Alex Callinicos Archive | ETOL Main Page

From International Socialism 2:81, Winter 1998.

Copyright © International Socialism.

Copied with thanks from the International Socialism Archive.

Marked up by Einde O’ Callaghan for the Encyclopaedia of Trotskyism On-Line (ETOL).

In the past few months the core zones of world capitalism – the United States and the European Union – have suddenly found themselves peering over an economic abyss. The financial and governmental collapse in Russia in late August dramatised the fact that the crisis which had begun in East Asia in the summer of 1997 was spreading and threatening to engulf the entire global economy. The Hungarian-American speculator George Soros summed up the mood of panic that swept the world’s financial centres in the autumn of 1998 when he told the US Congress, ‘The global capitalist system that has been responsible for such remarkable prosperity is coming apart at the seams’. [1]

Coming as it does towards the end of a decade in which global financial markets have been dominated by an atmosphere of euphoria and greed and in which the official left has largely abandoned any intention of reforming capitalism, this unfolding crisis is a development of historic significance. Properly to grasp its nature requires that we understand that it has three distinct, but interrelated dimensions – the financial panic which seized the headlines, the behaviour of the underlying rate of profit, and the growing crisis of government policy. Let us consider these three dimensions in turn.

The Asian crash: Undeniably the crisis started in East Asia. Commentators talk constantly of ‘financial contagion’ and ‘Asian flu’, as if some mysterious disease is inexplicably spreading from Indonesia and South Korea to the rest of the world. In fact, the Asian crisis and the boom that preceded it can only be understood within the framework of the destabilising movements of money-capital on a global scale. US, Japanese and European speculators played a critical role in the entire process. The Asian crash is thus best seen as merely the first stage in the global economic crisis that is now unfolding rather than as a local upset that is somehow spilling over the rest of us.

As world capitalism celebrated the collapse of the Stalinist regimes during the first half of the 1990s, a huge surge of Western investment poured into the booming ‘emerging markets’ of East Asia and Latin America. This outflow of funds from the advanced economies was made possible by the growing integration of financial markets promoted by government policies of deregulation, which make it very easy to move money around the globe. In countries like South Korea, local capitalists gambled on their export markets continuing to grow at very high rates, and consequently made huge investments largely financed by foreign loans, often of a highly short term nature. As the boom reached fever pitch, investment became increasingly speculative, spilling into financial markets (in the process of being deregulated under pressure from Washington), real estate, and grandiose state projects (Malaysia’s prime minister, Mahathir Mohamad, was particularly free spending).

The Asian boom helped to fuel a more general mood of confidence about the future of capitalism whose most visible feature was the extraordinary sustained rise of world stockmarkets in general, and of Wall Street in particular. Share prices soared against the background of a relatively mediocre performance by the big capitalist economies. In a series of perceptive leaders that appeared in December 1996, the leading capitalist paper, the Financial Times, surveyed this contradictory situation. ‘Since 1990 the fastest annual rate of growth in real domestic product achieved by the OECD countries has been 2.7 percent,’ the paper conceded. This compared unfavourably, not merely with the latter phase of the postwar boom in the 1960s and early 1970s (when European growth averaged 4.8 percent a year, US 4.3 percent, and Japanese 9.4 percent), but even with the crisis ridden 1970s and 1980s.

On this analysis government intervention would not achieve faster growth, since financial markets, having been badly burned by the great inflation of the 1970s and early 1980s, were deeply suspicious of anything that smacked of Keynesian demand management. The increased mobility of money-capital made possible by globally integrated markets meant that any state which appeared to be behaving ‘imprudently’ would suffer capital flight and a falling currency. The share boom offered a free market substitute for state intervention by providing a welcome stimulus to sluggish Western economies:

The joie de vivre on Wall Street may help to tide the world over to a more confident economic upturn in which the surprises may come on the side of faster than expected growth. This is, after all, a long cycle in which the contribution of the newly industrialising countries in Asia and elsewhere will be on an unprecedented scale. [2]

On this analysis, dynamic East Asian capitalism represented the future of world capitalism, coming as it matured to the rescue of the stagnating advanced economies. In fact, the Asian boom was part of the problem, intimately linked to the booming financial markets in a pattern as old as capitalism. The economic historian Charles Kindelburger outlined the anatomy of the financial crises that have been an endemic feature of capitalism:

What happens, basically, is that some event changes the outlook. New opportunities for profit are seized, and overdone, in ways so closely resembling irrationality as to constitute a mania. Once the excessive character of the upswing is realised, the financial system experiences a sort of ‘distress’, in the course of which the rush to reverse the expansion process may become so precipitous as to resemble panic. In the manic phase, people of wealth or credit switch out of money or borrow to buy real or illiquid financial assets. In panic, the reverse movement takes place, from real or financial assets to money, or repayment of debt, with a crash in the prices of commodities, houses, buildings, land, stocks, bonds – in short, whatever has been the subject of the mania. [3]

In the East Asian case it was the increasing problems faced by productive capital which precipitated the financial crash. [4] Competition for export markets became progressively more intense, especially after China devalued its currency, the renminbi, in 1994, and the Japanese yen began to fall against the US dollar from the spring of 1995 onwards. Most other East Asian currencies were pegged to the dollar, and therefore couldn’t be devalued in response, so competition from cheaper Japanese and Chinese exports exerted increasing pressure throughout the region. Economies such as South Korea and Taiwan found themselves increasingly vulnerable to the fluctuations in the world price of the computer chips they export.

The result was massive over-investment and over-capacity in East Asia. The Financial Times summarised the conclusion of one study:

At an annual average growth rate of over 20 percent this decade, investment has been rising about three times as far as growth in domestic gross national product, suggesting Asia has been suffering from a serious case of over-investment. Now ... capacity use is running at very low levels in countries such as China (below 60 percent), South Korea (below 70 percent) and Taiwan (72 percent). [5]

This gap between the underlying productive economy and the financial boom made a crash of some kind inevitable. Once confidence in East Asia began to crumble with the comparatively minor event of the collapse of the Thai currency, the baht, in July 1997, the huge investment boom unravelled astonishingly quickly. Speculators forced one East Asian currency after another off their pegs to the dollar. According to one study of the panic, it was local capitalists – Asian banks and corporations – who started selling off their currencies, but foreign investors soon joined in the rout. [6] Money poured out of East Asia as quickly as it had entered it in the first place. One commentator summarised the results:

The five countries that have been most damaged by the crisis – Indonesia, Malaysia, South Korea, Thailand and the Philippines – had net private inflows of $41 billion ... in 1994. By 1996, this had jumped to $93 billion ... Then, in 1997, came the panic: the net inflow turned into an estimated outflow of $12 billion. The swing in the net supply of private capital was $105 billion in just one year, a staggering 10 percent of the combined pre-crisis gross domestic product of the five countries. [7]

This massive flight of capital broke the backs of the worst affected economies. In order to get access again to foreign capital, their governments were forced to sign up to deals with the International Monetary Fund (IMF). The main thrust of the ‘reform’ programmes imposed as conditions of these ‘rescues’ was, true to the ‘Washington consensus’ developed by the IMF in close collaboration with the US Treasury, harsh deflation and measures designed further to deregulate these economies and thereby open them up to Western capital.

The most immediate effect of this was to engineer a growing socio-economic and human catastrophe. The latest projections suggest that Indonesia’s economy will contract by more than 15 percent in 1998, Thailand’s by 7 or 8 percent, and South Korea’s by about 5 percent. [8] In the second quarter of 1998 the Malaysian economy shrank by 6.8 percent – a huge turnaround considering that it grew by 7.8 percent in 1997. [9] Unemployment is soaring throughout the region, and in countries such as Indonesia the scrapping (at the IMF’s insistence) of subsidies on basic commodities has caused a huge surge in the rate of inflation. Mass pauperisation, reflected in such symptoms as a huge increase in prostitution in Indonesia and Thailand, is becoming a reality. In Indonesia, John Rees writes:

The Food and Horticulture Ministry reports that some 17 million families (or 68 million people out of a total population of 200 million) are ‘hit by dire food shortages’. In central and eastern Java, the richest and most populous island in the archipelago, some 17.5 million people survive on one meal a day. Another 38 million people eat twice a day, but ‘this ability is declining fast’ according to the ministry. [10]

Deflation in Japan: The East Asian crisis has been exacerbated by the fact that the Japanese economy, the second biggest in the world, has stagnated throughout the present decade as a result of an earlier financial crash. The collapse of the late 1980s speculative boom centred on the stockmarkets and real estate – the so called ‘bubble economy’ – has left Japanese banks with huge bad loans. Standard & Poor’s, the US credit ratings agency, recently estimated that problem loans in the Japanese banking system amount to 151,370 billion yen (£681 billion), a staggering 30 percent of gross domestic product. [11]

The structure of the keiretsu – the huge groups linking together industrial corporations with one of the 13 big City Banks – played the historical role of providing productive capitalists with cheap loans, but, with the banks in trouble, credit has dried up, paralysing the entire Japanese economy. To make matters worse, Japanese corporations massively invested in the rest of East Asia throughout the 1990s. Moreover, at the end of 1997 Japanese banks held claims of $191 billion on Asian emerging markets, compared to $257 billion for those of the EU and only $38 billion for US banks. [12] The regional collapse therefore deprived Japanese capitalism of badly needed profits and export markets, as well as adding a further threat to an already weakened financial system.

Japan is now caught in the same sort of deflationary spiral which gripped the world economy during the Great Depression of the 1930s. Prices are falling: in August wholesale prices were 2.1 percent lower than they were a year earlier. [13] Consumers are putting off major purchases, partly because they are afraid of rising unemployment, and partly because they expect goods to become cheaper. Starved of both domestic demand and export markets, the Japanese economy shrank throughout the first nine months of 1998, its worst performance since records began in 1955. [14] In these circumstances, conventional remedies like cutting interest rates have ceased to work. By the end of August, Japan’s long term market interest rates had dropped to 1.045 percent, according to the Financial Times ‘the lowest anywhere in the world for at least four centuries’, and were still falling. An economist commented, ‘The economic situation is now beyond gloom – it’s going downhill very fast’. [15]

Faced with this very deep depression, the Bank of Japan, seizing the initiative from a paralysed government, began to show signs of a willingness to ignore the free market economic orthodoxy of the past two decades and pump money into the financial system precisely because of the inflationary consequences this might have. Many economists believe that rising prices would actually be welcome in Japan because they might stimulate more spending by consumers and companies. The difficulty with this strategy is that it would probably cause a further fall in the yen. Most East Asian currencies – with the crucial exception of the Chinese renminbi – have been massively devalued over the past year. This has made their exports cheaper, but it has also placed the Chinese economy under increasing competitive pressure.

China is suffering from many of the same problems as the rest of the region – over-capacity, bad loans and slowing growth. Intense competition has caused prices to fall steadily since October 1997. Export industries such as textiles, shipbuilding and steel have been hit hard by the devaluations elsewhere in Asia. China’s exports in August 1998 were 2.4 percent lower than a year previously. [16] The vice-president of China’s biggest shipmaker told the Financial Times that ‘the yard needed a 20 percent devaluation in the Chinese currency to recoup the competitive advantage it had lost to South Korean and Japanese rivals’. [17] But a devaluation of the renminbi might spark off a further wave of competitive devaluations and financial turmoil in East Asia. So far the Beijing regime has held back from devaluation, using the threat of it to extract political favours from Washington. Nevertheless, if Tokyo were to pursue an inflationary policy, the pressure on China to devalue might become irresistible, with incalculable consequences. In October 1998 four government-backed investment companies which funnelled foreign loans to Chinese companies defaulted on their debts to international banks, raising the spectre of a financial crash in China.

The August storm: In August 1998 the financial crisis began visibly to spread from East Asia to the rest of the world. Western investors who had been willing to throw their money at emerging markets began a ‘flight to quality’, returning to the apparent safety of US and European financial markets. The collapse of the rouble at the end of August and Russia’s effective default on its foreign loans has proved to be a decisive turning point. Market capitalism in Russia has been a hot-house plant, flourishing mainly in a few big cities, and based largely on speculative, and straightforwardly criminal, activities. Much of the foreign funds which have flowed into Russia over the past few years were immediately exported by the financial oligarchy that has flourished under Yeltsin and invested abroad. Credit Suisse First Boston estimates that in 1994–1997 capital flight from the rouble was about $66 billion. Meanwhile the economy has shrunk by 40 percent since 1991 and wage arrears amount to over a quarter of gross domestic product. [18]

What kept the Russian economy afloat was the foreign exchange earned by its exports of oil, gas, and other primary commodities. This kept the balance of payments in surplus, and thus helped to reassure foreign speculators – notably the ultra-mobile and greedy hedge funds (see below) – who bought heavily into Russian government Treasury bills, many of which, known as GKOs, had to repaid on a very short term basis (usually 30 days). This meant that large quantities of Russian government debt had to be rolled over – renewed by the sale of new GKOs – every month, making the economy highly vulnerable to the ups and downs of the financial markets.

Worries about the East Asian crisis pushed up interest rates on the GKOs to over 100 percent, while, in large part in consequence of this crisis, commodity prices fell in 1998 to their lowest levels for 20 years. As Edward Luttwak puts it:

The fall in oil and other commodity prices turned a disproportionate, and now very costly, reliance on short term debt into a financial timebomb. Foreign currency reserves kept falling, going well below the level of the monthly turnover of GKOs held by foreign investors. Everything was set for a foreign currency insolvency crisis. All that was needed was for the hedge funds to become sufficiently frightened to give up their GKOs. [19]

That’s what happened in late August. The panic was precipitated, ironically enough, by a call by that arch-magician of the financial markets George Soros for the devaluation of the rouble. In previous financial crashes – for example, in Mexico in 1994–1995 and East Asia in 1997 – the Group of Seven (G7) leading industrial countries and the IMF had intervened with rescue packages designed, among other things, to ensure that Western creditors got their money back. But this time the G7 stood by, perhaps partly as a way of putting pressure on Yeltsin and the Russian parliament to make sure that, whatever government, they agreed to continue with free market ‘reforms’. Angry foreign banks and speculators were left holding apparently worthless Russian debt.

But the most significant economic consequence of the Russian crash has been to cause Western capital to flee other countries, particularly in Latin America and Eastern Europe. ‘The shock is just so great that emerging markets will be virtually dead for a prolonged period,’ said one City economist. [20] Many developing economies were already badly affected by falling prices of the primary commodities that are their main exports. Now some of them began to suffer from the same sort of capital flight that countries like South Korea had experienced in 1997. The credit ratings agency Moody’s warned, ‘The likelihood that countries in Latin America will resort to capital controls, debt rescheduling or debt moratoria ... has increased significantly’. [21]

Brazil proved particularly vulnerable. In the first ten days of September nearly $11 billion flowed out of the country, almost as much as had left in the whole of August. The Brazilian government stemmed the outflow at least temporarily by raising interest rates to 50 percent – adding an estimated £3 billion a month to the interest payments on a budget deficit expected to reach 7–8 percent of gross domestic product, and probably precipitating the economy into recession. [22]

The Brazilian president Fernando Henrique Cardoso tried to reassure the financial markets by promising to introduce, after his re-election in early October, a crash programme of budget cuts which will almost certainly drive the economy into slump. As The Observer pointed out, ‘The stakes are high. Brazil is the world’s ninth largest economy; it accounts for 45 percent of the total gross domestic product of Latin America’. [23] A financial crash there would drag in other major regional economies such as Mexico and Argentina as well as intensifying the global panic. The consequences would be especially serious for the US. According to the Financial Times:

Latin America accounts for 18 percent of US exports, against 17 percent for Asia (excluding Japan), and $20 billion of foreign direct investment against $15 billion. Around 12 percent of US companies’ foreign profits come from the region, almost twice as much as from Asia’s Tigers. And while European banks took the lead in lending to Russia and much of the Far East, US banks dominate south of the border. Their total cross-border exposure to Latin America, including loans, securities and derivatives, amounted to $79 billion as of March, compared with $59 billion to Asia and less than $7 billion to Russia. [24]

US triumphalism: Until August the world economy presented a highly contradictory picture. Japan and much of the rest of Asia were in deep depression, but North America and Western Europe, accounting between them for nearly 60 percent of world output, were growing quite strongly. Wall Street continued to boom; share prices rose relentlessly, brushing off a brief downward ‘correction’ in October 1997, and pulling up most Western stock exchanges.

In the US the combination of the long economic recovery since 1992 and the stockmarket boom bred a climate of euphoria in capitalist circles. Commentators argued that the so called low unemployment, low inflation ‘Goldilocks economy’ (’not too hot, not too cold’) represented a ‘New Economic Paradigm’ that marked the end of the business cycle of boom and slump. The publisher Mortimer Zuckerman chortled in the summer of 1998:

The American economy is in the eighth year of sustained growth that transcends the ‘German miracle’ and the ‘Japanese miracle’ of earlier decades. Everything that should be up is up – GDP, capital spending, incomes, the stockmarket, employment, exports, consumer and business confidence. Everything that should be down is down – unemployment, inflation, interest rates. The United States has been ranked number one among major industrial economies for three years in a row. America is riding a capital spending boom that is modernising its industrial base and expanding its industrial capacity. The Dow Jones Industrial Average is more than four times as high as it was six years ago. The New York and NASDAQ stock exchanges have added over $4 trillion in value in the last four years alone – the largest single accumulation of wealth in the history of the United States. By contrast, Europe is stagnating and burdened with double digit unemployment, and Asia is floundering in the wake of financial collapse. [25]

The feverish atmosphere on Wall Street encouraged even greater triumphalism. One money manager, James Kramer, declared, ‘I believe if stocks like Bristol Myers had been around 100 years ago, there would have been no Marx, there would have been no Communism, because these stocks have made many millions of people rich’. [26] Anyone familiar with the history of capitalism will know that silly statements like these are characteristic of the peaks of speculative booms. Thus, on the eve of the great Wall Street crash of October 1929, the financier John J. Raskob, in an article called Everybody Ought to be Rich, came out with a plan to allow the poor to make money on the stockmarket. The appearance of such nonsense may indeed be a sign that a crash is on the way. Such, at any rate, proved to be the case both in 1929 and in 1998.

A common US response to the Asian crisis was nevertheless to greet it with indifference or even to gloat. Many commentators claimed it marked the triumph of free market Anglo-American capitalism over its more regulated and interventionist rivals. The financial crash was explained away as a consequence of Asian ‘crony capitalism’: the proper workings of the market had been undermined by interfering bureaucrats bribed by firms which benefited from government protection. The Asian ‘miracle’ – only a couple of years before hailed as the future of world capitalism – was now forgotten. ‘Korea is one of the last transitional economies to market capitalism,’ the economist David Hale patronisingly explained, comparing it, quite absurdly, with East Germany. [27]

From this perspective, the East Asian collapse could even be welcomed as an opportunity for Western capital further to penetrate and profitably to restructure economies which usually had hitherto been dominated by local firms enjoying close relations with the state bureaucracy. The Financial Times reported in the spring of 1998 that ‘East Asia’s demand for fresh capital to clear up loans is providing Western institutions with unprecedented leverage. The conditions attached to International Monetary Fund and World Bank rescue programmes are playing a role in prising open Asia’s closed corporate cultures, creating opportunities for international companies.’ Adlai Stevenson, US senator turned investment banker, gloated, ‘The opportunity for investment, whether in production, distribution or portfolio assets, is once in a lifetime’. [28]

Alan Greenspan, chairman of the US central bank, the Federal Reserve Board, summed up this triumphalist mood: ‘My sense is that one consequence of this Asian crisis is an increasing awareness in the region that market capitalism, as practised in the West, especially in the US, is the superior model; that is, it provides greater promise of producing rising standards of living and continuous growth’. [29] As recently as June 1998 he speculated that the US economy might have moved ‘beyond history’ – beyond, that is, the cycle of boom and slump and onto an endless upward path.

Underlying problems: The August crisis soon made Greenspan sing a different tune: ‘It is not credible that the US can remain an oasis of prosperity unaffected by a world that is experiencing greatly increased stress,’ he admitted. [30] Following the Russian collapse, Wall Street and the other major stockmarkets fell sharply at the end of August. ‘What we are witnessing now in terms of the breadth and depth of value diminution is the biggest collapse in security markets since the war,’ said one investment banker. [31] As one Wall Street stockbroker put it, ‘We have seen the upside of globalisation for the last seven years; now we are seeing the downside’. [32]

Despite brief upward blips, share prices carried on falling. The ‘flight to quality’ increasingly took investors away from the stockmarkets and into the interest-bearing bonds issued by governments. In consequence real yields on government bonds in the advanced capitalist world fell significantly below the average for the previous 20 years. This shift in mood reflected more than the fear that Asian ‘contagion’ was now beginning to affect Western financial markets.

The ‘New Economic Paradigm’ hailed by light-minded capitalist apologists in the US rested on very weak foundations. Joel Geier and Ahmed Shawki pointed out:

This much celebrated economic expansion, though long, is weak both in terms of growth and productivity as compared to previous post World War II booms ... After six years of expansion the economy had grown by 31.5 percent in the 1960s (5.25 percent a year), by 24.2 percent in the 1980s (4.0 percent a year), and in the 1990s by 15.5 percent (2.6 percent). The expansion of the 1970s only lasted for four and a half years so comparisons are more difficult. In that expansion there was growth of 15.5 percent in the first three years, while it has taken six years for the expansion of the 1990s to produce similar results. [33]

US gross domestic product did grow by nearly 4 percent in 1997, but this is more likely to be seen as the Indian summer of the 1990s recovery than a breakthrough to an era of unlimited expansion. Claims made by boosters for an unparalleled revolution in US productivity also do no stand up to close examination. [34] They are best understood as ways of justifying and sustaining the continuing rise of shares on the stockmarket than as descriptions of economic reality.

This boom in fact depended on massive borrowing by both companies and households. The unorthodox economist Wynne Godley pointed out that the US private sector’s financial surplus – the excess of income over expenditure – had fallen from its average since 1953 of 1.1 percent of gross domestic product to a record deficit of 3.3 percent in the first quarter of 1998. This excess of spending over income was being financed by borrowing that was growing at an unsustainable rate:

As the private sector’s deficit is now at a level where large injections of finance are needed just to maintain it where it is, it can hardly go on growing much longer. For this deficit to go on growing, the ratio of debt to income, which is already rising fast, would have to accelerate out of sight.

This means that the motor which has driven the US economy through one ‘Goldilocks era’ – namely the expansion of private spending financed by loans – cannot possibly drive it through another. It looks more as though it is ready to conk out. [35]

By the time this diagnosis appeared in July 1998, concern about the future course of the US economy was growing. Greenspan warned that he might have to increase interest rates to prevent a revival in inflation caused, in all probability, by the comparatively low rate of unemployment – 4.5 percent in June. Workers might, in other words, use the greater bargaining power provided by tight labour markets to push up wages. Meanwhile, the US economy was showing definite signs of slowing down as companies’ inventories of finished goods increased sharply.

The logic of financial panic: The biggest economy in the world was thus already facing difficulties even before the August crisis. What would be the latter’s impact on North America and Western Europe? Economists and brokers referred to the danger of ‘contagion’, as if the growing panic were some sinister and incomprehensible disease. In fact, the spreading crisis was promoted by many of the same features of financial markets – their capacity to move capital very quickly across national borders, and the variety of avenues they offer for speculation – that have been celebrated by the boosters of globalisation over the past decade.

Financial crises have a tendency to feed off themselves. Will Hutton describes the dynamics of this process:

It is when the flows of credit and capital within and between countries get undermined by the incapacity of banks to continue underwriting these flows, because their balance sheets become so weakened, that downturns become slumps. A vicious circle is created in which the combination of actual losses and collapsing confidence causes financiers to cut back their readiness to lend and invest, which in turn means that output, employment and demand fall, which in turn generates more financial losses. [36]

The process is the reverse of what generates the financial boom in the first place. Charles Kindleberger argues that a speculative mania is characterised by what the classical economists call ‘overtrading’:

It may involve pure speculation for a price rise, an overestimate of prospective returns, or excessive ‘gearing’. Pure speculation, of course, involves buying for resale rather than use in the case of commodities, or for resale rather income in the case of financial assets. Overestimation of profits comes from euphoria, [and] affects firms engaged in the productive and distributive processes ... Excessive gearing arises from cash requirements which are low relative both to the prevailing price of a good or asset and to possible changes. [37]

Margin trading is a classic example of excessive gearing (or leverage, as it is often also called). Investors buy stocks (or other financial assets) by advancing only a fraction of the purchase price and borrowing the rest from a bank or a stockbroker, with the stock itself as collateral. The speculator hopes the price of the stock will rise sufficiently that by the time repayment of the loan falls due he or she can come away with a profit. This is a perfect device for those gambling on prices continuing to rise, since they only have to put a relatively small amount of cash upfront. But what happens if the price falls below what it cost to buy it? Then the bank or broker demands more cash to make up the collateral on the loan. If share prices are falling generally, a vicious circle develops in which these margin calls force investors to sell up to find the cash, causing prices to fall further, and thus producing yet more margin calls, and so on. This process was central to the great Wall Street crash of October 1929. [38]

Some experts think that this may be happening again. Ignoring the history of past financial crashes, much speculation is highly geared. The global hedge funds play a crucial role here. These have developed over the last decade, and operate unregulated by any national government. They make their profits by gambling on the ways in which the differences between the prices of various financial assets are likely to change over time. Hedge funds are estimated to have between them some $400 billion, and often borrow five or six times this amount – sometimes, as we shall see below, far, far more. [39] David Zervos of Greenwich NatWest estimates that there are about $60,000 billion worth of financial assets involved in margin trading and similar kinds of leverage. If, as is quite plausible, the value of these assets were to fall by $1,500 billion, the banks might start making margin calls. ‘If there was a failure of one or large counterparties to meet the margin call, the resulting sale of collateral and liquidation of swap positions could easily drive spreads further and induce even more widening, more margin calls, and a complete collapse in the credit market’. [40]

Some hint of the potential dangers came in late September when the Federal Reserve Board co-ordinated a $3.5 billion bailout by a consortium of 15 major American and European investment banks of Long Term Capital Management, one of the largest US hedge funds. LTCM had made very healthy profits for its investors by using highly elaborate mathematical models to guide its bets that the differences between the prices of various bonds would narrow. Its boss, John Meriwether, was a legendary figure on Wall Street from his time as head of Salomon Brothers’ bond trading operations during the Reagan boom in the 1980s. His staff included two Nobel prize winning economists and a former vice-chairman of the Fed, David Mullins. Success encouraged very high gearing – LTCM’s capital of $4.8 billion supported at the peak an incredible $900 billion of market exposure. [41]

Then came the August crisis. The flight to quality caused the differences between bond prices to widen spectacularly as investors fled to the safety of US and German government bonds. LTCM started taking huge losses that were exacerbated by a series of margin calls. Its capital was soon wiped out. When Barings faced a similar crisis in February 1995 thanks to Nick Leeson’s catastrophic derivatives trading it was allowed to go bust. But this time the threat was far more serious. ‘Many of the banks realised that if we went through a forced unwind of our derivatives positions, they might be taken down with us,’ said a source in the hedge fund. [42]

It turned out there were all kinds of cosy links between LTCM and its rescuers. David Mullins had, while working at the Fed, investigated a bond rigging scandal which led to Meriwether’s resignation from Salomon in 1991. He remained a friend of Greenspan, who directed the rescue. David Kosminsky, chairman of Merrill Lynch, one of the banks that took over LTCM, had invested in the fund. So had the Bank of Italy, and UBS, Europe’s biggest bank, whose chairman was forced to resign over the resulting loss of £413 million. The affair revealed what the financial journalist John Plender called ‘Western crony capitalism’. [43]

Towards financial armageddon? More important than the corruption and incompetence it revealed, the LTCM collapse suggested that the financial markets were becoming caught in a vicious downward spiral. The end-game of the kind of financial crisis we are now experiencing is a credit crunch. During a speculative boom all sorts of credit are easy to come by. When a panic ensues, however, investors rush for safety into the most secure forms of money – gold in the past, now the currencies and government bonds of the strongest economies. At the climax of this process, they refuse to risk their money in any sort of investment, and seek cash as the ultimate security. Other assets are desperately sold in order to obtain it, even if this forces down prices.

This process can be reinforced when government policy is ruled by laissez faire orthodoxy which relies on the unregulated market to restore equilibrium. Thus Andrew Mellon, US Treasury Secretary during the onset of the Great Depression at the end of the 1920s, declared that the solution of the crisis was to ‘liquidate labour, liquidate stocks, liquidate the farmers, liquidate real estate’. [44] In fact, as Keynes pointed out at the time, this remedy only makes matters worse. The falling prices and rising unemployment caused by the forced sale of assets reduce the income of both workers and capitalists and thereby cuts the demand for goods and services. The resulting bankruptcies and layoffs initiate yet another twist to the downward spiral.

Long before Keynes, Marx had outlined the irrational logic of this process, in which money is preferred to the commodities whose value it embodies:

In times of a squeeze, when credit contracts or ceases entirely, money suddenly stands as the only means of payment and true existence of value in absolute opposition to all other commodities. Hence the universal depreciation of commodities, the difficulty or even impossibility of transforming them into money, i.e. into their own purely fantastic form. Secondly, however, credit money itself is only money to the extent that it absolutely takes the place of actual money to the amount of its nominal amount value ... Hence coercive measures, raising the rate of interest etc., for the purpose of safeguarding the conditions of this convertibility ... A depreciation of credit-money ... would unsettle all existing relations. Therefore, the value of commodities is sacrificed for the purpose of safeguarding the fantastic and independent existence of this value in money. As money-value, it is only secure as long as money is secure. For a few millions in money, many millions in commodities must be sacrificed. This is inevitable under capitalist production and constitutes one of its beauties ... As long as the social character of labour appears as the money-existence of commodities, and thus as a thing external to actual production, money crises – independent of or as an intensification of actual crises – are inevitable. [45]

Precisely this kind of process is now at work in Western financial markets. Falling share and bond prices were tearing huge chunks off the value of investments: the Federal Reserve estimates that the net loss of wealth in US financial assets between July and October 1998 amounted to $1,500 billion. [46] Increasingly, investors shunned the shares and bonds of even the biggest private corporations. The share prices of many of the major investment and commercial banks, seen as major victims of the financial crises, halved between mid-August and early October, and their credit ratings were being slashed. The Financial Times reported:

The ‘flight to quality’, in other words, is turning into a flight from quality, and into AAA-rated havens – US Treasury bonds and German government bonds ... Broadly speaking, liquidity – the ease with which an investor can buy or sell a security – has dried up in all but the safest government bond markets ... ‘Investors normally look for a return on their capital,’ said Avinash Persaud, head of currency research at JP Morgan. ‘Now all they are doing is trying to preserve its value: capital retention as opposed to capital enhancement’. [47]

One effect of the credit crunch was to increase the interest payments companies have to make on their bonds in order to attract investors. The Financial Times commented, ‘The longer this continues the more likely it is that companies will default on their existing debt, as they will be unable to refinance it through the bond markets. Higher defaults would lead to higher unemployment and lower growth’. [48] The same mechanisms are at work in the currency markets. In early October the dollar fell sharply against the yen. Japanese financial institutions, loaded down with bad debts and therefore short of cash, sold dollars heavily. So did the hedge funds. Before the August crisis they had taken advantage of the weakness of the yen and the low level of Japanese interest rates to borrow cheap in Japan and use the money to invest in apparently more profitable assets elsewhere – for example, Russian government bonds. Now this ‘yen carry trade’ was turning against the hedge funds, as their losses forced them to sell the dollar and buy yen to repay their debts. The fear this raised of yet more collapses such as that of LTCM encouraged investors to hang onto their money, making liquidity even more scarce. Even US government bonds were dumped as investors sought the ultimate safe haven of cash itself.

Trade Wars? Currency volatility is in any case a further destabilising factor. Most East Asian countries’ currencies fell massively against other currencies during the financial crash of the second half of 1997. As a result, their exports have become much more competitive. Moreover, Asian firms and governments have a powerful incentive to export in order to restore profitability and repay foreign loans. About a third of US foreign trade and 10 percent of the EU’s is with Japan and the rest of East Asia. US and European firms are having to compete with cheaper exports from Asia at the same time the region’s economy – and therefore its demand for imports – is shrinking. [49] The Institute for International Economics estimates that the Asian crisis will reduce Western Europe’s net exports by $55 billion a year and the US’s by $43 billion. [50]

The massive US balance of payments deficit during the 1980s and early 1990s caused major conflicts over trade between the three major capitalist trading blocs – the US, Japan, and Western Europe. Similar tensions are already beginning to develop. The US steel industry charged its Japanese counterpart with dumping after Japanese steel exports to the US rose in August 1998 to 3.6 times their level a year previously. Japanese steelmakers, faced with a depressed domestic economy and the collapse of their main Asian markets, had redirected their exports towards the US and Taiwan. [51] European steel producers are also lobbying Brussels for anti-dumping measures against Asian importers. Meanwhile, the rise in continental European currencies (and soon the euro) against the dollar could accelerate the developing economic slowdown in the EU. Since 1995 continental Europe has benefited from the strength of the dollar, and the consequent relative cheapness of its exports, but if the US currency’s fall is sustained, this competitive advantage will disappear

Financial crises and productive capital: The most visible form of the crisis so far has been the spreading financial panic. In its face, Alan Greenspan, long regarded by leading capitalists as possessing positively magical powers, confessed bewilderment. He told a conference of economists that he had never seen anything like the events in financial markets since August. But he denied that the market was the problem: ‘A major shift towards liquidity protection is really not a market phenomenon. It’s a fear-induced psychological reaction’. [52]

In fact, as we have seen, developments over the past few months fit into a very familiar pattern characteristic of financial crises under capitalism. There is now a growing chorus of criticism of the prevailing free market orthodoxy, mainly from a Keynesian or social democratic point of view which does not reject capitalism as such but argues that markets need to be regulated. Such critics generally highlight the inherent instability of financial markets. Thus George Soros (who knows a thing or two about financial markets) wrote after the Asian financial crash:

The private sector is ill-suited to allocate international credit. It provides either too little or too much. It does not have the information with which to form a balanced judgement. Moreover, it is not concerned with maintaining macro-economic balance in the borrowing countries. Its goals are to maximise profit and minimise risk. This makes it move in a herd-like fashion in both directions.

The excess always begins with overexpansion, and the correction is always associated with pain. But with the intervention of the IMF and other official lenders, the pain is felt more by the borrowers more than by the creditors. That is why overexpansion has occurred so often after each crisis. Successive crises have, however, become more difficult to handle. [53]

This analysis is important because it underlines that the East Asian crisis was not a product of local ‘crony capitalism’. Highly mobile speculative investment from the advanced countries first raised up the Tiger economies and then brought them crashing down. Soros’s diagnosis recalls Keynes’s famous analysis of the irrationality of financial markets: ‘Speculators may do no harm as bubbles on a steady stream of enterprise. But the position is serious when enterprise becomes the bubble of a whirlwind of speculation. When the capital development of a country becomes the byproduct of a casino, the job is likely to be ill-done’. [54]

Social democratic economists such as Will Hutton of The Observer and Larry Elliott of The Guardian have in recent years revived the Keynesian critique of financial markets. [55] The other side of this critique is, however, the argument that, provided the excesses of speculation are curbed and the market properly regulated, capitalism can avoid serious slumps. By comparison with that offered by the Marxist tradition, this is a relatively superficial theory of crisis which fails to locate the sources of the cycle of boom and slump in the dynamics of the capitalist mode of production itself. [56]

Thus Marx distinguishes between productive capital and money-capital. The former is invested in the employment of wage labourers who produce commodities and in the process have surplus value extracted from them. Money-capitalists – bankers, for example, and shareholders – perform the function of advancing capital for productive investment; their profits derive ultimately from a portion of the surplus value that is created elsewhere, in the process of production. The various kinds of asset traded on financial markets – shares, bonds, derivatives, and the like – are thus ‘fictitious capital’, since they constitute, not actual investments in the production of commodities and extraction of surplus value, but rather claims on that surplus value:

The stocks of railways, mines, navigation companies, and the like, represent actual capital, namely the capital invested and functioning in such enterprises, or the amount of money advanced by stockholders for the purpose of being used as capital in such enterprises ... But this capital does not exist twice, once as the capital-value of titles of ownership (stocks) on the one hand and on the other hand as the actual capital invested, or to be invested, in those enterprises. It exists only in the latter form, and a share of stock is merely a title of ownership to a corresponding portion of the surplus value to be realized. [57]

Productive capitalists may use financial markets as a way of raising money for their investments. But the assets created in the process, like money-capital in general, represent ‘an accumulation of claims of ownership upon labour’. [58] At the same time, however, these assets gain a life of their own on the financial markets by becoming objects of speculation. Back at the dawn of modern capitalism in the 17th century, the Dutch called financial speculation windhandel – ’trading in wind’. [59] Even tulips became the object of frenzied buying during the mania of 1636–1637. [60] In contemporary derivatives markets, assets such as the option to buy some other asset for a given price at some point in future are traded on the basis of values that are ultimately derived from, say, the price of a commodity or an exchange rate.

Rudolf Hilferding provided the classic Marxist account of speculation:

Speculative gains or losses arise only from variations in the current valuations of claims to interest. They are neither profit, nor parts of surplus value, but originate in fluctuations in the valuations of that part of surplus value which the corporation assigns to the shareholders... They are purely marginal gains. Whereas the capitalist class as a whole appropriates a part of the labour of the proletariat without giving anything in return, speculators gain only from each other. One’s loss is the other’s gain. ‘Les affairs, c’est l’argent des autres.’ [Business is other people’s money] [61]

Speculators, in other words, make their profits by correctly anticipating the direction in which the prices of particular assets, or the differences between them, change. As in more everyday kinds of gambling, the losses of those who get their bets wrong provide the successful speculators with their profits. But the movements of the financial markets are ultimately regulated by those of productive capital. Speculators’ profits may derive from changes in the prices of financial assets, but these prices in turn depend on expectations about the profits generated in production. When the stockmarket develops ahead of productive capital for too long, a crash is inevitable.

In October 1997 the value of US stocks was 130 percent of what it would cost to replace the net assets of companies. ‘This is higher than at any time since 1920, double its long-run average and about three times higher than a decade ago,’ the free market economist Martin Wolf commented. He suggested the stockmarket was moving way out of line of the real economy:

Combined with economic growth running at around 3 percent, the recovery in the share of profits in GDP has generated growth in profits of 10 percent a year in real terms since 1992. This recovery has underpinned the stockmarket surge. Yet for anything like this to continue over the next five years, the share of GDP in profits must reach unprecedented levels. [62]

Towards a crisis of profitability? The behaviour of profits is thus a critical determinant of the future course of the crisis. The underlying profitability of capital accordingly constitutes the second dimension of our analysis. Marx argued that the main driving force behind capitalist crises lies in what he called the tendency of the rate of profit to fall. Competition forces capitalists to expand their investments in plant and equipment more quickly than the workers they employ. The organic composition of capital – the ratio between capital invested in means of production and capital invested in labour power – rises. But, since it is workers who create the surplus value that is the source of profits, this means that profits will grow more slowly than total investment. In other words, the rate of profit – the return the capitalists make on the capital they have advanced – falls. When the rate of profit falls sufficiently low to discourage capitalists from making further investments, an economic crisis is inevitable. [63]

It was a pronounced fall in the rate of profit in all the major capitalist economies during the late 1960s and early 1970s which ushered the present prolonged period of economic instability and stagnation. In their major attempt to apply Marxist value-theory to the US economy in a theoretically and empirically rigorous way, Anwar Shaikh and Ahmet Tonak show that the value-composition of fixed capital (a relationship closely connected with the organic composition of capital) rose by over 77 percent between 1948 and 1980, with the biggest rise taking place in the mid-1970s, and the rate of profit falling by a third. As they say, ‘This is striking empirical support for Marx’s theory of the falling rate of profit’. [64]

Shin Gyoung-hee has demonstrated that a crisis of profitability in South Korean manufacturing industry underlay last year’s financial crash. [65] What about the advanced capitalist countries? There have been a number of claims recently that the biggest economy of all, the United States, has finally restored the rate of profit to levels last seen during the long postwar boom. The Financial Times reported last summer, ‘Profit margins, lifted by the long economic expansion and tight control on labour costs have...risen to levels last seen in the 1960s’. [66] Even Robert Brenner, in a major attempt at a Marxist analysis of postwar capitalism, seemed to agree: ‘Despite the weakness of the cyclical upturn, the rate of profit in the private business sector has increased steadily in the course of the 1990s. By 1996 it had, for the first time, decisively surpassed its level of 1973, achieving its level of 1969, 20–25 percent below its boom time peaks. By 1997 it had come back even further’. [67]

|

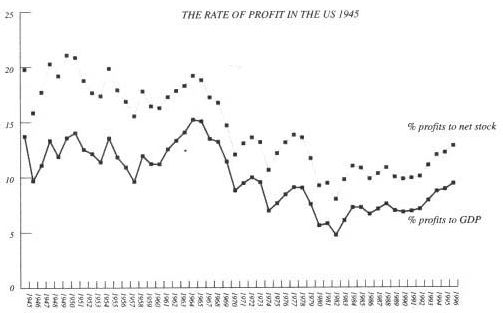

|

These claims are not supported by a study of the the rate of profit in the US by the Bureau of Economic Statistics, using Department of Commerce data (see graph). [68] If we compare profits with net stock (plant, equipment, and machinery net of depreciation) we find that the rate of profit in 1996 was 9.38 percent, about the same as it was in 1971 (9.44 percent), a pretty bad year for the US economy by the standards of the long boom. Joel Geier and Ahmed Shawki summarise the overall results of the study:

In the post-war boom years, 1946–1968, corporate profits to corporate net stock ranged from 11–15 percent, except for two recession years. In the run up to crisis from 1969–1973, the rate of profit fell from 13 percent to between 8.8 and 11 percent. Since 1973, the rate of profit averaged 7.3 percent and ranged from 4.7 to 9 percent. In 1996 it rose to 9.4 percent, higher than any year since 1973. Although better than the recovery years of the 1980s, it is very similar to the profit rates of the first crisis recovery in 1976–1978. These rates cannot be compared to the post-war boom; they are not even as good as the recession years of the 1940s, 1950s or 1960s. [69]

This performance in the US needs to be set again the background of a sustained and brutal employers’ offensive since the mid-1970s – 20 years of falling real wages, deregulation, downsizing, and soaring corporate profits and executive salaries. Brenner summarises the price the US working class paid so that profits could recover from the depths they fell to in the early 1980s:

Between 1979 and 1990, real hourly compensation in the private business economy grew at an average annual rate of 0.1 percent. The trend in these years was for hourly real wages and salaries alone (excluding benefits) was far worse, falling at an average amount of 1 percent. At no time previously in the 20th century had real wage growth been anywhere near so low for anywhere near so long. [70]

But despite this increase in the rate of exploitation of labour, the US ruling class has still been unable to push the rate of profit above the levels to which it had fallen on the eve of the first great post-war slump in the mid-1970s. And it is likely to be downhill from here. Corporate profits in the US have been falling since the last quarter of 1997. They are being squeezed from two directions. Intensified competition from cheap Asian exports will make it harder for US capitalists to raise prices. Meanwhile the lowest rate of unemployment in a generation has allowed workers finally to push up real wages, which have risen since at an annual rate of 2.6 percent since 1996. [71]

The same pressures are beginning to make themselves felt in the EU as well. The rash of plant closures in Britain by both local and multinational firms reflect both the specific problem caused by the strength of the pound, which has made British exports relatively expensive, and the more general impact of the competitive struggle to find markets. The British economy is out of phase with that of the rest of Europe, most of which has only begun to grow strongly since the mid-1990s, while Britain is plainly heading rapidly for a recession. But the global slowdown is beginning to affect continental Europe as well, as projections for company profits and growth rates are slashed.

Warnings of doom: There is, then, little doubt that world capitalism is heading towards its fourth major recession since the early 1970s. How serious will the slump be? Some influential economic commentators have begun to warn of the danger of a depression on the scale of the 1930s. Will Hutton declared, ‘The risk of a world economic catastrophe may be slight, but it is growing by the day’. [72] ‘What is now at stake’, he claimed, ‘is nothing less than the viability of the world financial and trade order put in place over the last 20 years’. [73] On the free market right, Martin Wolf of the Financial Times put forward a remarkably similar prognosis: ‘What is happening in the “emerging market” economies is a disaster ... The question is whether it will become a worldwide catastrophe. The chances may be small. They are not, alas, zero’. [74]

A critical factor in determining the development of the crisis is the response of the major capitalist states. During the present period of crises which began in the late 1960s, state intervention has not been able to prevent recessions or remove their underlying causes, but it has been sufficient to stave off a slump on the scale of the 1930s. Therefore the third dimension of the crisis that needs to be considered is government policy.

The reaction against the free market: Over the past 20 years free market economics has become entrenched as unchallengeable orthodoxy in the Western ruling classes. Though the vanguard of the ‘New Right’, represented by Reagan and Thatcher, has been pushed out of office in most places, the 1990s has seen the emergence of a ‘centre-left’ strongly committed to Thatcherite economics. Thus Bill Clinton accepted the Republican right’s agenda of deficit cutting and welfare ‘reform’. Tony Blair and Gordon Brown have been faithful pupils of Clinton. Their first, and most significant, policy measure was to give the Bank of England control over interest rates. Brown wrote a Thatcherite commitment to reduce public spending and abstain from economic intervention into his Code of Fiscal Stability.

The idea of independent central banks has become one of the main planks of monetarist dogma. It is intended to help insulate the market from any sort of democratic political control and leave the economy on autopilot. European Economic and Monetary Union, due to take full effect with the launch of the single currency at the beginning of 1999, will vest control over monetary policy into a European Central Bank (ECB) guided by a particularly narrow version of monetarism. The ECB’s remit, like that of the Bank of England, is solely to achieve price stability, making it difficult for it to play the traditional role of central banks as ‘lender of last resort’, pumping money into the financial system where it is threatened with complete collapse. [75] Meanwhile, the targets laid down by the Maastricht treaty, that participating governments must reduce their budget deficits to no more than 3 percent of national income, will continue to operate, under the EU’s Growth and Stability Pact, throughout the euro-zone. [76]

The major Western governments thus face the developing economic crisis with the same kind of rigid free market policies which helped push the world economy into the Great Depression of the 1930s. But a powerful reaction to these policies is beginning to set in. Thus various free market economists, notably Jeffrey Sachs, architect of the disastrous programme of ‘shock therapy’ forced through in Russia and Eastern Europe in the early 1990s, attacked the IMF for the harsh deflationary measures it demanded of South Korea and the other Tiger economies in exchange for lending them enough money to keep afloat (and repay their Western creditors). According to Sachs:

… the IMF has decided to impose a severe macroeconomic contraction on top of the market panic that is already roiling [sic] these economies. Consider the Korea programme ... The Fund argues that these draconian monetary measures are ‘to restore and sustain calm in the markets’ and ‘ [to] demonstrate the government’s resolve to confront the present crisis’. It is hard to see how recessionary monetary measures will restore calm. Indeed the panic has so intensified since the signing of the agreement that Korean banks may now be on the verge of outright default. [77]

Faced with economic collapse, governments have in fact been forced to violate free market dogma. In October 1997 the South Korean government nationalised the bankrupt car maker Kia. More serious still have been the challenges to the free movement of capital, one of the IMF’s most beloved dogmas. During the financial turmoil caused by the August 1998 crisis, Malaysian prime minister Mahathir Mohamad imposed strict exchange controls, and sacked his deputy, Anwar Ibrahim. As finance minister, Anwar had imposed a severe squeeze on the Malaysian economy. Mahathir now told banks to lend freely to industrial companies in order to keep them afloat. ‘The free market system has failed and failed disastrously,’ he said. ‘The only way that we can manage the economy is to insulate us...from speculators’. [78]

Even more remarkable, in that island of free market capitalism, Hong Kong, the Monetary Authority intervened vigorously in the stockmarket, buying $14 billion worth of shares in order to push up prices and prevent its currency from being forced off its peg to the US dollar. The Taiwanese government announced it was reviewing plans to scrap all capital controls by the end of 2000. Shea Jia-dong, deputy governor of Taiwan’s central bank, said, ‘When we established the goal, there was no such thing as Asia’s financial crisis, but in the light of that crisis we have to consider whether to move to completely free capital flows’. [79]

In Russia, even the Financial Times’s ultra-orthodox Lex column admitted that ‘the only alternative [to the collapse of the rouble] is to slam on exchange controls’. [80] The appointment of Yevgeny Primakov, a veteran of the Soviet era, as prime minister in mid-September represented a shift towards a more regulated economy. In an earlier speech he had criticised Russian governments for sacrificing economic growth to the financial stability demanded by the IMF and called for a Roosevelt-style New Deal. [81] ‘An anti-market backlash has begun,’ the Financial Times announced:

Policy makers and economists are increasingly questioning whether or not it is appropriate to impose a single model of Anglo-Saxon capitalism in countries at very different stages of development. Debate is focusing in particular on whether countries should allow investment capital to flow unimpeded across their borders, as the International Monetary Fund suggests they should. [82]

Political paralysis: The Keynesian commentator William Keegan wrote recently, ‘It is difficult to take the scale of the defeat suffered by the people responsible for the economic policy consensus of recent years’. [83] This shift in attitudes – even the IMF itself grudgingly conceded that the free movement of capital could have damaging consequences [84] – prompted another leading Keynesian, The Guardian’s Larry Elliott, to say that ‘the debate now is about the form intervention should take, rather than whether it should happen’. [85]

Initiatives by the G7 did manage to stave off financial collapse in the recent past. When Mexico defaulted on its foreign debt in August 1982, threatening the survival of the US banks that had lent heavily to Latin America, the Fed slashed interest rates. After Black Monday, the stockmarket crash of 19 October 1987, Greenspan led the other Western central banks in an operation designed to stabilise the world economy by cutting interest rates and pumping money into the financial system. [86] When Mexico experienced another financial crash in 1994–1995, Clinton co-ordinated a massive rescue programme by the G7 and the IMF.

The US did in fact intervene fairly vigorously in the early stages of the present crisis, after the Asian financial crash. In the autumn of 1997, Washington acted to block proposals backed by the Japanese government for a special Asian fund to co-ordinate the rescue of the Tiger economies. By ensuring that it was the IMF which signed agreements with Thailand, South Korea and Indonesia, the Clinton administration ensured that the conditions imposed would require market ‘reforms’ designed to open the Asian economies further up to Western investment. As IMF managing director Michel Camdessus put it, ‘What we are doing coincides with the basic purposes of American diplomacy in the world’. [87]

When the IMF agreement with South Korea looked like collapsing just before Christmas 1997, the US Treasury Secretary, Robert Rubin, initiated discussions leading to a $10 billion emergency loan to Seoul in exchange for tough conditions, notably labour ‘reforms’ making it easier for employers to sack workers and vary wages. Central bankers held meetings with the bosses of the big commercial banks in the G7 countries in order to persuade them to start rolling over their loans to South Korea. [88] Yet, faced with an escalating crisis in the autumn of 1998, the leaders of the major capitalist economies offered nothing but words. No rescue was mounted for Russia, while the only immediate measures taken were tiny cuts in US, British and Canadian interest rates. At the end of the IMF’s and World Bank’s annual meetings in Washington, the Indian finance minister, Yashwant Sinha, expressed his frustration: ‘The brute fact is that after five days of intense discussion and debate, we are still at a loss to explain why contagion has continued to spread. Nor do we seem to have clear, agreed and effective measures to contain the crisis’. [89]

This pathetic response reflected, in the first place, a vacuum of political leadership in the bourgeois world. Bill Clinton declared that the world economy was facing its most serious challenge for 50 years, and affirmed, ‘America can and must continue to act and to lead’. [90] But he had his mind on other things, and, in his greatly weakened position, was unable to secure from Congress such key requirements of US foreign policy as renewed ‘fast-track’ authority to negotiate more pacts like the North American Free Trade Agreement. Meanwhile, Germany was distracted by the federal elections and the formation of a new government, and the Liberal Democrat regime in Japan seemed totally paralysed in the face of the country’s slump.

The failure to act was, secondly, a consequence of the fact that the cycles of the three major Western economies were out of synchronisation. Japanese interest rates were already the lowest in the history of capitalism. After stagnating for much of the present decade, the continental European economy began to grow again in the late 1990s. The European Commission estimated that the euro-zone was growing at an annual rate of 3 percent in the spring of 1998. Although this recovery was not strong enough to reduce German unemployment below 4 million, it was sufficient to worry the notoriously conservative Bundesbank about a revival in inflation.

Its chiefs bitterly remember how the reaction to the 1987 crash helped to stoke up inflation in the US, Japan, and Britain, and thus to precipitate the recession of the early 1990s. They also resent that EU countries paid the lion’s share of the 1995 Mexican rescue, thus protecting the US speculators who had poured money into Mexico from suffering for their mistakes. The Bundesbank is obsessed with the ‘moral hazard’ which arises when economic actors are allowed to escape the consequences of their actions. While as we have seen, some free market economists have attacked the IMF for imposing deflationary policies on crisis-hit economies, German central bankers believe that IMF rescue plans have been too lax, in particular by encouraging speculators to undertake risky investments confident that they would be bailed out if things went wrong. According to Wolfgang Munchau:

Hans Tietmeyer, president of the Bundesbank, hardly misses an opportunity these days to warn about moral hazard and to call for economic reform in the affected countries as a necessary condition to a solution ... At a recent conference in Frankfurt, organised jointly by the Bundesbank and the IMF, senior German officials publicly berated the IMF’s top management. JÅrgen Stark, then a senior German finance ministry official and now vice-president of the Bundesbank, argued that the IMF’s bailout of Mexico after the 1994 crisis had directly contributed to the current crisis... Taken a step further, his reasoning suggests that the IMF not only failed to prevent the current crisis, it actually caused it by lulling investors into a false sense of security... It is an unfortunate fact that some sections of the German financial establishment look on the IMF as a gang of economic terrorists. [91]

The European Central Bank, which will take control of monetary policy in the euro-zone on 1 January 1999, is likely to pursue similarly conservative policies in order to prove to financial markets that it is as tough on inflation as the Bundesbank. Wim Duisenberg, the ECB president, dismissed talk of crisis as ‘overdone’, and denied that there was any need for action. ‘We will see about a crisis if that event arrives,’ he said. [92] This complacency is strikingly reminiscent of central bankers’ response to the onset of the Great Depression of the 1930s.

But, thirdly, the political paralysis reflects the sheer intractability of the crisis. Many of the remedies canvassed are simply an irrelevance. The introduction of capital controls has become, as we have seen, a popular remedy. Chile’s tax on short term inflows of capital is frequently cited as a model, for example by sociologist Anthony Giddens, theoretician of the Blairite ‘third way’. [93] No one seemed to notice that, since the Asian crash, Chile, like other ‘emerging markets’, has been suffering from a huge outflow of capital. As a result, the central bank been forced to push up overnight interest rates to as high as 100 percent on occasion, the Chilean peso has been devalued, and the economy is slowing down fast. [94]

More radical remedies include the Tobin Tax on financial speculation, and the reform of the international monetary system. Most versions of the latter are little more than platitudes, like Blair’s call in a speech to the New York stock exchange for greater ‘transparency’ from the IMF. [95] Will Hutton argues more robustly that ‘establishing a world central bank is the obvious next step’. [96] Like the Tobin Tax, this measure would require the existence of a global authority with the capacity to coerce national capitalist classes with their divergent, and often conflicting interests – a world state, in other words. It is the purest kind of reformist Utopia.

Others such as Larry Elliott advocate measures comparable to the Marshall Plan which revived West European capitalism after the Second World War. Thus G7 could fend off slump by pumping capital into the world economy. But the Marshall Plan was introduced in the context of a rapidly expanding capitalist system benefiting from the high levels of profitability made possible by the permanent arms economy. Moreover, the US ruling class was agreed that revitalising the European economy was essential to counter Russia in the Cold War. But no such agreement exists now. After the rescues of the past few years, the IMF has only $10 billion of its own resources left. Approval of an $18 billion contribution by the US to an overall $90 billion increase in the IMF’s capital was only extracted from the Republican-dominated Congress with great difficulty by a weakened Clinton administration.

In the absence of such measures, the world’s ruling classes are likely to be caught struggling between difficult alternatives. The plight of Japanese capitalism is a case in point. Since its formation in the summer, the government of Keizo Obuchi has been striving to come up with some solution to the crisis of the banking system, which is paralysing the entire economy. It lost two crucial months negotiating with the opposition over the fate of the bankrupt Long Term Credit Bank (a sound rule of thumb for investors: don’t put your money into anything called ‘long term’). The government didn’t want it to go bust, because agricultural co-operatives are heavily represented among the bank’s depositors and construction companies among its debtors. Both are important sections of the ruling Liberal Democrats’ base.

But the problem lies deeper than mere crony capitalism. A thorough shakeout of the Japanese financial system of the kind demanded by the US Treasury and the IMF would force many banks and industrial companies into bankruptcy. The likely effect would be to drive the economy into an even deeper slump. But failure to restructure the banking system means that the present condition of paralysis is likely to continue. The same dilemma exists on a world scale. The speculative boom of the 1990s has left a huge overhang of capital which cannot be realised profitably. If it is destroyed through an extension of the present panic, then a 1930s-style depression is on the cards. But if piecemeal state interventions stave off such a collapse, the result is likely to be, at best, a sluggish and nervous world economy.

How severe the resulting downturn will be depends on a number of variables whose value it is impossible to predict with any confidence. A combination of more political fumbling and further economic shocks could precipitate the financial markets in a vicious downward spiral in which all the devices that fuelled speculation in the past now help to feed the panic. This scenario could leave the global financial system broken or paralysed, leading to a generalisation of the deflationary slump currently being experienced by Japan. Such an outcome is by no means inevitable. But even if state action is sufficient to prop the financial markets and stave off a 1930s-style depression, Europe and the US will probably experience shrinking output and rising unemployment, with the rest of the world suffering more severely, and enormous pressure being placed on capitalist political structures.

Political instability: The political effects of the crisis are already making themselves felt in East Asia. Mahathir Mohamad once said, ‘Massive and rapid growth is a wonderful buffer. Like a river in flood it hides the rocks on the river bed’. [97] This is not only true of Malaysia. Throughout the region authoritarian regimes were able to contain significant social and ethnic tensions, as well as their conflicts with each other, thanks to the economic boom. But what happens when the growth stops? Then, to continue Mahathir’s metaphor, the rocks below can hole and sink boats that had hitherto been swept forward by the flood.

’As things stand in September 1998, the possibility of a serious military eruption or shock in Asia cannot be discounted,’ says Jean-Pierre Lehmann, professor of political economy at the Swiss Asia Foundation. [98] Already the region has had one major ‘shock’, with the revolution in Indonesia. This key development must, however, be considered in relation to the more general political instability of the system.

August 1998 marked not merely an intensification in the economic crisis. It also represented a qualitative increase in global political instability. Russia is the most obvious example of this change. Since the end of the Cold War, Western policy towards Russia has had two main thrusts – containing Russia strategically with a strengthened US-led military and political bloc (e.g. NATO expansion in Eastern Europe) and supporting Yeltsin economically and politically as the best hope of market capitalism in Russia.

The financial and political collapse at the end of August threw this policy into disarray. Given that, despite the decay of the past decade, Russia is still a military Great Power, the prospect is potentially horrific – ’Indonesia with missiles’, as Martin Wolf put it. [99] The commentater Otto Latsis said that the Yeltsin regime has one last chance with the Primakov government: ‘If this chance is not taken in a certain time it will be the end of democracy, the end of political liberalism and the problems will be solved by a Russian Pinochet’. [100]

The crisis of imperialist leadership: More generally, one can see developing a crisis of imperialist leadership, of which the G7’s inept response to the August crisis is but a symptom. The US is indeed the sole superpower, far stronger militarily than any other state in the world. The US’s share of world defence spending is larger now that it was in the mid-1980s, at the height of the Second Cold War, and is greater than that of the next six biggest Great Powers – Russia, Japan, France, Germany, Britain and China – combined. [101] But this military strength does not give Washington the political capacity to control a world heaving with crises.

Although the degeneration of the Clinton administration into a bedroom farce will make the situation worse, it is not the fundamental cause. Ever since the US became the main imperialist power at the end of the Second World War, it has relied not merely on its economic and military strength, but also on the construction of political alliances in order to secure its interests internationally. NATO is the most important example, securing as it does for the US the politico-military leadership of Western European capitalism. [102] But the Bush administration could launch the 1991 Gulf War against Iraq because it had created a coalition involving not merely European powers such as France and Britain, but also leading Arab states, notably Saudi Arabia, Egypt and Syria.

There are signs that, during the 1990s, the ability of US imperialism to carry its allies behind its major international initiatives has declined. The war crisis last February, when the US threatened to attack Iraq because of Saddam’s opposition to the UN weapons inspection programme, illustrated the political limits of US power. Among the Great powers only Britain’s Labour government supported Clinton. Russia, France and China opposed him, and Germany sat on the fence. In the Middle East even Egypt and Saudi Arabia, the major Arab states most closely aligned to Washington, refused to back the US war drive. Faced also with considerable domestic opposition, Clinton had to back down.