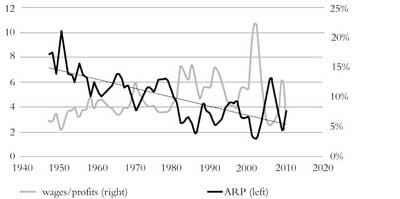

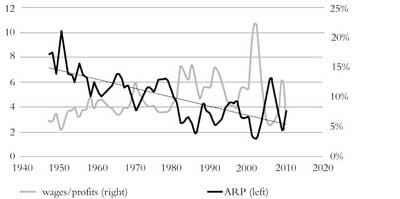

Figure 1: Wage share and ARP

in the US productive sectors

ISJ 2 Index | Main Newspaper Index

Encyclopedia of Trotskyism | Marxists’ Internet Archive.

From International Socialism 2 : 136, Autumn 2012.

Copyright © International Socialism.

Copied with thanks from the International Socialism Website.

Marked up by Einde O’Callaghan for ETOL.

For Marx, the proximate cause of crises is the fall in the average rate of profit (ARP). [1] An increasing number of studies has shown that this thesis not only is logically consistent but is also supported by a robust and growing empirical material. [2] If falling profitability is the cause of the slump, the slump will end only if the economy’s profitability sets off on a path of sustained growth. Then the relevant question is: can Keynesian policies restore the economy’s profitability? Can they end the slump?

To begin with, what are Keynesian policies? First, they are state-induced economic policies. Second, they can be redistribution policies or investments policies. Third, they should be capital financed and not labour financed. If labour-financed, they are neoliberal policies. Fourth, in the case of state-induced investment policies, they can be either civilian (mainly in public works like highways, schools, hospitals, etc, in order to avoid competition with those private sectors already experiencing economic difficulties) or military. I shall not deal with “military Keynesianism” because presently this is not what Keynesian economists propose to end the crisis. Some might think that a major war might be the only way out of the depression. This is an open admission of the monstrosity of this system. But then why save it? Then what follows refers only to civilian Keynesian policies.

Suppose the state brings about a redistribution of value from capital to labour through pro-labour legislation, progressive taxation, etc. Of course, it is the net outcome of these policies that counts. If the state cuts taxes for labour but also reduces public expenditure on services like health or education, either labour pays for those services, thus neutralising the effect of the wage rise on consumption, or its greater consumption is neutralised by the state’s lower expenditure on pro-labour services.

Then let us assume that net wages (direct, indirect and deferred) rise. More consumer goods are sold and labour consumes more. This is why these policies are supposed to be pro-labour. Supposedly the sale of unsold consumer goods spurs the production of means of consumption. This would generate the demand for means of production. An upward cycle would start. And this is why these policies are supposed to be pro-capital as well. Both capital and labour would gain. This is the basis of Keynesian reformism, of class collaboration.

But does labour’s greater consumption really cause a greater production of consumer goods and then of production goods and thus greater employment and economic growth? Suppose that some consumer goods are unsold. This is the hypothesis behind Keynesian interventionism (lack of demand). In this case, higher wages cause the sale of unsold consumer goods and not a greater production of these goods. Keynesian redistribution fails in its own terms, in terms of demand-induced production and thus employment and recovery.

But capitalism prospers not if production rises but if profitability rises. Once we introduce profitability, everything changes. If a capitalist cannot sell her output, she suffers a loss. If later, due to higher wages, those commodities are sold, she realises that unrealised profit. Profit and loss cancel out. But profitability falls. The proof requires three steps.

The numerators of the two sectors return to the original value. However, the denominators have increased. The average rate of profit (ARP) for the two sectors falls. Two points follow. First, wages and thus consumption can increase without profits (not the ARP) falling. Second, production does not increase. What increases is the realisation of previously produced commodities. In sum, labour’s consumption rises but production remains the same and the ARP falls. Keynesian redistribution fails not only on its own grounds, production, but also on grounds of profitability; the increase in labour’s consumption and the worsening of the crisis are two sides of the same coin.

Suppose now that wages keep rising up to the point where all consumer goods are sold. Given that there is sufficient demand, there is no need for Keynesian intervention. Nevertheless, would not a further rise in wages spur the extra production of consumer goods? No. Production increases both if profitability rises and if there is demand for the extra output, i.e. if the extra surplus value can be both produced and realised. Production does not rise if one of these two conditions is not satisfied.

Higher wages increase the demand for consumer goods but at the same time lower the profit rate. Some capitalists might decide to increase production even at lower levels of profitability. But eventually, in spite of their efforts, the economy’s production decreases. In fact, if profits fall, (a) less surplus value can be generated and thus reinvested and reserves are not invested in activities whose profitability keeps decreasing and, (b) due to higher wages, the weaker capitalists go bankrupt and cease production. It follows that capitalists as a whole reduce their output in spite of higher demand and in spite of their efforts to meet that demand.

Thus the equation

|

higher wages = more consumption |

is correct. However, the equation

|

more consumption = more production |

is wrong because (a) in case of remnant sales, higher wages do not affect production (only the realisation of already produced commodities is fostered) while profitability falls and (b) from the point at which all output has been sold on, higher wages decrease profitability and thus production. Production is either unchanged or falls but profitability falls in both cases. Higher wages cannot end the slump but worsen it. The Keynesian medicine is worse than the illness.

The above has shed light on the essential difference between the Keynesian and the Marxist approach. Contrary to the latter, for the former profitability is not the essential determinant of production. The Keynesian approach inverts the order of causation. In it profitability is a consequence of greater demand-induced production, a consequence of greater physical production induced by higher consumption. In the Marxist approach, higher production is the consequence of higher profitability. The theoretical, political and ideological consequences are far reaching.

If a greater demand (induced by higher wages) spurred production, the economy would tend towards a point at which, given pro-labour redistribution, higher demand and higher supply would meet. This is the point at which growth and equilibrium join. This is conventional economics’ illusion. But if the greater demand induced by higher wages does not spur production but actually causes its fall because of falling profitability, demand and supply cannot meet and no point of equilibrium can be reached. To counter falling profitability, wages would have to increase again. The result is a downward sequence of non-equilibrium points between demand and supply that are so many stations towards the crisis. Contrary to the Keynesian approach, higher wages at the cost of capital contribute not to the movement towards equilibrium and growth but to the movement towards depression and crises.

This conclusion is important for economic policy because it shows that policies aimed at stimulating growth through pro-labour redistribution are doomed to fail. But this conclusion is also important from a theoretical and political point of view because, by denying that the system, given the appropriate redistribution policies, can tend towards equilibrium and growth, we deny that this system is (or can be made to be) rational. Bourgeois economics, on the other hand, holds that the system is in or tends towards equilibrium at higher levels of production and consumption and that therefore it is rational. If this were the case, the consequences for labour’s struggle would be devastating because the struggle against this system would become a struggle against a rational system and thus an irrational, spontaneistic struggle. But if the system is irrational because it tends towards crises in spite of Keynesian (or other) policies, labour’s struggle is the conscious manifestation of the economy’s objective movement towards crises.

Alternatively, the state can induce a redistribution of value from labour to capital through falling wages and other measures. These are neoliberal (the opposite of Keynesian) policies. Nevertheless, they should be briefly considered. A wage cut increases profitability. But at the same time it reduces the demand for consumer goods. In this case, capitalists reduce their output not because profits fall but because demand falls. But should the increased profitability not revive the economy in spite of lower demand and production? Could not more profits relative to the capital invested be made on a lower level of production?

In a crisis, if the demand for consumer goods falls due to lower wages, the extra profits from lower wages are not reinvested in that sector and thus cannot spur investment in the production of means of consumption. Moreover, capital does not disinvest in sector II and invest in sector I because profitability also falls in sector I. The extra profits are either set aside as reserves or invested in the unproductive sectors (commerce, finance and speculation) where profitability is higher (but only as long as the bubble does not burst) or can be moved to countries where they can be reinvested more profitably. For some countries more than others, they can feed corruption, criminality and inefficiencies (Italy is a typical case). In any case, these extra profits cannot get the economy going again.

The state too contributes to diverting value away from the productive sectors. In the present conjuncture, given the high levels of state debt, the (surplus) value appropriated by the state (for example, through higher taxation) is used to decrease state losses or financial capital’s losses. Keynesian economists perceive state-induced “austerity” (an ideologically loaded word that should be carefully avoided) as the cause of (the deepening of) the crisis. In reality, the depression of consumption (lower wages) is the consequence of falling profitability, an attempt by private capital through the state to restore the ARP.

In sum, neoliberal policies are not the cause of the slump (they are the consequence of the slump, one of the factors counteracting the fall in the ARP) and fail to end the slump because profits are diverted away from productive investments and not, as held by Keynesian authors, because wage cuts reduce consumption. The dilemma “austerity” versus growth (policy measures paid by labour or by capital) as a remedy against the slump is a false one. Neither pro-labour nor pro-capital redistribution policies can end the slump. This can be empirically substantiated. Consider the following.

|

Figure 1: Wage share and ARP

|

This chart shows that up to 1986 wages rose relative to profits and the ARP fell, conforming to Marx but not to Keynesian underconsumptionism. From 1987 to 2009 wages fell relative to profits and the ARP rose, again conforming to Marx but not to Keynesian underconsumptionism. But the trend in the ARP kept falling throughout the whole period. Both pro-labour and pro-capital redistribution did not prevent the ARP from falling tendentially.

The strongest case for Keynesian policies is not state-induced redistribution but state-induced investment. As a rule, those authors (also Marxists) advocating state-induced investment policies as a way to end the slump omit a fundamental point, namely who is supposed to finance these investments (see footnote 4 below). There are two possibilities: capital-financed and labour-financed state-induced investment policies. I shall consider only capital-financed investment because labour-financed investments are not what Keynesian authors propose to end the slump.

Let us distinguish between sector I, the producer of public works, and sector II, the rest of the economy. Surplus value, S, is appropriated (e.g. taxed) by the state from sector II and channelled into sector I for the production of public works. [3] Rather than taxing surplus value, the state can appropriate unused reserves. But as far as capital is concerned, this is a loss and thus a deduction from surplus value. Having appropriated S from sector II, the state pays sector I a certain profit, p, and advances the rest, S−p, to sector I for the production of public works.

Consider first the effects for the state. The state receives public works from sector I to the value of S−p+p~, where p~ is the surplus value generated in sector I (whether p~ is equal to p or not). Sector I realises its profits because it has received p from the state, while p~ belongs to the state. How does the state realise S−p+p~, the total value incorporated in public works? Under capitalism value is realised only if and when it is metamorphosed into money through the sale of the use value in which it is incorporated. Since the state does not sell public works (unless it privatises them, but privatisation falls outside our present scope), it would seem that that value remains potential, trapped in an unsold use value. However, public works can realise their value in a different way. Their use value is consumed by the users of those facilities who, in exchange for this use, must pay in principle for the share of the value contained in the public works they consume. Once the public works are totally consumed, the state receives S−p+p~. The state has realised the potential value of public works by charging capital and labour for their use. These fees are an indirect reduction of wages and profits. The state has gained S−p+p~, sector I has gained p, sector II has lost S, and the private sector has lost S−p.

Consider the effects on the ARP. Sector II loses S but sector I gains p. In sum, private capital loses S−p to the state. The numerator of the ARP decreases by that much. The ARP falls. But this is not the end of the story. The capitalised surplus value advanced by the state, S−p, is invested by sector I. To determine the effect of this investment on profitability, we must introduce what I shall call the Marxist multiplier.

To produce public works, Sector I purchases labour power and means of production from other firms in both sectors. In their turn, these firms engage in further purchases of means of production and labour power. This multiple effect cascades throughout the economy. Under the most favourable hypothesis for the Keynesian argument, the state-induced investments are sufficiently large to first absorb the unsold goods and then stimulate new production. Given that the firms involved in the cascade effect have different organic compositions, three cases are possible.

Notice that the three possible outcomes are not policy options that can be influenced by the state’s policy. Once the initial state-induced capital has been invested, the final result in terms of organic composition and ARP depends on the spontaneous working of the system, i.e. on which capitals receive commissions by other capitals. The state can influence only the first step, by commissioning public investments to low organic composition capitals. But then, as in cases above, it helps to increase profitability but also to keep the less efficient capitals afloat.

But aside from this, the most likely outcome is a rise in the combined organic composition and thus a fall in the ARP because each capital in the cascade will tend to purchase the material it needs from the cheapest bidders. These are usually the most efficient ones, those whose organic composition is high relative to the average. The further investment induced by the state’s initial investment will go mainly to these producers. The organic composition rises and the ARP falls. In short, as a result of state-induced investment, either average profitability falls or, if it rises, the less efficient capitals are artificially kept alive. The crisis is either worsened or postponed. And if it is postponed, capital cannot self-destruct and the recovery is further delayed. In neither case can the economy restart.

Beside the limits underlined by the Marxist multiplier, state-induced redistribution and/or investment policies meet a further obstacle. They are possible when private capital can bear the loss of surplus value (or of reserves). But when capital sinks into crisis, when profitability falls, their financing becomes increasingly problematic. These policies can be applied where they are least needed and cannot be used where they are most needed. This shows how unrealistic is the call also by prominent Marxists for a massive wave of state-induced capital-financed redistribution and/or investment in the present economic predicament as a way out of the crisis. [4]

Some Keynesian authors propose to stimulate demand neither through redistribution nor through investments but by increasing the quantity of money. The assumption is that the ultimate cause of crises is lack of demand so that a higher quantity of money in circulation would stimulate demand. The argument against this view is not so much whether these policies are inflationary (as Austrian economists hold) or not.

Rather the objection is that by printing money one increases the representation of value rather than value itself. The economy cannot restart if the surplus value produced relative to the capital invested is unchanged. Moreover, by printing and distributing money, one redistributes purchasing power. But we have seen that neither pro-labour nor pro-capital redistribution is the way out of the slump. But usually, by “printing money” one understands granting credit. The notion that credit is money is almost universally accepted and yet fundamentally wrong. By creating credit, one does not “create money out of nothing”, an absurd proposition. Out of nothing, one can create nothing. Simply by creating credit one creates debt. So the crisis is postponed to the moment of debt repayment.

This is one of the reasons why the state may decide to borrow the capital needed for public works rather than expropriating it from capital. But eventually debts must be repaid. The Keynesian argument is that debts can be repaid when, due to these policies, the economy restarts and the appropriation of the surplus value needed for debt repayment does not threaten the recovery. But this is wishful thinking.

In fact, we have seen that state-induced capital-financed investment cannot restart the economy. At most, it can postpone the explosion of the crisis. Then, if either pro-labour or pro-capital anti-crisis policies are impotent against the slump, the crisis must run its course until it itself creates the condition of its own solution. This is the destruction of capital. Only when sufficient (backward) capitals have been destroyed (have gone bankrupt) can the more efficient productive units start producing again on an enlarged scale. It follows that, if these policies at best postpone the explosion of the crisis, they also postpone the recovery. By postponing the recovery, these policies are an obstacle to, rather than being a condition for, the repayment by the state of its debt. [5]

The thesis that state-induced redistribution and investment policies, possibly through state borrowing, could start a sustained recovery, provided the scale is sufficiently large, is not only theoretically invalid (see above) but also empirically unsubstantiated. The example usually mentioned is the long period of prosperity that followed the Second World War, the so-called Golden Age of capitalism. Supposedly, government borrowing made it possible for the US state to finance Keynesian policies and thus to start the long period of prosperity. In reality, the US gross federal debt as a percentage of GDP decreased constantly during the Golden Age, from 121.7 percent in 1946 to 37.6 percent in 1970. The long spell of prosperity was due to reconversion, ie to the reconstitution of civilian capital, and to the liberation of pent-up purchasing power after the war. [6]

The above should not be construed as if labour should be indifferent to state-induced capital-financed redistribution and/or investment policies. On the contrary, labour should strongly struggle for such policies. But this struggle should be carried out not from a Keynesian perspective but from the proper, Marxist, perspective.

The Keynesian approach considers Keynesian policies as a way to improve both labour’s conditions and capital’s condition, a way to counter or exit the slump. From the Marxist perspective, state-induced capital-financed distribution and/or investment policies need not be Keynesian, ie need not carry the ideological content attached to the word, the community of interests between the two fundamental classes. The Marxist perspective stresses (a) that these policies may improve labour’s lot but are impotent against the crisis-they can at most postpone it, and (b) the political potential of these policies. Through the struggle of labour for better living and working conditions, consciousness can arise and grow among workers that each time these policies are paid for by capital, capital is weakened both economically and politically, and that labour can exploit this to weaken the yoke of capital.

From the Marxist perspective, the struggle for the improvement of labour’s lot and the sedimentation and accumulation of labour’s antagonistic consciousness and power through this struggle should be two sides of the same coin. This is their real importance. They cannot end the slump but they can surely improve labour’s conditions and, given the proper perspective, foster the end of capitalism.

1. The fall in the ARP is the proximate cause because it itself is caused by technological competition, ie by the introduction of labour-”saving” but efficiency-increasing new technologies.

2. See Carchedi, 2011a; Carchedi, 2011b; Roberts, 2012, as well as the literature in these works. Marx defines the rate of profit as s/(c+v), where s stands for surplus value, c for constant capital (i.e. capital invested in means of production) and v for variable capital (i.e. capital invested in labour power, roughly equivalent to wages). Thus s is the numerator and (c+v) the denominator of the rate of profit equation. The rate of profit depends on the rate of surplus value (s/v) and the organic composition of capital (c:v).

3. This is a simplification. The state appropriates surplus value from, eg taxes, both sectors. The point is that sector I receives more surplus value to invest than it loses to the state.

4. For example, as Alan Freeman holds, “if the state makes available, to as many people as possible on an equal basis, the capabilities that capitalism has brought into existence, stepping in wherever private capital will not, the crisis will end” – Freeman, 2009. On the contrary, the crisis will either deepen or be postponed. Anwar Shaikh too thinks that direct government investment can pull the economy out of the crisis. This would stimulate “demand provided that the people so employed do not save the income or use it to pay down debt” – Shaikh, 2011. Aside from the unrealistic nature of the assumption that people do not save and do not pay back debts, given that banks need labour’s savings and that the default on debts means principally default on banks’ debt, this is a sure recipe for a financial crisis. Similarly, Foster argues, “Theoretically, any increase in government spending at this time can help soften the downturn and even contribute to the eventual restoration of economic growth” – Foster, 2009. These and other similar proposals have a characteristic in common: they do not concern themselves with who should finance these policies. But, aside from this macroscopic defect, given that the economy exits the crisis through capital destruction, these policies delay rather than prevent the onset of the crisis.

5. There is no affinity between this conclusion and the Austrian school. The differences are unfathomable. Just to mention two out of the many: for the Austrian school the economy, if not tampered with, tends towards equilibrium (rather than towards crises, as in Marx) and government intervention is the cause of crises (rather than being one of the many countertendencies, as in Marx).

6. See Carchedi, 2011b.

Carchedi, Guglielmo, 2011a, Behind the Crisis: Marx’s Dialectics of Value and Knowledge (Brill).

Carchedi, Guglielmo, 2011b, Behind and Beyond the Crisis, International Socialism 132 (Autumn).

Foster, John Bellamy, 2009, Keynes, Capitalism and the Crisis, interview by Brian Ashley.

Freeman, Alan, 2009, Investing in Civilization, MPRA.

Roberts, Michael, 2012, A World Rate of Profit, The Next Recession (July).

Shaikh, Anwar, 2011, The First Great Depression of the 21st Century, Socialist Register 2011 (Merlin).

ISJ 2 Index | Main Newspaper Index

Encyclopedia of Trotskyism | Marxists’ Internet Archive

Last updated on 27 November 2021