Nigel Harris Archive | ETOL Main Page

From Socialist Worker Review, No. 83, January 1986, pp. 8–9.

Transcribed & marked up by Einde O’Callaghan for the Encyclopaedia of Trotskyism On-Line (ETOL).

|

THERE IS a school of thought which argues that there is not much future for a competitive car industry in developing countries. Even in making car components, they say, the developing countries will remain restricted to the marginal and low value parts (windscreen wipers and so on).

In the late seventies, the idea of the ‘world car’ became popular in the big car making companies – a car of standard design, sold in all countries. That included many developing countries. The idea is said now to be dead. The industry, in sum, will remain where it is – in North America, Europe and Japan.

The notion must be a great relief to governments in America and Europe. It will not be much relief to the workforce since, even if the ‘industry’ stays, jobs do not continue. Since 1979, 158,000 jobs have been lost in the British industry, 130,000 in the Italian and 55,000 in the French. Some estimates suggest the European industry as a whole needs to lose another half million jobs to approach Japanese standards of productivity.

But is it even true that the car industry is marked by immobility? It is an odd idea when you consider how recently Japan emerged as the second largest maker of cars in the world – the process was concentrated only in the last twenty years.

Why is that process of redistribution to stop? The industry has, since the second world war, proved very mobile in terms of tne geography of location of capacity. In 1950, companies in the United States produced 76 percent of the world’s output: in 1979, 28 percent (and that share included the value of imported components). In 1956, 97 percent of world output came from North America and Europe; in 1979, 65 percent.

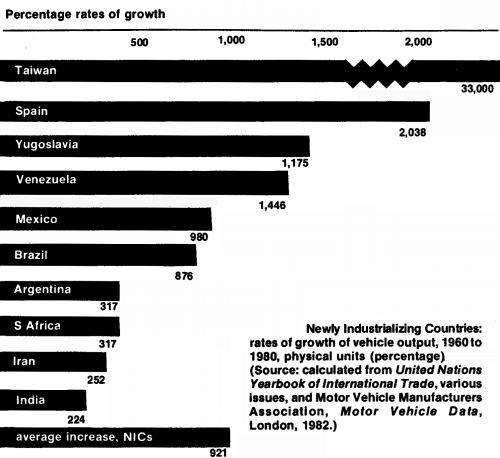

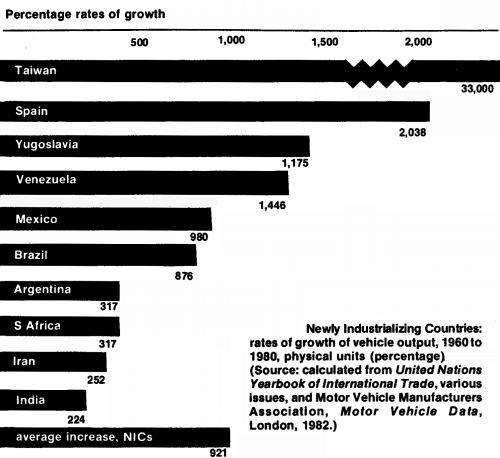

In the two decades to 1980 – as the bar chart shows – the rates of growth of the leading newcomers to car production (excluding Japan) were generally much higher than the rate of growth of world output – world output increased just under two and a half times over when the output of the newcomers increased over nine times over. The chart does not include countries with a high growth rate that began car manufacture after 1960 – for example, South Korea, Malaysia and China. By 1980, the countries represented in the bar chart had pushed up their output to 4½ million vehicles annually, 12 percent of world production (compared to 3 percent in 1970).

In component manufacture, it does not seem third world output is restricted to low value items. In 1983, the United States imported 3.6 million engines, two-thirds of them from Mexico and Brazil. Ford and General Motors have made – and continue to make – major investments in engine manufacture as well as vehicle assembly in the northern states of Mexico. The leading US car companies have become very dependent upon imported components in order to compete with imported vehicles – which is why Ford and General Motors are the leading opponents of import controls in the car trade.

The strategy of survival for the big US companies is both increased imports of cheap components (and whole cars as well), and buying shares in the foreign companies with which they compete. General Motors now owns 34 percent of Isuzu and 5 percent of Suzuki. It has a joint venture with Toyota. Ford owns 25 percent of Mazda, and has a joint venture with Toyo Kogyo in the United States and Mexico. Chrysler is raising its holding in Mitsubishi Motors to 24 percent and operates jointly with it in the US. By 1990, it is reckoned that Japanese companies (or joint ventures) will produce one and a half million cars in the United States.

Japanese companies are already themselves under threat from the newcomers. US controls on imported cars from Japan have pushed Japanese manufacturers into higher value cars (with the same number of cars, the value is much higher) – the $12 26,000 bracket. With astonishing speed, newcomers have moved in to fill the cheap car market gap (the $5–6,000 bracket) – in particular the Yugoslav Zastava and the Korean Hyundai Pony.

In Canada, the Korean Hyundai has had amazingly swift success in pushing back the Japanese. The first Pony cars arrived early in 1984 when the company aimed to sell 5,000; 25,000 were sold. In 1985 it is expected 85,000 Ponies will be sold – double the sale of any Japanese or European imported car. But the threat of import controls remains, and last August, Hyundai announced a $150 million investment in a Canadian plant to produce, by 1990, 100,000 cars, well placed to supply, duty free, the US market; (meanwhile, Japanese companies have lobbied Washington for restrictions on Korean and Taiwanese car imports!).

Korean output is still small by world standards. In 1981, operating at 50 percent of capacity, Korean companies made 121,000 cars and exported 16,000. The 1986 target was for 492,000 and 2 million in 1991 (with 900,000 exported). The 1991 target for all vehicles made in Korea is 4½ million (although Hyundai have a private estimation of 5 to 6 million, 55 percent of them exported). The Korean performance in shipbuilding – which took the country from 0 percent of the world market in 1970 to 23 percent in 1983 should caution the sceptics against ridiculing these targets.

Meanwhile, other hungry newcomers are on the prowl. The first shipment of the Malaysian Proton car (the result of a joint venture between the Malaysian government and Mitsubishi) arrived in Europe this year; Ford Lio Ho of Taiwan are constructing a new plant, most of the output of which is for export. Further out, General Motors, Volkswagen and Daimler-Benz are planning joint ventures in China to raise output from 1984’s 320,000 to one million by the 1990s, while some of the large Japanese companies are now manufacturing in India.

Where does all this leave the giant US car industry? Recent estimates suggest a continued shrinkage in the output of US companies – from 7.8 to 6.4 million in 1988 – and a faster decline in their share of 1988’s 12.6 million car market, to 57 percent. Japanese plants in the States should supply 7 percent, and imports from Japan 28 percent; imports from Europe 5.5, from South Korea 2.1 (or a quarter of a million) and from other places, 1.2 percent. Of course, US companies is a misleading concept when so much interrelated ownership and joint ventures are involved, and the US output includes a large input of imported components.

It does not seem the automation of car manufacture will change the trends. Already labour costs are down to 20 percent of the total, so that low wages in less developed countries are not necessarily a key matter. The more advanced of the less developed – the newly industrialising countries – are tending to specialise in capital intensive production (leaving to the poorer less developed, labour intensive manufacture), with the more developed concentrating on skill intensive and innovation output. Korea’s performance in shipbuilding and steel, like that of Mexico and Brazil, is the prototype; not garment making. The new car manufacturing plants of the less developed will be nearly as capital intensive as those in the more developed countries.

The concept of the world car as a planning target for the big world companies may have taken a knock of late, but the reality of the market constantly pushes the industry piecemeal in the same direction. The Japanese will soon face a host of new Japans. But each time round, the process becomes faster and faster – Japan’s dethronement will be much quicker than that of Europe and the United States. But there is no case to assume the dog-eat-dog syndrome can be contained in the Atlantic economy.

Nigel Harris Archive | ETOL Main Page

Last updated: 31 October 2019