One of the conditions of existence of the capitalist mode of production is developed commodity circulation, i.e., exchange of commodities through the medium of money. Capitalist production is inseparably connected with circulation.

Every individual capital begins its career as a certain sum of money, it appears as money capital. The capitalist uses money to buy commodities of certain kinds: (1) means of production, (2) labour-power. This act of circulation can be expressed like this:

In this diagram M stands for money, C for the commodity, L for labour-power, and Pm for means of production. As a result of this change of form which his capital has undergone, its owner has at his disposal everything he needs for production. Whereas previously he owned capital in the form of money, he now owns capital to the same amount but in the form of productive capital.

So the first phase in the movement of capital is the transformation of money capital into productive capital.

Following this begins the process of production, in which there takes place the productive consumption of the commodities which the capitalist has bought. It is expressed in the fact of the workers expending their labour, the raw material being worked up, fuel being burnt and machinery wearing out.

Capital changes its form once again: as a result of the production-process the capital invested appears embodied in a certain mass of commodities, it assumes the form of commodity capital. However, in the first: place, these are not the same commodities which the capitalist bought when he started up in business, and secondly, the value of this mass of commodities is greater than the original value of his capital, for in it is contained the surplus-value produced by the workers.

This stage in the movement of capital can be shown like this:

Here the letter P stands for production and the dots before and after it show that the process of circulation has been interrupted and a process of production is taking place, while C' stands for capital in the form of commodities, the value of which has grown as a result of the workers surplus labour.

Thus the second phase in the movement of capital consists of the transformation of productive capital into commodity capital.

Capital does not stop short with this movement. The commodities which have been produced have to be realised. In exchange for the commodities which he sells the capitalist receives a certain sum of money.

This act of circulation may be depicted like this:

Capital changes its shape a third time: it once more assumes the form of money capital. At the end of this process its owner has a larger sum of money than he had at the beginning. The aim of capitalist production, which is to extract surplus-value, has been attained.

Thus the third stage in the movement of capital consists in the transformation of commodity capital into money capital.

Having received money for the commodities he has sold, the capitalist spends it once again on buying the means of production and labour-power needed for further production, and the entire process starts anew.

These are the three phases through which capital passes successively in the course of its movement. In each of these phases, capital fulfils a corresponding function. The transformation of money capital into the elements of productive capital ensures the union of the means of production which belong to the capitalists with the labour-power of the wage-workers: unless such a union is effected the process of production cannot take place. The function of productive capital is to create, with the labour of the wage-workers, masses of commodities, new value, and consequently, surplus-value. The function of commodity capital is, through the sale of the mass of commodities which has been produced, first, to return to the capitalist in money form the capital which he invested in production and, second, to realise in money form the surplus-value created in the process of production.

Industrial capital passes through these three phases in the course of its movement. By industrial capital we mean, in this instance, all capital which is used for the production of commodities, regardless of whether industry or agriculture is meant.

"Industrial capital is the only form of existence of capital in which not only the appropriation of surplus-value or surplus product but also its creation is a function of capital. Therefore it gives to production its capitalist character. Its existence includes that of class antagonisms between capitalists and labourers." (Marx, Capital, Kerr edition, vol. II, p. 63.)

Consequently, all industrial capital performs a rotatory movement.

By the rotation if capital is meant the successive transformation of capital from one form into another, its movement, which includes three phases. Of these phases, the first and third take place in the sphere of circulation, while the second belongs to that of production. Without circulation, that is, without transformation of commodities into money and then of money back into commodities, capitalist reproduction, i.e., the constant renewal of the production-process, would be unthinkable.

The rotation of capital as a whole can be shown in the following form:

All three stages of the rotation of capital are very closely interconnected and mutually dependent. The rotation of capital proceeds normally only so long as its various phases flow uninterruptedly one into the other.

If capital stops short in its first phase, this means it drops into a barren existence as money capital. If the hold-up occurs in the second phase, this means that the means of production remain lifeless and labour-power remains unemployed. If capital stops short in its last phase, unsold commodities accumulate in the warehouses and clog the channels of circulation.

It is the second phase, when it is in the form of productive capital, that is of decisive importance in the rotation of industrial capital; in this phase takes place the production of commodities, value and surplus-value. In the other two phases value and surplus-value are not created; in them only a change in the form of capital takes place.

To the three phases of the rotation of capital correspond three forms of industrial capital: (I) money capital, (2) productive capital and (3) commodity capital.

Every capital exists simultaneously in all of these forms: at the same time as one part of it appears as money capital being transformed into productive capital, another part appears as productive capital being transformed into commodity capital, and a third part appears as commodity capital being transformed into money capital. Each part of it in turn assumes and discards, one after another, all three of these forms. This is true not only of each capital taken separately but also of all capitals taken together or, in other words, of the aggregate social capital. Therefore, Marx declares, capital can be understood only as a movement and not as a thing lying at rest.

This includes the possibility of distinct existence of the three forms of capital. Later on it will be shown how merchant capital and loan capital are separated off from capital employed in production. It is this distinction that provides the basis for the existence of the different groups of the bourgeoisie--manufacturers, merchants bankers-who share out the surplus-value among themselves.

Every capital undergoes rotation as an uninterrupted, constantly repeated process. In this way capital is turned over.

By the turnover of capital is meant its rotation, considered not as a momentary act but as a periodically renewed and repeated process. The period of turnover of capital is the sum of the time of production and the time of circulation. In other words, the period of turnover is the interval of time which elapses between the moment when the capital is invested in a certain form to the moment when it returns to the capitalist in the same form but increased by the amount of the surplus-value.

The time of production is the time during which the capital is in the sphere of production. The principal part of the time of production is the working period during which the object being worked up undergoes directly the operation of labour. The working period depends on the nature of the given branch of production, the level of technique in the particular enterprise, and other conditions. For example, in a spinning mill not more than a few days are needed for a certain quantity cotton to be transformed into yarn, ready to be sold, whereas in a locomotive-building works the completion of each locomotive requires the work of a large number of workers over long period.

The time of production is usually longer than the working period. It includes as well those breaks in the work during which the object of labour is undergoing the operation of certain natural processes such as, e.g., the fermentation of wine, the tanning of skins, the growth of wheat, etc.

The time of circulation is the time during which capital is being transformed from the money form into the productive form and from that into the money form. The length of the time of circulation depends on the conditions under which the purchase of means of production and the sale of completed commodities, are carried out, on the proximity of the market and on the level of development of the means of transport and communication.

The various parts of productive capital do not circulate in the same way.

The different ways in which separate parts of productive capital circulate derive from the different ways in which each of them transfers its value to the product. This underlies the division of capital into fixed and circulating.

By fixed capital is meant that part of productive capital which, though it fully takes part in production, transfers its value to the product not all at once but in parts, during the course of a series of periods of production. This is that part of capital which is spent on the erection of buildings and works and on the purchase of machinery and equipment.

The various elements of which fixed capital is composed usually serve the purpose of production over many years; they wear out to a certain degree every year and at last are found useless for further employment. This is what is meant by the physical depreciation of machinery and equipment.

Besides physical depreciation, the instruments of production also undergo a moral depreciation. A machine which has been in use for five or ten years may be still sound enough, but if during that period another, improved, more productive or cheaper machine of the same kind has been invented, this leads to the depreciation of the old machine. For this reason the capitalist is interested in completely using up his equipment in the shortest possible period of time. Hence the capitalists' endeavours to lengthen the working day, to intensify labour, and to introduce uninterrupted shift work in their enterprises.

By circulating capital is meant that part of productive capital the value of which during a single period of production is completely returned to the capitalist in the form of money when the commodities are realised. This is that part of capital which is spent on the purchase of labour-power, and also of raw material, fuel and auxiliary materials, i.e., those means of production which do not form part of fixed capital. The value of the raw material, fuel and auxiliary materials is fully transferred to the commodities during a single period of production, and the outlay on labour-power returns to the capitalist with an increase (an addition of surplus-value).

During the time that it takes for fixed capital to complete a single turnover, circulating capital manages to complete a number of turnovers.

When he sells his commodities, the capitalist receives a certain sum of money, which is made up of: (1) the value of that part of the fixed capital which has been transferred to the commodities in the process of production, (2) the value of the circulating capital, (3) the surplus-value. So as to keep production going, the capitalist uses once more part of the money he has received, corresponding to circulating capital, to hire workers and to buy raw material, fuel and auxiliary materials. The capitalist Uses part of the money corresponding to the part of his fixed capital which has been transferred to the commodities, to replace depreciation in his machinery, machine-tools, buildings, etc., i.e., for amortisation.

Amortisation means the gradual replacement in money form of the value of fixed capital, through periodical deductions corresponding to the extent of its depreciation. Part of the amortisation deductions is spent on capital repairs, i.e., on partial replacement of worn-out equipment, tools, factory buildings, etc. But the bulk of the amortisation deductions is kept by the capitalists in money form (usually in the banks) so as to be able when necessary, to buy new machinery in place of the old or to erect new buildings to replace those which have become unfit for further use.

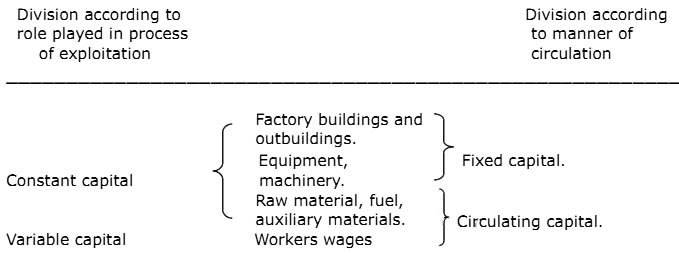

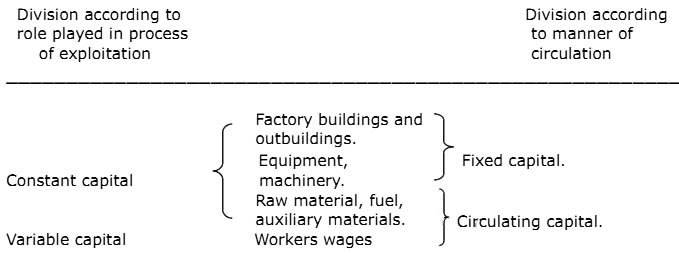

Marxist political economy distinguishes between the division of capital into fixed and circulating and its division into constant and variable. Constant and variable capital differ from each other in the roles which they play in the process whereby the workers are exploited by the capitalists, whereas fixed and circulating capital differ in the manner in which they circulate.

These two ways of dividing capital may be shown in the following fashion :

Bourgeois political economy recognises only the division of capital into fixed and circulating, since this way of dividing capital does not in itself show the role of labour power in creating surplus-value, but, on the contrary, conceals the radical difference between the capitalist's expenditure on the hiring of labour-power and that on raw material, fuel, etc.

The speed with which a given amount of variable capital is turned over has a bearing on the amount of surplus-value which a capitalist can extract from his workers during a year.

Let us take two capitals, in each of which the variable part is 25,000 dollars, the rate of surplus-value being in each case 100 per cent. Let us suppose that one of them is turned over once in one year whereas the other is turned over twice. This means that the owner of the second capital, though he possesses the same amount of money, is able to hire and exploit during one year twice as many workers as the owner of the first. At the end of a year, therefore, the results shown by the two capitalists will differ. The first will receive 25,000 dollars of surplus-value, while the second will receive 50,000.

The rapidity of the turnover of capital also has a bearing correspondingly on the size of that part of the circulating capital which is laid out for buying raw material, fuel and auxiliary materials.

The annual rate of surplus-value means the proportion which the amount of surplus-value produced per year bears to the variable capital invested. In our example the annual rate of surplus-value, expressed as a percentage, would be, in the case of the first capitalist 25,000/25,000=100 per cent, and in that of the second capitalist 50,000/25,000=200 per cent. Hence it is clear that it is to the interest of capitalists to accelerate the turnover of capital, since this acceleration enables them to obtain the same amount of surplus-value with a smaller capital or with the same capital to obtain a larger sum of surplus-value.

Marx showed that by itself the acceleration of the circulation of capital does not create a single atom of new value. More rapid turnover of capital and more rapid realisation in money form of the surplus-value created in a given year only enables the capitalists to hire with one and the same quantity of capital a larger number of workers, whose labour creates a larger amount of surplus-value per year.

As we have seen, the time of turnover of capital consists of the time of production and time of circulation. The capitalist strives to shorten the duration of both of these.

The working period necessary for the production of commodities becomes shorter as the productive forces develop and technique grows.

For example, present-day methods of smelting pig-iron and steel enable these processes to be completed many times faster, compared with the methods which were used 100-150 years ago. Noteworthy results have also been achieved by progress in the organisation of production, e.g., the transition to serial or mass production.

The interruptions in the work which form part of the time of production over and above the working period are also shortened in many cases as technique advances. Thus, the process of tanning hides formerly took weeks, but at present, thanks to the use of the latest chemical methods, it takes only a few hours. In a number of branches of production extensive use is made of catalysts, i.e., substances which speed up the action of chemical processes.

In order to accelerate the turnover of capital employers' resort also to lengthening the working day and intensifying labour. If with a 10-hour working day the working period lasts 24 days, then a lengthening of the working day to 12 hours shortens the working period to 20 days and correspondingly accelerates the turnover of capital. The same result is given by an intensification of labour, under which the worker expends in 60 minutes the same amount of energy as previously he expended, say, in 72 minutes.

Furthermore, the capitalists bring about an acceleration in the turnover of capital by shortening the time of circulation of capital. Such a shortening is made possible by the development of transport and of the postal and telegraph services, and by the improved organisation of trade.

But reduction of the time of circulation is counteracted, first, by the extremely irrational distribution of production in the capitalist world, which necessitates the transport of commodities over vast distances, and, secondly, the sharpening of capitalist competition and growth of difficulties in finding markets.

The surplus-value created during a given period passes through circulation along with the circulating capital. The shorter the period of turnover of capital, the more quickly the surplus-value which the workers have created is realised in money form and the more quickly it can be used to extend production.

(1)Each individual industrial capital goes through an uninterrupted movement in the form of a rotation comprising three phases. To these three phases correspond three forms of industrial capital-money, productive and commodity distinguished by their respective functions.

(2) The rotation of capital, taking place not as an isolated act but as a periodically renewed process, is called the turnover of capital. The period of turnover of capital means the sum of the time of production and the time of circulation. The principal part of the time of production is the working period.

(3) Each productive capital is divided into two parts, distinguished by the manner of their turnover: fixed capital and circulating capital. Fixed capital is the part of productive capital the value of which is transferred to commodities not all at once but little by little, during a series of periods of production. Circulating capital is that part of productive capital the value of which is in the course of a single period of production fully returned to the capitalist when the given commodities are sold.

(4) Acceleration of the, turnover of capital enables the capitalists to complete during one year, with the same capital, a greater number of turnovers, and, therefore, to hire more workers, who produce a larger amount of surplus-value. The capitalists endeavour to speed up the turnover of capital both by improving technique and, especially, by stepping up the exploitation of the workers-through lengthening the working day and intensifying labour.