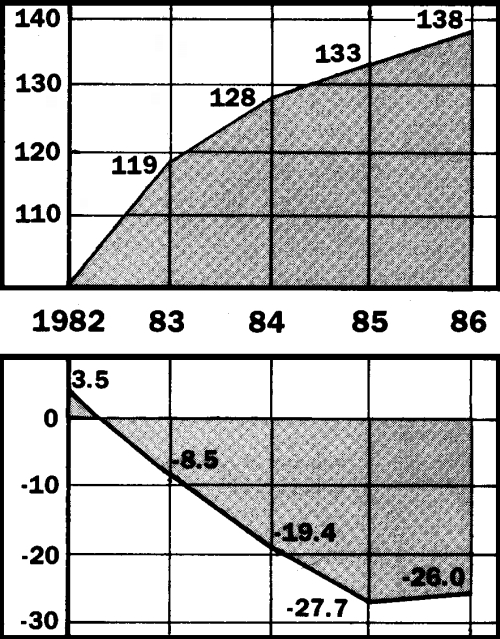

Cumulative debt:

17 largest borrowers

($ billion, Index

1982 = 100)

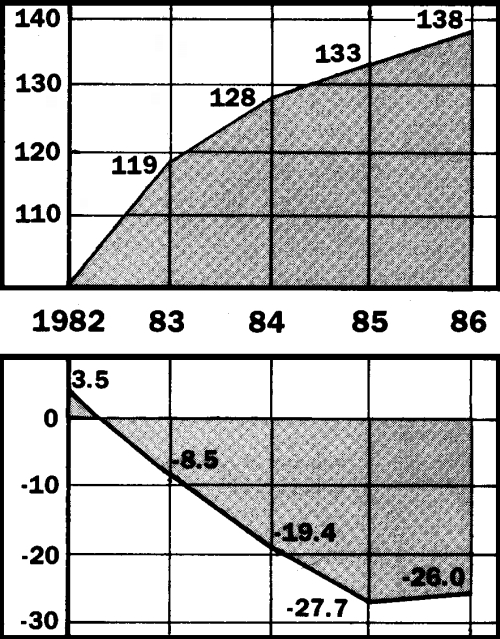

Net transfers

between top 17

largest borrowers

and Western banks

and governments

($ billion)

Nigel Harris Archive | ETOL Main Page

From Socialist Worker Review, No. 97, April 1987, p. 9.

Transcribed & marked up by Einde O’Callaghan for the Encyclopaedia of Trotskyism On-Line (ETOL).

|

Cumulative debt: Net transfers |

YOU MAY not have noticed, but 20 February saw the end of civilisation as we know it. The Brazilian government defaulted on two thirds of its debt (by announcing a refusal to pay interest for an indefinite period). Oddly enough, this momentous event evoked only mild reactions in Washington.

Treasury Secretary Baker murmured moderate approval of the efforts of Brazil to avoid a worse crisis (crippling the economy by continuing to pay so much interest). And on Wall Street the shares of Citicorp, the bank with the largest loans to Brazil, dropped five and a half dollars to $52.75, a mark of the threat to Citicorp’s 1987 profits, not to its very survival. The world, it seems, is to end with a whimper, not a bang.

In fact, the “debt crisis” has become an increasingly phoney threat, a banker’s ramp to frighten us all. After all, others – albeit with lesser size of debt than Brazil – have defaulted. Peru, Nigeria, South Africa and a host of others have been obliged to reschedule their debts (adding the outstanding interest to the principal and extending the repayment period).

Furthermore, the banks have spent the last five years salting away reserves to cover bad debts, reaching deals with other banks and governments to offset a run of defaults, selling the debt at knockdown prices or swapping it for shares in companies operating in the country concerned (a complicated deal, the details of which need not concern us).

In sum, as a threat to the world financial system, the debts of the developing countries are not crucial except in very special and unlikely circumstances.

More worrying are the debts of North America. Domestically, companies, farms and households are supporting an Everest of debt, dwarfing the small hills of Brazil, Mexico, Korea and the rest. The US government has been borrowing around $200 billion every year since Reagan came to power (as compared with Brazil, the largest Third World borrower, that has spent 20 years or so accumulating a debt of $100 billion).

Indeed, this borrowing kept interest rates very high (as well as keeping the value of the dollar high for a time), so crippling the Less Developed Country borrowers. High interest rates have attracted into the States a massive share of the world’s savings. The US has also been importing about a quarter of the world’s manufactured exports while its own exports declined – producing a deficit on its trade balance last year of about $150 billion. In sum, the Reagan administration may have added a million million dollars to the external debts of the United States – now that really is walking tall.

This vast overhang of American debt can be managed in ordinary circumstances, despite the bankrupting of the odd bank, company or farm. But put it alongside the vastly inflated scale of the Tokyo Stock Exchange. As the yen has strengthened, there has been a massive flow of funds both abroad (to finance the US trade and government deficits) and into Japanese stocks and shares.

Monetary values have soared in the scramble to buy, going far beyond the expected profitability of the shares (indeed, the strong yen is hammering the profits of exporting companies). These are just the conditions for a stock market crash – when a chill to confidence turns to galloping pneumonia.

The problem is not the straw of a Brazilian default, but the appalling vulnerability of the camel of North American debt and Japanese speculation. If default pushed a Japanese bank to the wall, it could puncture the balloon of Japanese share prices. If that pulled down American financial companies operating on the Japanese stock exchange (or affected the shares of Japanese companies trading in the United States), it could affect confidence in the States – and the whole precarious house of cards could tumble. There would be no way of Europe saving itself.

Dramatic stuff, but unlikely. The scenario would require a whole series of coincidences and accidents, not to mention the paralysis of governments. The Japanese government could organise the overnight rescue of a bank or seek to sustain the market on the margin long enough to smother the knock on effects. And if that did not happen, the US government has become quite skilled in organising and supporting threatened banks to inhibit a generalised crash, especially with the coordinated help of the European governments and international agencies (the Bank of International Settlements, IMF etc). In 1929, when a comparable run of financial crises, starting in Vienna, finally toppled Wall Street, these types of intervention were beyond the capacity of most governments and there was much less coordination.

On the other side, it is clear there is not much banks can do to punish defaulters. Gone are the days when Citicorp (or its predecessors) could call up the US Marines to act as bailiffs. The financial press not long ago was full of dark threats that the exports and overseas assets of defaulting countries would be seized (on, for some reason, “the high seas”, but not the low ones). The country would get no imports or credits and quite swiftly the economy would come to halt.

It now seems there is no legal power to do any such thing – exports and credits usually concern private companies, and could not be seized when the debt is owed by the government. There is even doubt whether the exports and assets of public sector companies could be legally held. And the threat to withhold new loans or credits does not carry weight – they are already denied to the countries with most debt. The historical record bears out the case. Most of Latin America defaulted in the 30s and nothing happened. In Brazil’s case the economy expanded by 11.8 percent per year for several years after the 1931 default.

In the case of the US government’s reaction, this shows Baker is more worried about keeping up or expanding US exports to Latin America (to reduce the gigantic trade deficit) than saving the odd bank. Between 1976 and 1981, US exports to Latin America increased three times over, fuelled by easy international bank loans.

The shutting off of new loans after 1982 had a violent effect on US export industries as governments in the south were obliged to slash imports. Thus squeezing the debtors leads not only to an expansion in the US trade deficit but also to the lay off of workers in American exporting industries.

However, if the debt crisis is in reality not much more than a nightmare for bankers, a different kind of nightmare continues for many Brazilians. The debt might worry an international ruling class, but even without the debt starvation persists. A recent Catholic report alleges that seven million Brazilian children have been abandoned in the past five years.

“In Rio, every month about 100 children under three years of age are abandoned in the streets and hospitals ... In Acre [an Amazon State] impoverished mothers sell their young daughters to lorry drivers or gold prospectors as prostitutes ... In Sao Paulo, there are 1,200 gangs of child criminals and between them they have 10,000 firearms.”

About a quarter of a million Brazilian children die under the age of one.

But was it different before 1982? Will it be different if all the debts are cancelled? The crisis continues with or without debt. Indeed, Brazil is by no means the worst off. A few months ago, the Government of Tanzania (with a quite small level of debt) announced a programme to promote donkey farms. The country could no longer afford to import oil to run trucks to the villages to collect the crops and deliver all the other things that make life possible. Now that is a debt crisis.

The poor of Africa with much tinier debts than the better off of Latin America are the worst afflicted by the debts. They do not loom large in the $1,080 billion owed by Developing Countries, nor do they contribute much to the Third World’s financing of Europe and North America – $82 billion over the past five years (see the box). But in terms of sheer human survival they are much more important. The bankers do not care about that at all. And the very poor are too poor to borrow anything.

The debt crisis reflects the terrors of bankers about their loans. It has very little to do with any real fears about people.

Nigel Harris Archive | ETOL Main Page

Last updated: 31 October 2019