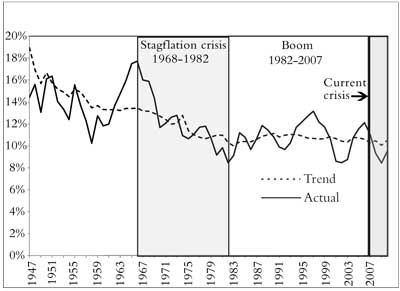

Figure 1: Rate of profit for US non-financial corporations

1947–2010

Source: Shaikh, 2011

Joseph Choonara | ETOL Main Page

From International Socialism 2 : 135, Summer 2012.

Copyright © International Socialism.

Copied with thanks from the International Socialism Website.

Marked up by Einde O’Callaghan for the Encyclopaedia of Trotskyism On-Line (ETOL).

David McNally writes in response to my review of his Global Slump that we need “serious, committed debate designed to strengthen the theoretical and practical capacities of the left”. [1] I agree. It is therefore unfortunate that he describes my review as making “cheap shots” and generating “heat about statistics”. Rather than stoop to discuss whether the evidence supports his case, he prefers to paint me as a latter-day Witchfinder General engaged in “heresy hunting”.

The claims I took issue with in McNally’s book are hardly heretical. His arguments – the world economy experienced a global “neoliberal” boom from 1982 to 2007; China’s expansion has created a powerful new centre of capital accumulation; the growth of financial transactions and instruments such as derivatives flows from the severing of convertibility between the dollar and gold – would be accepted as common sense for much of the radical left. Indeed, they would barely challenge the preconceptions of columnists at the Economist or Financial Times.

My issue with McNally’s book is not that his arguments are heretical; it is that some of them are wrong. Taking issue with his empirical claims was not, therefore, an exercise in nit-picking. My aim in doing so was to support my challenge to the overall thrust of his argument.

One central claim in his book is that the crisis of 2008 “represents the terminus of a quarter century of economic growth – which I shall call the neoliberal expansion – and the transition to a protracted period of slump”, a point he repeats in response to my review. Indeed, he devotes a lengthy chapter of his book to “developing this argument [in which] I dissent from the views of many radical theorists ... who see the last 40 years as one uninterrupted crisis, or a ‘long downturn’”. [2]

I do not agree with McNally’s characterisation of my position. As is clear from my review, I do not see the past four decades as being a period of uninterrupted crisis, a 40-year crisis or a permanent crisis. But it does seem to me that McNally’s book is in large part directed at those who, like me, see the recent period as one of relative stagnation for capitalism.

My reply to McNally will focus on this question because I think it is the most important substantial disagreement between us. As I suggested in my review, I found the closing chapters, dealing with questions of revolutionary strategy, the interrelation between oppression and class, and so on, pretty thin gruel. In some cases our differences seem to revolve around tone, emphasis or language. [3] Perhaps in some other instances – the derailment of the radical movement by “patriotic nationalism” after 11 September 2001, a period that saw some of the largest ever protest movements in various European countries in opposition to war – McNally is reflecting on a specifically North American experience.

Similarly, his emphasis on the extent to which “business unionism ... predominates” and his persistent pessimism about male, white members of the working class would have been disastrous in formulating the approach of the left to the substantial one-day strikes in Britain in 2011, which involved a multiracial workforce with disproportionate numbers of women – but also lots of male, white workers who, in my experience, were proud to unite across lines of race or gender. Other contentious issues, such as McNally’s favourable estimation of the Syriza coalition in Greece, are being tested by events far more sternly than they could be by words alone. And I am happy to accept our shared enthusiasm regarding the role of workers in the Arab revolutions or the potential of such struggles to challenge capitalism. [4]

So on to the evidence.

One of McNally’s arguments is that there has been an “upward trend in the rate of return” on fixed capital, a measure often used as a proxy for the Marxist rate of profit. [5] The rate of profit matters because it is a measure of the self-expansion of capital, a concept central to Marx’s analysis. [6]

Apparently I was getting “worked up” when I pointed out that McNally’s “doubling of US non-financial profit rates” was not reflected in the graph he presented (as if it said more about my troubled emotional state than McNally’s case). In my review I used Anwar Shaikh’s graph from a recent Socialist Register to check McNally’s figures, not because I believe Shaikh has the best method of calculating profit rates, but because it graphs the thing that McNally wrote had doubled. [7]

Shaikh argues that after the Second World War the rate of profit “drifted downwards for 35 years, but then stabilised”. [8] Over the past 25 years the trend was for it to rise a bit, then fall a bit, ending up where it started. I present a version of Shaikh’s graph in figure 1. The trend is surely unambiguous. But how does McNally read this graph? We are told, “Shaikh’s data show the same persistent rise in profitability across the period in question [1982–2007]”. [9] I leave it to the reader to decide who is right.

It may be that McNally now believes “profit of enterprise”, the difference between the rate of profit and the rate of interest, is the important thing. He does not explicitly say this in his book or in his reply to me, merely noting in a footnote that according to Shaikh this figure more than doubled from 1982 to 2007. Shaikh calculates “profit of enterprise” by subtracting the rate of three-month US Treasury bonds from his rate of profit. Unsurprisingly, the figure goes up – it was negative in 1982. I am not convinced by this method of calculating profit of enterprise. But even if it is valid, the crucial variable remains the rate of profit, measuring the total production of surplus value relative to investment, prior to its division into profit and interest. It is this measure that the rate of accumulation (the rate at which capitalists reinvest surplus value pumped out of workers) follows most closely. [10] In other words, looking at the profit rate allows us to understand the relative decline of capitalist accumulation over the recent period.

|

Figure 1: Rate of profit for US non-financial corporations

Source: Shaikh, 2011 |

McNally writes, “My concern in this area was not with the methodologies and preferred data sets for tracking movements in the rate of profit, which involve questions that lie far beyond the range of Global Slump. My interest was in showing that, notwithstanding the differences in methodology, multiple Marxist studies display a protracted upward trend in the rate of profit from the low point of the last crisis until 2006–7”. [11]

In other words, he chooses data that shows what he wants to show. Some of the data, on closer inspection, turns out not to show what he wants to show. When his use of data is criticised he disregards this as “heresy hunting” because it poses questions that lie outside the scope of his argument. By these criteria no argument can be refuted by evidence.

Since writing Global Slump McNally has acquainted himself with the work of Michael Roberts, who uses the historic costs of fixed capital to measure the rate of profit, rather than current costs. [12] I too am convinced that historic costs should be used to calculate the rate of return. The problem with using the current cost of fixed capital, or the “replacement cost” as it is also known, is that it does not measure profit against the sums actually invested by the capitalist but the amount that would be required to replace the investment today. [13] In other words, current cost calculations treat capitalism as if profits are generated at the same point at which investments are made – it treats capitalism as if time did not exist. This is obviously a nonsensical way to explore capitalism if we believe it to be a dynamic system, rather than a system in a state of static equilibrium. It turns out that the differences between current cost and historic cost calculations are also significant, and in particular the restoration of profitability in the recent period is, at least in large part, a result of this erroneous method of calculation.

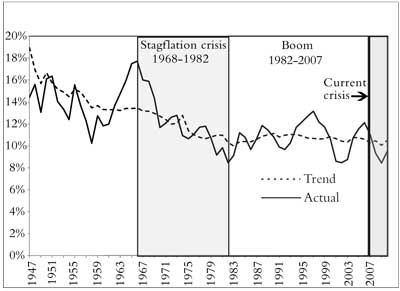

The author who has most effectively argued this point in recent years is Andrew Kliman, whose latest work, The Failure of Capitalist Production, is an important analysis of the crisis. Unlike McNally, Kliman does see it as within his remit to explain why different authors arrive at a different picture when assessing trends in profitability, setting out the issues at stake in a commendably accessible manner. Kliman presents several legitimate methods of calculating profit rates, each suitable for particular purposes, using historic rather than current costs. Here I present one of Kliman’s measures, the inflation-adjusted before-tax profit rate for the US corporate sector, in which the dotted line shows McNally’s method for obtaining a rise in profitability. [14]

|

Figure 2: Inflation-adjusted US corporate sector

Source: Kliman, 2012 |

I have added the dotted line showing how one could detect an increase in the rate of return between 1982 and 2007. There is a similar rise between 1982 and 1997. However, as I pointed out in my review of McNally’s book, both 2007 and 1997 lie near peaks in profitability; 1982 is a trough. It is no surprise to anyone that the rate of profit rises and falls periodically. The movement of the profit rate combines both long-term tendencies and short-term cyclical variations due to the business cycle. Once the data is extended to the crisis of 2008, we see that profit rates failed to mount any sustained recovery after 1982. The period cannot be seen as “one of an extended upturn in profitability” unless the data is “selected” to prove this. [15]

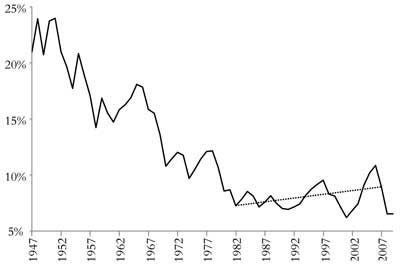

McNally’s book made an additional argument, namely that it was not acceptable to compare the “neoliberal boom” period with the long boom that followed the Second World War. In my review of his book I explained at some length why I disagreed, basing myself on changes to capitalism over the past century. [16] McNally has chosen not to argue the point. But, for what it’s worth, a paper by Simon Mohun presents the long-term US profit rate, and seems to show a higher trend rate through much of the 1890s and 1900s than during the long boom (figure 3). [17]

|

Figure 3: Long-term trends in profitability Source: Mohun, 2012 |

One final point about the figures. McNally claims that I “simply [declare] the rising trend in profits to be ‘fictitious’”. [18] On the relevant page of my review the reference to “fictitious profits” is me citing McNally who writes that from 2001 the profit data should be treated with caution “given the widespread phenomena of fictitious profits based on financial manipulation and accounting fraud”. [19]

So much for the trend itself. McNally’s response to my review sets out three causes for his perceived rise in profitability: attacks on workers’ living standards, rising productivity levels and the creation of global production chains.

On workers’ living standards he says that I “backhandedly grant this point” by citing Shaikh’s recent article. I would go further. In my review I fully endorsed that argument. Many other authors in this journal – Chris Harman and Guglielmo Carchedi among them – have made similar points prior to McNally’s book. We all said that the increased rate of exploitation helped to put a floor under profit rates from the 1980s. However, now I am not so sure.

Here Kliman’s new book makes a genuinely heretical claim: that the total compensation (wages, salaries, and health and pension contributions) going to US employees, as a share of new value, did not change dramatically in this period. It is true that in the 1970s wages stopped rising as rapidly as they had in the 1950s or 1960s, but so did the new value created. The slowdown in the growth of compensation was a consequence of the “relative stagnation of capitalist production”. [20] Unlike McNally, Kliman presents a carefully argued case. Far from “heresy hunting” I am convinced that his case should be taken seriously.

On McNally’s second point, he wants to argue not just that a rise in productivity cheapens “subsistence goods”, thus lowering the value that capitalists must grant workers to reproduce their labour power, but also that it “makes possible the capture of productivity gains by capital”. [21] Marx’s argument is that in the short term the introduction of new techniques might boost the amount of surplus value attracted by a particular firm or even a particular nation. But in the long run the replacement of living by dead labour leads to the tendency for the rate of profit to fall. Marx writes that “the progressive tendency of the general rate of profit to fall is ... just an expression peculiar to the capitalist mode of production of the progressive development of the social productivity of labour”. [22] In other words, a rise in productivity, if brought about by expanding the means of production harnessed by living labour, is perfectly consistent with a falling rate of profit.

Perhaps McNally means that the depreciation of constant capital raises profitability – one of the tendencies counteracting the falling rate of profit that Marx discusses in Capital. Again Kliman makes a compelling case that technological changes over recent decades have led to a substantial increase in the rate of moral depreciation, through which the means of production lose value as they become obsolete, especially in computing. [23] However, this affects both the value of fixed capital and the amount of profit realised by capitalists. Kliman ultimately estimates that the overall effect on profit rates is to reduce the actual rate relative to that indicated by the graphs such as figure 2.

McNally’s third underlying factor seems to rest mainly on the growth of China, an undisputed reality, which is described in an earlier article in this journal. [24] It is also clear that Chinese growth has been premised on the rapid expansion of a low-wage workforce. McNally agrees that this growth is contradictory and unbalanced and may not continue. Apparently the question is whether “something more has been going on than a ‘long downturn’ in the system”. [25] I agree that a section of the capitalist economy has grown rapidly in the context of relative stagnation of the world system. As I wrote, “Capitalism retained strong tendencies towards stagnation that coexisted with the dynamism produced as those presiding over the system competitively reorganised their capitals and sought new areas of the globe into which to expand”. [26] Indeed, I would argue that it is precisely this contradiction that is placing such a strain on China’s expansion.

Because it is utterly unheretical to say that China has grown dramatically in recent years, it is also important to avoid unnecessary hyperbole. McNally is unhappy that I have decried his use of data as selective. The vertical line in figure 4 shows the year that McNally “selected” to show that China was the biggest recipient of foreign direct investment (FDI) – completely failing to mention that it is the only year for which such a claim could plausibly be made. Again I leave it to the reader to decide if there is a problem with McNally’s choice of data – and, if there is, what it says about the strength of his argument.

Chinese growth may be real, but that does not mean that it compensates for the weakness of the global economy as a whole or has reversed the long-term decline in profitability at the core of the system. As Kliman shows, the “rate of profit [of US multinationals] on their foreign investments also fell and failed to recover. To be sure, the share of profits that US multinationals receive from their foreign operations has risen markedly. Yet their fixed assets located abroad have risen even more markedly as a share of their total fixed assets”. [27]

|

Figure 4: Annual flow of FDI into selected economies 1991–2007

Source: Unctad |

If the underlying causes of the “great boom” of 1982–2007 are suspect, as is the reality of the boom, at least as regards profit rates, what of the perceived consequences? On growth rates, McNally accuses me of hypocrisy because I criticise him for using Angus Maddison’s data on world GDP growth, data also used by Robert Brenner and Alex Callinicos (and me, for that matter). This is not my gripe. I have exactly the same reservations about such GDP data as Brenner and Callinicos. These do not rule such data out of order if they are used carefully and with awareness of their limitations. [28] My criticisms are over how McNally uses the data.

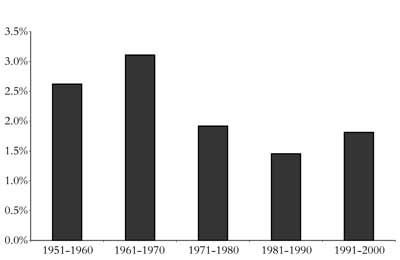

McNally claims that the world economy tripled in size from 1982 to 2007. The data shows that it did not. He claims to present a table showing that the compound growth rates of GDP for 1982–2007 are favourable compared with every phase of capitalist history apart from the long post-war boom. Actually his table does not give data for 1982-2007; it ends in 2001. If these are converted to per capita growth rates, the period is far from impressive (see figure 5). [29]

|

Why does any of this matter? First, because I think McNally mischaracterises the period from 1982, seeing capitalist strength where I see weakness. Second, because this seems to be grounded in a misunderstanding of Marx’s method, undermining our understanding of the current crisis and capitalism generally. Third, because I think that the expansion of the financial system, particularly the growing dependence on debt and the creation of asset-price bubbles in the run-up to the crisis, is rooted in the underlying weakness of capitalism. [30]

Fourth, I do not believe that the decline in the rate of profit is an irreversible trend. But I do believe that restoring profitability will require a far greater destruction of capital than has thus far taken place. As I made clear in my review, such destruction faces more substantial obstacles in contemporary capital than it has in the past. This implies a protracted period of economic and political instability, recurrent crises and revolutionary explosions. On this ultimate point at least, despite our ill-tempered exchange, McNally and I can hopefully agree.

1. McNally, 2012, p. 189.

2. McNally, 2011, p. 9.

3. I imagine that we would both agree with the necessity of responding to “every manifestation of tyranny and oppression”, to use Lenin’s phrase. However, I find claims that class relations are “constituted in and through” gender or racial oppression, or talk of a “constellation of relations of domination”, too vague to be helpful in formulating concrete conclusions about the struggle against oppression and for socialism. For me, class is a social relationship flowing from a position in the economic structure of society, relative to the means of production and other classes. I don’t know what it would mean to say that my class position manifested itself in or through being Asian, for example.

4. Though what my “notable silence” on the six paragraphs in his 230-page book detailing the general strikes in Guadeloupe and Martinique proves, I am not quite sure.

5. McNally, 2011, p. 183.

6. “Capital and its self-expansion appear as the starting and the closing point, the motive and the purpose of production ... production is only production for capital and not vice versa, the means of production are not mere means for a constant expansion of the living process of the society of producers” – Marx, 1971, p. 250.

7. Shaikh, 2011.

8. Shaikh, 2011, p. 49.

9. McNally, 2012, p. 184.

10. Specifically, the rate of accumulation in the US tended to follow what Andrew Kliman calls the “property income rate of profit” – Kliman, 2012, p. 91, figure 5.8.

11. McNally, 2012, p. 184.

12. Roberts runs an excellent blog: Michael Roberts Blog.

13. This is a question of the actual value advanced to make the investment at a certain point in history, not whether the data is adjusted for inflation. Historic costs can obviously be “inflation-adjusted” as in the graph I have used below.

14. Kliman, 2012, p. 84, figure 5.5. I have selected the measure that I hope will be least contentious. Kliman’s book came out after Global Slump, but his data have been in wide circulation for some time – see for example: Andrew Kliman, The Persistent Fall in Profitability Underlying the Current Crisis: New Temporalist Evidence, Andrew Kliman blog.

15. McNally, 2012, p. 184. See Kliman, 2012, pp. 104–105, for a critique of this kind of “cherry picking” of data.

16. Choonara, 2011, pp. 165–167.

17. Again, I don’t endorse Mohun’s method, but this is essentially a long-term version of the sole graph of profit rates presented by McNally. See McNally, 2011, p. 49.

18. McNally, 2012, p. 184.

19. McNally, 2011, p. 49 (my emphasis). I do not believe this is restricted to the period post-2001.

20. Kliman, 2012, p. 124.

21. McNally, 2012, p. 180 n10.

22. Marx, 1971, p. 213 (emphasis in original).

23. See Kliman, 2012, pp. 140–148.

24. Budd and Hardy, 2012.

25. McNally, 2012, p. 182.

26. Choonara, 2011, p. 168.

27. Kliman, 2012, p. 78. See the graph on p. 79.

28. Although Maddison’s estimates of Chinese GDP are far higher than those generally used-he estimates the Chinese economy at 94 percent the size of the US economy in 2008. See Kliman, 2012, p. 52. If we accept recent Chinese growth rates as accurate, this would mean that China is already the world’s largest economy.

29. If World Bank data is used instead of Maddison’s, the rise in 1991–2000 relative to 1981–1990 is even less evident.

30. McNally does not respond to my arguments on the relationship between finance and the wider capitalist economy, preferring to restate his own position (which, of course, does not involve an account of the relative stagnation of production).

Choonara, Joseph, 2011, Once More (with Feeling) on Marxist Accounts of the Crisis, International Socialism 132 (Autumn).

Hardy, Jane, and Adrian Budd, 2012, China’s Capitalism and the Crisis, International Socialism 133 (Winter).

Kliman, Andrew, 2012, The Failure of Capitalist Production: Underlying Causes of the Great Recession (Pluto).

Marx, Karl, 1971 [1894], Capital, volume 3 (Progress).

McNally, David, 2011, Global Slump: The Economics and Politics of Crisis and Resistance (Spectre).

McNally, David, 2012, Explaining the Crisis or Heresy Hunting? A Response to Joseph Choonara, International Socialism 134 (Spring).

Mohun, Simon, 2012, The Rate of Profit and Crisis in the US Economy: A Class Perspective, chapter in forthcoming book.

Shaikh, Anwar, 2011, The First Great Depression of the 21st Century, Socialist Register 2011: The Crisis This Time (Merlin)./p>

Joseph Choonara Archive | ETOL Main Page

Last updated: 30 November 2021