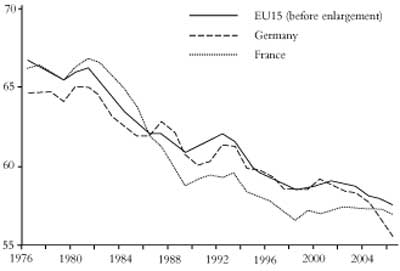

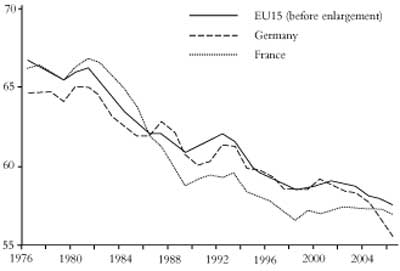

Figure 1: Evolution of the wage share

as a percentage of GDP 1976–2006

Source: Michel Husson “Le partage de la valeur ajoutée”, PowerPoint presentation,

August 2009

ISJ 2 Index | Main Newspaper Index

Encyclopedia of Trotskyism | Marxists’ Internet Archive.

From International Socialism

2 : 128, Autumn 2010.

Copyright © International Socialism.

Copied with thanks from the International Socialism Website.

Marked up by Einde O’Callaghan for ETOL.

“It is clear that since September 2008 we have been facing the most difficult situation since the Second World War – perhaps even since the First World War. We have experienced – and are experiencing – truly dramatic times ... A number of markets were no longer functioning correctly; it looked somewhat like the situation in mid-September 2008 after the Lehman Brothers’ bankruptcy”. [1]

– Jean-Claude Trichet, European Central Bank president

The crisis which hit Europe in the spring and early summer of 2010 is proof that all the talk about recovery from the crisis which broke out in September 2008 is totally off the mark. At the height of the panic in early May that gripped governments in continental Europe and investors across the world, there were many ominous signs that the situation was quite similar to that which preceded the collapse of Lehman Brothers and that precipitated the world economy into the deepest recession it has gone through since the end of the Second World War, as even such an authoritative figure as the president of the European Central Bank (ECB), Jean-Claude Trichet, has recognised. The risk of a wave of sovereign states in Europe defaulting on their debts forced even US president Barack Obama to step in and apply pressure on the French and German governments to agree to a solution that would avert another financial meltdown. In effect, European leaders spent three months – from mid-February to mid-May – wrangling over the exact terms on which they would provide financial assistance to the Greek state. Speculation about whether financial assistance would be provided at all and about whether the Economic and Monetary Union (EMU, the arrangement underpinning the euro) would survive the crisis was rife. And although disaster was avoided by means of a huge bailout package potentially amounting to €750 billion and the decision of the ECB to start buying sovereign debt, the debate about the future of EMU continues both among European politicians and among commentators. In the meantime, the austerity policies that accompanied throughout Europe the process culminating in the introduction of the euro in 1999 are being implemented all over again, causing pain and resistance.

The process of European integration was triggered by geopolitical considerations. [2] In the wake of the Second World War, the aim of France’s European policy was to contain and control German resurgence. [3] The French progressively came to the conclusion that the best way, given the historical circumstances of the Cold War and the Soviet threat, of preventing German dominance would be to lock Germany into Western Europe by setting in motion a process of long-term integration of the interests of the various continental ruling classes. France would take the lead politically and Germany would provide much of the economic muscle. The first concrete form that this took was the European Coal and Steel Community (ECSC) established in 1951 after a French proposal the previous year.

The strategic aims of the French partly coincided with those of the Americans. [4] The latter were acutely aware of the necessity of rebuilding the European economies, and this for two reasons. The first was the fear of a Russian takeover of Western Europe. The Western European economies,the German in particular, had to be reconstructed and rearmed under US leadership (this found concrete expression in Nato) so as to constitute a bulwark against the Stalinist bloc. But for reconstruction to prove effective, the Franco-German rivalries which had led to three wars in a period of 70 years had to be contained. The Marshall Plan for US aid to Europe, announced in June 1947, was conditioned on the acceptance by the Europeans of some form of cooperation. [5]

The second reason was the fear of the internal enemy, ie the European labour movements. 1947 saw insurrectionary strikes in the Renault factories in France and the fear of the Communists seizing power in France and Italy was very intense. Rebuilding Europe and bringing back some degree of economic stability would ease the pressure the labour movement was exerting.

The next step was the Treaty of Rome in 1957, which established the European Economic Community (EEC). This would progressively come into force through the elimination of tariffs by 1968.

The course of developments changed to some extent in 1958 with the demise of the French Fourth Republic and the advent of the Fifth under General Charles de Gaulle. This represented a turn to a more assertive French foreign policy based on a more centralised political system. De Gaulle had opposed the Treaty of Rome and although he did not intend to renegotiate it, he sought to steer the process of European integration towards a channel which privileged inter-state negotiations and institutional arrangements rather than the pooling of state functions in federal “supranational” institutions such as the European Commission. His aim was to exploit France’s comparative advantage in the politico-military field. He thus provoked the crisis of the “empty chair” in June 1965. For six months France withdrew from the council of ministers of EEC member states. This was in protest against the fact that, as of 1966, decisions in that body would no longer be taken on the basis of unanimity but of qualified majority, something that would reduce France’s influence by eliminating its power to veto decisions. The so-called “Luxembourg compromise” that was arrived at in January 1966 essentially amounted to maintaining the requirement of unanimity. It thus blocked a major move towards greater centralisation in the governance of the EEC.

De Gaulle’s vision was that Europe should strive for independence from the US while at the same time remaining within the Atlantic alliance. [6] He was hostile to British entry, which he vetoed twice in the 1960s, fearing that this would push the EEC much more in the direction of a giant free-trade area rather than in that of the strengthening of ties between the core continental countries that could one day become the basis for the emergence of a Europe capable of balancing US power. This clash between the vision of a huge European Common Market politically subordinate to the US, a vision associated with enlargement, and that of a more restricted but much more politically independent Europe, later on associated with “deepening”, is another major issue in European integration. It persists today and can explain many of the contradictions that run through the European Union.

The 1970s saw two very important changes. The first was the demise of the Bretton Woods system of fixed exchange rates and the second was the return of capitalist crisis, starting with the recession of 1974–75. Both had the potential to undo much of what had been achieved during the previous two decades. The end of fixed exchange rates led to disruptive competitive devaluations of national currencies of EEC member states and dangerous volatility in foreign exchange markets. The risk that European economies would drift apart was amplified. It could also create huge problems for all those firms that were now operating across the borders of the member states and needed stability in exchange rates to plan their operations. Similarly, the recession of 1974–75 led to a host of national uncoordinated responses. Progressively, the member states of the EEC managed to forge a common strategy. There was a first attempt at monetary coordination in 1972, called the “snake”, but this foundered in following years. [7]

A second attempt followed in 1979 with the European MonetarySystem (EMS) and the Exchange Rate Mechanism (ERM). This time thearrangements were more favourable to weak currencies. [8] This was designed both to win the support of the Gaullists in France, now led by Jacques Chirac, who opposed the austerity needed to entrench the franc’s participation in the ERM, and to protect the deutschmark from further revaluation against a rapidly depreciating dollar. [9] The failure of the snake also allowed the French to argue that the Germans had to shoulder part of the burden of adjustment if they wanted European integration to move forward. This debate about the contours of European monetary cooperation and the balance it should achieve between the interests of weak and strong currencies is a constant feature of European integration since the 1970s. Much of the wrangling in spring 2010 had to do precisely with this.

The depreciation of the dollar was a major feature of the 1970s, and indeed, ever since it has been a major weapon for the US ruling class in its attempt to preserve its economic power. One of the post-war boom’s by-products was the relative decline of the US economy compared to Germany and Japan. So the US ruling class attempted to reverse the uneven development of the previous decades through various policies and moves. These included cutting back on the level of arms expenditure [10], protectionist measures such as a 10 percent rise in tariffs [11] and an onslaught on the living standards of US workers. [12] But equally importantly, they included the aggressive exploitation of the privileged position of the dollar as the only international reserve currency. [13]

This privilege allows the US to run huge current account deficits and effectuate significant devaluations of the dollar for relatively long periods of time without running the risk of a collapse in the value of the dollar. So in the 1970s, the US pursued the unofficial policy of allowing the value of the dollar to decline in order to boost US exports (this is sometimes referred to as the policy of “benign neglect”). The result this has had on the German and, by extension, the European economy has been to introduce a deflationary bias in the way it has been run ever since. Since German development largely depended on an export-driven strategy and since the deutschmark could not compete with the dollar as an international reserve currency – thus preventing the US from exploiting the dollar in the way it has been doing – the only strategy available to Germany has been to suppress domestic demand, speed up the rationalisation and technological upgrading of its productive apparatus, shift production abroad to locations with lower labour costs and persistently run current account surpluses. [14]

This is why the creation of the EMS was not enough for stability to return in European monetary relations. In effect, for monetary cooperation to be successful there had to be some degree of economic policy convergence, and given the new conditions of international economic competition imposed by the US, this could only happen when the rest of Europe aligned itself on German economic policy. This did not materialise until 1983, the year of the famous tournant de la rigueur (austerity turn) in France, when President François Mitterrand decided to follow the prescriptions of the “modernising” camp within his government, led by finance minister and future architect of the new stage of European integration Jacques Delors. [15]

Delors went on to become European Commission president in 1985 and to orchestrate the Single European Act (SEA) in 1986. The act aimed to complete the internal market by removing all trade barriers by 1992. Significantly, the French also accepted the end of the Luxembourg compromise. Barriers to the mobility of capital were lifted everywhere in Europe by the end of the decade and the Treaty of Maastricht in 1991 reformed the EEC (now called the European Union – EU) and made plans for introducing a single currency by the end of the century. Underpinning the single currency, and for want of common fiscal and economic policies (the “European economic government” the French have been calling for since 1983) or a significant European budget, were five convergence criteria imposed by the Germans. [16] In 1997 these criteria became the Stability and Growth Pact. [17] The attempts made by European governments during the 1990s to fulfil these criteria led to a wave of austerity measures being implemented across Europe. This formed the background against which the revival of working class resistance and a growing scepticism in public opinion about European integration, leading to the rejection of the European constitution in 2005 by the French and Dutch electorates, have developed. [18]

The introduction of the euro and the creation of a European Central Bank (ECB), paradoxically following a French initiative, strengthened the supranational and federalist features of European integration. The supranational institutions (the Commission and the ECB) send their own representatives to most of the major international forums and have exclusive authority over significant swathes of European governance, namely trade, monetary policy and regulation of the internal market.

Finally, the collapse of Stalinism in the East created new complications. On the one hand, the French and the Germans had different attitudes towards the new independent republics. Initially the French talked about a confederation of European states. But the German preference for allowing them to join as soon as possible prevailed. Running the EU already largely hinged on delicate compromises struck between 15 states. Such compromises are now much harder to arrive at in a union comprising 27 members. On the other hand, the end of the Cold War and German unification revived old fears about an all too powerful Germany dominating Europe or even being pulled too strongly to the East. The German government headed by chancellor Helmut Kohl conceded EMU – although it was much more interested in political union – partly as a gesture addressed to its European “partners” that it continued to be committed to the whole process.

Both the end of the Bretton Woods regime and of the Cold War reinforced the position of Germany within Europe. The former did so because the deutschmark, being the currency of the biggest European economy and thanks to its strength and stability, became by default the pillar on which monetary cooperation in Europe was built. The EMS was essentially a deutschmark zone. [19] This gave the Bundesbank – the German central bank – virtual control of monetary and exchange rate policy across Europe. Finally German unification added demographic and political weight to the expanded Federal Republic, something which ultimately translated into greater weight for Germany in EU institutions. [20]

In the late 1960s and early 1970s Ernest Mandel and Chris Harman provided very sharp analyses of the process of European integration from a Marxist point of view. [21] The main points they made some 40 years ago are still relevant today and must form the basis for any understanding of the tendencies and counter-tendencies which drive the whole process forward.

The first point of fundamental importance is that European integration is a reaction to international competition and the strength of American capital. The latter’s advantages in size and technological sophistication exerted strong pressure on European capital to pool its resources together so as to regain a degree of competitiveness on the world market. But the domestic markets of each of the European states on their own were not large enough to allow for the emergence of firms capable of competing with the US. This necessitated a breakdown of the barriers to trade and investment and an integration of the various markets into one single giant one – the EEC. Even before this came fully into force, it triggered a process of national consolidation of capital whose aim was to prepare each state’s “national champions” for the new conditions of intensified intra-European competition that would result from the full implementation of the Treaty of Rome. [22]

Mandel argued that the strength of supranational institutions depended on the degree of interpenetration of capital in Europe. Thus the Commission’s weakness at the time was a sign of the very early stage Europeanisation of capital was still at. Later on Harman identified three tendencies of capital concentration – one at the national, another at the regional and a third at the international level. Harman predicted that “if the existing state provides too narrow a base for the activities of capitals, there will necessarily be an attempt to widen that base by alliances and mergers with other states. Therefore, in the long run the trend towards regional blocs is likely to be the predominate one”. [23]

Indeed, during the 1960s and 1970s “the tendency was for the concentration of capital to take place within national state structures, with the assistance of national states”. [24] But this changed once the crisis of the mid-1970s hit the European economies and triggered in the long run a far reaching process of restructuring. The number of European mergers increased significantly. The figures for mergers and acquisitions concerning Europe’s 1,000 largest firms show significant developments during the 1980s. In 1982–3 there were 117 mergers. The figure rose to 303 in 1986–7 and 662 in 1989–90. In the early years of the decade national deals predominated. This changed by the end of the decade. In 1983-4, 65.2 percent of the deals were national, 18.7 percent European and 16.1 percent international. By 1988–89 only 47.4 percent were national deals, whereas 40 percent were European and 12.6 percent international. [25] These figures suggest that the net effect of the decision in 1985 to move towards completion of the internal market was both to speed up the process of restructuring through mergers and acquisitions and to promote such deals at the European level. A political decision stimulated the tendency towards the centralisation of capital at the regional level. It also seems clear that European firms sought to attain the necessary magnitude of size first by national and then by European consolidation. [26] Finally, this process was amplified in the 1990s. A study commissioned by the French Planning Commission in 2004 concluded that “through the installation of firms in other European countries and the emergence of firms established at the European level, a European economic pole has truly been constituted, in particular during the last decade, marked by the Single Market and the euro”. [27]

Another indicator of the constitution of a European pole is the network of interlocking directorates at the level of multinational firms. This refers to directors simultaneously sitting on the boards of two firms. The density of these networks indicates that some sort of community of capitalists sharing a common strategy for competing on the world market exists. Kees van der Pijl studied the development of such networks at the level of the 150 largest multinationals in the 1990s. His conclusion is that “the neoliberal restructuring of capital in Europe also affected the network of interlocking directorates among large corporations. Over the first post-Maastricht decade, European capital developed into a pattern reflecting the opening up of nationally confined finance capital structures on the continent – and their transformation into a rival transnational network separate from the Atlantic one”. [28] The last part of this quotation indicates something very important: a European imperialist bloc, rivalling American imperialism on the world market, is in the process of being constituted.

What emerges from this is that, over the decades, the tendency towards the concentration of capital at the regional level drove European integration forward. European institutions were reinforced once the process of Europeanisation of capital overtook in economic importance the process of national consolidation of capital. The end of the Luxembourg compromise raised the degree of centralisation of decision-making while the powers of the Commission in those fields where it has exclusive competence have significantly been reinforced. [29] And the power of the ECB is hardly debatable. These developments can only reinforce the pressure exerted on European states to merge further into a European super-state. It is worth pointing out here that European industrial multinationals came together after a French initiative in 1983 to form the most powerful business lobby in Europe, the European Roundtable of Industrialists (ERT). The ERT has consistently argued in favour of the deepening of European integration and, in actual fact, many of its reports and suggestions became official policy of the European Commission. [30] The Lisbon agenda of 2000 was largely inspired by a series of reports published in the course of the previous years by an Advisory Group on Competitiveness set up by the ERT to advise the European Commission on an agenda of reforms. [31]

But both Harman and Mandel also argued that the process was subject to counter-tendencies. [32] Governments were still largely influenced by national interests. This translated into attempts at protectionism and a strong preference for national consolidation rather than European partnerships and mergers. [33] This was particularly true of France. Even today, to the extent that purely national solutions can be resorted to, this temptation has not totally disappeared. Examples of this are the way in which the Berlusconi government in Italy opposed the takeover of Alitalia by Air France-KLM in 2008 and then sold off the air-carrier to an Italian financial group or the orchestration by the French government of the merger of Gaz de France and Suez aimed at protecting the latter from a hostile takeover by the Italian energy giant Enel.

But even more importantly, within the framework created by European integration, each national state seeks to defend its own interests and those of the capitals predominantly based within it. For although European multinationals operate at the regional level – apart from the very rare cases where they operate globally – they are still largely controlled by groups of capitalists which tend to have privileged relations with a particular national state. [34] So each national state seeks to bend European Union policy and strategy so as to serve the interests of the capitals based within it. The clearest example of this is the governance of the currency shared by most of these countries, the euro. It is not by chance that Germany – along with the Netherlands – has consistently favoured a strong euro. As Guglielmo Carchedi has demonstrated, Germany has the highest concentration of technologically innovative firms that benefit from a strong currency. [35] This is much less the case in countries such as France or Italy which overall depend more on a weaker euro to stimulate exports. [36] This means that quite regularly French and Italian politicians complain that the euro is too strong or that the way it is run does not take into account the needs of their industries.

So, overall, European integration is a contradictory process that tends towards the effective integration of the various national fractions of European capital while at the same time each national group of capitals attempts to fashion the process according to its own interests. [37] Moreover, weak capitals that have little chance of surviving in the open waters of the European market seek protection from the national state within which they have developed. Both of the above elements act as a powerful conservative force which holds back the full development of the tendency towards integration and that of the two constitutive parts of this tendency, namely the regional consolidation of capital and the corresponding regional organisation of state functions. [38] The only way to get rid of this obstacle once and for all would be for the most powerful state – Germany – to impose by force the political unification of the continent. The last such attempt resulted in the Second World War and during the Cold War the German ruling class were forced to accept the compromise by which their dominance in Europe would have to be peacefully agreed to by the other European states. In the face of competition from other imperialisms of continental size (the US, Stalinist Russia before 1989 and now increasingly emergent China), these states did not have any other choice but to negotiate their stake in the forthcoming European imperialist bloc under German leadership (although it is fair to say that the French are also quite influential).

Two additional points need to be made here. The first is that the whole process does not take place in a vacuum but rather in the context of a global political economy in which already constituted rival imperialisms exist. The dominant one, the US, has the capacity to act globally and to influence developments across the world, including in Europe. Its attitude towards European integration depends on whether it considers that it proceeds in a direction that challenges its interests. It has therefore favoured all those developments that would water down the EU’s capacity to become strategically and politically independent by attaining a high degree of internal coherence. The US strongly supported the rapid admission of Eastern European states into the EU, vocally promoted Turkey’s candidacy – a traditional and until recently very loyal US ally – and strongly opposed attempts to create an independent European military capacity and command structure outside Nato structures. [39] One of the reasons for the US offensive in the Middle East since 2001 has been the division that this would create among European states. Apart from the traditional ally of the US in Europe, Britain, other important states such as Italy, Spain and Poland lined up behind George W. Bush’s crusade in Iraq, despite strong opposition from France and Germany, the states that constitute the driving force behind European integration. Finally, US officials keep complaining about German economic strategy, the structural trade surpluses it generates and its deflationary consequences. [40] To the extent that it is German economic strategy that dominates in Europe and which tends to force other European states to adapt to it, American complaints on this front are as important as complaints about Chinese exchange rate policy.

The second point goes back to one of the predictions Mandel made in 1970. He considered that so long as institutional integration had not sufficiently advanced, there was nothing irrevocable about European economic integration. This led him to predict that “the EEC’s moment of truth will arrive when Europe undergoes a general recession”. [41] This proved tobe true at least twice, once with the recessions of the mid-1970s andearly 1980s – which ultimately resulted in the deepening ofEuropean integration through the completion of the Common Market andEMU – and a second time with the European recession of theearly 1990s, one of whose results was the monetary crisis of 1992–3which once again forced the pound, the lira and the franc to leavethe Exchange Rate Mechanism (ERM). Despite this, and despite theintense speculation over whether the euro would be introduced in theend, European integration managed to move forward. According toCarchedi, “there was a recognition that further economicintegration (the EMU) was needed not only for political but also foreconomic reasons. The crisis of the Exchange Rate Mechanism (ERM) in1992–93 showed that this was a real concern”. [42] These two sequences of events indicate a pattern where each crisis acts as a catalyst which eliminates opposition to further integration by demonstrating in practice why the dominant fractions of European capital can no longer solely rely on a single national state and why individual national states would be much weaker if left on their own. [43]

The above discussion provides the framework in which to analyse EMU, the emergence of the euro and the current crisis surrounding the single currency. This crisis partly stems from the deficiencies and ambiguities of the arrangements underpinning the euro, which are the reflection of the contradictory nature of the process of European integration. In that respect, its root causes stretch back to the Maastricht Treaty and its failure effectively to establish a fiscal union alongside monetary union.

As I mentioned earlier, under the EMS European monetary cooperation was organised around the deutschmark and Germany. Since the objective of strengthening the various national currencies (the exceptions being the deutschmark and the Dutch guilder – they were already strong currencies) that participated in the EMS took precedence over any other policy objective and to the extent that in practice this meant attempting to keep up with the fluctuations in the value of the deutschmark, economic policy in Europe was dictated by Germany. If, for example, after a weakening of the dollar, there was an influx of capital into the deutschmark, leading it to appreciate, then the authorities in the other European countries would be forced to raise interest rates so as to attract volumes of capital large enough to allow their currencies to follow the deutschmark. Or, in a scenario that materialised in 1992, if the Bundesbank raised interest rates to keep inflation at bay, then this would have to be generalised across the continent (and in Britain at the time, since it participated in the ERM in 1990–2). In 1992 this precipitated the European economies into a deep recession. Given that there were significant inflation differentials between Germany (and the Netherlands) and the rest of Europe, in practice this translated into the Bundesbank imposing a strategy termed “competitive disinflation” across Europe, in an effort to bring inflation down to German levels and match Germany’s international competitiveness by means of the restructuring that disinflation provoked. [44] Of course, significant fractions of the ruling classes in the other European countries were only too happy to be led down that path by the Bundesbank. As Delors told an American political economist:

Historically there has always been a minority position in France that views inflation as the most damaging for the long-term health of the economy ... This minority has always sought to modernise France: to stabilise the currency, to fight inflation, and to promote healthy growth and employment. And it happened that this minority won in France during the 1980s. It was a long and difficult struggle. [45]

“Competitive disinflation” meant wage repression in order to boost profits and an end to the propping up of unprofitable firms. Its results can be seen in the graph that follows:

|

Figure 1: Evolution of the wage share

Source: Michel Husson “Le partage de la valeur ajoutée”, PowerPoint presentation, |

This strategy was the dominant one, despite the parallel existence of European “structural” and “cohesion” funds designed to prop up the least competitive regions of the Community by providing funds for infrastructural investment, something which essentially amounted to transfers from the richer to the poorer countries and to an embryo of a common economic policy at the European level.

But the dominance of the Bundesbank created resentment in the rest of Europe. Especially in a country like France, whose politicians like to think they have the capacity to act independently on the world market, there was a strong desire to regain control over monetary policy. In addition to this, political opposition to the strategy of “competitive disinflation” was gathering momentum, with economists, politicians and businessmen calling for alternative Keynesian policies of reflation and protectionist measures in favour of French industry. Finally, the Commission itself under the leadership of Delors was strongly in favour of a single currency. Delors presided over a committee that published a report in 1989 calling for such a development. The argument was that to solidify the European single market there had to be monetary union so as to prevent member states from pursuing disruptive monetary policies. In any case, it would be difficult to reconcile capital mobility with stable exchange rates. So eliminating them would solve the problem. Furthermore, a single currency would enhance the competitiveness and speed up the integration of the now liberalised European financial markets by making them deeper and more liquid and thus would potentially strengthen Europe’s monetary weight on the world market.

All of these reasons supported the case for monetary union. Discussion and preparations for an intergovernmental conference on monetary union started in the early part of the second half of the 1980s and preceded the demise of the Soviet bloc. This point is important because the impact of the fall of the Berlin Wall on Germany’s willingness to give up the deutschmark for the euro tends to be overestimated sometimes. It is certainly the case that these events did raise the stakes and put further pressure on the weak-currency countries to accept German conditions (the convergence criteria and the independence of the ECB). And the German government was eager to dispel France’s reservations about German unification by making a gesture tying it to Western Europe even more firmly. But even before 1989 Germany had strong incentives to maintain monetary stability in Europe. The region’s countries were now the main recipients of German exports and foreign investment and making sure their markets remained open to German capital was of paramount importance. [46] The 1970s had shown that national control of monetary policy could tempt member states to resort to competitive devaluations against the deutschmark. Finally, although this was an argument that the French were more eager to put forward than the Germans, a single currency could begin to provide sufficient monetary weight for countering the dollar’s pivotal position in the world economy and the advantages that the US ruling class had been deriving from it since the early 1960s. To the extent that the German ruling class had begun emancipating themselves from the tutelage of the Americans, this was a perspective they were keen to explore.

The negotiations on monetary union were a long drawn out process that involved much bargaining and long-term calculations. On the one hand, the French wanted to regain control over monetary policy, hoping that this would mean a less orthodox approach and an exchange rate policy that would take French interests into account as well as German ones. They also wanted industrial and economic policies at the European level similar to those that had existed in France since the 1950s and formed part of the state capitalist organisation of the post-war French political economy. On the other hand, the Germans would not give up the deutschmark unless they received serious guarantees that the new currency would be as strong. They would not settle for anything short of the independence of the new European Central Bank and strict convergence criteria to force its “partners” to imitate German economic performance, since they could not directly control fiscal policy in the rest of Europe.

The bargain that was struck was that Germany gave up its demand for greater powers for the European Parliament and more German MEPs in exchange for the independence of the future ECB and the five Maastricht criteria listed above. [47] French demands about common European industrial and economic policies were not met as Germany suspected that they would lead to hidden protectionism at the European level in the form of subsidies for ailing firms. Instead competition policy became the main instrument by which the internal market was to be regulated. This is much closer to the way the German political economy has been run in the post-war period. It was also an additional means of making sure that the necessary restructuring of the European economy would take place. Therefore, a certain strategic coherence emerged from the Maastricht negotiations: monetary and fiscal policy as well as internal market regulation would all be geared towards the speeding up of the process of restructuring, with the objective of both pushing back the labour movement and enhancing the regional consolidation of capital.

It is important to note that strategic divergences did not simply exist between national governments. They also existed within countries and between national institutions. France is probably the best illustration of this. As one of the main thinkers of the French social-liberal left has put it,

France’s economic government – or, if one prefers, the economic decision-making community: the Treasury, the Bank of France, the private governing boards of the industrial and financial corporations – would not have embarked upon the EMU project if its principal aim since the March 1983 turnabout [the austerity turn] had not been to engrave in the marble of European institutions the strategy of competitive disinflation by taking away from political authorities the discretionary manipulation of monetary policy. [48]

No wonder then that the Bank of France was the only French institution, in opposition to the foreign office and the finance ministry, which was in favour of the independence of the ECB from the outset. [49] In this respect, the issue of the independence of the ECB is the clearest example of what is generally called the “democratic deficit” of the European Union, ie that decisions at the European level are taken by unelected bodies such as the European Commission and the ECB. This is no mere accident. It has to do with the fact that European capitalists wanted to shield political decision making from pressures to which it is usually subject in the sphere of bourgeois representative democracy. And it is a sign of the difficulties that the European ruling classes have in imposing their will on European workers.

But there was another very important issue, namely which countries would finally qualify for EMU. Germany would have preferred a union made up of the countries of northern Europe and, in the event that it joined the EU, Austria, as this would ensure a strong currency. But France feared that this would leave it less room for manoeuvre in the future and would make it harder to bend monetary policy towards a less orthodox direction. The French therefore defended a series of arrangements, including a looser approach to the question of budget deficits, which strengthened the probability that southern European countries such as Spain, Portugal, Italy and Greece would finally be able to join EMU. [50] These countries lagged much behind the rest of Europe in terms of competitiveness, debt problems and inflation. And they were eager to join because joining would allow them to enjoy the credibility that would flow from participation. They would, as it were, be playing in the same league as the Germans, and this would bring down the cost at which they borrowed on the international financial markets. They could then hope to use the funds saved due to lower borrowing costs to strengthen their economies and enhance their competitiveness.

The Maastricht Treaty, however, fell short of creating an economic union in one very important domain. This was fiscal policy. The Delors report that was used as the basis for negotiating the treaty did not propose a fiscal union. For the federalists, this was a step back from the previous attempt at establishing a monetary union, the Werner report of 1970. [51] This report had proposed to transfer fiscal powers (taxation, public spending and borrowing) to the European Commission. But such bold steps towards federalism had no chance of being accepted by national polities that still attached huge importance to their sovereignty, particularly in France. Fiscal powers are a defining capacity of any state. To the extent that the structures of the nation-state had not yet been sufficiently undermined by a significant degree of regional consolidation of capital, it was unimaginable to transfer fiscal powers to the European level.

The Delors committee chose to follow a more pragmatic path. The convergence criteria, especially those concerning public debt and budget deficits, were to act as a sort of straitjacket designed to push national fiscal policies towards convergence. But in terms of sovereign debt, there was no advance. No European bond, debt agency or solidarity for states facing excessive debt burdens was proposed. And the ECB was prohibited from extending credit to or buying debt instruments from national governments or Community institutions (which is precisely what it did when it started buying Greek bonds in May 2010). [52] Each state was responsible for its own debts, despite sharing a common currency. EMU was only half complete. But for a long period of time no one really seemed to notice. Not only that, but as Alex Callinicos noted in 2005, “In the run-up to the euro launch interest rates across Europe converged ... This reflected the financial markets’ belief that the debts of all the eurozone economies were being underwritten, in effect, by the EU”, precisely the opposite of what the Maastricht Treaty laid down. [53]

Barely had European leaders left the negotiating table than the first test came. The US economy had gone into recession in 1990-1 and its effects started to be felt in Europe. And the Bundesbank raised interest rates to ward off inflation resulting from German unification. In a plot that bears some similarities to the current crisis, financial investors started doubting that European governments would follow the Bundesbank in raising interest rates and add to the already mounting unemployment that was hitting Europe. When the Danish electorate refused to ratify the Maastricht Treaty by referendum in June 1992, these doubts intensified and led to runs against the weaker currencies, including the Italian lira and the British pound. By September they had to leave the ERM.

The crisis seemed to prove right all those who were sceptical about EMU. It dealt a huge blow to British Europhiles who wanted to bring the pound into the euro. And, critically for what would follow, it allowed for a looser interpretation of the convergence process. As the world economy started recovering from the recession of the early 1990s, it became easier to fulfil the Maastricht criteria because of higher fiscal revenues. Still, European governments did attempt to enforce austerity measures. The result was important struggles and some victories for the labour movement, such as the 1994 general strike in Italy that broke the first Berlusconi government or the November-December 1995 public sector strikes that pushed back premier Alain Juppé’s “reform” package in France. [54] So apart from austerity, which could not on its own do the job, “governments [took] one-off measures – typically in the form of additional taxes – to temporarily squeeze under the 3 percent limbo bar but abandon fiscal discipline subsequently”. [55] Ten countries could therefore claim to fulfil the Maastricht criteria in 1999, and Greece joined them in 2001.

In the face of working class resistance that was too strong to break, the rules were bent so that EMU could be launched on schedule and create the illusion that it rested on strong foundations. Germany also demanded a stability pact providing for continued oversight of national budgets and penalties for countries running excessive deficits, hoping that such threats would put more pressure on governments to take on their workers. This became the Stability and Growth Pact in 1997. But when, in 2003, both France and Germany ran budget deficits exceeding 3 percent of GDP, instead of playing by the rules and fining themselves, they preferred to reform it and allow for more budgetary flexibility. Many pro-capitalist commentators complain that this set a precedent for weaker countries.

The euro was launched in 1999. Euro coins and banknotes were progressively brought into circulation in the first six months of 2002. A sense of euphoria about the prospects of European integration was quite widespread at the time. It reflected the fact that despite scepticism about the possibility to introduce the euro (in the US and among financial investors) and despite disagreements among them, the Europeans could set common goals and actually reach them. It was this enthusiasm that no doubt underpinned the Franco-German stance on the Iraq war in 2003.

The enthusiasm was reinforced by the fact that the euro’s exchange rate with the dollar was moving upwards quite rapidly. During the first two years of its existence, while it was still not in circulation, the euro fell about 30 percent against the dollar. But as of spring 2002, it followed an upward course. When it reached its high point against the dollar in July 2008, its value had almost doubled when compared to its low point, in October 2000.

The strength of the euro made it a plausible candidate for becoming an international reserve currency. As I mentioned earlier, part of the rationale for adopting the euro was its potential to become a rival to the dollar. One crucial ingredient for creating such a rival to the dollar is that it will have to be trusted as a “safe haven” by investors wanting to park their money in assets that are sure to maintain their value. This is why the ECB and its president keep repeating that they have done a good job at preserving price stability since the bank was created. When asked in an interview with Le Monde whether the euro was in danger, the first thing Trichet responded with was the following:

The euro is a very credible currency which maintains its value. Since its creation 11 and a half years ago, average annual inflation has been inferior to 2 percent and close to 2 percent, in accordance with our definition of price stability. This capacity of the euro to preserve its value is a crucial element for the confidence of domestic and foreign investors. [56]

But it is not enough for a rival to the dollar to be strong and stable. It also needs to be based on competitive financial markets and be widely used across the world economy (become a “world money”, as this is sometimes called). Competitive financial markets must be deep, liquid and profitable. This is what the European Commission set about to create as soon as the euro was launched by eliminating the remaining fragmentation of European financial markets. [57] And this is why the eurozone keeps expanding. Slovenia joined in 2007, Cyprus and Malta in 2008 and Slovakia in 2009. Estonia will join in 2011. And the other EU member states, having accepted the treaties, are under an obligation to meet the criteria and join too. [58]

A closer look at the evidence, however, suggests that the euro has a long way to go before really being in a position to challenge the dollar’s position in the world economy. [59] Some 27.3 percent of global foreign exchange reserves were held in euro-denominated instruments at the end of 2009, up from slightly above 20 percent in 1999. By comparison, the figures for the dollar were around 64 percent in 2009 and 67 percent in 1999. [60] As far as international debt securities are concerned, 31.4 percent were issued in euros and 45.8 percent in dollars in 2009. [61] But in terms of use in foreign exchange markets, which is perhaps the clearest indication of the extent to which a currency enjoys the status of world money, the dollar appeared on either side of 90 percent of such transactions with the euro lagging far behind at 40 percent. [62] The conclusion reached by the ECB itself in its latest report on the international role of the euro is that:

The results suggest that the international role of the euro increased somewhat during the first few years of existence of the single currency. Since then, the international use of the euro has remained relatively stable relative to that of other international currencies ... the use of the euro is most common in countries located in the broad geographical neighbourhood of the euro area, while the US dollar’s international use is more widespread across the global economy. [63]

But parallel to the above developments, others were taking place beneath the surface that were deepening the rift between the weaker economies of the eurozone and the stronger ones. This did not become apparent because, as noted by Callinicos, interest rates tended to converge.

Starting at the beginning of the previous decade, Germany implemented a series of measures (Gerhard Schröder’s Agenda 2010) that boosted its competitiveness relative to its European “partners” and returned its trade balance to surplus. [64] The measures meant that unit labour costs barely rose in Germany over the past decade, while those in the rest of Europe soared. [65] The result has been growing current account surpluses in Germany and current account deficits in the countries of southern Europe and France. [66] These surpluses and deficits became capital exports from Germany to the countries of southern Europe. [67] Germany was lending to the rest of Europe so that it could go on buying German exports, in a relationship that very much resembles that between China and the US.

All this meant that when the financial crisis erupted in 2007, and particularly after it was transformed into a deep recession in 2008 and 2009, the burden was much heavier for the southern European countries than for Germany. This had nothing to do with fiscal profligacy. As Martin Wolf has argued:

Greece is a bad boy. But Italy, France and Germany had far more breaches [of the 3 percent budget deficit criterion] than Ireland and Spain. Yet it is the latter that are now in huge fiscal difficulties.

The fiscal rules failed to pick up the risks. This is no surprise. Asset price bubbles and associated financial excesses drove the Irish and Spanish economies. The collapse of the bubble economies then left fiscal ruins behind it.

It was the bubbles, stupid: in retrospect, the creation of the eurozone allowed a once-in-a-generation party. Some countries had vast asset price bubbles; many had soaring relative wages. Meanwhile, Germany and the Netherlands generated huge current account surpluses. The union encouraged a flood of capital to the surging economies, on favourable terms. When private spending imploded, fiscal deficits exploded. [68]

This left states saddled with huge budget deficits. As has been argued in this journal during the last year or so, these budget deficits were the result of the policies implemented by states with the aim of preventing the economic crisis from morphing into a depression as well as the result of the reduced fiscal revenues and increased social spending provoked by the 2008–9 recession. The overall result has been to transfer the bulk of the bad debts that were threatening the banks onto the states that bailed them out, thus simply displacing the problem. The euro crisis of spring 2010 was the practical demonstration of this. Speculation over whether the banks were insolvent was transformed into speculation about the solvency of sovereign entities. And while every state is subject to pressures coming from the financial markets rapidly to reduce its exposure to debt, this pressure is much stronger on small and weak states, like Greece for example. What is more, the fact that the huge deficits brought to the centre of attention the capacity of each state to pay back its debts exposed the flawed nature of EMU. Greece was on its own and everyone was aware of it now.

The result was a crisis of confidence in the Greek state that pushed up its cost of borrowing on the international financial markets, while causing the euro to depreciate. The difference in interest payments on Greek and German government bonds (German bunds are taken as the benchmark for European sovereign debt) widened. Something had to be done, but there was disagreement on what exactly that should be. France led a bloc of deficit countries in campaigning for a bailout orchestrated by the EU while Germany led a bloc of surplus countries (the Netherlands, Austria and Finland) which put up resistance to the idea of extensive aid to Greece.

When things threatened to get out of control in the beginning of May, with worrying signs that the crisis of confidence was spreading to Spain and Portugal and under increasing pressure from the US who were worried that a new Lehman Brothers-type collapse was in the making, the two camps found a compromise. [69] The German-led camp agreed to come up with the money and the guarantees needed to bail out Greece and potentially any other European state that would come under pressure from the markets on condition that the IMF would be involved, that strict conditionality in implementing austerity measures would apply and that making any funds available would have to be approved by national parliaments. The ECB announced it would start buying sovereign debt, a decision running counter to the Maastricht Treaty. Given that the institutions exposed to sovereign debt in the periphery were primarily German and French banks, the euro bailout can be likened to a second bank bailout, just a year and a half after the 2008 bailouts. [70]

For most commentators, the bailout represented a qualitative change in the way the eurozone was run. The French government hastened to reinforce this impression. French minister for European affairs Pierre Lellouche told the Financial Times that that the bailout “amounted to a fundamental revision of the European Union’s rules and a leap towards an economic government for the bloc” and likened it to Nato’s Article 5 mutual defence clause. [71] And other Europhiles, feeling that the bailout had created the opportunity to overcome the deficiencies of EMU, joined in. So for example, former European Commission president Romano Prodi published an opinion piece in the same paper entitled “A Big Step towards Fiscal Federalism in Europe”. [72]

Yet a big step is not the same as having gone all the way. The European Financial Stabilisation Fund set up to administer the bailout funds is temporary. And there is disagreement between France and Germany on what exactly they need to do now. France favours tighter coordination between eurozone states and some sort of a fiscal union, either through euro-bonds or in the form of fiscal transfers between member states. Germany puts a lot more emphasis on stricter penalties and sanctions for deficit countries and coordination at the level of EU member states, where it hopes it can line up behind it Central and Eastern European states against France and the countries of southern Europe.

But probably the clearest sign of the tensions in the Franco-German axis came last March when French finance minister Christine Lagarde criticised the German trade surplus in a Financial Times interview. [73] According to the paper “her comments [broke] a long-standing taboo between the French and German governments about macroeconomic imbalances inside the eurozone”. Although the extent to which Berlin’s economic policies were accommodating or not the interests of other European states – especially those of southern Europe – had been a permanent object of disagreement between the two governments over the last two decades, Germany had been much more used to public criticism coming from the US on that front and did not find it particularly hard to ward it off. But now, in the midst of a great crisis hitting the euro, France was attempting to lay the blame at Germany’s door.

Since the bailout was agreed, the two sides have been attempting to find common ground and give the impression that they want to go in the same direction. German finance minister Wolfgang Schäuble participated in July in a French cabinet meeting and the two finance ministers have issued a joint call for the suspension of voting rights for member states that will repeatedly break rules on fiscal discipline. [74] But this is about as far as it goes for the moment. A set of tougher measures favoured by Germany – such as an orderly insolvency procedure for bankrupt European states or the setting up of a European Monetary Fund – have been rejected by France.

The divergences between France and Germany at this particular juncture are characteristic of the broader strategic disagreements that lie at the root of last spring’s speculation against the euro. On the one hand, the French want the Germans to pursue more cooperative economic policies that will ease the competitive pressure that German capital is exerting on its European “partners”. [75] The political rationale for this is that if Europe is to attain greater political cohesion in order to raise its game in international competition, there has to be more inter-state solidarity within the EU. There is also the fact that France finds it extremely hard to suppress the living standards of its workers to the same extent that Germany has done and that French public opinion is quite hostile to the European project – largely because it has been associated in that country with the attacks waged on workers since 1983. But France won’t accept a political union along federal lines because the majority of French politicians fear that this will diminish France’s political and diplomatic weight in the world. On the other hand, this is precisely Germany’s strategic aim at least since the fall of the Berlin Wall. A political union will do away with Second World War memories and the inhibitions associated with them while at the same time it will institutionalise German primacy within the new federal EU. And it seems that this is the price that the Germans are putting on their eventual acceptance of more redistribution at the European level. In an interview with the Financial Times, Schäuble indirectly blamed France for the euro-crisis, saying that

Europe needs leadership. Any organisation needs that. Germany cannot lead alone – that would be nonsense. France and Germany can do a great deal together ... When we introduced the euro in the 1990s, Germany wanted a political union and France did not. That is why we have an economic union without a political union ... Germany has a lot of experience with federalism, more than the UK or France. If you want to create a federal organisation, you must be ready to have a certain amount of redistribution within it. You can dismiss that by rudely calling it a “transfer union”. But strong and weaker states both have their responsibility. [76]

The problem with this stalemate is that, as proven by the crisis of spring 2010, it puts even monetary union at risk. There is now a serious discussion among bourgeois commentators and on the left over whether the euro will survive. A collapse seems highly unlikely, not least because the bailout has for the moment eased the pressure exerted on the euro. But even more importantly, there is neither a provision in the treaties for an exit procedure nor the political will to push even a small country like Greece out. For pushing Greece out would be a sign that commitment to the euro is waning. It would only reinforce the speculation over an eventual break-up. This is why, shortly after the panic was over in May, it was announced that Estonia would join in 2011. What is at stake with the euro is so important to the interests of capitalists in the core countries that they would rather come to bitter compromises than see the edifice of European integration that they have built over the last few decades crumble.

So how exactly further integration will take place is hard to tell. In any case, as in the past, it will be the result of hard bargaining and will reflect a compromise between France and Germany. But a leap to full-blown federalism seems impossible for the moment as there is no constituency for it anywhere in Europe. As Luxembourg’s premier Jean-Claude Juncker put it in 2007, “We all know what to do, but we don’t know how to get re-elected once we have done it”. [77]

There is, however, one thing that is certain. Any solution to the eurozone’s problems will have to come at the expense of Europe’s workers. Soon after the euro bailout was agreed in May, the German government announced an €80 billion austerity package in a bid to force other European governments to follow in its footsteps. Austerity measures are becoming generalised across Europe. This is the second pillar of the attempt by European states to solve the euro crisis.

But there are two big unknowns surrounding the attempt at fiscal consolidation. The first has to do with the fact that the measures are partly self-defeating. Reducing budget deficits and public debts largely hinges on growing fiscal revenues. But the austerity measures will very likely push the economy back into recession and recreate the conditions that led states to borrow heavily on financial markets. The second is the strength of working class resistance. The succession of one-day general strikes in Greece in recent months is a foretaste of what is likely to take place across Europe when the austerity measures start to bite. If the experience of the post-Maastricht period is anything to go by, we can expect working class resistance to prove a huge stumbling block for the projects of European capitalists.

Five years ago this journal argued that a new fault line had emerged in the world system and that it was in Western Europe:

there are signs of new, widespread political dissent as the pressure on European capitalism from competition in global markets is pushing governments towards even harder versions of the neoliberal agenda, with attacks on pensions and unemployment benefits and demands for longer working hours. [78]

That pressure is now far stronger and the attacks will be far more brutal. Likewise the fault line will grow deeper and deeper. The job of the left in Europe is to both make sure it grows as deep as possible and exploit the political possibilities that will be thrown up in this situation. The instability generated by the attacks on the euro and the squabbles between the European ruling classes will only open up more spaces in which the left can intervene.

1. Tuma and Pauly, 2010. Thanks to Alex Callinicos and Jane Hardy for reading and commenting on an earlier draft of this article.

2. Soutou, 1996, chapters 1–3, while focusing on the Franco-German relationship, provides a very detailed account of how security concerns were at the heart of diplomatic manoeuvring at the time.

3. Van der Pijl, 2006, pp. 39–41.

4. See Loriaux, 1991, pp. 115–132.

5. Van der Pijl, 2006, pp. 36–39; Loriaux, 1991, p. 120; Serfati, 2004, p. 196.

6. This, too, was the vision of the main architect of the ECSC, Jean Monnet (on this, see Anderson, 2009, pp. 13–15). In this respect, there was continuity in French strategy and aims despite regime change in 1958. But de Gaulle’s personal style and explicit defiance of US hegemony created the impression that there had been a profound break.

7. Eichengreen, 2008, pp. 149–172, is a very good and accessible account of what follows.

8. See the discussion in Parsons, 2003, pp. 164–170, for details on this. Eichengreen, 2008, p. 158, makes a similar point. The whole process involved a lot of manoeuvring which was not limited to exchanges between national governments but also, significantly, between the German government and the Bundesbank. The latter was extremely wary of any arrangements that might extend support to weak-currency countries and undermine its price stability policies.

9. Callinicos, 1997, p. 28; Eichengreen, 2008, p. 158.

10. Harman, 2003, figure 3, p. 61.

11. Van der Pijl, 2006, p. 96.

12. Harman, 2007, pp. 127–128, figures 9 and 10.

13. A lot has been written on this. From a Marxist perspective, probably the best known analysis is Peter Gowan’s in Gowan, 1999. But see also Parboni, 1981, chapter 1, and Carchedi, 2001, chapter 5.

14. Parboni, 1981, pp. 132–137.

15. After an attempt at Keynesian reflation and extensive social policies which caused speculation against the franc, balance of payments problems, a flight of capital and inflation, the Socialist Party government of Mitterrand, which had come to power in 1981, reverted to a very orthodox set of economic policies, including the end of industrial subsidies, severe austerity and so on.

16. These set targets for inflation and long-term interest rates, required stability in participation in the ERM and, perhaps most importantly, required that budget deficits should not exceed 3 percent and national debt 60 percent of gross domestic product (GDP).

17. The term “Growth” was added after French insistence. It has a purely symbolic role to play, namely that of creating the illusion that price stability does not take precedence over growth and employment as a policy objective. The current response to the sovereign debt crisis (whose first pillar is a more radical version of the adjustment policies of the 1990s aimed at fulfilling the convergence criteria) makes nonsense of any such assertion.

18. See Callinicos, 1994, 1997 and 1999 for accounts of the revival in class struggle as it was unfolding. Kouvelakis, 2007, is a very good study of the French case. See Wolfreys, 2005, on the French referendum and Brandon, 2005, on the Dutch one.

19. Holman, 1992, pp. 7–8, and Parboni, 1981, chapter 5.

20. Since the revision of the treaties in 2000 in Nice, Germany sends the most MEPs to the European Parliament and the vote of its representative on the Council of Ministers weighs more than any other’s. This is also the case when it comes to the governance of the ECB.

21. Mandel, 1970; Harman, 1971; see also Harman, 1991, especially pp. 45–48.

22. See, for the French case, Serfati, 2008, p. 13.

23. Harman, 1991, p. 48.

24. Harman, 1991, p. 45.

25. Cox and Watson, 1995, pp. 322–324.

26. This is the conclusion that a French study of European finance networks came to in 1993. Dupuy and Morin, 1993, p. 15.

27. Dietsch and others, 2004, p. 170.

28. Van der Pijl, 2006, p. 283.

29. Serfati, 2004, p. 200. Serfati even considers that “the Commission’s power of control is greater than that of anti-trust authorities in the US”.

30. For a Marxist study of the ERT, see van Apeldoorn, 2002.

31. Van der Pijl, 2006, p. 287.

32. There were, however, differences in the two approaches. Harman stressed much more than Mandel the resilience of the structures of the national states. He predicted that “we face a long period of hard bargaining between rival, national capitalisms, in which national ideologies will remain of key importance to the ruling classes and in which political and social struggles will by and large remain nationally based”. This statement is still broadly true today given that the balance of power between the national states and the institutions of the EU still favours the national states. Mandel, however, considered that a European imperialism would emerge to challenge the US fairly rapidly. He thought that Gaullist economic nationalism was “irrational” (Mandel, 1970, p. 54) instead of understanding it precisely as a way of defending the interests of the capitals concentrated within the French state within the process of integration. Thanks to Alex Callinicos for pointing out the importance of the differences in the two approaches.

33. Harman, 1971, p. 11; Mandel, 1970, pp. 52–55 on Gaullism, and p. 105 on protectionism and economic nationalism.

34. Rugman and Verbeke, 2002, show that “in the overall set of 20 highly internationalized MNEs [multinational enterprises], the case of a global strategy and structure can be made for only six firms, with the additional observation that even these firms exhibit regional elements”, p. 11.

35. Carchedi, 2001, pp. 129–143.

36. Hence important voices could be heard in France during the spring crisis and depreciation of the euro welcoming this development, such as Patrick Devedjian, minister for the stimulus package – Les Echos, 18 May 2010.

37. Alex Callinicos’s account of the EU’s response to the 2008 financial crash suggests a different analysis. He paints a picture of an EU paralysed under the weight of “diverging national interests” (Callinicos, 2010, p. 97) and predicts that “ultimate power will continue to reside in the member states” (p. 101). He and Jane Hardy have both criticised the analysis presented in this article for underestimating the contradictions of the EU and the power of the national states.

38. Note that something similar, albeit of much less importance, exists in the US. The 50 states of the union each have the same weight in as important an institution as the Senate. This frequently makes the centralisation of decision making rather problematic. But of course, the parallel stops there. The US has a chief of state and the armed forces elected by universal suffrage, which is the case neither for the president of the Commission nor for the president of the European Council. And the American House of Representatives, unlike the European Parliament, wields real power.

39. On this last point, see Carchedi, 2006.

40. Bouilhet, 2009, de Vergès, 2010. Various articles in the Financial Times by Martin Wolf have formulated the same criticism. Wolf directs this criticism at both Germany and China. For one example, see Wolf, 2009.

41. Mandel, 1970, p. 102.

42. Carchedi, 2001, p. 13.

43. This point is also made in an opinion piece in the Financial Times by one of the most prominent representatives of European multinational capital, Peter Sutherland, former EU commissioner, BP and Goldman Sachs International director: “An honourable tradition of the European Union is that of turning a crisis into an opportunity. ‘Eurosclerosis’ and budgetary squabbles in the 1980s were the precursors of the Single European Act of 1986; and the crisis of the exchange rate mechanism in 1992–1993 accelerated the creation of the European single currency” – Sutherland, 2010.

44. The figures cited in the previous section on mergers and acquisitions support this analysis.

45. Abdelal, 2006, pp. 7–8.

46. Parboni, 1981, pp. 157–163.

47. Balleix-Banerjee, 1999, pp. 191–192.

48. Cohen, 1996, pp. 347–348.

49. Balleix-Banerjee, 1999, pp. 144–148.

50. Balleix-Banerjee, 1999, pp. 213–240, p. 200.

51. Eichengreen, 2008, pp. 150–152.

52. This is article 21.1 of the protocol on the ECB, available online.

53. Callinicos, 2005.

54. See German, 1995, and Harman, 1996.

55. Eichengreen, 2008, p. 220.

56. Le Monde, 1 June 2010.

57. For details, see Grahl (ed.), 2009, chapter 3.

58. The UK is the exception as it has opted out of the euro.

59. For an optimistic account of the euro’s prospects, see McNamara, 2008; for a pessimistic one, see Cohen, 2007. Both make the same point however: it is the institutional and political deficiencies of EMU which are the main obstacle to the euro’s advance as world money.

60. ECB, 2010, p. 34.

61. ECB, 2010, pp. 15–16. This gap had almost disappeared in 2005 when the share of both currencies converged towards 40 percent. This was another sign of the enthusiasm generated by the euro soon after its introduction.

62. ECB, 2010, pp. 22–23.

63. ECB, 2010, p. 13.

64. For analysis of the measures and the political conjuncture in Germany since their implementation, see Bornost, 2005 and 2007.

65. Lapavitsas and others, figure 10, 2010, p. 23.

66. For southern Europe, see Lapavitsas and others, figure 14, 2010, p. 27. Jean-Marc Vittori shows how in ten years, the efficiency of the German government’s attacks on its workers in comparison to the French government’s inability to do the same shifted the balance in competitiveness in favour of Germany – Vittori, 2010.

67. Lapavitsas and others, figure 15 2010, p. 28.

68. Wolf, 2010.

69. See the account by Ian Traynor of the summit meeting on 9 May that decided the bailout – Traynor, 2010. A German expert is reported to have said: “This was supposed to be a German euro. It’s turned into a French euro.”

70. See the figures in Analysis, International Socialism 127, p. 6.

71. Hall and Mallet, 2010.

72. Prodi, 2010.

73. Hall, 2010.

74. Hollinger, 2010.

75. This is sometimes presented as Germany needing to assume its leadership role within Europe. I remember listening to a Greek financial analyst saying as much in a heated debate on Greek television last March as well as Costas Lapavitsas saying that Germany does not know how to rule Europe at the talk he gave at Marxism 2010 on the euro crisis.

76. Peel, 2010.

77. Quoted in the Economist, 10 July, 2010, p. 11.

78. Harman, 2005, p. 3.

Abdelal, Rawi, 2006, Writing the Rules of Global Finance: France, Europe, and Capital Liberalisation, Review of International Political Economy, 13:1.

Anderson, Perry, 2009, The New Old World (Verso).

Balleix-Banerjee, Corinne, 1999, La France et la Banque Centrale Européenne (Presses Universitaires de France).

Bornost, Stefan, 2005, Germany: The Rise of the Left, International Socialism 2:108 (Autumn).

Bornost, Stefan, 2007, Germany’s Political Earthquake, International Socialism 2:116 (Autumn).

Bouilhet, Alexandrine, 2009, L’Europe Affronte la Chine et les Etats-Unis, Le Figaro (25 September).

Brandon, Pepijn, 2005, A Note on the Dutch Referendum, International Socialism 2:108 (Autumn).

Callinicos, Alex, 1994, Crisis and Class Struggle in Europe Today, International Socialism 63 (Summer).

Callinicos, Alex, 1997, Europe: The Mounting Crisis, International Socialism 75 (Summer).

Callinicos, Alex, 1999, Reformism and Class Polarisation in Europe, International Socialism 85 (Winter).

Callinicos, Alex, 2005, The No’s Have It, Socialist Review (July).

Callinicos, Alex, 2010, Bonfire of Illusions (Polity).

Carchedi, Guglielmo, 2001, For Another Europe: A Class Analysis of European Integration (Verso).

Carchedi, Guglielmo, 2006, The Military Arm of the European Union, Rethinking Marxism, volume 18, number 2.

Cohen, Benjamin J, 2007, Enlargement and the International Role of the Euro, Review of International Political Economy, 14:5.

Cohen, Elie, 1996, La Tentation Hexagonale: La Souveraineté à l’Épreuve de la Mondialisation (Fayard).

Cox, Andrew, and Glyn Watson, 1995, The European Community and the Restructuring of Europe’s National Champions, in Jack Hayward (ed.), Industrial Enterprise and European Integration: From National to International Champions in Europe (Oxford University Press).

Dietsch, Michel, Edouard Mathieu, Moustanshire Chopra and Alain Etchegoyen, 2004, Mondialisation et Recomposition du Capital des Entreprises Européennes (La Documentation Française).

Dupuy, Claude, and François Morin, 1993, Le Cœur Financier Européen (Economica).

ECB, 2010, The International Role of the Euro.

Eichengreen, Barry, 2008, Globalising Capital: A History of the International Monetary System (Princeton University Press).

German, Lindsey, 1995, Falling Idol, Socialist Review (January).

Gowan, Peter, 1999, The Global Gamble: Washington’s Faustian Bid for Global Dominance (Verso).

Grahl, John (ed.), 2009, Global Finance and Social Europe (Edward Elgar).

Hall, Ben, 2010, Lagarde Criticises Berlin Policy, Financial Times (14 March).

Hall, Ben and Victor Mallet, 2010, EU Bailout Scheme Alters Bloc Treaties, says France, Financial Times (28 May).

Harman, Chris, 1971, The Common Market, International Socialism 49 (first series, Autumn).

Harman, Chris, 1991, The State and Capitalism Today, International Socialism 51 (Summer).

Harman, Chris, 1996, France’s Hot December, International Socialism 70 (Spring), http://pubs.socialistreviewindex.org.uk/isj70/france.htm

Harman, Chris, 2003, Analysing Imperialism, International Socialism 99 (Summer).

Harman, Chris, 2005, Analysis, International Socialism 108 (Autumn).

Harman, Chris, 2007, Snapshots of Capitalism Today and Tomorrow, International Socialism 113 (Winter).

Hollinger, Peggy, 2010, Paris and Berlin Unite on Fiscal Discipline, Financial Times (21 July).

Holman, Otto, 1992, Introduction: Transnational Class Strategy and the New Europe, International Journal of Political Economy, volume 22, number 1.

Kouvelakis, Stathis, 2007, La France en Révolte: Mouvements sociaux et Cycles Politiques (Textuel).

Lapavitsas, Costas, A. Kaltenbrunner, D. Lindo, J. Michell, J.P. Painceira, E. Pires, J. Powell, A. Stenfors, N. Teles, 2010, Eurozone Crisis: Beggar Thyself and Thy Neighbour, Research on Money and Finance (March).

Lauer, Stéphane, Frédéric Lemaître, Marie de Vergès, 2010, M. Trichet: ‘Nous avons besoin d’une fédération budgétaire’, Le Monde (1 June).

Loriaux, Michael, 1991, France After Hegemony: International Change and Financial Reform (Cornell University Press).

McNamara, Kathleen, 2008, A Rivalry in the Making? The Euro and International Monetary Power, Review of International Political Economy, 15:3.

Mandel, Ernest, 1970, Europe versus America: Contradictions of Imperialism (Monthly Review Press).

Parboni, Riccardo, 1981, The Dollar and its Rivals: Recession, Inflation and International Finance (Verso).

Parsons, Craig, 2003, A Certain Idea of Europe (Cornell Univerity Press).

Peel, Quentin, 2010, Schäuble Interview: Berlin’s Strictures, Financial Times (19 May).

Prodi, Romano, 2010, A Big Step Towards Fiscal Federalism in Europe, Financial Times (21 May).

Rugman, Alan, and Alain Verbeke, 2002, Regional Multinationals and Triad Strategy.

Serfati, Claude, 2004, Impérialisme et Militarisme: L’Actualité du XXIe Siècle (Page Deux).

Serfati, Claude, 2008, L’insertion du Capitalisme Français dans l’Économie Mondiale, La brèche/Carré rouge, number 2.

Soutou, Georges-Henri, 1996, L’Alliance Incertaine: Les Rapports PoliticoStratégiques Franco-allemands, 1954–1996 (Fayard).

Sutherland, Peter, 2010, Radical reforms can save the euro, Financial Times (30 June).

Traynor, Ian, 2010, How the euro – and the EU – teetered on the brink of collapse, Guardian (14 May).

Tuma, Thomas, and Christoph Pauly, 2010, Interview with Jean-Claude Trichet, ECB President, Der Spiegel (13 May).

Van Apeldoorn, Bastiaan, 2002, Transnational Capitalism and the Struggle Over European Integration (Routledge).

Van der Pijl, Kees, 2006, Global Rivalries From the Cold War to Iraq (Pluto).