Larry Summers, makes much the same argument, suggesting that ‘the recovery has fallen significantly short of predictions and has been far weaker than its predecessors’. [36] He goes onto point out that ‘had the American economy performed as the Budget Congressional Office forecast in August 2009 ... GDP would be about $1.3 trillion higher than it is’. [37] ‘In the valley of the blind the one eyed man is king’ may be the best way to define the current US position. Productivity has fallen year on year for the first time in three decades and this alone could pull the US back into recession. [38] Indeed, such is the depth of the current malaise that some mainstream commentators have begun to believe that stagnation is the new normal. It is to their analyses that we now turn.

Neoclassical economics is a deeply ideological discipline. It argues that the selfinterested decisions of millions of firms and households can be brought into balanced equilibrium through the hidden hand of the capitalist market. This idea, first popularised by Adam Smith, has become the central vision of the neoclassical paradigm. It presupposes that the normal state of a capitalist economy is one of full employment and an absence of crisis. In any genuinely scientific discipline these ideas would have been disregarded a long time ago, given the boom-bust cycles that have actually characterised capitalist history. If they comment at all on this discrepancy, neoclassical economists generally claim that economic crises result from external factors like war and/or population changes. The exception to this was the 1930’s. Working during the Great Depression, John Maynard Keynes insisted that real world evidence had to count for something. [39] Capitalism was in a near decade long slump and this forced Keynes to search for new answers. In his General Theory of Employment, Interest and Money, Keynes argued that capitalism is a dangerously unstable system, prone to crises due to its inability to produce enough effective demand. He laid the blame for this failure in the ‘animal spirits’ of the capitalist classes who would periodically refuse to invest enough to purchase the output already on the market.

Since that time a debate has ensued within mainstream economics about whether the supply side (technology, productivity etc.) or the demand side (investment, and consumption of output) is the primary driver of economic crises. Most mainstream thinkers favour supply-side explanations which focus on factors like labour productivity and external shocks brought on by war and/or political instability. This routes any problems outside the normal workings of the system and absolves the capitalists of primary responsibility. It also keeps distributional issues like the growing levels of inequality off the agenda.

Robert Gordon has produced what is perhaps the most influential supply side explanation for the current crisis, arguing that the productivity of labour has been falling continuously since the 1950’s. [40] In a paper for the National Bureau of Economic Research, Gordon argues that capitalism was extremely productive from the 1750’s until the 1950’s, but has since succumbed to what must seem like terminal decline. His argument rests on the idea that early capitalism was able to secure exponential productivity gains through the mass education of a previously rural population and the mass mechanisation of industrial processes. In stark contrast, modern innovation has been patchy, short lived and of marginal benefit to the wider economy. To make matters worse, capitalism now faces what Gordon defines as ‘six head winds associated with demography, education, inequality, globalization, energy/environment, and the overhang of consumer and government debt’. [41] Gordon’s analysis is welcome in comparison to the general detachment of the mainstream profession, but there are at least two problems with his line of argument. Firstly, a significant drop in overall output should have led to runaway inflation in the context of eight years of quantitative easing, as paper money should have completely outstripped the fall in supply. In reality, there has been a sustained period of falling prices suggesting that it is demand that has not been strong enough, even with trillions of extra dollars flooding the system. Secondly, Gordon disconnects issues such as debt, inequality and globalisation from the profitability crisis that initially made them politically necessary. Neoliberal globalisation was the solution to an earlier crisis of profitability that is now creating problems of its own for the capitalist system. The rate of profit is something that Gordon studiously avoids even though it must surely be central to the long run dynamics of an economy based on profitable accumulation.

Can the Keynesians do any better? In one way or another most Keynesian analysis argues that there are too much savings in the system, leading to a lack of effective demand. On the political right of this spectrum, Ben Bernanke, the Ex Chair of the Federal Reserve, has argued that the roots of this problem lie with savers in exporting countries such as Germany and China. [42] This keeps the heat off US capitalism (which tends to consume) and allows the rich in his own country off the hook too. At the more progressive end of the Keynesian spectrum, Joseph Stiglitz has argued that rising inequality associated with globalisation has made much of the running, as the rich tend to sit on their income rather than spending it. [43] Larry Summers also incorporates rising inequality into his account of secular stagnation, but for him the more important problem is a lack of investment even at minimal levels of interest. Summers’ suggests that savings have been driven by increases in the share of income going to the wealthy, whilst reduced investment has been driven by ‘an absence of good new investment opportuni-ties’. [44] Fellow Keynesian, Martin Wolf, also argues that the ‘global savings glut’ is rooted in ‘excessive hoarding caused primarily by capitalists unwilling to invest’. This results in a lack of effective demand with interest rates being held artificially down through excess savings (a liquidity trap). [45] Considering the historically low price of oil, the undeniable rise in inequality and the cheapness of borrowing this focus on anaemic investment is timely and important. Capital seems to have the perfect environment in which to undertake investment and yet, as a class, it is increasingly refusing to fund new production. The obvious question is why this has been the case and it is here that Keynesian analysis is found particularly wanting.

Instead of recognising this centrality of profits for capital accumulation, Keynesians argue that firms are either; (1) overburdened with legacy debts; (2) struggling for customers due to inequality; and/or (3) suffering pessimism in their ‘animal spirits’ due to endless years of crisis and deflation. Each of these arguments seems plausible when taken in isolation, but they fail to work when properly rooted within their historical context. Michael Roberts points out that if firms are now overburdened with debt it is precisely because they spent too much in a previous phase of the economic cycle. This would mean that a crisis caused by too much spending is now being sustained through too little spending and the purported solution is to once again increase spending. [46] The reality is that if previous investment is now weighing on companies balance sheets it is because the expected profit rates have not been forthcoming. In the absence of sufficient profit, extra speeding merely increases corporate debt rather than stimulating any recovery.

Turning to the issue of rising inequality, it is precisely because profits were historically falling that capital ramped up its efforts to reduce workers’ wages. Protecting profits was the historical driver of rising inequality and understanding this makes a mockery of Summers’ suggestion that recovery can be helped by raising ‘the share of total income going to those with a high propensity to consume, such as support for unions and increased minimum wages’. If capitalists have been reluctant to invest with cheap money and major attacks on workers conditions they are hardly likely to invest if profits are further undermined through state led redistribution. The rate of profit is what counts in an investment decision and redistributing to the working classes will not help the bottom line even if it does mean more consumers looking for commodities. Finally, the idea that capitalists have lost their confidence reaches for psychological arguments when none are needed. Capitalists invest when there are profits to be made – regardless of their psychological dispositions – and refrain from investment when profits are no longer available. Optimism and pessimism do not exist in a psychological vacuum. They are directly linked to the ability of capital to get a high enough return on their future investments.

The promise of profit drives productive investment in capitalist enterprises, but as Marx showed long ago, this process is hampered by an internal contradiction. Put simply, profit rates have a tendency to fall with repeated investment, periodically sucking the global economy into crisis. As a class, capitalists rely on the exploitation of human labour power purchased on the open market. The amount of surplus value pumped out of the working classes must therefore be kept sufficiently high if investment is to be forthcoming. The rate of profit is consequently linked to the rate at which workers can be exploited, but this is not the only variable in the equation. The relationship between capital and wage labour is foundational to the capitalist economy, but it is always mediated by the relations between the capitalists themselves. This is because capital is not one monolithic block. It is made up of hundreds of thousands of commercial units all competing with each other to exploit the labour of the working classes. They do this through technological competition. This means investing in the latest means of production such as machinery, tools and information technology. To stay ahead of their rivals, capitalists purchase the newest technologies to increase the productivity of their workers. The most technologically advanced capitalists invariably produce better output cheaper than their rivals. If they sell at the same price as their rivals they can capture some of the overall value via the normal workings of the market. The latest machinery cannot produce new value but it can help capitalists to capture more of the value being produced within the system. The trick is to be ahead of the average productivity in a given industry.

This gives every capitalist the incentive to increase their investments in machines and technology. As they continue to accumulate capital, the proportion of investment going to new sources of human labour tends to lag that going towards machines and technology. This is the Achilles Heel of the system overall, however, as the total amount of value and surplus value tends to fall over the economic cycle. Capital needs to invest in (non-value creating) plant and machinery in order to successfully exploit the working classes, but this puts downward pressure on the rate of profit. Eventually, this creates an economic crisis that can only be solved when some of this capital is destroyed and/or new sources of labour power are found and exploited.

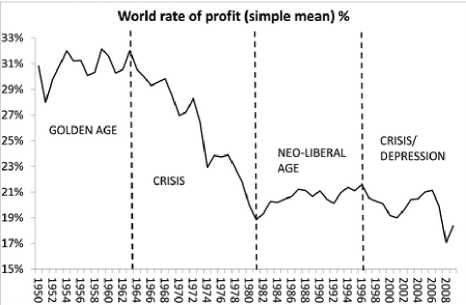

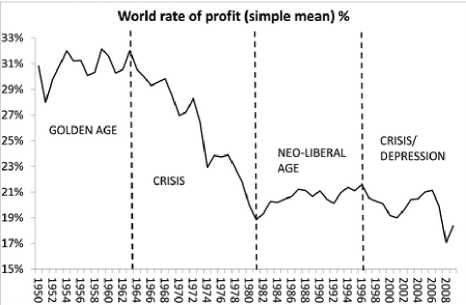

Historically, there have been four major counter-tendencies to falling rates of profitability. The first is the intermittent reality of crises themselves. Once capital refuses to invest, the value existing in plant, machinery and human labour power begins to disintegrate. Long periods of crisis can destroy enough capital to begin the process of exploitation anew, giving the capitalist economy its familiar pattern of boom and bust. The second counter-tendency is the ability of capital to speed up the production of means of production, thereby cheapening this aspect of the process. This cheapening of machinery has occurred historically, but the incredible pressure exerted by capitalist competition has meant that the value component of the means of production has nevertheless increased. [47] The third key counter-tendency has been aggressive geographical expansion. From the 1870’s onwards capital moved out of its European core on the back of a wave of Imperial expansion. More recently, capital has been able to seek new sources of human labour power to exploit via the capital flows associated with neoliberalism. Finally, capital intermittently ramps up its levels of exploitation. The neoliberal period has also played witness to this counter-tendency as unions have been undermined and wages and welfare have been rolled back everywhere. Taken collectively, these counter-tendencies can reverse the process for periods of time, but the tendency for the rate of profit to fall has not been completely eradicated. Michael Roberts gives a useful visual representation of this below.

Source:

Michael Roberts’ Blog Post – |

The last six decades of capitalist development also provide compelling evidence for the Marxist analyses. From 1929 until 1945 capital accumulation was severely disrupted under the twin pressures of the Great Depression and World War Two. Andrew Kliman has estimated that prices fell by as much as 25% in that time, destroying up to 40% of the accumulated capital in the USA. This constituted the longest period of value destruction in capitalist history. It also led to the greatest expansion of the capitalist system after the war – as predicted by the Marxist thesis. [49] From the late 1940’s onwards, unusually high rates of return sparked 25 years of investment, accumulation and economic growth. This process was significantly aided by the massive expansion of the ‘arms economy’ which slowed down the accumulation of unprofitable capital through a form of waste. [50] Be-that-as-it-may, the accumulation of capital steadily weighed on the system’s ability to keep on accumulating. From a high point in the 1950’s, profit rates fell steadily into the early 1970’s under pressure from continual cycles of reinvestment. In the face of a steady erosion of their economic power the capitalist classes were forced into action. [51] From the early 1970’s, ruling class forces centred in the US and the UK rolled out a neoliberal strategy based around four key strategic objectives.

The first of these involved reorienting state policy to allow capital to become more international. This helped transnational corporations to leave areas of low profitability in order to suck new layers of workers into the system. Much is made of the increasing mechanisation of certain branches of industry, but the fact remains that when capitalists felt most threatened they moved to find hundreds of millions of new labourers to exploit. The second key strategy was an all-out assault on workers living conditions. This tactic was tied up with the internationalisation of capital flows in so far as capital attempted to set up a globalised race to the bottom. Internationally, this involved undermining domestic labour laws, reducing corporation taxes and squirreling resources into tax havens. Domestically, the state was used as a battering ram against wages and conditions, reducing welfare systems, attacking unions and making labour contracts increasingly precarious. The third strand of the policy involved increasing financialisation. In Europe, the US and Japan, financialisation allowed corporations to grab resources from working people through an explosion of household and credit card debt. In the developing economies, it also allowed the accumulation of public sector debt recycled from the petro-dollars of the western bankers. [52] As this debt burden became intolerable, capital moved to restructure entire regions of the Global South through an insidious form of primitive accumulation (structural adjustment). At least $5 trillion dollars have since been redirected from the poorest people in the world into capitalist firms under a process that David Harvey rightly describes as ‘Accumulation by Dispossession’. [53]

For a time this combination of predatory policies breathed new life into the system. Estimates vary, but there is a general consensus amongst Marxist economists that the neoliberal project reversed the tendency towards falling profits and even pushed them slightly higher for a period. For the US, Guglielmo Carchedi and Michael Roberts estimate that profit rates recovered by around 19% on the back of a rise in surplus value of 24%. [54] Fred Moseley and Duménil and Levy have independently performed similar calculations for the wider system, coming to roughly the same conclusion. Profit rates recovered from their low point in the early 1970’s, but never more than half of their initial decline. [51] This is in line with the empirical evidence given by Maito above. It is also in line with the anaemic economic growth rates of the major economies listed in Table 1.

|

Table 1 |

|||||

|---|---|---|---|---|---|

|

|

1961–69 |

1970–79 |

1980–89 |

1990–99 |

2000–09 |

|

USA |

4.66 |

3.54 |

3.14 |

3.25 |

1.81 |

|

Japan |

10.44 |

4.11 |

4.37 |

1.47 |

0.56 |

|

UK |

2.90 |

2.45 |

2.44 |

2.71 |

1.94 |

|

France |

5.55 |

4.11 |

2.29 |

1.87 |

1.32 |

|

Germany |

N/A |

3.08 |

1.96 |

2.17 |

0.90 |

|

Italy |

5.77 |

4.02 |

2.55 |

1.44 |

0.58 |

In all cases the overall growth rate has declined consistently save for some minor increases during the 1990’s. This has forced capital out of its traditional heartlands in search of profits in the rest of the system. Since the late 1970’s much of the impetus for accumulation has been carried from Western corporations into South East Asia and, latterly, into the BRICS. Since that time, growth rates in these areas have been consistently higher than their rivals off the back of the exploitation of vast quantities of formerly peasant labour. Yet even this process has now begun to lose energy as the over-accumulation of unprofitable capital drags down profit rates in China and South East Asia. Table 2 is illustrative of these general patterns.

|

Table 2 |

||||||

|---|---|---|---|---|---|---|

|

BRICS |

1961–69 |

1970–79 |

1980–89 |

1990–9 |

2000–09 |

2010–15 |

|

China |

3.10 |

7.44 |

9.75 |

9.99 |

10.29 |

7.72 |

|

India |

3.90 |

2.93 |

5.69 |

5.77 |

6.90 |

8.05 |

|

Russia |

N/A |

N/A |

N/A |

−4.91 |

5.48 |

2.20 |

|

Brazil |

5.90 |

8.47 |

2.29 |

1.70 |

3.32 |

2.25 |

|

South Korea |

8.25 |

8.29 |

7.68 |

6.25 |

4.39 |

3.05 |

Growth rates have been persistently higher in the BRICS than the developed core of the system, but with the exception of India, this energy now seems to be receding. Coming amid general stagnation in Europe and Japan, this trend is ominous for global capitalism and it explains why so many of the key international institutions have become so worried since the start of 2016.

Over the course of the last 150 years capitalism has proven incredibly resilient. Time and again it has faced challenges to its profitability which have been overcome through a combination of economic crises, technological breakthroughs, geographical expansions, intensified exploitation, fascism, war and destruction. In one way or another each of these processes allowed capital to rebalance investment in favour of labour power, rescuing the profit rate from its tendency to decline. To argue that capitalism can never recover is to assume that all of these processes have completely run their course. Outside worldwide working class revolution this is clearly premature, but there are signs that the channels for overcoming crises are becoming weaker. On the one hand, there is an over accumulation of unprofitable capital weighing heavily on system’s the ability to recover. On the other hand, the mechanisms for clearing out this capital have become less and less effective. Let’s start with the normally regenerative effects of economic crises. In previous eras, crises were the most important means by which the system recovered, with the most competitive capitalists climbing out of recession on the backs of their (bankrupt) rivals. Once a corporation collapsed they generally left a gap in the market alongside valuable assets available at knock down prices. Simultaneously, they would push workers into unemployment, helping to put downward pressure on wages and conditions. As the system has become more centralised, it is no longer easy to disentangle profitable from unprofitable capital units.

When Lehman Brothers collapsed in 2009 for example, it threatened to rip a hole it the heart of the system as large sections of otherwise healthy capital came under pressure. This sent shock waves throughout the ruling classes, forcing them reassess their crisis strategy. Since Lehman’s, they have adopted a ‘precautionary principle’, meaning that the state frequently intervenes to prop up firms that would otherwise go under. This has meant that the level of deleveraging (writing off of unprofitable capital) has not gone nearly far enough. As capital becomes ever more concentrated the ability of the system to clear out its rubbish gets increasingly difficult. [56] This is one of the primary reasons for the longevity of the current crisis.

Technological breakthroughs are always occurring but the intensity of international competition means that firms proportionately invest more in machinery than in living labour power. Historically the tendency has been towards more intensive use of machinery rather than less intense use, resulting in the accumulation of unprofitable capital referred to above. Moving across international borders is also showing signs of diminishing returns as many parts of the globe have already been brought into the capitalist system. This process is by no means exhausted, as the rise of Indian capitalism suggests, but there are obvious limits to geographical solutions in the context of an ever more integrated economy. Neoliberal globalisation has also left deep scars on many of the developing economies that will not prove easy to heal. In large parts of Africa for example, IMF led structural adjustment has made capital accumulation of the sort seen in China more difficult to achieve. A ‘scorched earth strategy’ works for pillaging resources, but not for developing advanced forms of capitalistic social relations. Neoliberal globalisation has also led to an excess of Third World saving, as developing economies scramble to protect themselves from sudden shifts in financial capital flows. This makes it even more difficult to generate the levels of demand necessary to use up corporate cash piles.

That said, financialisation has worked for global capital on a number of levels. Most importantly, it has led to a massive boon in corporate profits, accounting for up to 40% of total US returns prior to the crisis. [57] Speculation has become an extremely lucrative business as corporate hedge funds scour the earth in search of returns. Debt has also proven itself useful in the struggle to impose post-crisis austerity, but it has not been without its destructive effects. According to the IMF there have been no less than 127 major financial crises since 1972. This has put significant strain on the ability of finance to support accumulation, as the systems wider need for a functioning architecture increasingly clashes with the need of individual corporations to extract value through speculation. Either way, global capitalism is now awash with various forms of debt, making another major financial rupture ever more likely. More ominously, this debt simultaneously holds back government and central bank use of policy tools in times of distress.

The ability to exploit human labour power is clearly not yet exhausted, but ramping up neoliberalism has not been able to weed out the major problem of too much unprofitable capital. Rising inequality has been ongoing for three decades and there are increasing signs that the ruling classes are now facing a backlash from this on two separate levels. On the economic level, rising inequality is making life harder for a section of capital as stagnating wages reduces consumer demand. Neoliberal restructuring may have been necessary insofar as it held down wages, but it also caused auxiliary problems to do with the volume of sales. Workers cannot spend what they do not earn and so here the need to generate (surplus) value clashes with the need to transform this value into profits. Keynesianism ignores this half of the story, rightly arguing that progressive redistribution increases demand without assessing the negative effects on surplus value. For this reason, increasing exploitation is likely to remain the dominant ruling class strategy even as it eats away at their political credibility. Three decades of neoliberal austerity have now begun to erode the political centre as the radical left and the far right have each made ground over the last eight years. Mainstream commentators rightly perceive the rise of such radical alternatives as directly linked to their imposition of austerity at the same time as they feel powerless to reverse it. The current crisis is therefore likely to be long and enduring. Workers will face major attacks, and the potential for the system to regenerate itself through war and destruction cannot be discounted. That said, the class polarisation that is slowly occurring can also lead to fissures to the left, and opens up the possibility for emerging challenges to neoliberal hegemony in the coming period. The experience of Syriza shows both the possibility of building such a radical alternative, and the dangers of confining that alternative to the rules of the system. To win we must go much further, rooting our strategy in the revolutionary potential of the world’s working classes.

* The author would like to thank Seán Mitchell for comments on this paper. All errors are my own.

1. Jamie McGeever, Citi – There is a 65% Chance the US goes into Recession Next Year, Business Insider, 2 December 2015.

2. Mike Whitney, A Warning from the Bank of International Settlements – The Calm Before the Storm, Global Research, 10 March 2016.

3. IMF Report – Global Economy Faltering from too low Growth for too Long, 12 April 2016.

4. ibid.

5. Global Economic Perspectives – Spillovers Amid Weak Growth, January 2016.

6. Gabriel Wildau & Don Weinland, China Debt Load Reaches Record high as Risk to Economy Mounts, Financial Times, 24 April 2016.

7. Milton Ezrati, Still Wallowing in the Shallows – The Ongoing Failure of Abenomics, The International Economy, Spring 2015, pp. 62–64.

8. Guglielmo Carchedi & Michael Roberts, The Long Roots of the Present Crisis – Marxists, Keynesians and Austerians, World Review of Political Economy, Vol. 4 No. 1, Spring 2013.

9. ibid.

10. David Harvey, A Brief History of Neoliberalism, Oxford University Press, 2005.

11. Annual data of China’s GDP: published on China NBS: National data – annual – national accounts – Gross Domestic Product; Figures for the current year 2015 are based on the Statistical Communiqué of the People’s Republic of China on the 2015 National Economic and Social Development.

12. China the Largest Migration Flow in History, University of Washington, Department of Geography, 28 February 2012.

13. Jeff Desjardins, China Uses Mind Boggling amounts of the World’s Raw Materials, Visual Capitalist, 10 September 2015.

14. CIA, The World Fact Book.

15. Gross Domestic Product China 2007–2014.

16. Capitalism relies on a cycle of investment – profit – reinvestment etc. This leads to an accumulation of capital as firms grow ever bigger. It also leads for a tendency for the profit rate to fall and thus to an over accibid.umulation of unprofitable capital. When this happens the economy goes into crisis. The reasons for this will be outlined in more detail below.

17. Martin Wolf, China’s Struggle for a New Normal, Financial Times, 22 March 2016.

18. China’s Recent Stock Market Crash – What are the Implications, 11 February 2016.

19. Why Has Growth in Emerging Market Economies Slowed, ECB Economic Bulletin, Issue 5, 2015.

20. ibid.

21. Dollar Credit to Emerging Market Economies, BIS Quarterly Review, December 2015.

22. Ian Talley & Anjani Trivedi, Rising debt in Emerging Markets Poses Global Threat, The Wall Street Journal, 19 January 2016.

23. Ben Moshinsky, Goldman: Welcome to the Third Wave of the Financial Crisis, Business Insider, 12 October 2015.

24. Alex Bigman, Eurozone Economy Finally Reaches Pre-Crisis Levels, 29 April 2016.

25. Low oil prices are having contradictory effects. In oil producers, the effects are negative as revenues fall and investment slows down. In oil importing countries the effects are often positive as the price of energy falls for most corporations. Yet even here the effects are complex as many of the major oil companies reside in Europe and the US. As they scale back on investment this can hurt other firms that rely on the oil industry for effective demand. Either way the low oil prices reflect the fact that overall global demand is weak.

26. Tom Fairless & Paul Hannon, Eurozone Slides Back into Recession, The Wall Street Journal, 29 February 2016.

27. ibid.

28. Martin Wolf, Germany is Eurozone’s Biggest Problem, Financial Times, 10 May 2016.

29. The PIGS are Portugal, Ireland, Greece and Spain. Each of these countries was in receipt of some form of Troika loan since 2010.

30. Olivier Blanchard, Slow Growth is a Fact of Life in the Post Crisis World, Financial Times, 13 April 2016.

31. Daniel Gros, Why has the US Recovered More quickly than Europe?, World Economic Forum, 22 July 2014

32. Bureau of Labour Statistics.

33. James Furman, It could have happened here. The Policy Response that Helped Prevent an Second Great Depression, 19 September 2015.

34. Robert A. Bleecker, The US Economy Since the Crisis Slow Recovery and Secular Stagnation, March 2016.

35. ibid.

36. Larry Summers, The Age of Secular Stagnation, 15 February 2016.

37. ibid.

38. Sam Fleming & Chris Giles, US Productivity Slips For the First Time in Three Decades, Financial Times, 25 May 2016.

39. That said, Keynes himself had been guilty of blind optimism, declaring in the 1920s that ‘there will be no further crashes in our lifetime.’

40. Robert J. Gordon, Is US Growth Over – Faltering Growth Confronts the Six Head Winds, NBER Working Paper Series, August 2012.

41. ibid.

42. Bernanke is actually a monetarist economist in the tradition of Alan Greenspan and Milton Friedman, but his account of a ‘savings glut’ does point in a Keynesian direction in so far as it assumes that the overall output of society is not currently being purchased. See http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.471.4631&rep=rep1&type=pdf for more details. [No longer available online]

43. Joseph Stiglitz, Inequality and Economic Growth.

44. Larry Summers, The Age of Secular Stagnation, 17 February 2016.

45. Martin Wolf, Why the Future Looks Sluggish, Financial Times, 19 November 2013.

46. The Global Crawl Continues

47. G. Carchedi & M. Roberts, The Long Roots of the Present Crisis – Marxists, Keynesians and Austerians, World Review of Political Economy, Vol. 4 No. 1, Spring 2013.

48. [No note in printed edition]

49. Andrew Kliman, The Failure of Capitalist Production – Underlying Causes of the Great Recession, London, Pluto Press.

50. See Mike Kidron – A Permanent Arms Economy.

51. David Harvey, A Brief History of Neoliberalism.

52. Harry Cleaver, Close the IMF, Abolish Debt and End Development: A Class Analysis of the International Debt, Capital & Class.

53. David Harvey, A Brief History of Neoliberalism.

54. Carchedi & Roberts, The Long Roots of the Present Crisis – Marxists, Keynesians and Austerians.

55. Fred Moseley – The Rate of Profit and the Future of Capitalism; Duménil, Gérard and Dominique Lévy, The Profit Rate: Where and How Much Did it Fall? Did It Recover? (USA 1948–1997).

56. Chris Harman – The Profit Rate and the world Today.

57. 58 [sic!].

IMR Index | Main Newspaper Index

Encyclopedia of Trotskyism | Marxists’ Internet Archive

Last updated on 31 August 2021