US government spending as proportion

of gross domestic product [56]

MIA > Archive > Harman > Zombie Capitalism

Marx depicted a system that was very dynamic, but also plagued with seemingly insuperable contradictions. Its very dynamism continually led capital to try to expand at a greater rate than could be sustained by the living labour power on which it ultimately depended. The barrier to capitalist production, Marx wrote, lay in capital itself. The implication was that as capitalism engulfed the whole world, it would be subject to longer and deeper slumps, interspersed with shorter and shallower periods of boom. At the same time, the concentration and centralisation of capital would produce an ever greater polarisation between a capitalist class which was diminishing in size and a working class that absorbed into itself the rest of society.

The model was by design an abstraction. Marx consciously ignored much of the day to day functioning of markets and many of the features of particular capitalist societies in his attempt to grasp the underlying tendencies built into the mode of production as such – its “general laws”. The way each of the three volumes of Capital operated at a different level of abstraction meant that the third volume, by integrating production and circulation, was closer to the actual operating detail of any really existing capitalist society than the first volume, even though its analysis depended on the basic concepts developed there. It dealt not only with the equalisation of profit rates, the deviation of prices from values, crises and the tendency of the rate of profit to fall, but also with credit and the banking system, commercial profits, interest payments to money lenders and rents to land owners. But even the third volume deliberately paid little attention to many important things: foreign trade, the impact on the capitalist system of absorbing the still enormous pre-capitalist parts of the world or the role of the state. Marx had intended in the original plan for Capital he drew up in the early manuscripts of the work further volumes dealing with such things. But he never had time to do so, immersed as he was in day to day revolutionary political activity, compelled to make a livelihood for himself through journalistic articles and, in the last years of his life, plagued by illness, although the three volumes he did fully or partially complete were themselves an incredible achievement.

The gap between the model and the reality left many questions unanswered about the course capitalism would take. These questions did not necessarily seem to matter that much either to Marx and Engels or to the activists in the new workers’ movements of the 1870s and 1880s. These were the years of a long period of crises known as the Great Depression. The US steel magnate Andrew Carnegie expressed the mood even in capitalist circles in 1889:

Manufacturers ... see savings of many years ... becoming less and less, with no hope of a change in the situation. It is in a soil thus prepared that anything promising of relief is gladly welcomed. The manufacturers are in the position of patients that have tried in vain every doctor of the regular school for years, and are now liable to become the victim of any quack that appears ... [1]

A quarter century of falling profit rates [2] led to massive pools of poverty in London and other cities and to mass unemployment in the mid-1880s. [3] It was not surprising that Frederick Engels could feel that the logic of Marx’s model was working itself out right in front of his eyes in England as “the decennial cycle of stagnation, prosperity, overproduction and crisis” seemed to give way to “a permanent and chronic depression”. [4]

The trajectory of capitalism soon, however, proved to be more complicated than the experience of the 1880s suggested. Profit rates recovered in Britain in the 1890s, and the US and Germany went through a new wave of economic expansion. [5] There were certain positive reforms for workers that seemed to contradict Marx’s picture: Otto von Bismarck granted pensions to Germany’s workers in 1889 and a British Liberal government produced a similar scheme in Britain 20 years later, along with free school meals; real wages rose in the last two decades of the 19th century, even if they tended to stagnate after that [6]; working hours everywhere tended to fall from 12 or 14 hours a day to eight, and the working week to fall from six days to five and a half. [7]

The apparent refutation of the predictions drawn from Marx’s model led to a crisis within Marxist ranks, known as the revisionist controversy. Out of it emerged two very different trends in the analysis of capitalism which were to confront each other again and again over the next century.

Edward Bernstein, only a few years previously a close collaborator of Engels, produced a root and branch critique of Marx’s methods and conclusions. “Signs of an economic worldwide crash of unheard of violence have not been established”, he wrote. “Overproduction in single industries does not mean general crises.” [8] “Workingmen”, he concluded, are not “universally pauperised as was set out in the Communist Manifesto.” [9] These changes, he argued, had arisen because of “the enormous extension of the world market” and the regulation of production with “the rise of the industrial cartels” so that “general commercial crises” were “improbable”.

Bernstein’s “revision” of Marx was rejected by Engels’ other collaborator, Karl Kautsky. But this did not prevent many socialist activists coming to accept in practice that capitalism had stabilised itself for the indefinite future. Challenging such views meant going further than Kautsky and adding to Marx’s analysis. It is this which, each in their own way, Rudolf Hilferding, Vladimir Lenin, Nicolai Bukharin and Rosa Luxemburg tried to do.

Soon it was not only the purely economic functioning of the system that required something more than the basic account provided by Marx. So too did a new period of immense political convulsions as 44 years of peace in western Europe gave way to the most horrific war humanity had yet known.

The first Marxist economist to publish a detailed analysis of the changes was the Austrian Rudolf Hilferding in his work Finance Capital, in 1910. Basing himself on developments in Germany, he argued that banking capital and industrial capital were merging to produce a synthesis of the two, which he labelled “finance capital”. On this basis giant trusts and cartels were emerging that could dominate whole sectors of industry:

There is a continual tendency for cartelisation to be extended. The individual industries become increasingly dependent upon the cartelised industries until they are finally annexed by them. The ultimate outcome of this process would be the formation of a general cartel. The whole of capitalist production would then be consciously regulated by a single body which would determine the volume of production in all the branches of industry. [10]

Hilferding did not see competition as disappearing completely. He emphasised the importance of international competition, pointing to the way the merger of finance and industry inside a country led to pressure on its state to use protectionist tax duties to aid its capitalists in their struggle against rivals in the world market. “It is not free trade England, but the protectionist countries, Germany and the United States, which become the models of capitalist development”, wrote Hilferding. [11] Far from continuing with the traditional liberal notion of a minimal “night-watchman state” the great trusts wanted it to have the power to widen its boundaries so as to enlarge the market in which they could gain monopoly profits: “While free trade was indifferent to colonies, protectionism leads directly to a more active colonial policy, and to conflicts of interest between different states” [12], Hilferding argued. “The policy of finance capital is bound to lead towards war.” [13]

This analysis went beyond anything in Marx. He had witnessed the wars of his lifetime and written about them: the opium wars of Britain against China, the Crimean War, the American Civil War and the Franco-Prussian War. But these were wars, as he saw it, resulting from the drive of capitalism to impose itself on the remnants of the pre-capitalist world around it. Capitalism had come into the world “mired in blood”, but Marx’s model contained no more than a few hints as to why fully established capitalist countries would be driven to war with each other. Hilferding had taken a first step towards a Marxism for the 20th century that explained what had changed since Marx’s time in this all-important respect.

There were, however, ambiguities in Hilferding’s approach. The main trend in his book was to argue that the growth of monopolies did not do away with the tendency of capitalism to crisis, and their growing reliance on the state would lead to intensified international competition, imperialism and the drive to war. But at points there were suggestions that pointed to a very different conclusion – that the monopolies and the state could work together to dampen the tendency towards crisis: “The specific character of capital is obliterated in finance capital” which was able to resolve “more successfully the problems of the organisation of the social economy”, even though it was still a class society, with “property concentrated in the hands of a few giant capitalist groups”. [14] This meant the mitigation of the old style economic crisis:

As capitalist production develops, there is therefore an increase ... in the part of production that can be carried on under all circumstances. Hence the disruption of credit need not be as complete as in crises in the earlier period of capitalism. Furthermore, the development of the credit crisis into a banking crisis on the one side and a monetary crisis on the other is made more difficult ... [15]

The mass psychoses which speculation generated at the beginning of the capitalist era ... seem gone for ever. [16]

Hilferding did not carry his argument through to its logical conclusion in Finance Capital, and still wrote that the system could not do away with “the cyclical alternation of prosperity and depression”. [17] But by the 1920s, when he served as a minister in two Weimar Republic governments, he veered towards Bernstein’s approach with a theory of “organised capitalism” in which the anarchy of the market and the trend towards crisis disappear. [18] One corollary was to deny that there was anything in capitalism inevitably leading to war, since the “organised capitalisms” in different countries would want to cooperate with each other.

A similar conclusion had already been reached in 1914 by Karl Kautsky, leading him too to a position that barely differed in practice from Bernstein’s. But where Hilferding pointed to the merger of finance and productive capitalism, Kautsky’s argument rested on seeing a fundamental distinction and antagonism of interests between them:

The finance capitalists ... had a direct interest in transforming each national state into an apparatus of support for their own expansion. Imperialism was therefore directly linked to finance capitalism. But the interests of finance capital were not identical to those of industrial capital, which could expand only by broadening its markets through free trade. It was from the industrial sector that impulses towards international concord arose in the bourgeois camp ... Imperialism, the expression of one phase of capitalist development and the cause of armed conflicts, was not the only possible form of development of capitalism. [19]

Kautsky stressed the role of arms firms in particular as having an interest in imperialism and war. But he maintained that the economic costs of rearmament, while they favoured the development of some sectors of industry, were detrimental to others. Capital in the industrial countries needed to dominate the “agricultural” countries in order to get raw materials. But there was no reason why capitalists should not be able to cooperate to do this through a “sort of super-imperialism”. [20]

In holding that the drive to war was something that happened despite the interests of most capitalists, Hilferding and Kautsky were articulating a view very similar to that of some liberals. One was the influential economist Hobson, who had produced his own theory of imperialism some eight years before Hilferding. He saw imperialism as the product of one interest group, those connected with certain financial institutions. [21] These opted for guaranteed returns of interest on overseas loans rather than taking the risks involved in industrial investment at home, and welcomed colonial expansion as a way of making sure their state guaranteed the safety of their investments. So for Hobson the root of imperialism lay not with capitalism as such but with finance capital and those he saw as benefitting directly from it – the bond-holding rentiers who received their dividends regularly without ever having to worry themselves with productive or commercial activity of any sort.

Another British liberal, Norman Angell, argued a similar position, identifying an essentially peaceful dynamic in capitalism, although ascribing a more benign role to finance – no doubt influenced by the unhesitating way the central banks of France and Germany had sent gold to help Britain, and Russia had then sent gold to help Germany, during the major financial crisis of 1907. [22] “In no department of human activity”, he wrote, “is internationalisation so complete as in finance. The capitalist has no country, and he knows, if he be of the modern type, that arms and conquests and jugglery with frontiers serve no ends of his ...” [23]

Such arguments have percolated down through the years to the present day. So the former revolutionary Marxist Nigel Harris argues that “business has in general no more power over governments than populations” and the threat to the world comes not from untrammelled capitalism but from the states which guard their own interests. [24] Ellen Wood is still a militant Marxist, but her arguments are not that different. She has criticised what she calls “classical-Marxist theories of imperialism” of the First World War years for failing to see that the “‘political’ form of imperialism, in which exploitation of colonial peoples and resources depends on political domination and control of territory”, is “the essence of pre-capitalist empires”. [25] “Capitalist class exploitation”, she insists, is a “purely economic process which, like capitalist class relations, concerns the commodity market”. [26] From this it follows that, while capitalism needs a state to exert control over society, it does not need states that enter into conflict with each other. Much the same argument is put by Michael Hardt and Toni Negri in their book Empire. Hardt wrote shortly before the US invasion of Iraq that the “elites” behind the decision to go to war “are incapable of understanding their own interests”. [27]

Writing in the middle of the First World War, Nicolai Bukharin [28] and Vladimir Lenin [29] drew very different conclusions. They began with Hilferding’s description of the integration of banking capital, industrial capital and the state, but removed from it any sense of the result being harmonious by stressing the way in which the role of the state in international economic competition led to war.

This was the overriding theme of Lenin’s pamphlet Imperialism. Its aim was to be a “popular outline”, showing how the resort to war was a product of the “latest stage of capitalism” – the original subtitle to the work:

Half a century ago, when Marx was writing Capital, free competition appeared to the overwhelming majority of economists to be a “natural law” ... Marx had proved that free competition gives rise to the concentration of production, which, in turn, at a certain stage of development, leads to monopoly ...

This is something quite different from the old free competition between manufacturers ... producing for an unknown market. Concentration has reached the point at which it is possible to make an approximate estimate of all sources of raw materials (for example, the iron ore deposits) of a country and even ... of the whole world ... These sources are captured by gigantic monopolist associations ... The associations “divide” them up amongst themselves by agreement. [30]

Once this stage is reached, competition between the giant corporations is no longer based simply – or even mainly – on the old purely market methods. Taking control of raw materials so that rivals cannot get them, blocking rivals’ access to transport facilities, selling goods at a loss so as to drive rivals out of business denying them access to credit, are all methods used. “Monopolies bring with them everywhere monopolist principles: the utilisation of ‘connections’ for profitable deals takes the place of competition in the open market.” [31]

The capitalist powers had partitioned the world between them, building rival colonial empires, on the basis of “a calculation of the strength of the participants, their general economic, financial, military and other strength.” But “the relative strength of these participants is not changing uniformly, for under capitalism there cannot be an equal development of different undertakings, trusts, branches of industry or countries”. A partition of the world that corresponded to the relative strength of the great powers at one point no longer did so a couple of decades later. The partitioning of the world gives way to struggles over the repartitioning of the world:

Peaceful alliances prepared the ground for wars and in their turn grow out of wars. One is the condition for the other, giving rise to alternating forms of peaceful and non-peaceful struggle on one and the same basis, that of imperialist connections and interrelations of world economics and world politics. [32]

The epoch of the latest stage of capitalism shows us that certain relations between capitalist associations grow up, based on the economic division of the world; while parallel to and in connection with it, certain relations grow up between political alliances, between states, on the basis of the territorial division of the world, of the struggle for colonies, of the “struggle for spheres of influence”. [33]

Britain and France had been able to build great empires, dividing Africa and much of Asia between them. The Netherlands and Belgium controlled smaller but still enormous empires in Indonesia and the Congo. By contrast, Germany had only a few relatively small colonies, despite its economy beginning to overtake that of Britain. It was this discrepancy that lay behind the repeated clashes between the rival alliances of great power that culminated in the First World War.

Finally, where Kautsky focused simply on the control of the “agrarian” parts of the world (what today would be called the Third World or the Global South), Lenin was insistent that the imperialist division of the world was increasingly centred on industrial areas. “The characteristic feature of imperialism is precisely that it strives to annex not only agrarian territories, but even most highly industrialised regions (German appetite for Belgium; French appetite for Lorraine).” [34]

Bukharin’s Imperialism and World Economy, written shortly before Lenin’s work, but appearing afterwards with an introduction by Lenin, made the argument just as forcefully as he draws of the consequences of the tendencies that Hilferding had described:

Combines ... in industry and banking ... unite the entire “national” production, which assumes the form of a company of companies, thus becoming a state capitalist trust. Competition ... is now competition of the state capitalist trusts on the world market ... Competition is reduced to a minimum within the boundaries of the “national” economies, only to flare up in colossal proportions, such as would not have been possible in any of the preceding historical epochs ... The centre of gravity is shifted in the competition of gigantic, consolidated and organised economic bodies possessed of a colossal fighting capacity in the world tournament of “nations” ... [35]

Writing three years after the end of the war, he drew out the implications even more sharply:

The state organisation of the bourgeoisie concentrates within itself the entire power of this class. Consequently, all remaining organisations ... must be subordinated to the state. All are “militarised” ... Thus there arises a new model of state power, the classical model of the imperialist state, which relies on state capitalist relations of production. Here “economics” is organisationally fused with “politics”; the economic power of the bourgeoisie unites itself directly with the political power; the state ceases to be a simple protector of the process of exploitation and becomes a direct, capitalist collective exploiter ... [36]

War now becomes central to the system, arising from the competition between the “state capitalist trusts”, and also feeding back into and determining their internal organisation:

With the formation of state capitalist trusts, competition is being almost entirely shifted to foreign countries. The organs of the struggle waged abroad, primarily state power, must therefore grow tremendously ... In “peaceful” times the military state apparatus is hidden behind the scenes where it never stops functioning; in war times it appears on the scene most directly ... The struggle between state capitalist trusts is decided in the first place by the relation between their military forces, for the military power of the country is the last resort of the struggling “national” groups of capitalists ... Every improvement in military technique entails a reorganisation and reconstruction of the military mechanism; every innovation, every expansion of the military power of one state, stimulates all the others. [37]

The logic of the argument presented by Lenin and Bukharin was that the period of peace that followed the First World War would, sooner rather than later, give way to a new world war unless capitalism was overthrown. “The possibility of a ‘second round’ of imperialist war is ... quite obvious”, wrote Bukharin. [38] As we shall see later, the reaction of the great capitalist powers to the economic crisis that began in 1929 confirmed this prediction. That has not, however, stilled the argument against the Lenin-Bukharin account.

This argument assumed – and still assumes [39] – that peaceful free trade rather than a militaristic struggle to control chunks of territory would have been the most profitable course for the majority of capitalists to pursue. This claim is easy to deal with. The great period of growth of the Western empires was the last quarter of the 19th century. In 1876 no more than 10 percent of Africa was under European rule. By 1900 more than 90 percent was colonised. In the same period Britain, France, Russia and Germany each established colonial enclaves and wide spheres of influence in China; Japan took over Korea and Taiwan; France conquered all of Indochina; the US seized Puerto Rico and the Philippines from Spain; and Britain and Russia agreed to an informal partitioning of Iran.

At the same time there was a massive growth in the export of capital from Britain, still the biggest capitalist economy and the centre of the world financial system, even if the US and Germany were rapidly catching up in industrial output. Total British investment in foreign bonds rose from £95 million in 1883 to £393 million in 1889. It soon equalled 8 percent of Britain’s gross national product and absorbed 50 percent of savings. [40] Not all exports of capital, let alone of goods, went to the colonies. Much went to the US and quite a lot went to Latin American countries like Argentina. But the colonies were important. Britain’s biggest colony, India, alone accounted for 12 percent of exported goods and 11 percent of capital exports; it also provided a surplus to Britain’s balance of payments that could help pay for investments elsewhere in the world; and it provided Britain, free of charge, with an army for conquering other places. [41] The raw materials required for the most technologically advanced industries of the time came from colonial areas (vegetable oils for margarine and soap manufacture, copper for the electrical industry, rubber and oil for the fledgling automobile industry, nitrates for fertilisers and explosives). On top of this, there was the strategic importance of the colonies. What mattered for both politicians and industrial interests was that “Britain ruled the waves” and could use its bases in the colonies to punish states that threatened those interests.

It hardly seemed a coincidence to the theorists of imperialism that the decades which witnessed this massive expansion of colonisation, of exports of capital and of extraction of raw materials also saw the recovery of profitability and markets from the gloom of the Great Depression. They may not always have managed to theorise this clearly, but the coincidence of empire and capitalist boom was real enough.

The Lenin-Bukharin theory therefore stands up as an account of the pre-World War One decades – and of the drive to war. Nevertheless, there was a weakness in Lenin’s version of the theory. It generalised from the experience of British imperialism at the end of the 19th century to the whole of imperialism, and tended to make the entire theory rest upon the key role of the banks in exporting financial capital. But this did not fit with the picture even when Lenin was writing, let alone in the decades afterwards. The export of finance had indeed been a central feature of British imperialism, but the situation was rather different with its new competitors. In the German case it was the industrial combines, especially those in heavy industry, rather than finance as such, that sought to expand beyond national frontiers by the establishment of colonies and spheres of influence. And the characteristic feature of the US and Russian economies in the pre-First World War decades was not the export of capital but the inflow of funds from other capitalist countries (although there was some re-export of capital). The focus on finance became even more problematic in the quarter of a century after Lenin wrote. The quantity of capital invested abroad never rose above the level of 1914 and then declined. [42] Yet the great capitalist powers remained intent on imperialist expansion during the interwar years, with Britain and France grabbing most of the Middle East and the former German colonies, Japan expanding into China, and German heavy industry looking to carve out a new empire in Europe.

The phraseology of certain parts of Lenin’s pamphlet has led to some interpretations of it that see financial interests, rather as Hobson and Kautsky did, as mainly responsible for imperialism. This was especially so when, basing himself on Hobson, Lenin insisted on the “parasitic” character of finance capital, writing of:

the extraordinary growth of ... a social stratum of rentiers, i.e. people who live by “clipping coupons”, who take no part in any enterprise whatever, whose profession is idleness. [43]

This stress on the “parasitism” of finance capital has even led to some on the left embracing strategies based on anti-imperialist alliances with sections of industrial capital against finance capital – precisely the Kautsky policy that Lenin attacked so bitterly.

Bukharin’s account of imperialism by and large avoids these faults. He uses the category of “finance capital” repeatedly. But he explicitly warns against seeing it as something distinct from industrial capital. “Finance capital ... must not be confused with money capital, for finance capital is characterised by being simultaneously banking and industrial capital.” [44] It is inseparable, for Bukharin, from the trend towards domination of the whole national economy by “state capitalist trusts” struggling globally against other “state capitalist trusts”.

Such a struggle did not have to concentrate on investing in foreign countries. It could turn into something else: the effort to wrest from other countries already industrialised areas or sources of important raw materials by force. As Bukharin put it, “The further it [imperialism] develops the more it will become a struggle for the capitalist centres as well.” [45]

It was necessary, in other words, to turn vast amounts of value into means of destruction – not only in order to try to obtain more value but to hold onto that already possessed. This was the logic of the capitalist market applied to the relations between states. Each had to invest in preparations for war in order not to lose out as the other invested more, just as each capital had to invest in new means of production so as to hold its own in market competition. “Imperialist policies” were “nothing but the reproduction of the competitive struggle on a worldwide scale,” with “state capitalist trusts”, not individual firms, “the subjects of competition”. The “explosions of war” were a result of “the contradiction between the productive forces of the world economy and the ‘nationally’ limited methods of appropriation of the bourgeoisie separated by states”. [46] In other words, just as competition between capitals (and with it the free operation of the law of value) was reduced within states, it operated on an ever more ferocious scale between them.

Lenin and Bukharin were not the only Marxist opponents of imperialism to attempt to prove that it was an essential stage of capitalism. Rosa Luxemburg also did so with a rather different theoretical analysis in her The Accumulation of Capital, published in 1913. [47] It rested on what she believed to be a central contradiction within capitalism that had escaped Marx’s notice.

Marx had produced tables in Volume Two of Capital showing the interrelation between accumulation and consumption. Each round of production involved using the products of the previous round, either as material inputs (machinery, raw materials, etc.) or as means of consumption for the workforce. This required that the material products in one round corresponded to what was needed for production to proceed at the next round. It was not merely a question of the right amounts of value passing from one round to the next, but also of the right sorts of use values – such and such quantities of raw materials, new machinery, factory building, etc., and such and such quantities of food, clothing, etc, for the workforce (plus luxury goods for the capitalists themselves). Rosa Luxemburg, in examining Marx’s tables, came to the conclusion that discrepancies were bound to arise between the distribution of value from one round to another and the distribution of the use values needed to expand production. More consumer goods would be produced than could be bought with the wages paid out to workers or more investment goods than could be paid for out of profits. In other words, the system inevitably produced an excess of goods for which there was no market within it. Overproduction was not just a phase in the boom-slump cycle, but endemic. Conceived of as a closed system, in which all the outputs of one round of production had to be absorbed as inputs in later rounds, capitalism was doomed to tend towards a complete breakdown.

In the early stages of capitalism this was not a problem. It was not a closed system. Precisely because it grew up within a precapitalist world it was surrounded by people who were not part of it – artisans, the remnants of feudal ruling classes and vast numbers of subsistence peasants. They could absorb the surplus goods, providing raw materials in return. But the more capitalism came to dominate in a particular country, the more it would be faced with this contradiction – unless it expanded outwards to seize control of other, pre-capitalist, societies. Colonisation was in this way essential for the continued functioning of the system. Without it capitalism would collapse.

Luxemburg did not simply produce this argument in an analytical form. She supplemented it with chapter after chapter showing in horrifying detail how the historical development of capitalism in Europe and North America had been accompanied by the subjugation and exploitation of the rest of the world. Her conclusion, like Lenin and Bukharin’s, was that socialist revolution was the only alternative to imperialism and war.

Her analysis was, however, subject to trenchant and devastating critiques, most notably by the Austrian reformist Marxist Otto Bauer and by Bukharin. Bauer produced his own versions of the reproduction tables, claiming that there was no problem getting the inputs and outputs to balance properly over several rounds of production. Bukharin concentrated on refuting points Luxemburg made in her “anti-critique” reply to Bauer. She had argued that there had to be something outside capitalism to provide an incentive to the capitalists to keep investing. It was not good enough for ever increasing amounts of investment to absorb the growing output of society, since, she argued, this would provide no gain to the capitalists to justify such investment:

Production to an ever greater extent for production’s sake is, from the capitalist point of view, absurd because in this way it is impossible for the entire capitalist class to realise a profit and therefore to accumulate. [48]

Bukharin’s reply, in essence, amounted to pointing out that it was precisely such apparently absurd accumulation for the sake of accumulation that characterised capitalism for Marx. [49] Capitalism did not need a goal outside itself. It could be added that it is precisely this which epitomises the extreme alienation of human activity in the system: it is driven forward not by the satisfaction of human need, not even by the human need of the capitalist, but by its own dynamic.

Bukharin did not deny that discrepancies arise in the course of capitalist development between production and consumption. He insisted in his comments on Luxemburg that they are inevitable – but it is precisely the capitalist crisis that overcomes them. Over-accumulation and overproduction occur, but not all the time. They arise in the course of the crisis and are liquidated by its further development. And Bukharin quoted Marx: “There is no permanent crisis.” [50] For him imperialism was not to be explained by the problems of overproduction, but by the way in which it aids the capitalist pursuit of higher profits.

Bukharin’s argument against Luxemburg cannot be faulted. But he and Lenin do leave something unexplained: why the export of capital during the high tide of imperialist expansion was able to lead capitalism out of the Great Depression. For all its problems, Rosa Luxemburg’s theory did attempt to find a link between imperialism and the temporary mitigation of crisis, which Lenin and Bukharin failed to.

Writing in the 1920s, Henryk Grossman, critical both of Rosa Luxemburg and her detractors [51], did point to a way of making the link. The flow of capital from existing centres of accumulation to new ones overseas could ease the pressure leading to a rising organic composition of capital and a falling rate of profit, even if such a solution would “only have a short time effect”. [52]

This insight can make sense of the actual pattern of economic development during the high tide of imperialism at the end of the 19th century. Had the half of British investment that went overseas been invested domestically it would have raised the ratio of investment to labour (the organic composition of capital) and so lowered the rate of profit. As it was, estimates suggest that the capital-output ratio actually fell from 2.16 in 1875–83 (the years of the first “Great Depression”) to 1.82 in 1891–1901 [53], and that the early 1890s were a period of rising profit rates (following a fall from the 1860s to the 1880s). [54] And in these years what happened in Britain still had a major impact on the rest of the system.

This points to a wider and very important insight into the dynamic of capitalism in the 20th and 21st centuries to which we will return in later chapters. For the moment it is sufficient to recognise that imperialism arose out of the competitive drive of capitals to expand beyond national frontiers – and led, as a temporary side-effect, to a lessening of the pressures otherwise driving up the organic composition of capital and so lowering the rate of profit. But it could only be a temporary effect because eventually investments made in the new centres of accumulation would produce new surplus value seeking investment and exerting a downward pressure on profit rates. As that happened the old contradictions in the system would return with a vengeance, opening up a new period of economic instability which would lead to intensified competition, not only of an economic but also of a military sort. This is effectively what happened in the first decades of the 20th century, with an international tendency towards falling profit rates and increased tensions between states. Amended in this way, the insistence by Lenin, Bukharin and Luxemburg on the connection between capitalism and war could be made theoretically watertight.

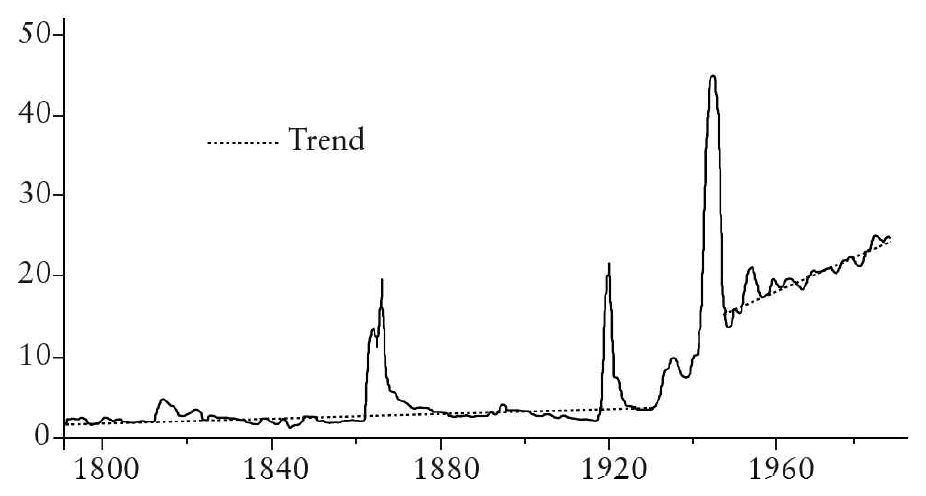

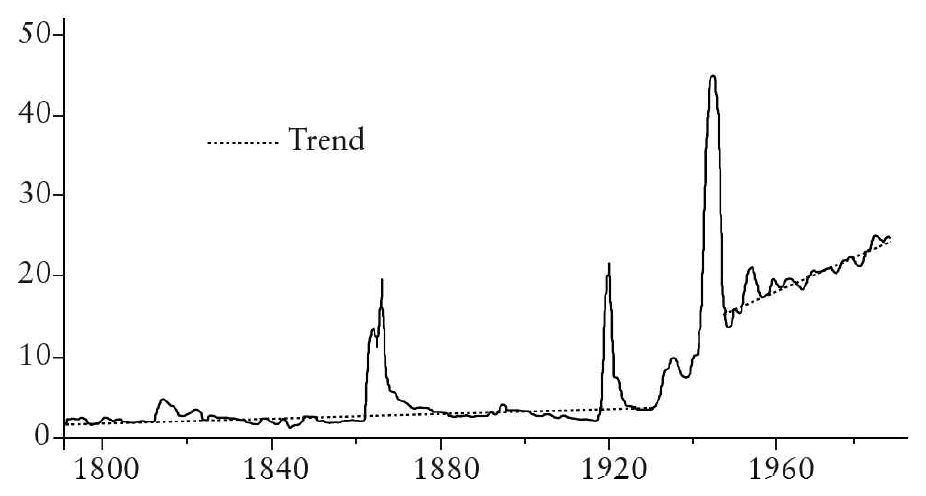

The classic theory of imperialism has one important implication. It raises the question of the relation between states and the capitals within them. Marx left the question unresolved. He took up some of its aspects in his non-economic writings [55], but did not get as far as integrating them into his analysis of the capitalist system as a whole. But the question is not one that any serious analysis of capitalism in the century after his death can avoid. A quick glance at the growth of state expenditure shows why (see the graph below for the United States). From its share of national output being more or less static through the 19th century, except at times of all-out war, it started growing in the second third of the 20th century and has never stopped doing so.

|

US government spending as proportion |

|

The most common view of the state, among Marxists and non-Marxists alike, has been to see it as something external to the capitalist economic system. This approach has long been accepted by the mainstream “Realist” school in the academic discipline of international relations. It sees states as self-contained entities clashing internationally according to a logic which has nothing to do with the economic form of organisation existing within them. [57] A somewhat similar approach is to be found in some Marxist writings.

Capitalism, in this view, consists of the pursuit of profits by firms (or, more accurately speaking, the self-expansion of capitals) without regard to where they are based geographically. The state, by contrast, is a geographically based political entity, whose boundaries cut across the operations of individual capitals. The state may be a structure that developed historically to provide the political prerequisites for capitalist production – to protect capitalist property, to police the dealings of different members of the ruling class with each other, to provide certain services which are essential for the reproduction of the system, and to carry through such reforms as are necessary to make other sections of society accept capitalist rule – but it is not to be identified with the capitals that operate within it.

Those who view the state as simply external to capitalism tend to refer to the “state” in the singular – and often to “capital” in the singular as well. This way of putting it may make sense when providing an account of capitalism at the most abstract level, with the state providing a level playing field on which different capitals compete on equal terms. But the actually existing capitalist system is made up of many states [58] and many capitals. [59]

But even those who see states as existing in the plural, as does Ellen Wood, often conclude that they serve the interests of capital in general, not of particular capitalists based within them. “The essential role of the state in capitalism”, she argues:

is not to serve as an instrument of appropriation, or a form of “politically constituted property”, but rather as a means of creating and sustaining the conditions of accumulation at arms length, maintaining the social, legal and administrative order necessary for accumulation. [60]

As against these views, there are those whose analyses start from the classic theories of imperialism, with their language about the state “merging” with capital, of “state monopoly capitalism”, or simply of “state capitalism”, and their view of the clashes between states as an expression of international competition of the capitals operating within them.

A bowdlerised version of this view became part of the orthodoxy of Stalinised Marxism in the years from the 1930s to the 1970s, known for short as “stamocap”. A more serious attempt to describe the world system as composed of state capitals in the decades after the Second World War was made by Mike Kidron. [61] In his account individual states and individual capitals became completely congruent with each other: every state acted at the behest of a set of nationally based capitals, and every significant capital was incorporated in a particular state. Any exceptions, for Kidron, were a hangover from the past, relics which would disappear with the further development of the system.

A parallel attempt to see the world in terms of states representing capitals was developed in the early 1970s in debates between German Marxists. [62] Claudia von Braunmuhl, for instance, wrote: it is not the state in general that must be analysed but “the specific political organisation of the world market in many states” ... the role of the state in question in its specific relationship with the world market and with other states must always be included in the analysis from the outset. [63]

Few people have followed through such attempts to develop such insights into a rigorous interpretation of the world system. But some of their presuppositions are taken for granted in everyday ways of talking and writing about the world. People habitually speak of “the economic interests” of this or that state, of how one is doing compared with another, of the “profits” of one or other country. So the recent very useful account of capitalism since the Second World War by Robert Brenner emphasises the interactions of “US capitalism”, “Japanese capitalism” and “German capitalism”, with negotiation by states playing a central role. [64] There is the implication of a tight alignment of interest between a particular national state and a particular sector of the international capitalist system.

The view of national states as wholly congruent with “national” capitals is a big oversimplification, especially in today’s world, with multinational corporations operating in scores of countries, as we shall see later. But this does not mean that states simply stand at “arms length” from particular capitals, or that states do not act at the behest of particular nationally based groupings of capital. They remain tied to them in complex ways.

A starting point for understanding this can be found in the relationship between the development of modern states and capitalism. This was not dealt with explicitly by Marx, and it was Engels who first did so in a manuscript written after Marx’s death and not published until 1935. His studies led him to conclude that as merchants and tradespeople of the towns (the “burghers”) grew in importance at the end of the Middle Ages they allied themselves with the monarchy against the rest of the feudal ruling class: “Out of the confusions of the people that characterised the early Middle Ages, there gradually developed the new nationalisms” – and the beginnings of national states very different to the earlier political structures. [65] Lenin further theoretically elaborated similar insights as the revolutionary movement in Russia tried to come to terms with the demand for independent states arising among the Tsarist empire’s minority nationalities on its borders in south eastern Europe and in the colonial possessions of the West European powers.

He spelt out the deep connections between the struggle to establish national states and the emergence of groups in the pre-capitalist world who wanted to base themselves on capitalist forms of economic organisation:

Throughout the world, the period of the final victory of capitalism over feudalism has been linked up with national movements. For the complete victory of commodity production, the bourgeoisie must capture the home market, and there must be politically united territories whose population speak a single language, with all obstacles to the development of that language and to its consolidation in literature eliminated ... Therefore, the tendency of every national movement is towards the formation of national states, under which these requirements of modern capitalism are best satisfied ... The national state is typical and normal for the capitalist period. [66]

Modern states have not developed, according to this conception, as external to the capitals (or at least, to most of the capitals) based within them. They have been shaped historically by the process by which capitalist methods of accumulating wealth began to take root, first in parts of Europe and then in the rest of the world. Those groups identifying with such methods needed to protect themselves against the various social forces associated with the pre-capitalist society in which they developed – and very soon against other capitalist groups located elsewhere. This meant seeking to shape political structures to defend their common interests, by force if necessary, in what could be a hostile world. Where old pre-capitalist state forms existed, they had to get control of them and reorganise them to fit their own interests (as in England or France) or break apart from them to form new states (as with the Dutch Republic, the United States and the ex-colonial countries of the second half of the 20th century). By the late 19th century it was not only existing capitalist interests which sought to build such states. So too did elements from old exploiting classes in places like Germany, Tsarist Russia and Japan who wanted to survive in a world increasingly dominated by capitalist powers on the one hand, and the middle class intelligentsia who came to play a leading role in many of the national movements in the colonial world on the other.

This picture has been rejected by some Marxists on the grounds that states existed before the rise of capitalism. The “system of states” is then seen as something completely distinct from the system of capitalism, and there is a “logic of states” that differs from the “logic of capital”. But the old states were not left as they were with the rise of capitalism. They were reshaped fundamentally, with a redrawing of old territorial boundaries and the establishment for the first time of centralised structures that reached down into the lives of every inhabitant (for the first time they were all “citizens”). [67] The fact that the new structures functioned through the deployment of force, not the production of commodities for sale, did not stop them being shaped by the changing relations of production and exploitation created by the rise of capitalism. And they were from the beginning – and remain today – structures that feed back into the organisation of production by capitals, influencing the tempo and direction of their accumulation. The logic of states was a product of the wider logic of capitalism, even if it frequently came into contradiction with other elements in the system. [68]

Capital exists in three forms – as productive capital, as commodity (or merchants’) capital and as money capital. [69] Every process of capital accumulation under fully developed capitalism involves repeated changes from one form to another: money capital is used to buy means of production, raw materials and labour power; these are put together in the production process to turn out commodities; these commodities are then exchanged for money; this money is then used to buy more means of production, raw materials and labour power, and so on. The forms of capital are continually interacting as one changes into the other. But there can also be a partial separation of these three different forms. The organisation of direct production, the selling of commodities and the supply of finance can devolve upon different groups of capitalists.

Money capital and commodity capital can be continually mobile, moving from place to place and across national boundaries, unless obstructed by the state or other bodies exercising force. Things are rather different with productive capitals. Regarded simply as accumulations of value, they differ from each other only in their size. But each individual capital, like each individual commodity, has a twofold character. As well as being measurable in terms of exchange value, it is also a concrete use value – a concrete set of relations between people and things in the process of production. Each particular capital has its concrete ways of bringing together labour power, raw materials and means of production, of raising finance and getting credit, and of maintaining networks for distributing and selling its output. These all involve interaction with other people and with nature, interactions of a physical sort, which take place on a day to day basis in fixed geographical locations.

No productive capital can function without, on the one hand, a guarantee of its control of its own means of production (a guarantee which, in the last resort, relies upon “armed bodies of men”), and, on the other, a labour force that is doubly “free” – free from coercion by non-capitalist exploiters on the one hand and free from any way of making a livelihood than by selling its labour power on the other. The productive capitalists in any particular locality necessarily act together to try to shape its social and political conditions, that is to exercise influence over the state. As sociologist Neil Brenner puts it:

In its drive to accumulate surplus value, capital strives to ... overcome all geographical barriers to its circulation process. Yet to pursue this continual dynamic ... capital necessarily depends upon relatively fixed and immobile territorial infrastructures, such as urban regional agglomerations and territorial states ... Capital’s endemic drive ... is intrinsically premised upon the production, reproduction, and reconfiguration of relatively fixed and immobile configurations of territorial organisation, including urban regional agglomerations, transportation networks, communication systems, and state regulatory institutions. [70]

Most capitalist enterprises operate not simply on market calculations, but also on the long-term relations they establish with other enterprises that sell to them and buy from them. Otherwise they would live in continual fear that any change in market conditions would cause their suppliers to sell elsewhere and those who transport and retail their goods suddenly to lose interest in them. They seek to “lock in” these other firms by a combination of financial incentives, business favours and personal contact. To this extent production does not take place in individual firms, but in “industrial complexes”, which have grown up over time. [71]

The market models of classical and neo-classical economics portray capitals as isolated atoms which engage in blind competition with other capitals. In the real world capitalists have always tried to boost their competitive positions by establishing alliances with each other and with ambitious political figures – alliances cemented by money but also by intermarriage, old boy networks and mutual socialising. [72]

Even the fluidity of money capital does not diminish the importance of the particular national states for particular financial institutions. As Costas Lapavitsas has noted in his analysis of money under capitalism, “Trade credit depends on trust among individual capitalist enterprises that is subjective and private, since such trust draws on knowledge that enterprises have accumulated about each other in the course of their commercial relations.” [73] And the networks that provide such knowledge have to a very high degree been organised on a national basis, with the state, through the central bank, playing a key role. “The institutions and markets of the credit system, regulated and managed by the central bank, place social power and trust at the service of capitalist accumulation.” [74]

The relationship between states and capitals are relationships between people, between those engaged in exploiting the mass of the population and those who control bodies of armed men. Personal contact with the leading personnel of the state is something every capitalist aims at – just as every capitalist seeks to cultivate ties of trust and mutual support with certain other capitalists. The “connections” Lenin referred to [75] are immensely important.

Such interactions inevitably leave an imprint on the internal make up of each capital, so that any particular capital would find it very difficult to cope if it were suddenly to be torn apart from the other capitals and the state with which it has co-existed in the past. The national state and different nationally based capitals grow up together, like children in a single family. The development of one inevitably shapes the development of the others.

The groups of capitals and the state with which they are associated form a system in which each affects the others. The specific character of each capital is influenced by its interaction with the other capitals and the state. It reflects not only the general drive to expand value, to accumulate, but also the specific environment in which it has grown up. The state and the individual capitals are intertwined, with each feeding off the other.

Neither the state nor the particular capitals can easily escape this structural interdependence. The particular capitals find it easier to operate within one state rather than another, because they may have to profoundly restructure both their internal organisation and their relations with other capitals if they move their operations. The state has to adjust to the needs of particular capitals because it depends on them for the resources – particularly the revenues from taxation – it needs to keep going: if it goes against their interests, they can move their liquid assets abroad. The pressures which different states apply on each other are indispensable for the capitals based within each to ensure that their interests are taken into account when they are operating globally. The existence of rival states is not something produced from outside capitalism nor is it optional for capitalists. It is integral to the system and to its dynamic. Failure to grasp this, as, say, Nigel Harris does, leaves a great hole in any attempt to understand capitalism over the last century.

The mutual dependence of states and capitals does not, however, mean that states can simply be reduced to the economic entities that operate within them. Those who do the actual running of the state take on functions which competition between firms prevents firms themselves undertaking. They have to mediate between rival capitals, providing judicial systems and overseeing, through central banks, the financial system and the national currency. As Claus Offe put it, “Since ‘capital as a whole’ exists only in the ideal sense ... it requires special guidance and supervision by a fully differentiated political-administrative system”. [76]

The state also has to provide mechanisms for integrating the mass of people into the system: on the one hand the coercive institutions that beat people into submission (police, secret police, prisons); on the other hand the integrative mechanisms that divert grievance into channels compatible with the system (parliamentary structures, frameworks for collective bargaining, reformist, conservative or fascist parties). The proportions in which these two sets of mechanisms operate vary from situation to situation, but everywhere they exist to complement each other. The coercive mechanisms persuade people to take the easier path of integration into the system; the integrative mechanisms provide the velvet glove which conceals the iron hand of state coercive power, so legitimising it. The Italian revolutionary Marxist Antonio Gramsci rightly used Machiavelli’s metaphor of the “centaur”, half animal, half human, to capture the way in which force and consent are combined in the state. [77]

The coercive and the integrative mechanisms depend on organisation and leadership from outside the sphere of capitalist exploitation and accumulation as such – from military and police specialists on the one hand, from political leaders able to mobilise some degree of social support on the other. An effective state requires the building of coalitions that obtain the support – or at least the compliance – of such elements while allowing them a certain leeway to pursue their own interests. [78] It then, inevitably, reflects not just the interests of capital in general, but the concessions it makes to integrate other social groups and classes into its rule. It necessarily displays an important degree of autonomy.

Marx commented in 1871 that “the complicated state machinery ... with its ubiquitous and complicated military, bureaucratic, clerical and judiciary organs, encoils the living society like a boa constrictor ...” The state bureaucracy arises to assure the domination of the existing ruling class, but in the process becomes a “parasite” which is capable of “humbling under its sway even the interests of the ruling classes ...” [79]

This autonomy reaches its highest points when governmental power lies with reformist, populist or fascist parties with a powerful base among workers, peasants or the petty bourgeoisie. There are cases when those who exercise such autonomy are able to break with and even expropriate important capitalist interests within their territory. This was to be true on numerous occasions in the course of the 20th century – German Nazism, Argentine Peronism, Nasserism in Egypt, Ba’athism in Syria and Iraq, are all examples. There are also innumerable cases in which individual capitals behave in ways detrimental to the interests of “their” state – moving funds and investment abroad, doing deals with foreign capitalists that undercut other local capitals, even selling weapons to states fighting their own.

Yet there are limits to the extent to which a state can break free from its capitals, and capitals from their state. A state may override the interests of particular capitalists; it cannot forget that its own revenues and its own ability to defend itself against other states depend on the continuation of capital accumulation. Conversely, the individual capital can, with considerable difficulty, uproot itself from one national state terrain and plant itself in another; but it cannot operate for any length of time in a “Wild West” situation with no effective state to protect it both against those forces below which might disrupt its normal rhythms of exploitation and against other capitals and their states.

A break between either a state with its capitals or by capitals with their state is a difficult and risky business. If a state turns on private capital, it can create a situation in which people begin to challenge not merely private capital but capital accumulation as such and, with it, the hierarchies of the state. If a private capital breaks with “its” state it risks being left to fend alone in a hostile and dangerous world.

This mutual interdependence between states and capitals has implications for an issue which many analysts never even touch on – the class character of the state bureaucracy itself. The assumption is usually either that it is simply a passive creature of a private capitalist class or that it is a separate political formation with interests quite different to those of any form of capital. Class is seen as depending on individual ownership (or non-ownership) of property, and the conclusion drawn is that the state bureaucracy cannot be an exploiting class or part of an exploiting class. This is implicit in the view of, say, Ellen Wood and David Harvey, who see state run economic activities as lying “outside” the system of capitalist production. [80]

Such an approach leaves a huge hole when it comes to analysing capitalism in the century and a quarter since Marx’s death. The total income of society passing through the hands of the state has reached levels much greater than income going directly to private capital as profits, interest and rent. Investment directly undertaken by the state is often more than half of total investment [81], and the state bureaucracy directly disposes of a very big portion of the fruits of exploitation.

An analysis of class in such a situation cannot restrict itself to looking at things as they appear in the official “common sense” of a society as expressed in its juridical definitions of property. Classes, for Marx, depend not on such formal definitions, but on the real social relations of production in which people find themselves. They are aggregates of people whose relationship to material production and exploitation forces them to act together collectively against other such aggregates. In an unfinished final chapter to Volume Three of Capital Marx insists that classes cannot be identified simply by the “sources of revenues” since this would lead to an infinite division of classes, paralleling “the infinite fragmentation of interests and rank into which the division of social labour splits labourers as well as capitalists and landlords”. [82] What makes such diverse groups come together into the great classes of modern society, he argues elsewhere, is the way in which the revenues of one set of groups arise out of the exploitation of those who make up other groups. As he put it in his notebooks for Capital, “Capital and wage labour only express two factors of the same relation”. [83] The capitalist is only a capitalist insofar as he embodies the selfexpansion of value, insofar as he is the personification of accumulation; workers are workers only insofar as “the objective conditions of labour” confront them as capital.

Since the directing layer in the state bureaucracy is compelled to act as an agent of capital accumulation, whether it likes it or not, it comes to identify its own interests as national capitalist interests in opposition to both foreign capital and the working class. Just as the individual capitalist can choose to enter one line of business rather than another, but cannot avoid the compulsion to exploit and accumulate in whatever line he goes into, so the state bureaucracy can move in one direction or another, but cannot ignore the needs of national capital accumulation without risking its own longer term future. Its “autonomy” consists in a limited degree of freedom as to how it enforces the needs of national capital accumulation, not in any choice as to whether to enforce these or not.

The dependence of the state bureaucracy on capitalist exploitation is often concealed by the way in which it raises its revenues – by taxation of incomes and expenditure, by government borrowing or by “printing money”. All of these activities seem, on the surface, to be quite different from capitalist exploitation at the point of production. The state therefore seems like an independent entity which can raise the resources it needs by levying funds from any class in society. But this semblance of independence disappears when the state’s activities are seen in a wider context. State revenues are raised by taxing individuals. But individuals will attempt to recoup their loss of purchasing power by struggles at the point of production – the capitalists by trying to enforce a higher rate of exploitation, the workers by attempting to get wage increases. The balance of class forces determines the leeway which exists for the state to increase its revenues. These are part of the total social surplus value – part of the total amount by which the value of workers’ output exceeds the cost of reproducing their labour power.

In this sense, state revenues are comparable to the other revenues that accrue to different sections of capital – to the rents accruing to landowners, the interest going to money capital, the returns from trade going to commodity capital and the profits of productive capital. Just as there is continual conflict between the different sections of capital over the sizes of these different revenues, so there is continual conflict between the state bureaucracy and the rest of the capitalist class over the size of its cut from the total surplus value. The state bureaucracy will, on occasions, use its own special position, with its monopoly of armed force, to make gains for itself at the expense of others. In response to this, the other sections of capital will use their own special position – industrial capital its ability to postpone investment, money capital its ability to move overseas – to fight back.

Yet in all this, the different sections of capital cannot escape their mutual interdependence more than temporarily. It eventually asserts itself in the most dramatic fashion, through crises – the sudden collapse of the system of credit, the sudden inability to sell commodities, sudden balance of payment crises or even the threat of state bankruptcy. Those who direct the bureaucracies of the state may not own individual chunks of capital, but they are forced to behave as agents of capital accumulation, to become, according to Marx’s definition, part of the capitalist class.

Marx points out in Capital that with the advance of capitalist production there takes place a division of function within the capitalist class. The owners of capital tend to play a less direct part in the actual organisation of production and exploitation, leaving this to highly paid managers. But, insofar as these managers continue to be agents of capital accumulation, they remain capitalists. Hilferding developed the argument further, pointing to the divisions within a single capitalist class between the mass of rentier capitalists, who rely on a more or less fixed rate of return on their shares, and “promoter” capitalists who gain extra surplus value by gathering together the capital needed by the giant corporations. [84] We can add a further distinction, between those who manage the accumulation of individual capitals and those who, through the state, seek to promote the development of the sibling capitals operating within an individual state – what may be called “political capitalists”.

One of the most significant developments of the 20th century was the emergence of big state-owned economic sectors. The state came to plan the whole of internal production in Germany in the latter part of the First World War, in the US and Britain as well as Germany throughout most of the Second World War – and, of course, in the USSR from Stalin to Gorbachev and in China under Mao.

Just as many analysts accept the “common sense” view that the state is something outside of capitalism, so they also refuse to accept that state-run industries and economies can be capitalist. [85] The classical Marxists, however, saw things rather differently. Marx in Volume Two of Capital was already “including” among “the sum of individual capitals”, “... the state capital, so far as governments employ productive wage labour in mines, railways etc., perform the function of industrial capitalists”. [86] Engels spelt this out much more fully in reacting to Bismarck’s nationalisation of the German railway system:

The modern state, no matter what its form, is essentially a capitalist machine, the state of the capitalists, the ideal personification of the total national capital. The more it proceeds to the taking over of productive forces, the more it actually becomes the national capitalist, the more citizens it exploits. The workers remain wage workers – proletarians. The capitalist relation is not done away with. It is rather brought to a head. [87]

Kautsky could argue in the 1890s that the original economic liberalism (from which present day neoliberalism gets its name) of the “Manchester school” “no longer influences the capitalist class” because “economic and political development urged the necessity of the extension of the functions of the state”, forcing it “to take into its own hands more and more functions or industries”. [88]

Trotsky could write a quarter of a century later, in The Manifesto of the Communist International to the Workers of the World:

The statisation of economic life, against which the capitalist liberalism used to protest so much, has become an accomplished fact ... It is impossible to return not only to free competition but even to the domination of trusts, syndicates and other economic octopuses. Today the one and only issue is: Who shall hereforth be the bearer of statised production – the imperialist state or the victorious proletariat. [89]

What all of them recognised was that state rather than private ownership of the means of production did not alter the fundamental relations of production or the dynamic of capitalist accumulation. For the state, the purpose of nationalised industry was to enable domestic accumulation to match that undertaken by foreign rivals so as to be able to survive successfully in economic and/or military competition. To this end, the labour employed remained wage labour, and the attempt was made to hold its remuneration down to the minimal level required to sustain and reproduce labour power. The state might plan production within the enterprises it owned, but its planning was subordinated to external competition, just as the planning within any privately owned firm was. The self-expansion of capital remained the goal, and this meant that the law of value operated and made itself felt on the internal operations of the enterprises.

In behaving like this, state appointees behave as much like capitalists – as living embodiments of capital accumulation at the expense of workers – as do private entrepreneurs or shareholders.

It was a failure to recognise this that led Hilferding in the 1920s to come to the conclusion that “organised” capitalism was overcoming the contradictions analysed by Marx. By the late 1930s state planning in Nazi Germany led him to conclude that what existed was no longer capitalism at all, but a new form of class society, in which “organisation” had superseded “capitalism”, and where the driving force had ceased to be profit making to feed the competitive accumulation of rival capitals.

What Hilferding failed to grasp – as do all those today who still identify capitalism with the private ownership of firms competing in free markets – is that the system remained based on competitive accumulation between different capitals, even if these were now military state capitalisms. It was driven forward by the same dynamic and subject to the same contradictions analysed by Marx. This was true during the period of total war, in which the rival states did not trade directly with each other and naval blockades greatly limited their competition in foreign markets. Every success in accumulating military hardware by a state forced efforts to accumulate similar levels of military hardware in its rivals. Just as the efforts of rival car producers to outsell each other bring the concrete forms of labour in different car plants into an unplanned inter-relationship with each other, transforming them into different amounts of a homogenous abstract labour, so too the efforts of rival tank-producing states to outshoot one another have the same result.

Marx described how under the market capitalism of his time:

the labour of the individual asserts itself as a part of the labour of society only by the relations which the act of exchange establishes directly between the products, and indirectly through them, between the producers. [90]

In the world system as it developed after Marx’s death, military competition came to play the same role in bringing individual acts of labour performed in different, apparently closed, state entities, into a relationship with each other.

Acquisition of the means of destruction on the necessary scale to assure success in war depended upon the same drive to accumulate means of production as did the struggle for markets – and with that went the holding down of wages to the cost of reproduction of labour power, the forcing up of productivity to the level prevailing on a world scale, and the drive to use the surplus for accumulation.

As Tony Cliff pointed out more than 60 years ago, the only difference, in this respect, between military and economic competition was the form the accumulation took – whether it was terms of an accumulation of use values that could be used to produce new goods or of use values that could be used to wage war. In either case the importance of these use values to those controlling them was determined by comparison with use values elsewhere in the system, a comparison which transmuted them into exchange values.

This also meant the rate of profit continued to play a central role. It no longer determined the distribution of investment between different sectors of the internal economy. The requirements of the military did this. But it operated as a constraint on the economy as a whole. If the ratio of total national surplus value to total investment in the military-industrial machine fell, this weakened the ability of the national state capitalism to sustain itself in warfare with its rivals. The decline in the rate of profit could not lead to economic slump, since the war machine would go on growing as long as there was any remaining mass of surplus value to be used up, however small. But it could contribute to military defeat.

The same capitalist logic could be seen as operating in the states where new bureaucracies emerged to take control of the means of production (the USSR from the late 1920s onwards [91], Eastern Europe and China after World War Two, various former colonial states in the late 1950s and 1960s). Although they called themselves “socialist” their economic dynamic was dependent on their inter-relations with the wider capitalist world. If they traded with the capitalist countries beyond their borders, they were drawn into the logic of commodity production – and the requirement to remain competitive in markets by undertaking accumulation in an essentially capitalist way. But even if they tried to adopt an autarchic policy of cutting themselves off economically, they could not avoid having to defend themselves against predatory foreign imperialisms. In either case, they were subject to the logic of capitalism as a world system in the 20th century in the way Bukharin had described in the early 1920s. And those who ruled these societies were as much “personifications” of accumulation as were the private capitalists of Marx’s time, driven into historic opposition to the wage labourers who toiled on the means of production. They were, in other words, members of a capitalist class, even if it was a class which collectively rather than individually carried through exploitation and accumulation.

The state seemed, on the face of it, a great island of planning – at one time even half a continent of planning – within a world of market relations. But so long as states competed to expand the forces of production within them more rapidly than each other, the planning was, like the islands of planning within the individual capitalist enterprise of Marx’s time, simply planning to keep labour productivity abreast with the labour productivity prevailing on a world scale. The law of value imposed itself through such competition on all the units in the world system. Those running whole states, particular state sectors or individual enterprises were alike subject to pressure to reduce the price paid for every exertion of labour power to its value within the system as whole.

The individual capitalist managers and individual state managers could rely for a time on the sheer size of the resources at their disposal to try to ignore these pressures. But they could not do so indefinitely. At some point they had to face hard choices if they were not to risk collapse: they could try to impose the law of value on those who laboured for them through what could be a painful and hazardous process of internal restructuring; or they could take desperate gambles in order to try to shift the global balance of forces in their favour. For the civilian corporation this might mean pouring resources into one last, possibly fraudulent, marketing ploy; for those running the state, to try to use its military force to compensate for its economic weakness. Hence the way in which the real history of capitalism in the 20th century was very different to the picture of peaceful and honest competition presented in economic textbooks – and accepted by some Marxists who have not understood the need to look at the real social relations which lie beneath surface appearances.

1. Quoted in D.M. Gordon, Up and Down the Long Roller Coaster, in Bruce Steinberg and others (eds.), US Capitalism in Crisis, p. 23.

2. See Figure 2: Net Returns on Capital in the UK, 1855–1914, in A.J. Arnold and Sean McCartney, National Income Accounting and Sectoral Rates of Return on UK Risk-Bearing Capital, 1855–1914, November 2003, available at http://business-school.exeter.ac.uk [download].

3. See the accounts in Gareth Stedman Jones, Outcast London (Harmondsworth, Penguin, 1991).

4. Frederick Engels, Preface to the English Edition (1886) in Marx, Capital, Volume One, available at http://www.marxists.org.

5. For details and sources, see my book Explaining the Crisis, p. 52.

6. See, for Germany, G. Bry, Wages in Germany 1871–1945 (Princeton, 1960), p. 74; A.V. Desai, Real Wages in Germany (Oxford, Clarendon, 1968), pp. 15–16 and p. 35.

7. See the detailed account of the trend of working hours in the 20th century in B.K. Hunnicutt, Work Without End (Philadelphia, Temple, 1988).

8. Edward Bernstein, Evolutionary Socialism (London, ILP, 1909), pp. 80 and 83.

9. As above, p. 219.

10. R. Hilferding, Finance Capital, p. 304.

11. As above.

12. As above, p. 325.

13. As above, p. 366.

14. As above, p. 235.

15. As above, pp. 289–290.

16. As above, p. 294.

17. As above.